Global Artificial Pancreas Device Systems Market By Device Type (Control-to-Target (CTT) Systems, Control-to-Range (CTR) Systems, and Others), By End Use (Hospital and Medical Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 56270

- Number of Pages: 385

- Format:

- keyboard_arrow_up

Artificial Pancreas Device Systems Market Overview:

The global artificial pancreas devices market was worth USD 208.1 million in 2021. It is expected to grow at a CAGR of 19.1% between 2023 to 2032.

Industry growth is driven by the rising prevalence of diabetes and intensive R&D efforts made by industry players. Artificial pancreas devices (APDS), which control blood glucose levels in diabetic patients, are being researched extensively by industry players.

These devices are much more accessible and are widely accepted by patients. Major factors driving the growth of this market include the growing geriatric population and the rising incidence of diabetes.

Global Artificial Pancreas Device Systems Market Scope:

Device Type analysis

The market can be divided into three segments based on type: CTR system, threshold suspended device system, and CTT system. In the artificial pancreas devices, the market segment Threshold suspended system was the largest and contributed 75.2% of global revenue in 2021.

The device stops insulin delivery if the sensor glucose level reaches a certain threshold and automatically responds to a threshold suspension alarm. This device is attractive because of its potential to treat hypoglycemic disorders such as type 1 diabetes. The threshold suspended device system, also known as the low glucose suspend the system, is also called this. This is used when severe hypoglycemia is present. Insulin is administered to raise glucose levels.

The Control-to-Target systems segment will experience exponential growth over the forecast period. CTT systems can be fully automated and do not require patient intervention for the administration of insulin or monitoring glucose levels. The CTT system will gain more momentum over the forecast period.

According to the International Diabetes Federation, 538 million people will be living with diabetes in 2021. This number is expected to increase to 650 million in 2032, and 783 million in 2045. Around 7 million people died from diabetes in 2021. CTT systems will likely see a rise in demand due to increasing diabetes prevalence and the large diabetic population.

End-Use analysis

In 2021, the Hospital industry led the Artificial Pancreas device market and accounted for the biggest revenue share. Over the projection period, the segment is anticipated to continue to rule. The increasing investment in building hospitals with cutting-edge technology and equipment is to blame for this development.

Kеу Маrkеt Ѕеgmеntѕ

By Device Type

- Control-to-Target (CTT) Systems

- Control-to-Range (CTR) Systems

- Threshold Suspend Device Systems

By End-Use

- Hospital

- Medical Centers

- Other End Uses

Market Dynamics:

Bionic Pancreas technology, and technological advances, such as in-home Bionic Pancreas use, are expected to provide significant growth opportunities in near future. Market growth has been driven by both developing and developed countries increasing their awareness of APDS and their usage.

Market growth will be aided by the COVID-19 epidemic. The business growth has been affected by disruptions in logistics and changes to international trading. The market for APDS is expected to increase as many countries have begun to relax their lockdowns and built strong distribution networks to regain lost business and prevent the discontinuation of market players.

In addition, COVID-19 deaths in diabetics are associated with obesity and hyperglycemia. COVID-19 patients with diabetes who have been treated for it have developed resistance to insulin and traditional insulin injections are not effective in managing their condition.

APDS can be used to replace frequent sugar level checks. Globally, increased teleconsultancy activities for routine and follow-up check-ups during pandemics are expected to increase market growth for point-of-care technologies like APDS. These trends will have a major impact on the adoption rate of APDS over the next few years.

One of the main factors driving the market growth for artificial pancreas device systems is the rising incidence of diabetes as a result of aging, obesity, and unhealthy lifestyles. Diabetes is on the rise due to obesity and overweight. WHO estimates that in 2016, more than 1.9 billion people were overweight. Of those, approximately 650 million were obese. These factors will increase diabetes prevalence, thereby increasing the demand for APDS.

According to the same source, diabetes prevalence is expected to increase from 171 million people in 2000 to 366 million in 2032. Market players in these markets will be able to capitalize on the huge growth potential created by diabetes. The market for artificial pancreas devices is also expected to grow due to the growing dependence of type 2 diabetes upon insulin.

The artificial pancreas was created with the primary purpose of controlling accurate blood glucose levels for patients with type 1 diabetes. For better diabetes management, many industry players have conducted numerous researches. Juvenile Diabetes Research Foundation (JDRF), for instance, launched the Artificial Pancreas Project in order to assist patients with type 1 diabetes. This project aimed at developing a commercially viable artificial pancreas that would replicate the biological function.

Medtronic is the leading company in R&D for the artificial pancreas system market. Medtronic launched the first artificial pancreas device, “MiniMed 670G”. Bigfoot Biomedical is also testing an artificial pancreas in the phase of its clinical trials. Globally, more than 21 research activities have been conducted in preparation for the introduction of the devices over the next few years. This will contribute to market growth over the forecast period.

With 89% of the artificial pancreas devices market, the United States dominated it in 2021. The key factors that will drive global artificial pancreas device market growth are high per capita incomes and rising healthcare spending. The American Diabetes Association estimates that in 2019, the average cost of diabetes-specific treatment per person was US$ 9,506.

A diabetic patient in the United States can expect to spend nearly US$ 16,750 annually on medical expenses. The industry is also growing due to the widespread adoption of smart devices, and technological advances such as AI and data analytics. One in eight people suffers from impaired glucose tolerance, according to the International Diabetes Federation. The forecast period will see this ratio increase.

These automated systems can also be used to control glycemic levels. They include the artificial pancreas, Insul pumps, insulin pens, and many other devices. These devices are in high demand due to their flexibility, accuracy, rapid insulin action, quick glucose detection, and ease of use. This product is supported by the large target market of children and the elderly.

News Medical data showed that the artificial pancreas system had better control over blood glucose than the traditional method for diabetes management in children. Artificial pancreas device systems will be more popular due to the efforts of healthcare organizations like WHO to improve care and provide better lives.

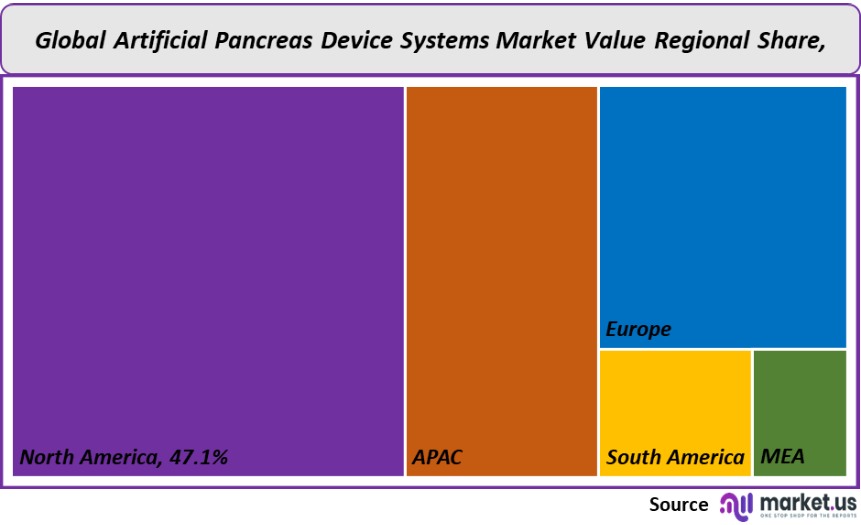

Regional Analysis

North America was the dominant market for artificial pancreas device systems in 2021. It accounted for 47.1% of the total revenue. The region is expected to be driven by the rising prevalence of obesity and the availability of effective reimbursement policies. There is also growing awareness about advanced technologies for diabetes management.

The market will be driven by major players, high treatment costs, technological advancements,s, and product launches. Globally, there has been a rise in diabetes incidences that have attracted both private and public investments to help manage the disease. These factors are expected to increase the adoption rate of APDS within the region.

The Asia Pacific artificial-pancreas devices market is forecast to experience lucrative growth over the forecast period. This region is seeing significant growth due to increased healthcare funding and government initiatives to raise awareness about diabetes. According to the International Diabetes Federation (IDF), India and China have the highest number of diabetes patients worldwide.

The majority of these countries are developing nations. This has led to an increase in type I and II diabetes. Despite diabetes’s increasing prevalence, the cost of treating the disease was much lower. The market will also be boosted by the adoption of new technology within developing countries.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

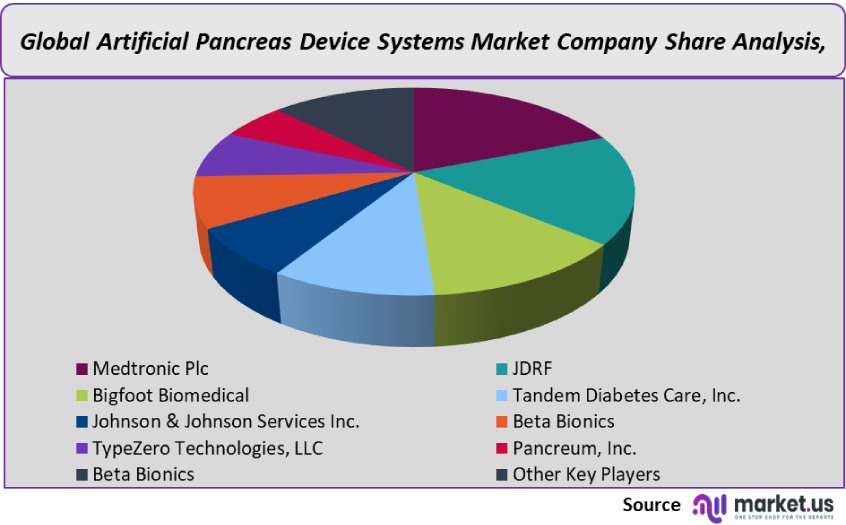

Market Share & Key Players Analysis:

To strengthen their market position, key market players participate in strategies like mergers and acquisitions, partnerships, and the launch and promotion of new technology-advanced products and services.

They invest heavily in R&D to produce technologically advanced products. Medtronic, for example, received CE-Mark in 2020 for its MiniMed780G. This device adjusts basal insulin rate automatically after five minutes. It is suitable for patients with diabetes between 7 and 80 years old. The U.S. FDA approved in September 2020 a next-generation closed-loop hybrid insulin delivery system for type 1 diabetic children aged 2-6 years.

Маrkеt Кеу Рlауеrѕ:

- Medtronic Plc

- JDRF

- Bigfoot Biomedical

- Tandem Diabetes Care, Inc.

- Johnson & Johnson Services Inc.

- Beta Bionics

- TypeZero Technologies, LLC

- Pancreum, Inc.

- Beta Bionics

- Other Key Players

For the Artificial Pancreas Device Systems Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Artificial Pancreas Device Systems market in 2021?A: The Artificial Pancreas Device Systems market size is US$ 208.1 million in 2021.

Q: What is the projected CAGR at which the Artificial Pancreas Device Systems market is expected to grow at?A: The Artificial Pancreas Device Systems market is expected to grow at a CAGR of 19.1% (2023-2032).

Q: List the segments encompassed in this report on the Artificial Pancreas Device Systems market?A: Market.US has segmented the Artificial Pancreas Device Systems market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Device Type, market has been segmented into Control-to-Target (CTT) Systems, Control-to-Range (CTR) Systems, and Threshold Suspend Device Systems. By End User, the market has been further divided into Hospital and Medical Centers.

Q: List the key industry players of the Artificial Pancreas Device Systems market?A: Medtronic Plc, JDRF, Bigfoot Biomedical, Tandem Diabetes Care, Inc., Johnson & Johnson Services Inc., Beta Bionics, TypeZero Technologies, LLC, Pancreum, Inc., Beta Bionics, and Other Key Players engaged in the Artificial Pancreas Device Systems market.

Q: Which region is more appealing for vendors employed in the Artificial Pancreas Device Systems market?A: North America accounted for the highest revenue share of 47.1%. Therefore, the Artificial Pancreas Device Systems industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Artificial Pancreas Device Systems?A: The U.S., Canada, U.K., Germany, France, Italy, Spain, Japan, China, India, are key areas of operation for Artificial Pancreas Device Systems Market.

Q: Which segment accounts for the greatest market share in the Artificial Pancreas Device Systems industry?A: With respect to the Artificial Pancreas Device Systems industry, vendors can expect to leverage greater prospective business opportunities through the threshold suspended system segment, as this area of interest accounts for the largest market share.

![Artificial Pancreas Device Systems Market Artificial Pancreas Device Systems Market]() Artificial Pancreas Device Systems MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Artificial Pancreas Device Systems MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Medtronic Plc

- JDRF

- Bigfoot Biomedical

- Tandem Diabetes Care, Inc.

- Johnson & Johnson Services Inc.

- Beta Bionics

- TypeZero Technologies, LLC

- Pancreum, Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |