Global Antibiotics Market By Action Methods (Cell Wall Synthesis Inhibitors, Protein Synthesis Inhibitors, DNA Synthesis Inhibitors, RNA Synthesis Inhibitors, Mycolic Acid Inhibitors, and Other action methods), By Drug Class (Cephalosporin, Penicillin, Fluoroquinolone, Macrolide, Carbapenem, and Other Drug classes), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 65175

- Number of Pages: 205

- Format:

- keyboard_arrow_up

Antibiotics Market Overview:

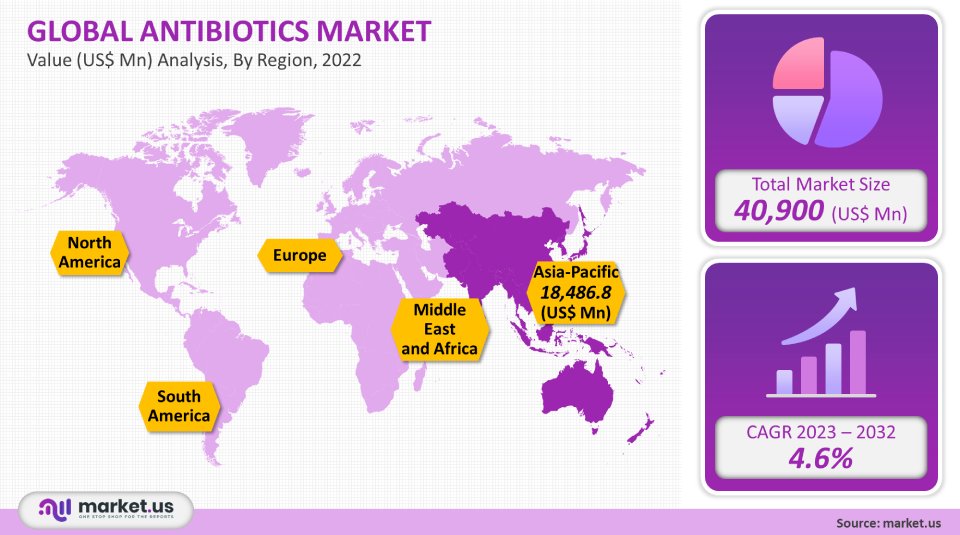

In 2021, the global market for antibiotics was worth USD 40,900 million. Between 2022 and 2032, it is predicted to expand at a CAGR of 4.6%.

Market drivers such as the increased frequency of infectious diseases as well as government legislation’s assistance. A surge in antibiotic resistance owing to abuse or misuse of antibiotics would also have an impact on the market. This could lead to the development of novel antibiotics to treat bacterial infections. Antibiotic-resistant infections affect more than 2.8 million individuals in the United States, according to the CDC. Pathogens such as Enterobacteriaceae and Pseudomonas aeruginosa have a 40% resistance rate in wealthy countries.

Global Antibiotics Market:

Action Mechanism Analysis

With a market share of 52.1% in 2021, cell wall synthesis inhibitors were the dominant players and will continue to hold that position throughout the forecast period. The key drivers of this segment are high consumption and prescription patterns, as well as significant government capital.

Cell wall synthesis inhibitors are one of the most popular antibiotics because they have a broad range of actions against both gram-positive bacteria and negative bacteria. Due to government funding and increased research, cell wall synthesis inhibitors will see notable growth in the years to come. Bicycle Therapeutics, for example, reported in February 2019 that it had obtained a grant from the United Kingdom to research a novel cell-wall synthesis inhibitor.

The RNA synthesis inhibitors market will develop significantly as a result of increased product releases and R&D initiatives. Aemcolo (rifamycin) is an extended-release tablet developed by Cosmo Pharmaceuticals N.V. for the treatment and prevention of Travelers’ Diarrhea. The medication was also given Fast Route and Qualified Infectious Drug Product (QIDP) designations, as well as marketing rights until 2028, by the US FDA.

Drug Class Analysis

Penicillin was the most popular drug in 2021, representing 23.9% of the total market. This is due to its high prescription rate and a large number of generic producers. These drugs are the first choice for treating infections such as bronchitis and skin infections, gonorrhea, pharyngitis, and ear infections. Cephalosporin was the second-largest segment of drug classes after Penicillin. It is expected to continue growing at a rapid pace during the forecast period.

The cephalosporin-fluoroquinolone category is predicted to increase at a rapid pace between 2022 and 2032. During the projected period, these categories will expand due to the commercialization and distribution of new pharmaceuticals. The third round of clinical trials for three cephalosporin medicines is underway. In the next three to four years, they are projected to be marketed. The approval of Shionogi’s Fetroja by the US FDA in November 2019 will boost market share (cefiderocol). The approval of Lasvic (lascufloxacin) by the Japanese PMDA, as well as Wockhardt Ltd.’s new Indian drug application, will accelerate the expansion of fluoroquinolones.

Because of the upcoming launch of new therapies, the other segment will grow the fastest in the future. This includes both some newer ones and existing antibiotics, including tetracyclines. Market economic growth is expected to be attributed to the commercialization of gepotidacin and zoliflodacin over the forecast period.

Key Market Segment:

Action Mechanism

- DNA Synthesis Inhibitors

- Cell Wall Synthesis Inhibitors

- Mycolic Acid Inhibitors

- Protein Synthesis Inhibitors

- RNA Synthesis Inhibitors

- Others

Drug Class

- Cephalosporin

- Carbapenem

- Penicillin

- Fluoroquinolone

- 7-ACA

- Macrolide

- Aminoglycoside

- Sulfonamide

- Others

Market Dynamics:

Pharmaceutical companies’ enhanced efforts to create novel therapies for infectious disorders are projected to fuel market expansion. In December 2019, the Pew Charitable Trusts announced that 41 potential compounds were being studied for the treatment of severe bacterial infections. Seventeen of the investigational medications are currently in the third stage of clinical studies, while the remaining seventeen have submitted NDAs for approval.

During the projected period, they are expected to be marketed. In the second half of 2019, the US FDA authorized four new antibiotic medicines. The GAIN Act (together with the REVAMP Act) is also projected to speed up the global approval process. The market will rise throughout the forecast period due to the introduction of new antibiotic treatments.

Antibiotic demand has increased significantly as the incidence of infectious diseases has increased. The significant prevalence of infectious disorders such as malaria, pneumonia, and lower respiratory infections is also fueling market expansion. The rising disease burden has driven both government & non-government organizations to invest in research and development. This will aid in the development of new antibiotics as well as regulatory policies that will expedite the approval procedure. BARDA has extended its assistance to numerous companies to help research new therapies for infectious diseases in collaboration with the government.

Over the next few years, collaborations in the development and manufacture of antibiotics are likely to result in the development of a large number of novel antibiotic medications. Pharmaceutical companies have begun to collaborate on the discovery of new therapeutics in order to cut medication development expenses. In July 2019, Nosopharm established a partnership with Evotec AG to develop NOSO-502. It’s a brand-new antibiotic that combats infections caused by Enterobacteriaceae bacteria. Basilea Pharmaceutica Ltd. and Forge Therapeutics, Inc. announced research cooperation and a license agreement to develop innovative antibiotics in April 2019.

The product pipeline will be bolstered by the expanding number of public-private partnerships, which offer governmental agencies financing and novel R&D methodologies for antibiotic research. For example, the Global Antibiotic Research and Development Cooperation established a public-private partnership between Evotec AG and Evotec AG in March 2019 to create first-in-class antibiotics for treating drug-resistant bacterial infections.

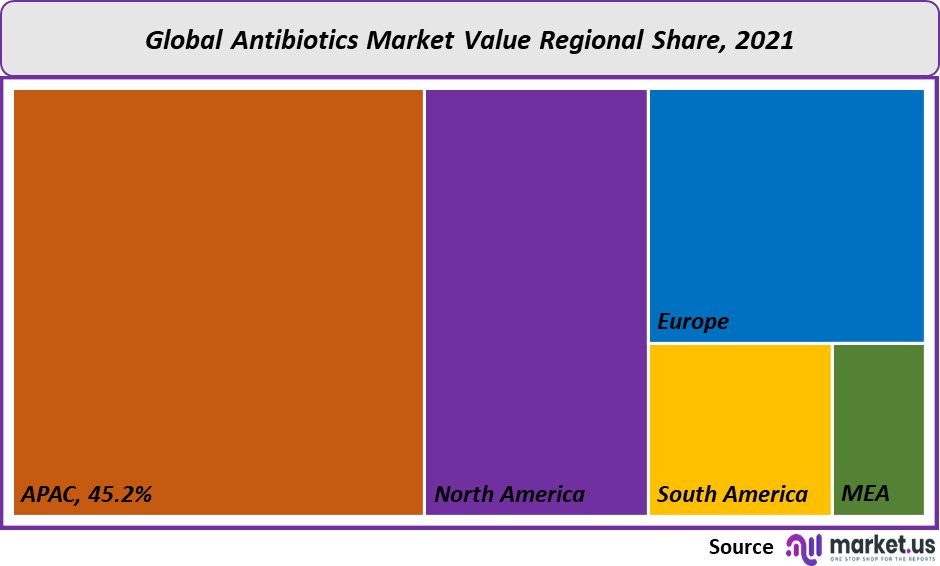

Regional Analysis:

In 2021, Asia Pacific was responsible for 45.2% of the worldwide market. Over the projection period, it is expected to grow significantly. This is attributed to increased antibiotic use, an increase in infectious diseases, and government efforts to discover new drugs to tackle drug-resistant infections. The presence of generic players is also helping to boost the industry in the region. India and China are the two main markets for antibiotics in the region. Because of their unregulated sales and high antibiotic consumption, these countries are important market growth drivers.

After Europe, North America was the second-largest regional market for antibiotics. In 2021, North America and Europe accounted for 48.0% of the global antibiotics market. The healthcare infrastructure in these markets is well-developed and closely controlled. Infectious disease rates are rising, and government healthcare spending is increasing throughout North America. The US government has taken a number of steps to prevent infectious diseases, including encouraging research and development and promoting antibiotic stewardship.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

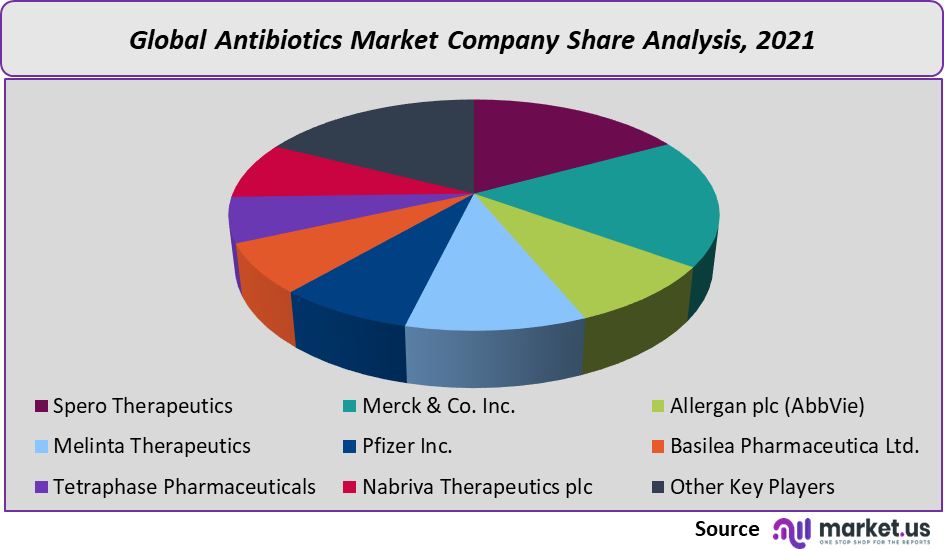

Market Share Analysis:

These businesses work on the development and marketing of novel treatments. They also sell products that attack the mechanisms of bacterial resistance. Other businesses include those with clinical-stage assets that are expected to join the market soon.

Key Market Players:

- Spero Therapeutics

- Merck & Co. Inc.

- Allergan plc (AbbVie)

- Melinta Therapeutics

- Pfizer Inc.

- Basilea Pharmaceutica Ltd.

- Tetraphase Pharmaceuticals

- Nabriva Therapeutics plc

- Other Key Players

For the Antibiotics Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Antibiotics market size in year 2021?A: The Antibiotics market size was $40,714 million in 2021.

Q: What is the CAGR for the Antibiotics market?A: The Antibiotics market is expected to grow at a CAGR of 5.48% during 2023-2032.

Q: What are the segments covered in the Antibiotics market report?A: Market.US has segmented the Antibiotics market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Action Method, the market has been segmented into cell wall synthesis inhibitors, protein synthesis inhibitors, dna synthesis inhibitors, rna synthesis inhibitors, mycolic acid inhibitors, and other action methods. By Drug Class, the market has been further divided into cephalosporin, penicillin, fluoroquinolone, macrolide, carbapenem, and other drug classes.

Q: Who are the key players in the Antibiotics market?,A: Merck & Co., Inc., Allergan plc (AbbVie), GlaxoSmithKline plc., Pfizer Inc., Melinta Therapeutics, Basilea Pharmaceutica Ltd., Tetraphase Pharmaceuticals, Paratek Pharmaceuticals Inc., and Other Key Players

Q: Which region is more attractive for vendors in the Antibiotics market?A: APAC accounted for the largest revenue share of 47% among the others. Therefore, APAC Antibiotics market is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Antibiotics ?A: Key markets for Antibiotics are the China, Japan, South Korea, India, US, etc.

Q: Which segment has the largest share in the Antibiotics market?A: In the Antibiotics market, vendors should focus on grabbing business opportunities from the pharmaceutical applications segment as it accounted for the largest market share in the base year.

![Antibiotics Market Antibiotics Market]()

- Spero Therapeutics

- Merck & Co. Inc.

- Allergan plc (AbbVie)

- Melinta Therapeutics

- Pfizer Inc Company Profile

- Basilea Pharmaceutica Ltd.

- Tetraphase Pharmaceuticals

- Nabriva Therapeutics plc

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |