Global Automatic Number Plate Recognition (Anpr) Market By Type (Automatic Grease Lubrication System, And Automatic Oil Lubrication System), By Application (Mining, Mineral Processing Industry, Construction Industry, Automotive Industry, And Others), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 13823

- Number of Pages: 246

- Format:

- keyboard_arrow_up

Automatic Number Plate Recognition (ANPR) Market Overview:

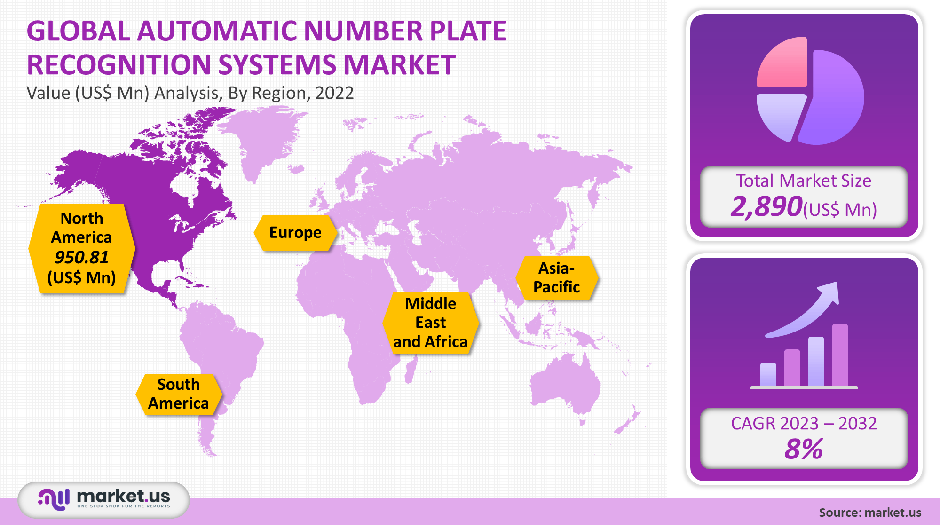

Automatic number plate recognition systems had a global market value of USD 2,890 million in 2021. Between 2022 and 2032, the market is expected to grow by 8%.

The technology of automated number plate recognition (ANPR), which is used in mass surveillance, allows for the identification of vehicle registration numbers and images.

As law enforcement agencies see an increase in vehicle thefts, there is a strong demand for these systems. Concerns are also growing about the potential for these vehicles to be used in crimes like robbery and kidnapping.

ANPR uses Object Detection and Recognition technology to provide real-time insight into vehicle plate using Object Detection Recognition technologies. Closed-circuit televisions, cameras, and character recognition are just a few of the methods that can identify license plates.

Global Automatic Number Plate Recognition Systems Market Scope:

Type Analysis

Fixed systems held a dominant market share in 2021, resulting in a higher revenue share. Due to the high demand from both traffic police/personnel and defense forces, this segment has experienced significant growth in recent times.

Security forces prefer fixed systems because they can be customized for any purpose. Individual equipment can also be configured to provide multilane coverage. Fixed systems offer benefits like continuous surveillance in high-density areas and multilane coverage.

This market is expanding. Market growth is also being driven by the fact that fixed systems allow for real-time enforcement against frequent toll violators. Portable systems are expected to gain traction, with the highest CAGR predicted during the forecast period.

Because of its ease of use and low cost, this equipment is very popular among law enforcement agencies. This equipment is increasingly being used by public safety agencies to speed up enforcement. Various governments around the world are focusing on contracting with ANPR providers such as NDI Recognition Systems or Siemens for portable ANPR systems.

Component Analysis

The hardware segment dominated the ANPR market in 2021 and will continue to dominate it for six more years. IoT has emerged because of the rapid hardware addition to cloud-based software. This will drive the hardware segment’s growth.

This is expected to drive hardware growth. These devices use separate cameras and a standalone computer.

Software is the software component of an ANPR program. It corresponds to image recognition via OCR or GUI, Database, and character recognition via OCR. Software for ANPR is becoming more popular on the web. This is driving growth in the software sector.

VaxALPR Acceso is a web-based ANPR tool that can be used with access control equipment. Software that recognizes automatic number plates from different OEMs has grown popular.

End-Use Analysis

This market was dominated by the government segment in 2021. The market was dominated by the government segment in 2021. Automated number plate recognition technology can be used at various levels to disrupt and deter criminality.

This includes the surveillance of organized crime groups, the movement of terrorists, and the travel of criminals. ANPR systems are used most frequently by the government. Automated number plate recognition can be used to identify evidence and investigate various other situations.

Over the forecast period, the commercial end-use segment will see the highest CAGR. Vehicle and Operator Services Agencies and driver and vehicle licensing agents, private parking facilities, and toll collection agencies are all using ANPR systems.

Electronic toll collection systems have experienced a significant rise in demand due to the development of roads. Shopping malls have seen an increase in their parking spaces.

Agents are more likely to employ advanced techniques to manage their vehicles in their parking lots.

Маrkеt Ѕеgmеntѕ:

By Type

- Portable ANPR Systems

- Fixed ANPR Systems

By Application

- Hardware

- Software

- Service

By End-Use

- Government

- Commercial

Market Dynamics:

The rapid growth of the automobile industry around the world is likely to impact the widespread use of ANPR devices. The market is growing, thanks to advancements in processing technology and recognition devices. The main users of ANPR systems are law enforcement agencies.

They continue to play an important role in vehicle inventory management. Government agencies are focusing more on the development of crewless aerial vehicles (UAVs), which will allow for the creation of a network for ANPR across cities. This bodes well for market growth.

ANPR systems have been widely used to identify speeding cars, traffic enforcement, and automated toll collection centers. This has led to a greater awareness among drivers about highway speed limits, contributing to a reduction in highway accidents. Driving vehicles without registered number plates is a major problem impacting road safety.

These vehicles can increase road safety because it is difficult to identify them. Increasing government initiatives also bode market growth for smart city development, such as intelligent transport systems and traffic management systems.

These systems address the issue of number plate cloning. Thieves have used car cloning methods to evade automated number plate recognition systems. Car cloning refers to using a legally registered number plate to conceal the identity of a stolen or salvaged car.

However, market stability could be hampered by inaccuracies caused by the ANPR system, leading to false-positive readings. Data privacy is another restriction of the systems. These systems offer less security for images and data.

Regional Analysis

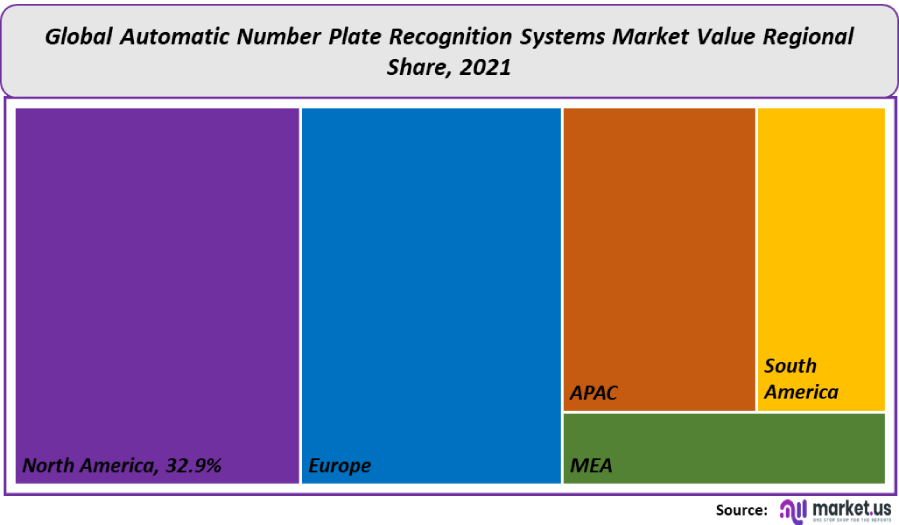

In 2021, North America remained the dominant market leader, accounting for the largest share of the total market with 32.9%. Because traffic monitoring devices on highways and bridges are rapidly digitizing, the IoT-enabled method of configuring ANPR equipment with traffic monitor devices will gain popularity in the forecast period.

The demand for human-free traffic monitoring devices will drive significant regional market growth during the forecast period. The ongoing research and development in North America to develop radar-based ANPR systems will drive the demand for fixed systems. Over the Forecasted period, APAC will be the fastest-growing regional market.

In countries like Indonesia, Vietnam, and China, ANPR systems are being used more frequently to enforce traffic laws and traffic control.

This equipment is also in high demand due to the rapid growth of smart cities. These economies are expected to place greater emphasis on highway patrolling. This will drive demand for handheld ANPR systems.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

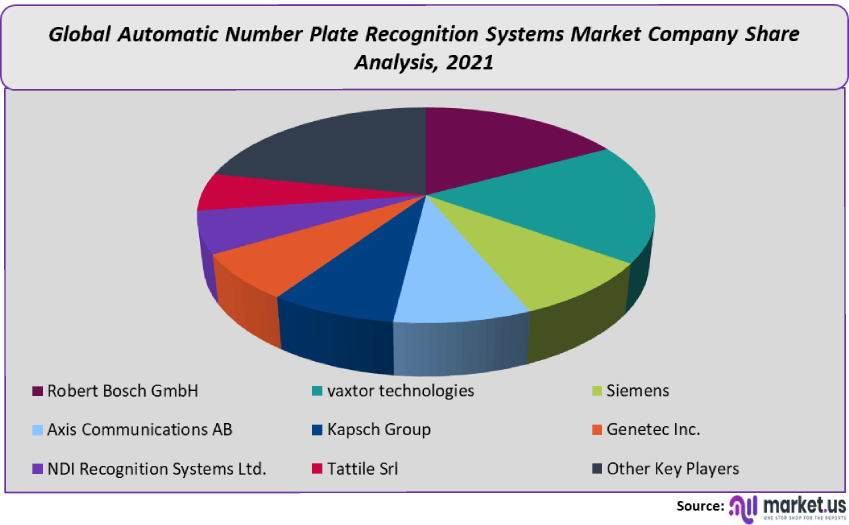

Robert Bosch GmbH, Vaxtor Technologies, Siemens, Axis Communications AB, Kapsch Group, Genetec Inc., NDI Recognition Systems Ltd., Tattile Srl, and Selex ES Inc. are the key players in this market. Many companies are focusing on R&D investments to help them develop new products. Siemens, for example, launched the Sicore II ANPR camera.

It can scan up to 2,000 vehicles an hour. Other players are also focusing their efforts on securing long-term contracts with government agencies and law enforcement agencies to deliver this equipment.

Genetec Inc., for example, won a contract with the University of British Columbia to install Genetec Inc.’s ANPR system in its parking lot. The following are some of the most prominent players in global ANPR systems Markets:

Маrkеt Кеу Рlауеrѕ:

- Robert Bosch GmbH

- vaxtor technologies

- Siemens

- Axis Communications AB

- Kapsch Group

- Genetec Inc.

- NDI Recognition Systems Ltd.

- Tattile Srl

- Selex ES Inc.

- Other Key Players

For the Automatic Number Plate Recognition (ANPR) Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Automatic number plate recognition systems Market size in 2021?A: The Automatic number plate recognition systems Market size is US$ 2,890 million in 2021.

Q: What is the CAGR for the Automatic number plate recognition systems Market?A: The Automatic number plate recognition systems Market is expected to grow at a CAGR of 8% during 2023-2032.

Q: What are the segments covered in the Automatic number plate recognition systems Market report?A: Market.US has segmented the Global Automatic number plate recognition systems Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Fixed ANPR System and Portable ANPR Systems. By Component, market has been further divided into Hardware, software, and Service. By End-Use, market has been further divided into Commercial and government.

Q: Who are the key players in the Automatic number plate recognition systems Market?A: Robert Bosch GmbH, vaxtor technologies, Siemens, Axis Communications AB, Kapsch Group, Genetec Inc., NDI Recognition Systems Ltd., Tattile Srl, and Other Key Players are the key vendors in the Automatic Number Plate Recognition Systems market.

Q: Which region is more attractive for vendors in the Automatic number plate recognition systems Market?A: North America accounted for the highest revenue share of 32.9% among the other regions. Therefore, the Automatic number plate recognition systems Market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Automatic number plate recognition systems?A: Key markets for Automatic number plate recognition systems are The U.S., Germany, U.K., China, India, Brazil.

Q: Which segment has the largest share in the Automatic number plate recognition systems Market?A: In the automatic number plate recognition systems Market, vendors should focus on grabbing business opportunities from the fixed ANPR systems segment as it accounted for the largest market share in the base year.

![Automatic Number Plate Recognition (ANPR) Market Automatic Number Plate Recognition (ANPR) Market]() Automatic Number Plate Recognition (ANPR) MarketPublished date: Oct 2021add_shopping_cartBuy Now get_appDownload Sample

Automatic Number Plate Recognition (ANPR) MarketPublished date: Oct 2021add_shopping_cartBuy Now get_appDownload Sample - Robert Bosch GmbH

- vaxtor technologies

- Siemens

- Axis Communications AB

- Kapsch Group

- Genetec Inc.

- NDI Recognition Systems Ltd.

- Tattile Srl

- Selex ES Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |