Global Athletic Footwear Market By Type (Aerobic Shoes, Running Shoes, Walking Shoes, and Others), By End-Use (Men, Women, and Children), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 19833

- Number of Pages: 224

- Format:

- keyboard_arrow_up

Athletic Footwear Market Overview:

The global market for athletic footwear was worth USD 115,514.1 million in 2021. This market is forecast to grow at a compound annual growth rate of 5.3% between 2023-2032.

Market growth is being driven by rising awareness and enthusiasm regarding the health benefits associated with sports and fitness, the flourishing retail industry e-commerce sector around the world, and increasing disposable income.

Global Athletic Footwear Market Scope:

Type Analysis

Running shoes dominated the market in 2021. Their revenue share was over 37.1%. This is due to their daily use and availability in a variety of price points, from athletic shoes to expensive athletic shoes. Running shoes can be used for training, racing, trail running or advanced running. We have also reviewed the segment of sports shoes based on top sports in each region. In the United States, there is a market for sports shoes that includes basketball, American football and tennis.

Technological advancements that allow hikers more comfort and flexibility have led to the hiking and trekking shoe segment experiencing a healthy growth rate over the forecast period. W.L. In association with Salewa, Gore & Associates, Inc. introduced the first version of surround technology. GORETEX laminates are incorporated into the upper of hiking and trekking shoes to surround the feet from all sides. The shoes then expel sweat and heat through side ventilation.

End-Use Analysis

The largest revenue share was held by the men’s section at 56.4.0% in 2021. It will continue to dominate this market until 2030. As women continue to be more interested in sports, the market for footwear for women is growing. As compared to underdeveloped and developing countries, women athletes represent their country at major sporting events in most developed countries.

In advanced countries, women are much more likely to be aware of their fitness levels than in developing countries. However, this is gradually changing in the developing world due to efforts by governments in encouraging women to get involved in fitness and sports. This will increase sales of women’s footwear in emerging markets.

Key Market Segments:

By Type

- Aerobic Shoes

- Running Shoes

- Walking Shoes

- Trekking & Hiking Shoes

- Sports Shoes

By End-Use

- Men

- Women

- Children

Market Dynamics:

Young people are more interested in a healthy lifestyle and actively engage in sports and other activities. In the same way, many people are realizing that exercise and sport can improve health and lower the risk of developing chronic conditions such as diabetes, cardiovascular disease, depression, or other serious illnesses. These factors are driving the growth of the market.

Covid-19 had a significant effect on U.S. sports footwear and activewear companies. Brands: Converse, Brand Jordan, and Nike saw their footwear sales decline in the teens. Converse’s sales dropped more than 30%. Adidas, Skechers ASICS, Vans, and Under Armour all saw a decline in teens. Fila was almost half off.

If we look at the specific categories, spring sports are the most difficult to hit. The majority of these sports have been cancelled, postponed, or postponed. In fact, sales of golf shoes, soccer and baseball declined by an average of 30%. Both performances in basketball and lifestyle both declined in the teens. Mid-teens saw sales of running shoes drop and skate shoes (which had been growing rapidly before the pandemic) also suffered. Brooks experienced a modest increase, and Puma showed a positive trend in the low singles.

The importance of wearing the correct shoes for sports activities is also being recognized by more people. This helps to avoid muscle injuries, leg injuries, knee pain and hip pain as well as back pain. In the next few years, there will be a significant increase in demand for athletic footwear.

Athletic footwear is in high demand because of its use in different conditions. Athletic footwear is used by many consumers, including athletes and climbers. These shoes are used by many people, including athletes and gym-goers. Many types of athletic footwear are available on the market made from high-quality raw materials, including leather, foam and plastic. These shoes can also be enhanced with advanced chemical additives.

An increase in environmental concerns is limiting the growth of athletic footwear. The market is restrained by the government’s active efforts to reduce pollution. Industries are one of the major causes of the pollution of rivers and the environment.

Greenpeace reported that Puma, along with other brands of sportswear such as Nike and Adidas were referred to as “Dirty Laundry” in a report. Puma was accused in the report of working with Chinese suppliers, who, according to the report, contributed to the pollution of the Yangtze River and Pearl rivers.

Adidas AG has developed a Forged Mesh, which is a single-layer shoe with a ribbed design. It was created using ARAMIS motion tracking technology. The technology provides maximum flexibility and support for the ankles to allow for foot movement. Adidas AG has also patented other technologies, including Adaptive Traxion and Boost, Bounce Climachill, and Promeknit

Regional Analysis

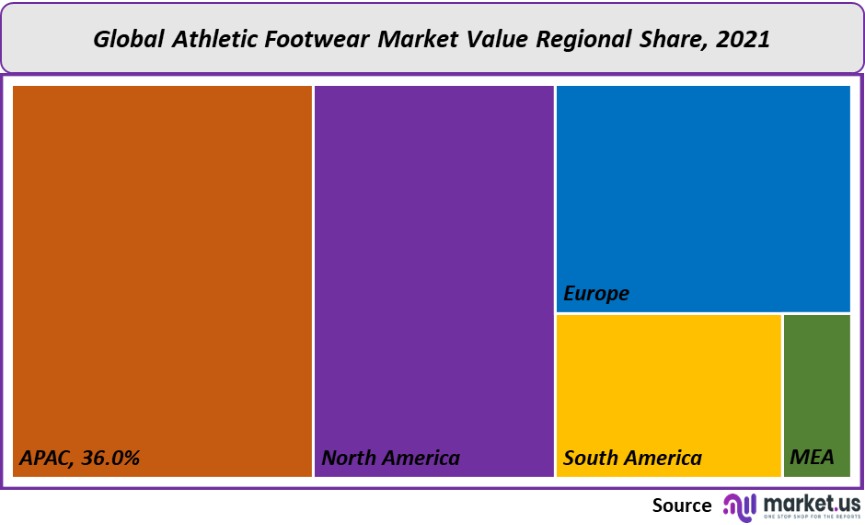

The Asia Pacific dominated this market, accounting for more than 36.0% of the total revenue in 2021. It is expected to remain the market leader over the forecast period. APAC is expected to see the greatest growth rate during the forecast period.

Asia Pacific’s growing disposable income and increased penetration of eCommerce will play a key role in driving demand for athletic shoes. The region’s market growth is being aided by the growing interest in participating in sporting events like the Asian Games, ICC Cricket World Cup and ACC Asia Cup.

This can be explained by the high population density and low average selling prices for athletic footwear in the region compared with developed economies such as the U.K. The U.S. is the main revenue source for the region’s growth. This can be attributed in part to the enthusiasm of the citizens for adventures, sports and fitness activities like trail running, hiking, training and aerobics.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

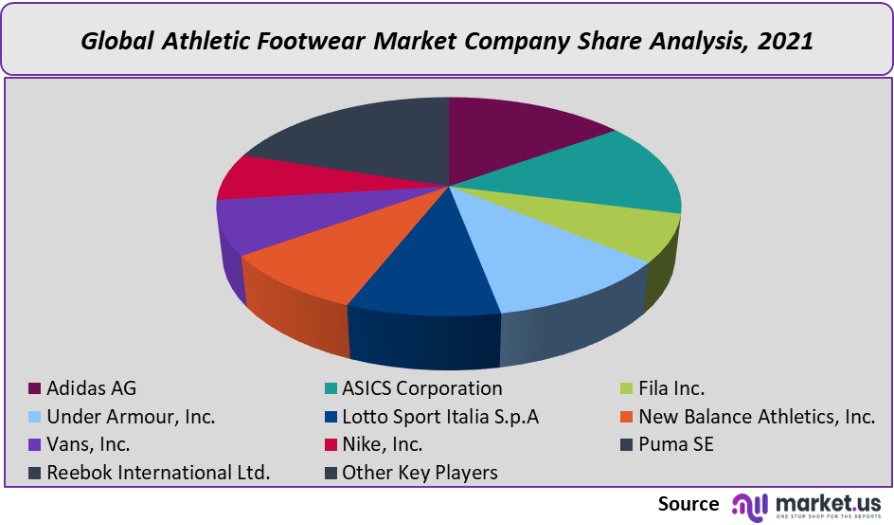

Market Share & Key Players Analysis:

Both domestic and international participants are represented in the market. The market’s key players are focused on new product launches and innovation to increase their portfolio. Adidas released the Yeezy Series 450 in March 2021 as a follow-up to its Yeezy 350 line. Kiko Kostadinov launched the ASICS GEL Quantum Levitrack in June 2021. It featured a GEL midsole.

Market Key Players:

- Adidas AG

- ASICS Corporation

- Fila Inc.

- Under Armour, Inc.

- Lotto Sport Italia S.p.A

- New Balance Athletics, Inc.

- Vans, Inc.

- Nike, Inc.

- Puma SE

- Reebok International Ltd.

- Other Key Players

For the Athletic Footwear Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Athletic Footwear market in 2021?A: The Athletic Footwear market size is US$ 115,514.1 million in 2021.

Q: What is the projected CAGR at which the Athletic Footwear market is expected to grow at?A: The Athletic Footwear market is expected to grow at a CAGR of 5.3% (2023-2032).

Q: List the segments encompassed in this report on the Athletic Footwear market?A: Market.US has segmented the Athletic Footwear Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By type, the market has been segmented into aerobic shoes, running shoes, walking shoes, trekking & hiking shoes, and sports shoes; and the end-use market has been segmented into men, women, and children.

Q: List the key industry players of the Athletic Footwear market?A: Adidas AG, ASICS Corporation, Fila Inc., Under Armour, Inc., Lotto Sport Italia S.p.A, New Balance Athletics, Inc., Vans, Inc., Nike, Inc., Puma SE, Reebok International Ltd., and Other Key Players, are engaged in the Athletic Footwear market.

Q: Which region is more appealing for vendors employed in the Athletic Footwear market?A: APAC accounted for the highest revenue share of 36%. Therefore, the Athletic Footwear industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for the Athletic Footwear Market.A: The US, Canada, Mexico, China, Japan, Germany, France, UK, etc., are leading key areas of operation for Athletic Footwear Market.

Q: Which segment accounts for the greatest market share in the Athletic Footwear industry?A: With respect to the Athletic Footwear industry, vendors can expect to leverage greater prospective business opportunities through the running shoes segment, as this area of interest accounts for the largest market share.

![Athletic Footwear Market Athletic Footwear Market]()

- Adidas AG

- ASICS Corporation

- Fila Inc.

- Under Armour, Inc. Company Profile

- Lotto Sport Italia S.p.A

- New Balance Athletics, Inc.

- Vans, Inc.

- Nike, Inc.

- Puma SE

- Reebok International Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |