Global Automotive Adhesives and Sealants Market By Product (Acrylic, PVA, Polyurethane, Styrenic Block, Epoxy, EVA, and Other Products), By Technology (Solvent-based, Water-based, Hot melt, and Reactive & Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCV), and Medium & Heavy Duty Commercial Vehicles (H/MCV)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 13830

- Number of Pages: 261

- Format:

- keyboard_arrow_up

Automotive Adhesives And Sealants Market Overview:

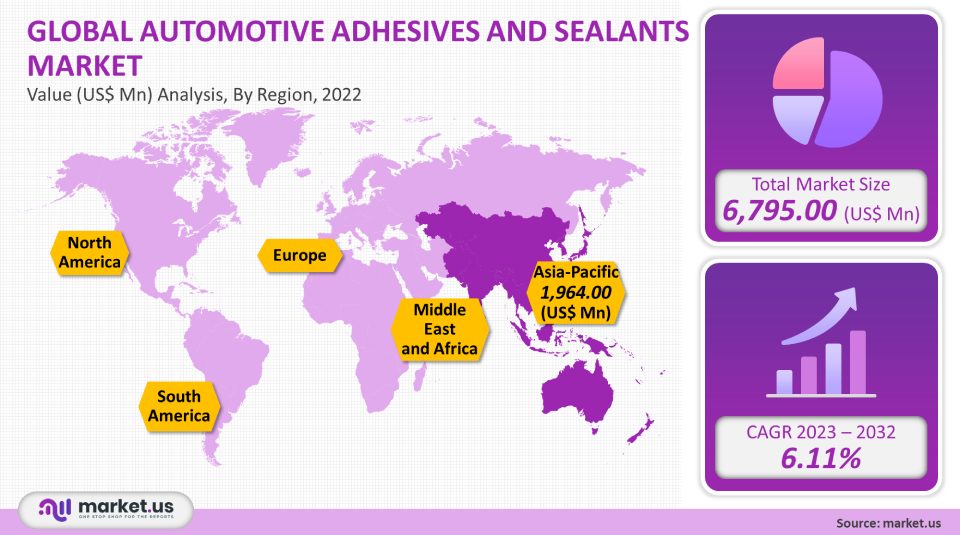

In 2021, the global automotive sealants and adhesives market was valued at USD 6,795.00 Million. This market is expected to grow at a compound annual growth rate (CAGR) of 6.11% between 2022-2032.

Authorities have imposed strict environmental regulations to cut carbon emissions. This has driven demand for lightweight adhesives materials instead of heavy metal fasteners.

Most adhesives used in automotive are synthetic. They use a variety of raw materials, including vinyl acetate monomer and acrylics as well as polyester resins, polyester resins, and amine-based resins. Major industry players are developing innovative products that use bio-based and renewable feedstock.

Global Automotive Adhesives and Sealants Market Scope:

Product analysis

Acrylic, Polyvinyl Acetate (PVA), epoxy, styrenic blocks, epoxy, EVA, and others (silicones, polyisobutylene) are all products. Acrylics will be the fastest-growing product segment with a 4.4% CAGR. This is due to their exceptional bonding strength and high resistance to humidity and impact. This segment will see rapid growth due to rising passenger car sales in emerging countries.

Another important segment is a polyurethane (PU), which has seen high growth in the Asia Pacific automotive market. Favorable government rules and increased investments are two of the main factors driving PU demand in the region.

There are many types of sealant products, including silicones, acrylics, PVAs, polyurethanes, polyurethanes, and polyurethanes. Because of their flexibility, high thermal & electric conductivity, and resistance to high temperatures, silicones will continue to be the most popular product.

Technology analysis

In 2021, water-based technology dominated the market. This was due to the replacement of traditional solvent-based adhesion products with more options. These products can be made from either natural polymers such as protein, vegetables, and animals, or soluble synthetic polymers like polyvinyl alcohol and cellulose ethers.

With a 5.8% CAGR, reactive is expected to expand at a moderate pace. High-performance adhesives such as Reactive are gaining popularity due to their high bond strength and durability in adverse environments.

Vehicle Type analysis

Commercial vehicles are increasingly using automotive adhesion products because they can be custom-designed to meet numerous requirements, such as utility operations, emergency service, trash collection, etc., so high-performance solutions are required. For preventing water intrusions or leaks in heavy commercial vehicles, sealants are used. These sealants are used to bond trailer bed to frame, wall skin, and interior brackets to frame.

Due to the high number of passenger cars sold in major countries around the world, the industry was dominated by them. According to OICA statistics, passenger car sales increased by 4.5% between 2023 and 2032. This may have been due to rising disposable income, increased production in developing economies, and technological advances at the OEM level that allow for higher, more efficient production.

Кеу Маrkеt Ѕеgmеntѕ:

By Product

- Acrylic

- PVA

- Polyurethane

- Styrenic Block

- Epoxy

- EVA

- Other Products

By Technology

- Water-based

- Solvent-based

- Hot melt

- Reactive & Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Medium & Heavy Duty Commercial Vehicles

Market Dynamics:

Bostik has introduced a new silyl modified plastic (SMP) technology to increase safety and efficiency for automotive manufacturers. Water-based adhesives are becoming more popular as they are environmentally friendly and less toxic to the environment.

Sealants that were traditionally silicone- or acrylic-based are now being made with renewable feedstocks and innovative technologies. This will allow for enhanced product properties. Sika AG has developed new technologies, such as multipurpose and anchoring sealants that have waterproof properties specifically for automotive technology.

For glazing and caulking technology in construction, hybrid sealants are used. These innovative products are also designed to facilitate the movement of pre-joined automotive parts. Henkel also has products that don’t require pre-treatment. This eliminates the need for substrate treatment.

Technology trends are influenced by the key factors of minimalism and weight reduction. Specialized products are being introduced by companies that combine multiple properties. Manufacturers have new opportunities to create environment-friendly, fast-curing adhesives using biobased and renewable materials. This is expected to encourage industry growth.

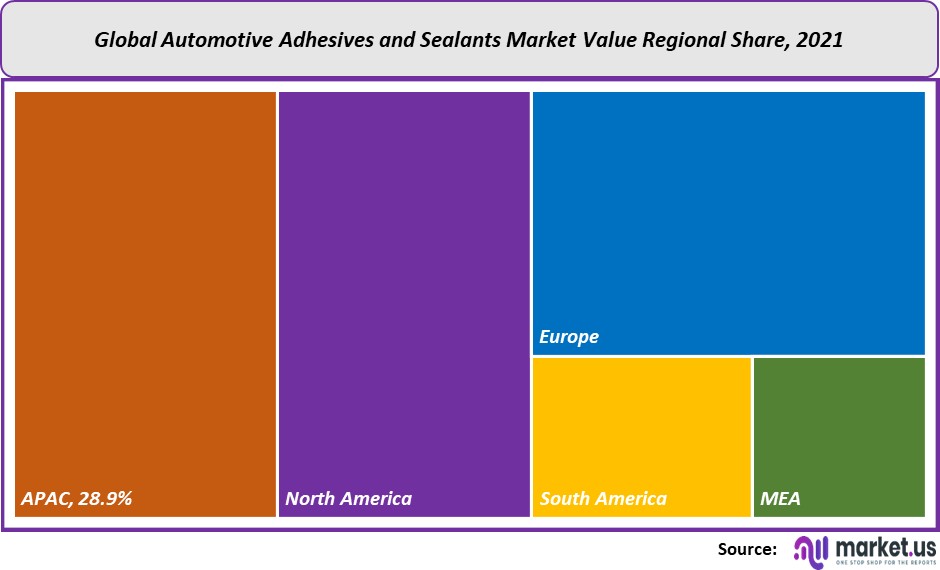

Regional Analysis:

APAC accounted for the highest market share of 28.9% in 2021. The region of Greater China is expected to remain lucrative from 2023-2032 due to an increase in automobile production and favorable conditions like low labor costs and proximity to emerging economies.

The fastest-growing region in the world is expected to be the rest of the planet (RoW), due to the rapid expansion of the automotive sector in India and Brazil, Colombia, Indonesia, and The Philippines.

The U.S. automotive sector is expected to rebound and Mexico’s expansion will drive North American demand at a faster pace than other economies. Due to the recent shale oil boom, feedstock prices have fallen which has positively impacted manufacturers’ profit margins.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

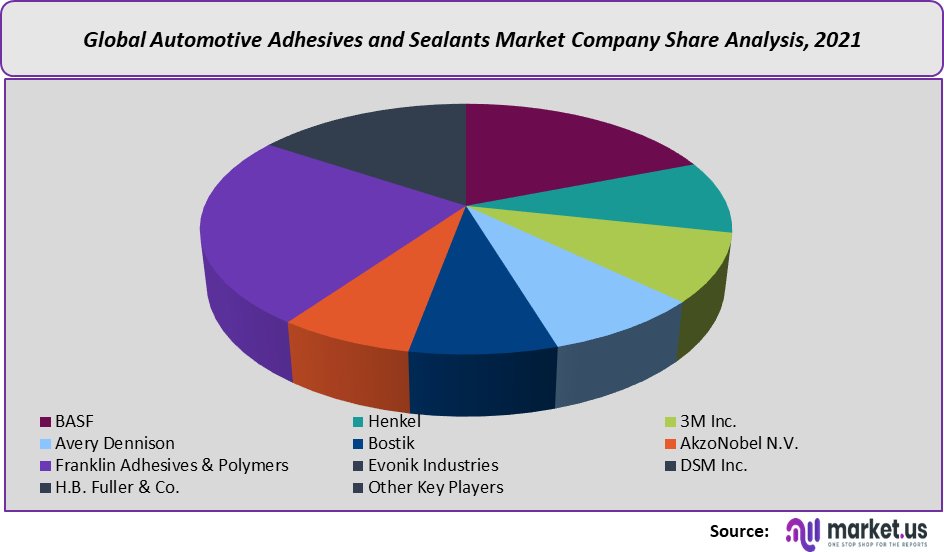

Market Share & Key Players Analysis:

The industry is fragmented by major multinationals that have a presence in several countries. Multinational companies are expected to face increased competition from smaller and medium-sized players in the sector. As companies seek to grow their portfolios and consolidate their position in the industry, they will be able to increase their technological and product innovation.

Маrkеt Кеу Рlауеrѕ:

- BASF

- Henkel

- 3M Inc.

- Avery Dennison

- Bostik

- AkzoNobel N.V.

- Franklin Adhesives & Polymers

- Evonik Industries

- DSM Inc.

- H.B. Fuller & Co.

- Other Key Players

For the Automotive Adhesives And Sealants Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Automotive Adhesives and Sealants market?The Automotive Adhesives and Sealants market size is projected to generate revenues of approx. US$ 6,795.00 million (2023-2032).

Q: What is the projected CAGR at which the Automotive Adhesives and Sealants market is expected to grow at?The Automotive Adhesives and Sealants market is expected to grow at a CAGR of 6.11% (2023-2032).

Q: List the segments encompassed in this report on the Automotive Adhesives and Sealants market?Market.US has segmented the Automotive Adhesives and Sealants market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Acrylic, PVA, Polyurethane, Styrenic Block, Epoxy, EVA, and Other Products. By Technology, the market has been further divided into Water-based, Solvent-based, Hot melt, and Reactive & Others. By Vehicle Type, the market has been further divided into Passenger Cars, Light Commercial Vehicles (LCV), and Heavy & Medium Duty Commercial Vehicles (H/MCV).

Q: List the key industry players of the Automotive Adhesives and Sealants market?BASF, Henkel, 3M Inc., Avery Dennison, Bostik, AkzoNobel N.V., Franklin Adhesives & Polymers, Evonik Industries, DSM Inc., H.B. Fuller & Co. and Other Key Players engaged in the Automotive Adhesives and Sealants market.

Q: Which region is more appealing for vendors employed in the Automotive Adhesives and Sealants market?APAC is expected to account for the highest revenue share of 28.9%. Therefore, the Automotive Adhesives and Sealants Technology industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Automotive Adhesives and Sealants?South Korea, Germany & The US, are key areas of operation for Automotive Adhesives and Sealants Market.

Q: Which segment accounts for the greatest market share in the Automotive Adhesives and Sealants industry?With respect to the Automotive Adhesives and Sealants industry, vendors can expect to leverage greater prospective business opportunities through the Epoxy segment, as this area of interest accounts for the largest market share.

![Automotive Adhesives And Sealants Market Automotive Adhesives And Sealants Market]() Automotive Adhesives And Sealants MarketPublished date: Oct 2021add_shopping_cartBuy Now get_appDownload Sample

Automotive Adhesives And Sealants MarketPublished date: Oct 2021add_shopping_cartBuy Now get_appDownload Sample - BASF SE Company Profile

- Henkel

- 3M Inc.

- Avery Dennison

- Bostik

- AkzoNobel N.V.

- Franklin Adhesives & Polymers

- Evonik Industries

- DSM Inc.

- H.B. Fuller & Co.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |