Global Alcoholic Drinks Market By Type (Beer, Wine, Spirits, Hard Seltzer, Cider, Perry & Rice Wine, and Others), By Distribution Channel (Pub, Bars & Restaurants, Liquor Stores, Internet Retailing, Supermarkets, Grocery Shops, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Mar 2022

- Report ID: 32203

- Number of Pages: 369

- Format:

- keyboard_arrow_up

Alcoholic Drinks Market Overview:

The global market for alcoholic drinks was worth USD 1,350,100 million in 2021. This is expected to increase at a compound annual growth rate of 9.8% between 2023-2032.

This can be attributed to the rising consumption of premium beer in developed economies like the U.S. and the U.K. The rising demand for beer and wine as well as dark spirits is increasing the sales of alcoholic beverages. Market growth is also expected to be boosted by the growing popularity of bars, restaurants, and pubs over the forecast period. This industry is driven by the acceptance of beer’s distinctive flavors to help the digestive system.

Global Alcoholic Drinks Market:

Type Analysis

In 2021, beer accounted for 37.0% of the total revenue. There are many options for beer, including a variety of ales and a German-style altbier. In the next few years, the market will see a significant increase in demand for California common beer. In the future, the beer segment will be boosted by the increasing demand for Belgian Flanders to supply B-group Vitamins.

In 2021, wine accounted for more than 23.0% of the second-highest revenue share. Wine is known for its many health benefits. It contains antioxidants that can increase longevity. This is what has driven segment growth. Wine can also help prevent harmful inflammation and heart disease. Red wine is richer in antioxidants that lower the risk for heart disease and prevents damage to the coronary arteries. This is what will fuel the segment’s growth during the forecast period.

The market for alcoholic drinks is expected to see the strongest growth in hard seltzer during the forecast period. This can be attributed to the rising demand in Europe for arctic ginger-lime hard seltzer. In the U.S., the bud light strawberry seltzer is an emerging trend to meet the demand for fruit-flavored alcohol beverages. During the assessment period, the orange guava soft seltzer will increase sales.

Distribution Channel Analysis

In 2021, the revenue share for liquor stores was more than 28.0%. The interconnecting channel will be created by the rapid urbanization of emerging economies. The increasing adoption of western culture will boost the growth of the market. Domestic liquor stores provide a diverse portfolio of alcoholic drinks at a lower cost, which will boost segmental growth. Market growth will be driven by supportive measures taken globally by multiple governments to simplify liquor licenses.

The revenue share for the restaurant, bar and pub segment was more than 18.0% by 2021. One of the main factors driving the growth in alcoholic drinks sales in this sector is the increasing popularity of bars and restaurants among young people. In the future, there will be an increase in sales of alcoholic beverages in restaurants, bars, and pubs in developed countries.

The fastest-growing segment for internet retailing is expected to be during the forecast timeline. This can be attributed to increased supplier focus to implement advanced eCommerce trade technology. Internet retailing offers door-step liquor delivery. The increasing demand for high-end wine products through an online portal is driving the market growth. The market is being driven by the kind actions of private companies in the United States to fulfill the demand for alcoholic beverages via an e-commerce portal.

Key Market Segments:

Type

- Beer

- Wine

- Spirits

- Hard Seltzer

- Cider, Perry & Rice Wine

- Others

Distribution Channel

- Pub, Bars & Restaurants

- Liquor Stores

- Internet Retailing

- Supermarkets

- Grocery Shops

- Others

Market Dynamics:

The rising demand in emerging economies like India and China for artisanal spirits is expected to increase the growth of the market. This market has a great opportunity because of the rising demand to purchase value-added hard seltzer products at an affordable price. The market’s growth is being hampered by the growing desire to drink non-alcoholic drinks. Current market leaders are working to launch cordials, and liquors that have a lower alcohol content to protect human health.

The global impact of the coronavirus infection was greater in the financial years 2020-2021. The COVID-19 period had caused a slight disruption to the supply chain. Lockdowns imposed by various governments around the world hampered distribution channels, such as grocery shops, liquor stores, and supermarkets. The COVID-19 epidemic saw a rise in demand for beer and dark spirit. The market leaders in alcoholic beverages are currently evaluating the eCommerce platform for the internet retailing to increase market sales statistics. This was a way to increase the commercial potential of alcoholic beverage products, which in turn can drive market growth.

The market is seeing a surge in investment from U.K.-based players to purchase high-quality Scotch whisky products. The main players are the suppliers of superior quality Perry, cider, and rice wine. U.S. consumers are increasingly looking for beer supplements that are lower in calories. This is driving further industry growth. This market has a future opportunity due to rising demand for value-added hard seltzer products at an affordable price. Accordingly, the market for alcoholic drinks will perform well over the forecast period.

Market growth is being held back by a rising interest in non-alcoholic beverages. Vendors in the alcoholic drinks sector must also invest significant capital and resources to establish a business and get legal certifications. The above-mentioned factors may require a long processing time which could limit the growth of the market. The overall market growth is expected to be limited by increasing health-conscious consumers over the forecast period. Current trends are to launch cordials, and liquors that have lower alcohol levels to protect human health. This is an ongoing trend to increase market share. Key players such as Asahi use the strategy of giving beer with every order of twenty bottles by asking liquor shops, also known as the “Quarter Strategy”, which aims to increase their market share.

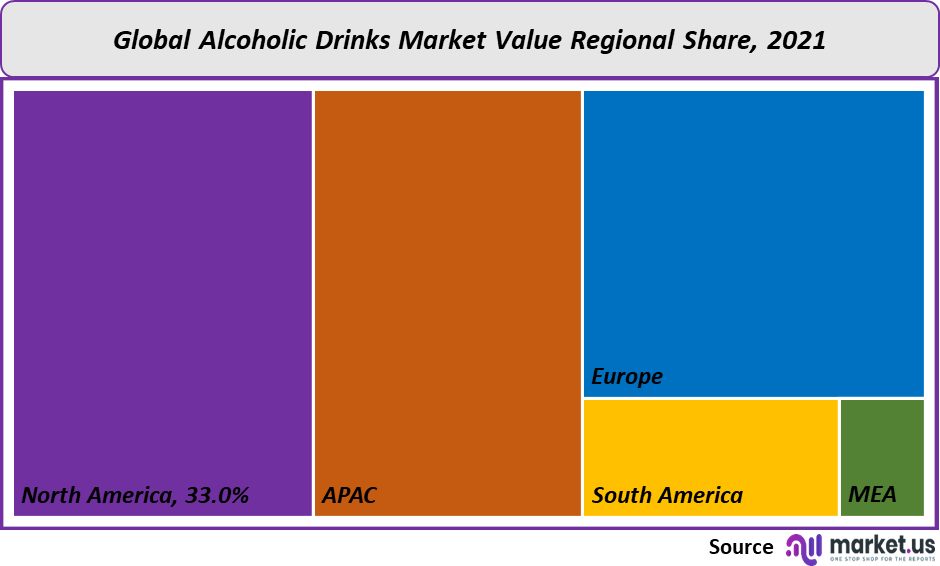

Regional Analysis:

North America dominated the alcoholic beverages market. In 2021, North America accounted for more than 33.0% of revenue. This was due to the increasing demand for polished malt whisky in Canada and the U.S. The market will grow due to the increasing popularity of classic brands like Arnold Palmer Spiked Half & Half, Burgasko, and Bergenbier in the United States. Private firms from Canada will provide funding to buy premium alcoholic beverages to boost the market.

From 2023 to 2032, Asia Pacific’s market for alcoholic drinks will experience an 11.1% CAGR. This is due in part to the rising demand for agave spirits from emerging countries such as India and China to fulfill the market demand for alcoholic beverages. India’s growing preference for local spirits such as McDowells whiskey and VAT69 black label is driving the market growth. China’s increasing adoption of Gin, beer, and Tequila flavors will show the fastest growth rate in the forecast period.

Europe’s market for alcoholic drinks will experience the 2nd fastest growth rate of 10.4% in the period 2023-2032. Europe is the biggest consumer and producer of alcoholic beverages in the world. Diageo Plc and Carlsberg A/S are the major players in this market. Anheuser-Busch InBev SA/NV uses different marketing strategies to stay competitive. This contributes greatly to the growth in the European market for alcoholic drinks.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

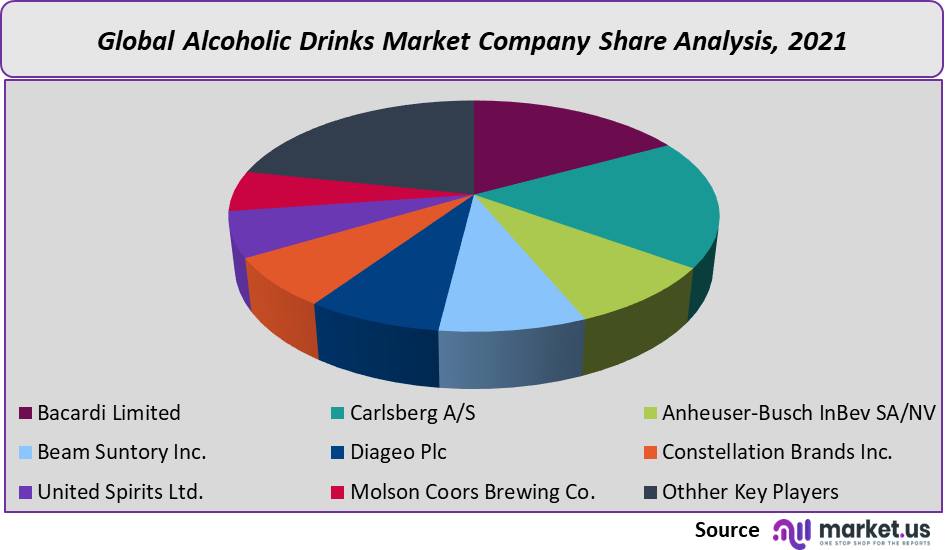

Market share Analysis:

Companies are mostly focused on launching old-aged products of rum to satisfy the growing demand for alcoholic drinks. The main players in this market are those who want to preserve the peculiar taste of alcoholic beverages. However, e-commerce implementation presents its own challenges and limitations. Numerous companies are looking to launch premium beer products on the market for alcoholic beverages. Asahi was the first to take over the Carlton and United Breweries, Australia’s largest brewers, in June 2020. Asahi Beverages customers will now have a variety of great-tasting beverages thanks to the acquisitions of Asahi, Carlton, and United Breweries.

Pernod Ricard, in partnership with UN’s EducateAll platform, announced a partnership for free and sustainable bartending training via online platforms in May 2020. Through EdApp, an online learning platform that is accessible to legal-drinking adults, all courses can be accessed online. This mobile platform was developed by EducateAll and the United Nations Institute for Training and Research. EdApp and UNITAR created a joint initiative to create a global course library. It hosts around 50,000 lessons each day.

Key Market Players:

Some of the major players in the alcoholic drinks industry include:

- Bacardi Limited

- Carlsberg A/S

- Anheuser-Busch InBev SA/NV

- Beam Suntory Inc.

- Diageo Plc

- Constellation Brands Inc.

- United Spirits Ltd.

- Molson Coors Brewing Co.

- Othher Key Players

For the Alcoholic Drinks Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Alcoholic Drinks market in 2021?The Alcoholic Drinks market size was US$ 1,350,100 million in 2021.

Q: What is the projected CAGR at which the Alcoholic Drinks market is expected to grow at?The Alcoholic Drinks market is expected to grow at a CAGR of 9.8% (2023-2032).

Q: List the segments encompassed in this report on the Alcoholic Drinks market?Market.US has segmented the Alcoholic Drinks market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Beer, Wine, Spirits, Hard Seltzer, Cider, Perry & Rice Wine, and Others. By Distribution Channel, the market has been further divided into Pub, Bars & Restaurants, Liquor Stores, Internet Retailing, Supermarkets, Grocery Shops, and Others.

Q: List the key industry players of the Alcoholic Drinks market?Bacardi Limited, Carlsberg A/S, Anheuser-Busch InBev SA/NV, Beam Suntory Inc., Diageo Plc, Constellation Brands Inc., United Spirits Ltd., Molson Coors Brewing Co., and Other Key Players engaged in the Alcoholic Drinks market.

Q: Which region is more appealing for vendors employed in the Alcoholic Drinks market?North America is accounted for the highest revenue share of 33%. Therefore, the Alcoholic Drinks industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Alcoholic Drinks?The U.S., Canada, U.K, Germany, France, Italy, Russia, China, India, Japan, Brazil, and Argentina are key areas of operation for Alcoholic Drinks Market.

Q: Which segment accounts for the greatest market share in the Alcoholic Drinks industry?With respect to the Alcoholic Drinks industry, vendors can expect to leverage greater prospective business opportunities through the beer segment, as this area of interest accounts for the largest market share.

![Alcoholic Drinks Market Alcoholic Drinks Market]()

- Bacardi Limited

- Carlsberg A/S

- Anheuser-Busch InBev SA/NV

- Beam Suntory Inc.

- Diageo Plc

- Constellation Brands Inc.

- United Spirits Ltd.

- Molson Coors Brewing Co.

- Othher Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |