Global Antimicrobial Plastics Market By Product (Commodity Plastics, Engineering Plastics, High Performance Plastics), By End-use (Building & Construction, Automotive & Transportation, Healthcare, Packaging, Food & Beverage, Textile, Consumer Goods, & Other End-uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: May 2022

- Report ID: 61652

- Number of Pages: 294

- Format:

- keyboard_arrow_up

Antimicrobial Plastics Market Overview:

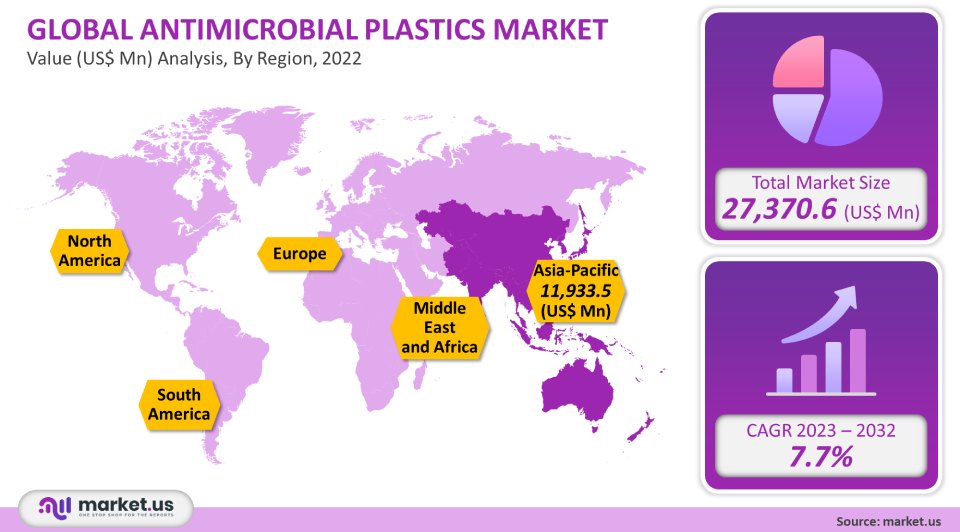

The market for antimicrobial plastics was worth USD 27,370.6 million in 2021. It is projected to grow at a CAGR of 7.7% between 2023 and 2032.

The market’s main driver is expected to be the increasing penetration in the healthcare, food, and beverage industries. In recent years, there has been a significant increase in antimicrobial plastic demand in consumer goods due to rising awareness about personal hygiene in light of increasing epidemics like H5N1 Avian flu, COVID-19, and H1N1 Swine Flu. Because of their antimicrobial properties, antimicrobial plastics are increasingly being used in healthcare to replace conventional materials for medical instruments like ventilators and anesthetic devices.

Global Antimicrobial Plastics Market Scope:

Product Analysis

Commodity plastic dominated the market, accounting for 68.4% of global revenue in 2021. Over the forecast period, the market will be driven by the increasing use of commodity plastic in packaging, healthcare, food and beverage, and consumer products. These industries are seeing product growth due to rising consumer awareness about personal hygiene and changing lifestyles. Due to their biocompatibility, high impact resistance, moisture resistance, and chemical resistance, and a wide variety of applications in different end-use industries, polyethylene, and polypropylene antimicrobial plastics are major contributors to the increase in demand for commodity plastic.

Coronavirus disease has impacted the demand for antimicrobial plastics used in consumer goods applications. Consumers are shifting to products that are safe, reliable, and sustainable. This shift in consumer purchasing behavior and structural changes in the consumer goods sector are expected to increase the demand for commodity plastics that have antimicrobial properties in consumer goods applications during the forecast period.

End-use Analysis

The market’s largest segment, the healthcare end-use segment, accounted for over 33.4% of global revenue in 2021. Due to the lower costs of home healthcare compared to hospital care, and the growing demand for ICU medical devices, the demand for antimicrobial plastics in the healthcare industry is expected to grow in the next few years. Medical devices will be in high demand due to the growing demand for healthcare services, the development of healthcare infrastructure, and the rising incidences of cardiovascular disease. This is expected to have positive effects on the demand for antimicrobial plastics in healthcare applications.

The recent spread of COVID-19 around the world is driving the demand for medical equipment such as gloves, masks, and testing equipment. This is boosting the market for antimicrobial plastics. An increasing number of positive cases in countries such as the U.S. and Iran are driving the demand for medical components. This is creating lucrative growth opportunities for the antimicrobial plastics market.

Because it doesn’t require any processing and is preservative-free (no need to be processed), antimicrobial plastic packaging is used extensively in the food and beverage industry. It inhibits the growth and reproduction of microorganisms, which extends the shelf life of perishable foods. Antimicrobial plastic packaging has seen an increase in usage in recent years due to consumer health awareness and the increasing demand for products that have a longer shelf-life. This trend is expected to continue in the future.Key Market Segments:

By Product

- Commodity Plastics

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Acrylonitrile Butadiene Systems (ABS)

- Polyethylene Terephthalate (PET)

- Engineering Plastics

- Polyamide (PA)

- Polycarbonate (PC)

- Thermoplastic polyurethane (TPU)

- Others

- High Performance Plastics

By End-Use

- Building & Construction

- Automotive & transportation

- Healthcare

- Packaging

- Food & Beverage

- Textile

- Consumer Goods

- Other End-Uses

Market Dynamics:

These plastics are great for food packaging in the food and beverage industries. They have excellent moisture resistance and help to reduce the growth of pathogenic microorganisms such as bacteria and yeast. Antimicrobial additives increase the plastic’s functional life and prevent the growth of bacteria which can make it less durable. This makes the plastic more resistant to odor, and corrosion, and easier to use in medical devices. Antimicrobial plastics are made using a combination of plastic resins with antimicrobial additions. Many antimicrobial additive producers invest in research and development to develop advanced technologies that will help them maintain a competitive edge. Polyfuze Graphics Corp. Launched a line of polymer-fusion products that include antimicrobial blocking agents in April 2020.

The need for hospitals and clinics is increasing due to rising healthcare costs and the growing population of developing countries. This will drive the demand for high-end medical equipment and devices in these areas, which in turn will fuel the demand to use antimicrobial plastics.Numerous government initiatives, such as the United Nations Task Force’s cervical cancer prevention and control program, encouraging the adoption of home healthcare services, and the establishment of long-term care centers are some of the key factors driving the demand for antimicrobial plastics within the healthcare industry. Antimicrobial plastic packaging is gaining popularity in the healthcare sector. It is used to protect medical equipment and plastic products from fungal and bacteria growth. This helps prevent communicable diseases.

The demand for antimicrobial materials in the healthcare sector has increased dramatically due to the recent COVID-19 outbreak. Due to the increasing number of sick patients, the demand for medical equipment like ventilators, beds, and gloves is growing. This has boosted the demand for antimicrobial materials in the healthcare sector.

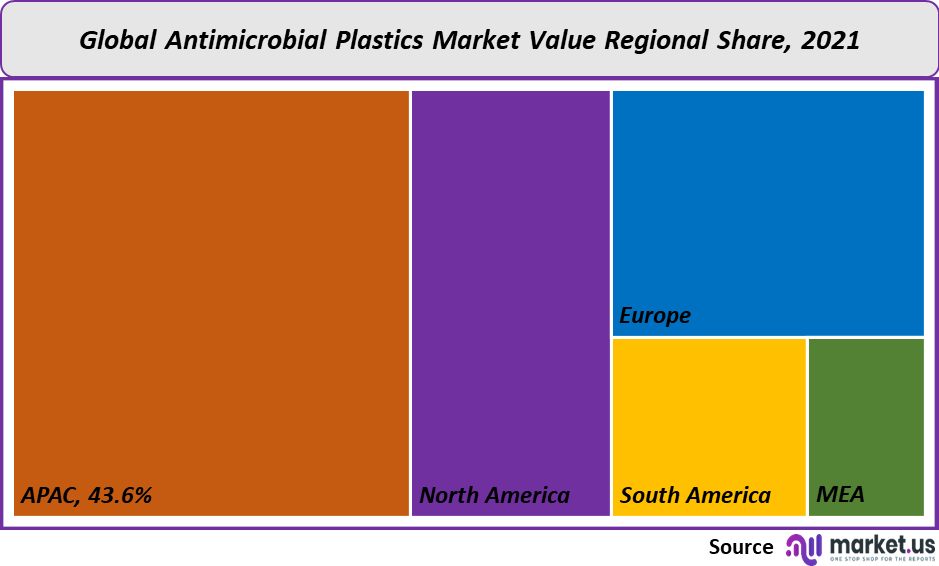

Regional Analysis:

The Asia Pacific was the dominant region in the antimicrobial plastics industry and held the largest revenue share at 43.6% in 2021. It is expected to maintain its dominance during the forecast period. Major end-use industries driving the Asia Pacific antimicrobial resins market include packaging, healthcare, building and construction, food & drink, and automotive & transport. The strong manufacturing base in China, India, and Japan will contribute to the region’s growth over the forecasted time.

China is expected to be one of the most promising markets in the region due to the government’s support in promoting investment in the manufacturing sector. The lower manufacturing costs in China have prompted many foreign direct investments into the country’s automotive industry. China’s abundant supply of raw materials, such as metals and polymers, is a positive factor that encourages new investment in the automotive & transport industry. The outlook for the Chinese automotive and transport industry is positive, which will likely boost the market growth in antimicrobial plastics over the forecast period.

Due to the growing demand for non-residential projects like schools and hospitals, the North American construction industry will experience significant growth over the forecast period. The “Affordable Health Care Act” has led to the construction of healthcare facilities and hospitals in the United States. The increasing population will also drive the construction of schools, offices, factories, and colleges. This will increase the demand for antimicrobial materials in the construction industry.

The U.S. has a strong manufacturing base that includes Johnson & Johnson and Unilever. This will increase the demand for flexible antimicrobial packaging in personal care. Over the forecast period, the U.S. government’s efforts to reduce carbon emissions by using eco-friendly products will likely increase the scope of applications for antimicrobial plastics within flexible plastic packaging.

The increasing demand for hybrid and electric vehicles, along with the presence of major European automotive manufacturers such as Volvo Car Corporation, Volkswagen AG and ASTON MARTIN and JAGUAR LANDROVER LIMITED, Mercedes-Benz AG and BMW AG, AUDI AG and FCA Italy S.p.A, Ferrari S.p.A, Automobili Lamborghini S.p.A. and Porsche Austria GmbH & Co. are expected to drive industry expansion. This will in turn lead to an increase in demand for antimicrobial materials in the automotive industry.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

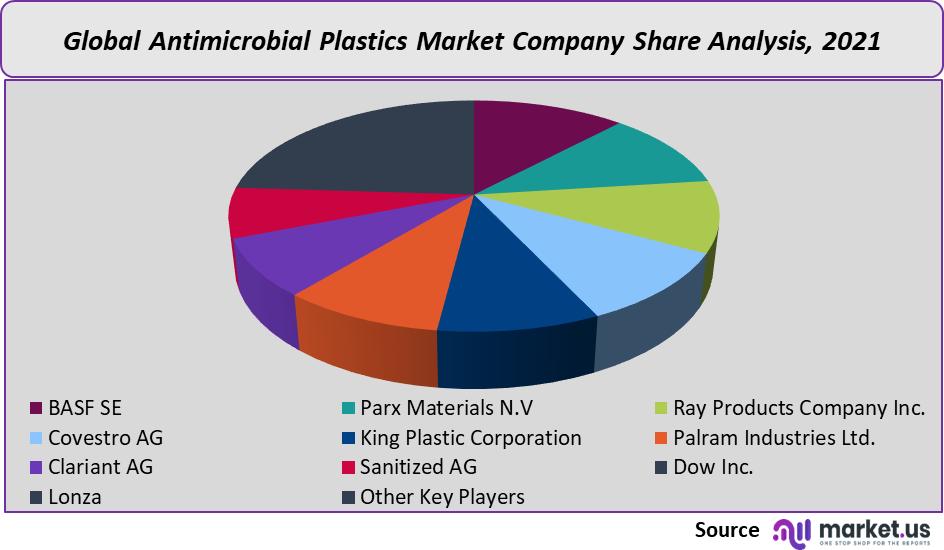

This market is characterized by large and small-sized companies that cater to local and global needs. Forward integration is key to the market’s success. This includes raw material production, manufacturing, distribution, and final sale to different industries. Continuous raw material supply is possible due to integration across all stages of the value chain. This also results in low manufacturing costs. A few companies have taken R&D steps to improve their product specifications and market reach. These initiatives are expected to increase product demand over the next years.

The following are some of the major players in this sector:

Market Key Players:

- BASF SE

- Parx Materials N.V

- Ray Products Company Inc.

- Covestro AG

- King Plastic Corporation

- Palram Industries Ltd.

- Clariant AG

- Sanitized AG

- Dow Inc.

- Lonza

- Other Key Players

For the Antimicrobial Plastics Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Antimicrobial Plastics market in 2021?The Antimicrobial Plastics market size is US$ 27,370.6 million in 2021.

What is the projected CAGR at which the Antimicrobial Plastics market is expected to grow at?The Antimicrobial Plastics market is expected to grow at a CAGR of 7.7% (2023-2032).

List the segments encompassed in this report on the Antimicrobial Plastics market?Market.US has segmented the Antimicrobial Plastics Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By product, the market has been segmented into Commodity Plastics, Engineering Plastics, High Performance Plastics; by end-use, the market has been segmented into Building & Construction, Automotive & transportation, Healthcare, Packaging, Food & Beverage, Textile, Consumer Goods, & Other End-uses.

List the key industry players of the Antimicrobial Plastics market?BASF SE, Parx Materials N.V, Ray Products Company Inc., Covestro AG, King Plastic Corporation, Palram Industries Ltd., Clariant AG, Sanitized AG, Dow Inc., Lonza, and Other Key Players are the key vendors in the Antimicrobial Plastics market.

Which region is more appealing for vendors employed in the Antimicrobial Plastics market?Asia Pacific accounted for the highest revenue share of 43.6%. Therefore, the Antimicrobial Plastics industry in Asia Pacific is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the Antimicrobial Plastics Market.The US, Canada, Mexico, Germany, U.K., France, Italy, China, India, Japan, Brazil, Argentina, GCC, South Africa, etc., are leading key areas of operation for Antimicrobial Plastics Market.

Which segment accounts for the greatest market share in the Antimicrobial Plastics industry?With respect to the Antimicrobial Plastics industry, vendors can expect to leverage greater prospective business opportunities through the commodity plastic segment, as this area of interest accounts for the largest market share.

![Antimicrobial Plastics Market Antimicrobial Plastics Market]() Antimicrobial Plastics MarketPublished date: May 2022add_shopping_cartBuy Now get_appDownload Sample

Antimicrobial Plastics MarketPublished date: May 2022add_shopping_cartBuy Now get_appDownload Sample - Commodity Plastics

- BASF SE Company Profile

- Parx Materials N.V

- Ray Products Company Inc.

- Covestro AG

- King Plastic Corporation

- Palram Industries Ltd.

- Clariant AG Company Profile

- Sanitized AG

- Dow Inc.

- Lonza Group AG Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |