Global Assisted Reproductive Technology Market By Type (In-Vitro Fertilization, and Artificial Insemination), By Application (Hospitals, and Fertility Clinics), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2020-2029

- Published date: Dec 2021

- Report ID: 63178

- Number of Pages: 297

- Format:

- keyboard_arrow_up

Assisted Reproductive Technology Market Overview

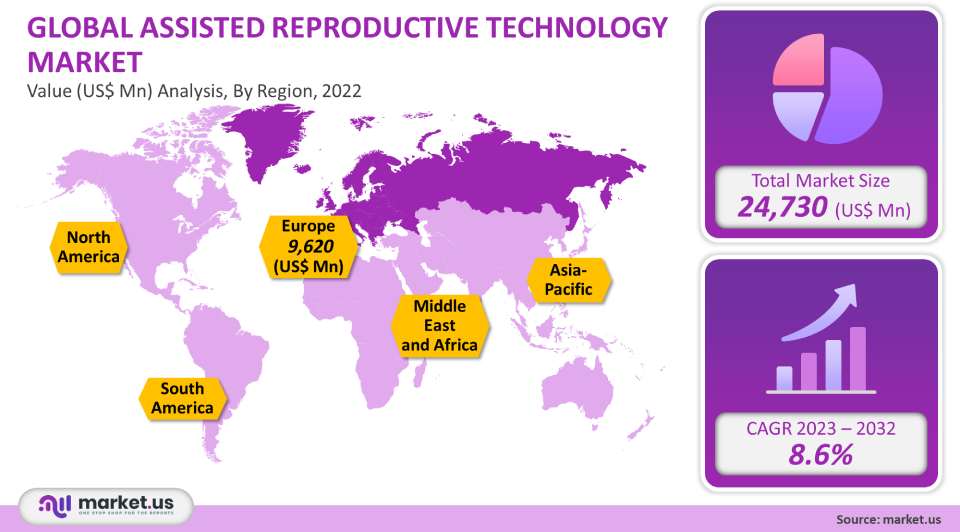

The global assisted reproductive technology market size was worth US$ 24.73 Billion in 2021. It is expected to grow at a CAGR of 8.6% over the forecast period of 2023-2032. This industry is expected to grow owing to surging infertility rates, improved ART market revenue success rates, and increased disposable incomes across the developing world. Growing awareness about fertility and declining fertility rates are key driving factors driving the market growth.

Global Assisted Reproductive Technology Market Scope:

Type Analysis

On basis of technology Type, this industry is categorized into Vitro Fertilization (IVF), and Artificial Insemination segment. On the basis of procedure, Further classification of the IVF sub-segment is as follows – fresh donor, frozen donor, and fresh non-donor. In 2021, the IVF segment accounted for more than 94.5% of global revenues. In 2021, the frozen non-donor sub-segment also accounted for a significant largest revenue share. This growth can be mainly attributed to the advantages associated with frozen donors over other In-Vitro fertilization procedures. Market analysis from technology-based analysis to market portfolio strategies is of target competitors.

When a woman is trying to conceive healthy eggs or undergoing ART because of male infertility, the frozen non-donor procedure is used. As a result, the number of IVF cycles using frozen non-donor advanced techniques continues to increase. Artificial insemination is expected to index the highest CAGR over the forecast period. This segment can be further broken down into intrauterine, intracervical, intravaginal, and intratubal fertilization. Artificial insemination can be used to treat minor fertility problems. There has also been an increase in the number of single women or couples of the same gender. Artificial insemination success rates vary depending on age.

According to the Human Fertilization and Embryology Authority, artificial insemination success rates per cycle are around 15.8% for women below 35 years, 11% for those between 35-39 years old, and 4.7% for women who were 40-42 years of age. More than half of intrauterine insemination women conceive children within 6 cycles.

End-User Analysis

Based on end-users, this global industry can be further divided into hospitals, specialty clinics, ambulatory surgical center segments & diagnostic centers. In 2021, the highest revenue share was attributed to fertility clinics and other facilities. This segment is expected to grow the fastest and maintain its position as the industry leader throughout the forecast period. This rapid annual growth rate and high revenue share can be attributed to an increase in primary infertility cases and the need to have ART performed in a specialized setting.

In May 2021, Gulf Capitals ART Fertility Clinics (based in West Asia) announced that it would invest US$ 31.3 Million in 18 clinics across major Indian cities. The segment’s growth is expected to be driven in developing nations by cost-effectiveness and specialization, expertise in the field, and personalized treatment. Due to the insufficient infrastructure to set up fertility clinics, hospitals are anticipated to index lucrative growth. Multispecialty hospitals are now the best option to treat infertility.

Key Market Segments:

By Type

In-Vitro Fertilization (IVF)

Artificial Insemination

By End-User

Hospitals

Specialty Clinics

Ambulatory Surgical Centers

Diagnostic Centers

Market Dynamics:

Assisted Reproductive Technology procedure (ART), is a medical procedure to improve fertility or prevent infertility. It typically involves the manipulation of eggs and sperm outside of the body and can be used to treat a wide variety of fertility issues. ART is not without its risks, however, and it is essential to consult with a doctor before pursuing any treatment. The first step in an ART fertility cycle is often the use of fertility drugs to stimulate the ovaries to increase the production of eggs. This process can take several weeks and may require additional drugs. After the eggs are harvested, they may be fertilized with donor sperm in a laboratory setting. This process is called “In Vitro” Fertilization (IVF). In IVF, eggs and sperm are placed in a glass chamber to facilitate fertilization outside the body. The fertilized eggs are then placed in the patient’s uterus. After the IVF process is complete, the patient will usually be asked to return for a series of ultrasounds to measure the embryo’s growth and observe fetal development.

According to the 2019 Fertility Clinics Success Rates Report by the Centers for Disease Control and Prevention, approximately 330,773 ART procedures were performed at almost 450 fertility clinics across the U.S. This industry is expected to grow due to a greater level of awareness concerning the causes and treatments of infertility. Pre-Implantation Genetic Testing (PGT), Endometrial Receptivity Analysis Testing (ERA), Magnetic Activated Cell Sorting (MACS), and time-lapse imaging of embryos are all expected to increase the acceptance demand for ART procedures in society.

Several organizations, such as the Society for Assisted Reproductive Technology (SART) & the American Society for Reproductive Medicine (ASRM), are working together to raise awareness about various infertility treatment options. In the area of embryo culture media for assisted reproductive advancements in technology, there are many innovative research methods. For instance, CooperSurgicals have found that embryo culture media with Granulocyte-macrophage Colony-Stimulating Factor (GM-CSF) includes essential nutrients which are required to develop a fresh embryo and further enhance the transmission between the embryo and the endometrium, developing the required environment for a pregnancy.

Due to the cessation of operations and a subsequent decrease in patient care volumes, this pandemic has had a negative impact on this industry. According to Sympathy Health data which contains data from 280 million Americans, there was a significant decline in ART procedures between March and April 2020 and 2019. The industry rapidly recovered & reclaimed pre-pandemic numbers thanks to the resumption of consultation and treatments by the American Society for Reproductive Medicine, the European Society of Human Reproduction and Embryology, and the International Federation of Fertility Societies. The governments used different strategies to stop the spread of this infection. Some measures taken were to stop fertility treatments such as artificial insemination, In Vitro Fertilization (IVF), canceling all frozen embryo transfer, as well as non-urgent cryopreservation.

This industry’s growth is anticipated to be boosted by technological advancements and the adoption of telehealth in ART. Telehealth adoption in ART advanced services is still in its infancy stages. It has great potential for the future due to its advantages, such as remote monitoring, continuous management, and monitoring. However, the high costs of ART treatments and ethical concerns surrounding them could potentially restrain the market growth. The World Health Organization’s Statistics 2020 estimates that approximately 186 million people worldwide are affected by the rate of infertility. Many factors contributing to the rising incidence prevalence of infertility include Sexually Transmitted Infections (STIs), a growing number of cigarette smokers, and cases of obesity, endometriosis (PCOS), Primary Ovary Insufficiency (POC), and other conditions. Industry growth is expected to be supported by technological advancements, new product launches, and strategic mergers & acquisitions by key players.

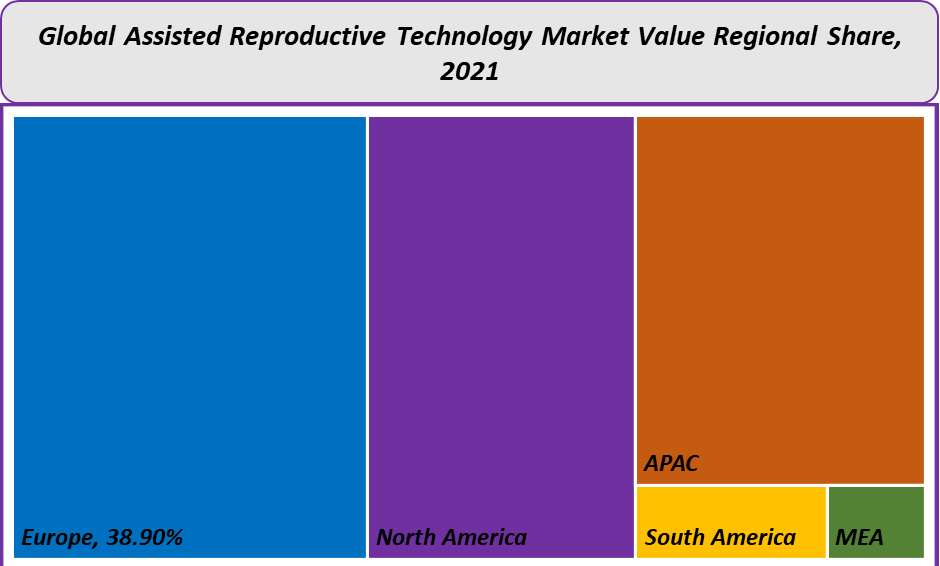

Regional Analysis

The markets in Europe were dominant in 2021, accounting for more than 38.9% of total revenues. This high share can be attributed to an increased rate of infertility, improved awareness about fertility treatments and technological advances, as well as the implementation of supportive government initiatives. According to the European Society of Human Reproduction and Embryology (EUSRHE), approximately 25 million people in the European Union experience infertility. This is the highest number worldwide. The forecast period for North America will index significant growth. Patients who undergo this treatment have positive outcomes that lead to this growth. The CDC reports that 2.1% of U.S. infants are born with ART. 5.5% are born in Massachusetts (the highest), 5.0% in the District of Columbia, and 4.4% in New Jersey. The ART market is expected to expand in the Asia Pacific region due to technological advancements and increased research activities. According to the Reproductive Medicine and Biology journal, Japan registered approximately 458,101 ART treatments in 2019, with 60,598 newborn births. Japan had 624 ART facilities, and 598 reported some form of ART treatment.

Key Regions and Countries Covered in this Report:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

Market Share & Key Players Analysis:

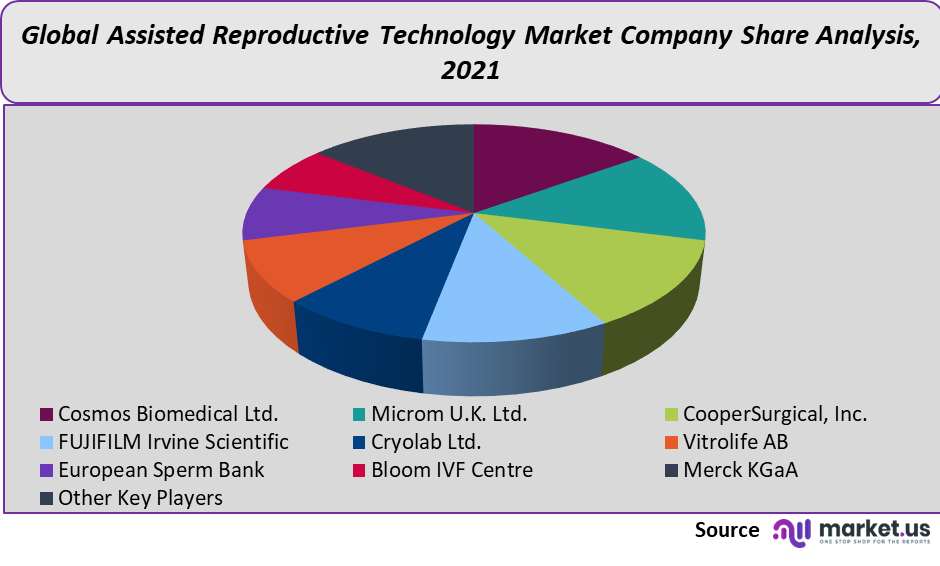

To gain a more significant industry share, key players are implementing various strategies such as product launches and investments in R&D. For example, CooperSurgical purchased Embryo Options in January 2021. This company is a significant player in cryo-storage software for fertility clinics. Embryo Options will inform patients about their stored specimens to aid in future ART treatments. For instance, Hamilton Throne Ltd. acquired IVFTech ApS, a global provider for ART research, and K4 Technology ApS. This is an associated company with IVFtech, which is dedicated to providing ART with high-capacity incubators and laminar flow workstations. This transaction was valued at US$8 million. Some key players have contributed to this market opportunities growth factors through investments, collaborations, mergers & acquisitions. Cooper Companies acquired Generate Life Sciences in December 2021. Generate Life Sciences is the world’s largest supplier of donor eggs and donor sperm for fertility treatments. Cooper Companies will benefit from the transaction valued at US$1.6 billion. Fertility clinics provide a wide range of treatments from IVF and freezing eggs.

The following players dominate the market for assisted reproductive technology:

Market Key Players:

Microm U.K. Ltd.

CooperSurgical Inc.

FUJIFILM Irvine Scientific

Cryolab Ltd.

Vitrolife AB

European Sperm Bank

Bloom IVF Centre

Merck KGaA

Ferring B.V.

Other Key Players

For the Assisted Reproductive Technology Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

24.73 Billion

Growth Rate

8.6%

Forecast Value in 2032

61.28 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the assisted reproductive technology market in 2021?The assisted reproductive technology market was valued at US$ 24.73 billion in 2021.

What is the projected CAGR at which the assisted reproductive technology market is expected to grow at?The assisted reproductive technology market is expected to grow at a CAGR of 8.6% (2023-2032).

List the segments encompassed in this report on the assisted reproductive technology market?Market.US has segmented the Global Assisted Reproductive Technology Market Value (US$ Mn) Analysis by Region, 2022 market by Region (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into In-Vitro Fertilization (IVF), and Artificial Insemination, By End-User market has been segmented into Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Diagnostic Centers.

List the key industry players in the assisted reproductive technology market?Cosmos Biomedical Ltd., Microm U.K. Ltd. CooperSurgical Inc., FUJIFILM Irvine Scientific, Cryolab Ltd., Vitrolife AB, European Sperm Bank Bloom IVF Centre, Merck KGaA, and Ferring B.V., among other key players.

Which region is more appealing for vendors employed in the assisted reproductive technology market?Europe accounted for the highest revenue share of 38.9%. Therefore, the assisted reproductive technology industry in Europe is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the assisted reproductive technology market.Germany, France, the UK, The US, Canada, Mexico, China, Japan, etc., are key leading areas of operation for the assisted reproductive technology market.

Which segment accounts for the highest market share in the assisted reproductive technology industry?With respect to the assisted reproductive technology industry, vendors can expect to leverage greater prospective business opportunities through the in-vitro fertilization segment, as this area of interest accounts for the largest market share.

![Assisted Reproductive Technology Market Assisted Reproductive Technology Market]() Assisted Reproductive Technology MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Assisted Reproductive Technology MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - Cosmos Biomedical Ltd.

- Microm U.K. Ltd.

- CooperSurgical Inc.

- FUJIFILM Irvine Scientific

- Cryolab Ltd.

- Vitrolife AB

- European Sperm Bank

- Bloom IVF Centre

- Merck KGaA Company Profile

- Ferring B.V.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |