Global Aftermarket Automotive Parts Market by Replacement Parts (Body parts, Brake Parts), By Distribution Channel (Wholesalers & Distributors, and Repair Shops), By Certification, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 13831

- Number of Pages: 246

- Format:

- keyboard_arrow_up

Aftermarket Automotive Parts Market Overview

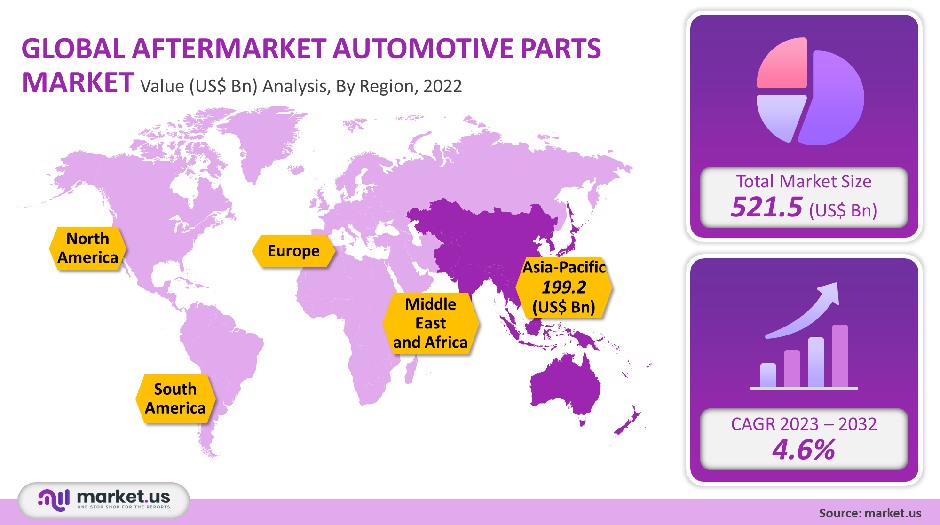

In 2021, the global Aftermarket Automotive Parts Market was valued at USD 521.5 billion. Between the forecast period 2022 to 2032, this market is expected to experience a CAGR of 4.6%.

Automobile drivers are the main core element of this industry. In addition, this market is driven by vehicle performance, including speed, exhaust sound, appearance, and other parameters. Key players are expected to invest heavily in digitizing component delivery services and sales and creating an online portal that distributes aftermarket components in conjunction with global auto-part supplier groups.

In the coming years, global market demand will be driven by top industry suppliers like CarParts.com and US Auto Parts Network Inc. The potential for online aftermarket businesses in developing countries is high due to these trade above portals. This market is expected to grow rapidly due to increasing online sales of automobile components.

Market Scope:

Replacement Part Analysis

This market was dominated by the ‘Others’ segment, with a 48.7% market share in 2021. Concerning replacement parts, ‘Tires’ were the largest sub-segment and are expected to retain its edge in terms of market size. On account of the short replacement cycles of tires, this sub-segment is expected to continue to be the most significant aspect.

Aftermarket replacement parts suppliers include lubricants, tire suppliers, and other genuine component replacement suppliers. Industry value chains also include service enablers like repair and entertainment service providers. The automobile industry’s growth is steadily increasing the demand for Automobile components for hybrid electric vehicles.

This would eventually reduce the need for specific tools and engines otherwise needed for conventional ICE vehicles. The increasing costs of petrol and petrol-powered automobiles have directly influenced this decrease. This market’s annual growth rate will be affected by an expected increase in customer disposable incomes in developing countries like Brazil and China. The growing industry demand for transportation solutions will drive the demand for components. Market economies are expected to be governed by rigid safety standards for automobiles. Major players in this industry use 3D printing technology for automotive parts to reduce overall production costs. 3D printing allows for efficient fabrication and lowers emission toxicity.

Distribution Channel Analysis

This market was dominated by the retail segment, which accounted for a 56.6% share in 2021. Regarding market size, the retail segment is slated to retain its place in this industry throughout the forecast period (2032). From 2022 to 2032, the wholesale and distribution segments will experience a rapid annual revenue growth rate. The automotive aftermarket landscape is essential to the overall automotive manufacturing process. Automotive components must be regularly replaced to maintain a vehicle’s overall performance.

This industry is gradually transitioning towards digitalization due to the increasing influence of numerous technological advancements. The marketplace is constantly changing, and the aftermarket industry is moving online. Online sales of parts and services are also increasing. The growing trend toward online aftermarkets is affecting every player in the value chain, including Original Equipment Manufacturers (OEMs), Original Equipment Suppliers (OES), wholesalers, and insurers workshops. A few factors expected to drive the market growth are advancements in technology for automotive parts fabrication, increased consumer and passenger vehicle production, and the adoption of digitalization in auto repair and maintenance services.

Service Channel Analysis

The Original Equipment (OE) market share for 2021 was 72.0%. In terms of size, the OE segment is expected to continue its dominance in the aftermarket arena by 2032. From 2022 to 2032, the DIY segment will experience rapid revenue growth. DIY customers are skilled in maintaining, repairing, and upgrading their respective vehicles. Do-It-for-Me (DIFM) customers can order parts online and install them by a professional workshop.

Aftermarket service channels include members such as raw material suppliers and Tier-1 distributors. Key stakeholders of the service channels of distribution are repair centers. There is a growing trend toward strategic alliances and collaborations among collision repair centers and top auto insurance companies to gain a competitive edge in this market. Utica Mutual Insurance Company and State Farm Mutual Automobile Insurance Company have tie-ups with automotive repair shops in all 50 US states.

Certification Analysis

The genuine parts sub-segment accounted for the majority market share, with 52.0% of this industry in 2021. In terms of size, the genuine segment is expected to continue its dominant position in the aftermarket market until 2032. The revenue growth of the uncertified sub-segment will be rapid from 2022 to 2032. Counterfeit parts can be illegal and are not certified or tested. They also come with no warranty. Original parts are made by OEMs or car manufacturers, also known as under-contractors. Genuine parts are more reliable, easier to find, and have a warranty. These parts are not cheap and must be bought from authorized dealers.

Certified organizations inspect and test certified automotive parts. The Certified Automotive Parts Association (CAPA) was a non-profit organization established in 1987. CAPA offers testing programs that verify and ensure the suitability and quality of automobile replacement parts. Automotive insurance companies created CAPA to guarantee the quality of replacement parts from collision repair shops.

It is cheaper than expensive genuine, certified parts. Non-certified parts, on the other hand, can be used in place of original components. A carmaker will not approve of uncertified parts. The low cost of these parts opens up a significant growth potential for this segment over the next few years.

Key Market Segments:

By Replacement Parts

- Body parts

- Brake Parts

- Lighting & Electronic Components

- Other Replacement Parts

By Distribution Channel

- Wholesalers & Distributors

- Retailers

- OEMs

- Repair Shops

By Service Channel

- DIY (Do it Yourself)

- DIFM (Do it for Me)

- OE (Delegating to OEMs)

By Certification

- Certified Parts

- Non-Certified Parts

- Genuine Parts

Market Dynamics:

Drivers:

For market growth, OEMs must expand aggressively into the aftermarket to increase their share of sales. Original equipment manufacturers are increasing their activity and focusing more on the automotive parts supply chain. They have also created networks of repair shops that do not specialize in a specific car brand. Major market players have developed second-service formats and second-brand re-manufactured parts to keep up with evolving market dynamics. OEMs invest in customer experience optimization and offer differentiated aftermarket Quality service. Using vehicle connectivity to retain customers and automate the decision-making process regarding services and repair.

Restraints

Vehicle Safety Technologies are being adopted, and increasing electric vehicle sales are anticipated to hinder market growth prospects for the industry. Sensors in vehicles allow for optimum driving behavior. This reduces brakes and tire wear-and-tear, which most conventional vehicles are often subject to due to extreme driving conditions. This reduces the need for replacements, potentially restraining further industry advancements.

Opportunity

Europe is expected to be the most lucrative region for suppliers and manufacturers of automotive parts. This region is expected to grow at a CAGR of 5.8%. Germany is slated to account for nearly 30% of Europe’s market share. Germany is home to the largest number of automobile manufacturers worldwide, which is a significant factor in the industry expansion of this regional market. Over the last few years, Europe’s number of passengers and light commercial vehicles has significantly increased. This is another primary driver for the revenue growth of the online automotive parts market.

Aftermarket Automotive Parts Market Trends

The digitalization of the Automotive Component Delivery Service is expected to lead to greater price transparency and supply diversity, which will help fuel customers’ growth prospects. Social media and other digital channels are increasingly influential in customer research and purchasing decisions in emerging and developed markets. Online customers can easily access pricing information. End customers also use these channels to help them choose car parts they wish to purchase.

Online forums allow customers to analyze feedback from other customers about workshop quality and costs. Suppliers, OEMs, and distributors are increasingly engaging with potential clients online. Hella GmbH & Co. KGaA is just one of a few key players who have established online channels. Suppliers will benefit from a digital sales model that allows for a shorter, more efficient value chain. It is possible to streamline the supplier layer and eliminate intermediaries, which enables substantial margins for industrial component suppliers and allows them to save money, which can then be passed onto end-users.

COVID-19 Impact Analysis

The transportation and automotive industries are among the most vulnerable due to the ongoing COVID-19 pandemic. COVID-19 is expected to continue to have a significant effect on this industry’s supply chain and product demand. Concerns in the industry have shifted from China’s supply chain disruption to a general slump in aftermarket product demand. With all non-essential services being shut down, the demand for parts for commercial vehicles is also likely to decline. Uncertainty surrounding the pandemic could seriously affect this industry’s future growth. Individuals are more likely to keep their cars despite economic ups and downs.

Aftermarket players are already being affected by liquidity shortages and cash crunches. This trend is likely to continue over the next few months. In the aftermath of this pandemic, consumers will probably prefer private transport solutions. Financial inequalities will likely hinder the purchase and maintenance of new vehicles.

Commuters will opt for used cars due to budget constraints. The demand for aftermarket parts for vehicle maintenance is expected to surge with the increasing sales of used cars. Some entry-level aftermarket companies are expected to return to emerging countries due to the pandemic. As each class has its own car maintenance and repair preferences, this market will likely vary.

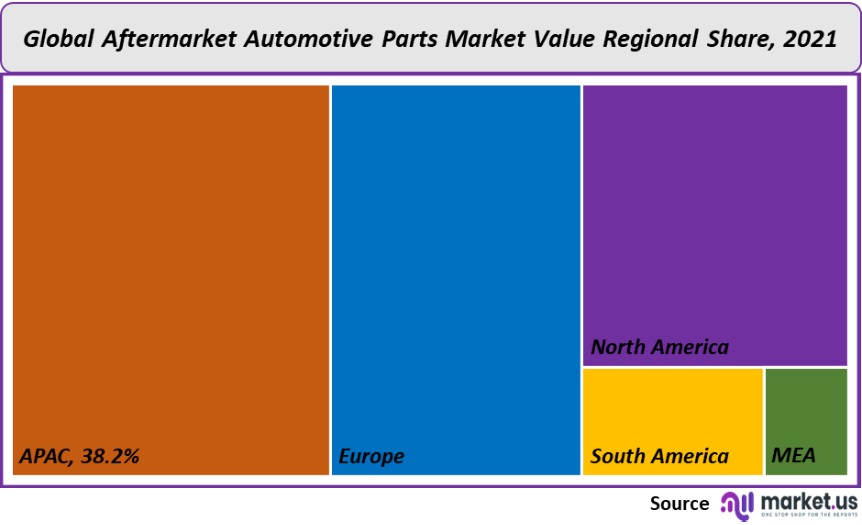

Regional Analysis

Markets in the Asia Pacific region were the dominant regional sub-segment in terms of market share, with 38.2% of the total market in 2021. This industry is expected to expand between 2022 and 2032 significantly. Automotive sales are expected to spike due to the use of advanced technology in the production of parts, a surge in passenger and consumer automobile sales, and the digitalization of component delivery services and automotive components. For a greater share of this market, several companies are looking to acquire other related businesses. To combine brand portfolios and offer comprehensive services across the value spectrum of this market, Goodyear Tire & Rubber Company purchased Cooper Tire & Rubber Company in February 2021.

Key Regions and Countries Covered in this Report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

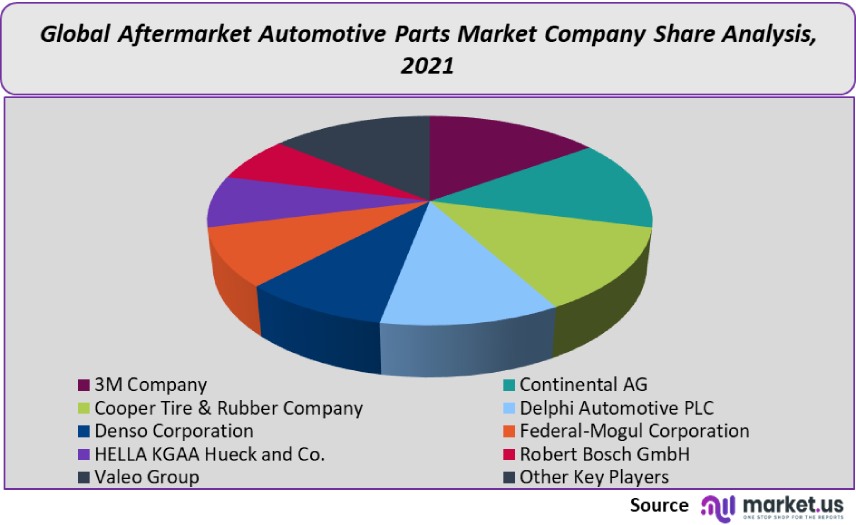

Market Share & Key Players Analysis:

This industry is expected to grow due to technological proliferation and increased investments by manufacturers and associations toward R&D activities. The market is saturated with domestic and regional rivals challenged to develop innovative offerings that help buyers address changing technologies, security requirements, and business practices. In terms of market share gains or losses, the key players are in a favorable but vulnerable position. To expand their global footprint, these key players are now actively pursuing various merger & acquisition strategies. Listed below are some of the most prominent players in the aftermarket automotive parts industry:

Market Key Players:

- 3M Company

- Continental AG

- Cooper Tire & Rubber Company

- Delphi Automotive PLC

- Denso Corporation

- Federal-Mogul Corporation

- HELLA KGAA Hueck and Co.

- Robert Bosch GmbH

- Valeo Group

- ZF Friedrichshafen AG

- Other Key Players

For the Automotive Aftermarket Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the aftermarket automotive parts market in 2021?The aftermarket automotive parts market size is US$ 521.5 Billion in 2021.

What is the projected CAGR at which the aftermarket automotive parts market is expected to grow at?The aftermarket automotive parts market is expected to grow at a CAGR of 4.6% (2023-2032).

List the segments encompassed in this report on the aftermarket automotive parts market?Market.US has segmented the aftermarket automotive parts Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Replacement Parts, the market has been segmented into Body parts, Brake Parts, Lighting & Electronic Components, and Other Replacement Parts. By Distribution Channel, the market has been segmented into Wholesalers & Distributors and Repair Shops, and the Certification market has been segmented into Certified Parts, Uncertified Parts, and Genuine Parts.

List the key industry players of the aftermarket automotive parts market?3M Company, Continental AG, Cooper Tire & Rubber Company, Delphi Automotive PLC, Denso Corporation, Federal-Mogul Corporation, HELLA KGAA Hueck and Co., Robert Bosch GmbH, Valeo Group, ZF Friedrichshafen AG, and Other Key Players are the key vendors in the aftermarket automotive parts market.

Which region is more appealing for vendors employed in the aftermarket automotive parts market?APAC accounted for the highest revenue share of 38.2%. Therefore, the aftermarket automotive parts industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the aftermarket automotive parts Market.China, Japan, The US, Canada, Mexico, Germany, France, UK, etc., are leading key areas of operation for aftermarket automotive parts Market.

Which segment accounts for the greatest market share in the aftermarket automotive parts industry?With respect to the aftermarket automotive parts industry, vendors can expect to leverage greater prospective business opportunities through the retail segment, as this area of interest accounts for the largest market share.

![Aftermarket Automotive Parts Market Aftermarket Automotive Parts Market]() Aftermarket Automotive Parts MarketPublished date: Oct 2021add_shopping_cartBuy Now get_appDownload Sample

Aftermarket Automotive Parts MarketPublished date: Oct 2021add_shopping_cartBuy Now get_appDownload Sample - 3M Company Company Profile

- Continental AG

- Cooper Tire & Rubber Company

- Delphi Automotive PLC

- Denso Corporation

- Federal-Mogul Corporation

- HELLA KGAA Hueck and Co.

- Robert Bosch GmbH

- Valeo Group

- ZF Friedrichshafen AG

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |