Global Ammonium Sulfate Market By Product (Solid and Liquid), By Application(Fertilizers, Water Treatment, Pharmaceuticals, Food & Feed Additives and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Aug 2022

- Report ID: 38253

- Number of Pages: 301

- Format:

- keyboard_arrow_up

Ammonium Sulfate Market Overview:

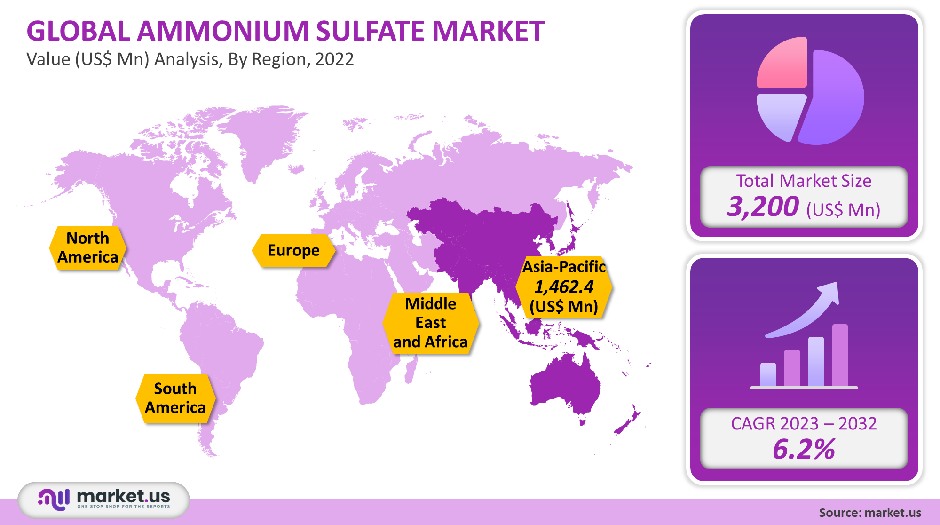

The global ammonium sulfurate market was worth USD 3,200 million in 2021. It is anticipated to grow at multiple yearly rates of 6.2% between 2023 to 2032.

This market growth is due to an improved claim for ammonium sulfurate in fertilizer formulations, which are widely used in agriculture. Intake of solid ammonium sulfurate is a major driver of the market.

The ultimatum for liquid ammonium sulfate is expected to rise. Global market growth is driven by the ultimatum for fertilizers, which contain sulfur and nitrogen. Because alkaline soils have high pH levels, it is used to reduce their acidity. It contains both nitrogenous elements and sulfur which are essential for plant protein synthesis. This product is preferred for rice cultivation in flooded soils. Nitrate-based fertilizers can cause denitrification or leaching.

Global Ammonium Sulfate Market Scope:

Product Analysis

With an income share exceeding 91.1%, the segment solid conquered this market in the year 2021. This can be attributed to a rise in claims for solid segments. The white, odorless solid ammonium sulfate can be recognized as a biological salt. It dissolves easily in water, nevertheless, it is not able to dissolve in alcohol or acetone. Because of their ability to improve soil nutrients and reduce sulfur deficiencies, solid ammonium-sulfate gemstones can be widely used in fertilizers for alkaline soils.

The crystalline or solid grade is purer and will be preferred in the industry of pharmaceutical. The fluid or fluid version of the merchandise can be purchased in a light yellow-colored solution. It is non-toxic, non-hazardous, and stable. Water treatment submissions are a common use for fluid ammonium sulfurate solution.

Marketplace for liquid ammonium sulfurate (LAS), is predictable to grow significantly as other LAS options, such as anhydrous or aqueous ammonia are deemed to be dangerous and require strict protocols. This kind of sulfate has been widely acknowledged and is used to provide ammonia for chlorination.

Application Analysis

In 2021, fertilizers accounted for 70.6% of the total revenue. Because it contains both sulfur and nitrogen, ammonium sulfate is used as a fertilizer for alkaline soils. The forecast period will see an increase in fertilizer intake in agriculture-built countries. The product is broken down into ammonia and sulfur dioxide in the soil. Plants use ammonia and nitrogen to create amino acids. Sulfur is essential for breakdown. Ammonium sulfate is used in many applications, including fertilizers, food and feed additives, water treatment, and pharmaceuticals.

Market drivers are primarily fertilizers. Ammonium sulfate is used extensively in fertilizer production. It is used almost exclusively by all main nitrogenous fertilizer producers worldwide. The growing demand for food products has driven the agricultural industry worldwide to use ammonium sulfurate products in fertilizer formulations. Over the forecast period, the pharmaceuticals sector is probable to experience a significant CAGR. The pharmaceutical industry is dependent on ammonium sulfate, which is used extensively as an intermediate to precipitate or fractionate protein.

Key Market Segments

By Product

- Solid

- Liquid

By Application

- Fertilizers

- Water Treatment

- Pharmaceuticals

- Food & Feed Additives

- Other Applications

Market Dynamics

Most commonly, ammonium-sulfate is used as fertilizer. It is a water-soluble organic salt that contains nitrogen and sulfur. This fertilizer can be used in large quantities in agriculture. Because of its high nitrogen content, it is popular for fertilizing nitrogen-deficient soils and lawns. It can be mixed with other nitrogen fertilizers to increase its stability and functionality. The main sources of ammonium sulfurate are coke-oven and caprolactam processes. Caprolactam is the main ingredient in nylon fiber manufacturing. Caprolactam is a key ingredient in the manufacture of nylon fibers. It can be used to make textiles and carpets. Nylon fibers can also be used to make industrial yarns or fishing lines. Caprolactam production has risen, which has, in turn, led to an increase in global supply.

Forecasts show that demand for the product is expected to grow slowly over the next few decades, which could result in an increase in market supply. The product’s price has been reduced as a result. These fertilizers have key advantages such as low water solubility and ease of mixing with fertilizers. They enhance sulfur and nitrogen levels and nourish alkaline soils.

Global farming communities are accepting the product because of its high plant growth potential. Due to increased competition from multinationals in product design, the market will continue to grow. Ammonium Sulfate can be harmful to your health. Inhalation or inhalation of aqueous aerosols and dust can cause severe respiratory tract infections. Prolonged skin contact might cause dermatitis, permanent eye damage, and lung damage. These factors are likely to slow down market growth.

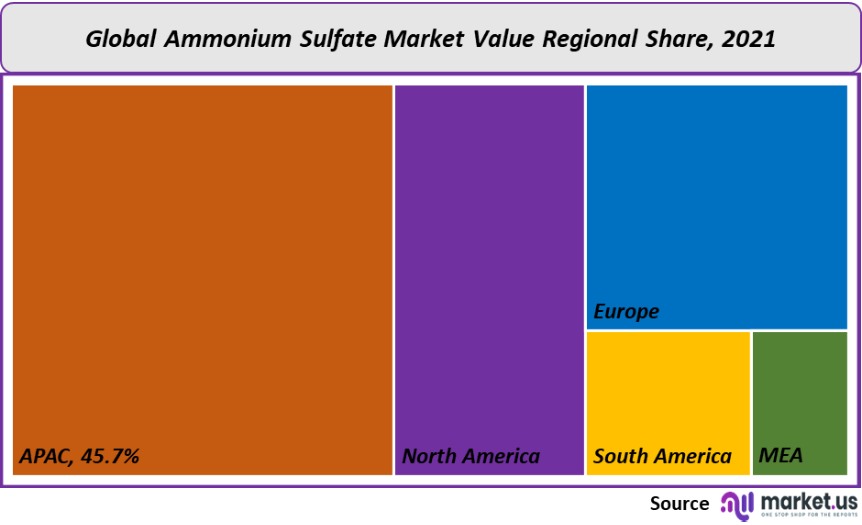

Regional Analysis

The Asia Pacific accounted for the foremost volume share, with 45.7% share in 2021. This growth can be attributed to a rise in demand for fertilizers for the crop-growing sector, which will in turn lift the demand for ammonium sulfurate. Many of the economies of this region, including India, Sri Lanka, and Bangladesh are dependent on farming as a primary sector. Despite slow growth in agriculture, there are significant growth chances for fertilizers.

In 2021, Europe was second in volume. This is due to a proliferation in the claim for fertilizers that can be used in multiple crops. Multiple agencies have established regulations for the use of synthetic fertilizers within the region.

The forecast period sees a 6.3% revenue-based CAGR in South America and Central America due to the augmented mandate for high-quality ammonium-sulfate-based fertilizers that are used in the healthy growth and maintenance of key crops such as grapes, sunflower seeds, and wheat. Half of South America and Central America GDP is accounted for by the agronomy sector, which includes Argentina, Bolivia, and Paraguay.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

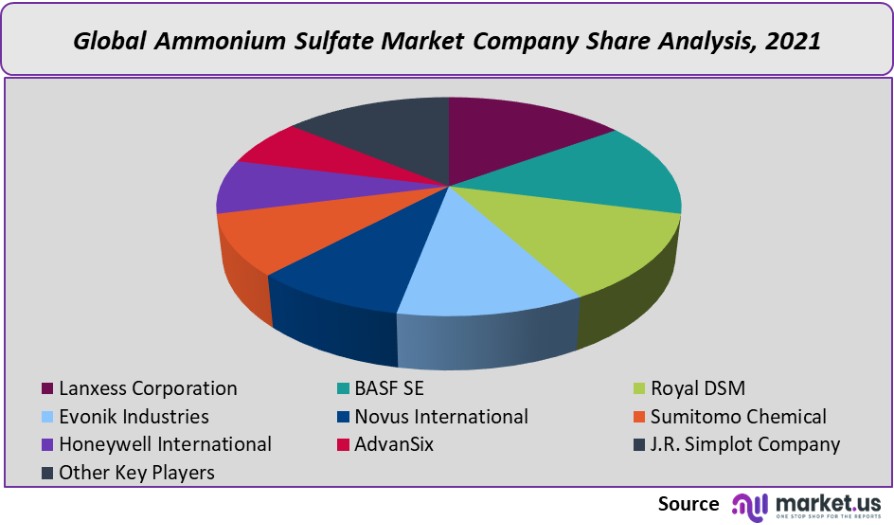

Market Share Analysis

Ammonium sulfate has a highly competitive market. Large global brands are focused on building long-term relationships and trust with end users. The competition will increase due to the continued growth in water treatment and the pharmaceutical sector. Companies like Honeywell International, SABIC, BASF, and Domo Chemicals have high levels of integration throughout the value chain, as they also produce caprolactam. These companies are well-known for being the main producers, and they concentrate on R&D to find new uses for the product.

Key Market Players

- Lanxess Corporation

- BASF SE

- Sumitomo Chemical

- Royal DSM

- Honeywell International

- Evonik Industries

- Novus International

- AdvanSix

- J.R. Simplot Company

- Other Key Players

For the Ammonium Sulfate Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Ammonium Sulfate market in 2021?A: The Ammonium Sulfate market size is US$ 3,200 million in 2021.

Q: What is the projected CAGR at which the Ammonium Sulfate market is expected to grow at?A: The Ammonium Sulfate market is expected to grow at a CAGR of 6.2% (2023-2032).

Q: List the segments encompassed in this report on the Ammonium Sulfate market?A: Market.US has segmented the Ammonium Sulfate Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been segmented into Solid and Liquid. By Application, the market has been segmented into Fertilizers, Water Treatment, Pharmaceuticals, Food & Feed Additives and Other Applications.

Q: List the key industry players of the Ammonium Sulfate market?A: Lanxess Corporation, BASF SE, Royal DSM, Evonik Industries, Novus International, Sumitomo Chemical, Honeywell International, AdvanSix, J.R. Simplot Company and Other Key Players are the key vendors in the Ammonium Sulfate market.

Q: Which region is more appealing for vendors employed in the Ammonium Sulfate market?A: Asia-Pacific accounted for the highest revenue share of 45.7%. Therefore, the Ammonium Sulfate industry in Asia-Pacific is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for the Ammonium Sulfate Market.A: The US, Canada, Mexico, Germany, U.K., Italy, etc., are leading key areas of operation for Ammonium Sulfate Market.

Q: Which segment accounts for the greatest market share in the Ammonium Sulfate industry?A: With respect to the Ammonium Sulfate industry, vendors can expect to leverage greater prospective business opportunities through the solid segment, as this area of interest accounts for the largest market share.

![Ammonium Sulfate Market Ammonium Sulfate Market]()

- Lanxess Corporation

- BASF SE Company Profile

- Sumitomo Chemical

- Royal DSM

- Honeywell International, Inc. Company Profile

- Evonik Industries

- Novus International

- AdvanSix

- J.R. Simplot Company

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |