Global Automotive Metal Market by Product Type (Steel, Aluminum, Magnesium, Others), By Application (Power train, Body structure, Suspension, Others) By End-Use (Light commercial vehicles, Passenger cars, heavy commercial vehicles) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 13949

- Number of Pages: 283

- Format:

- keyboard_arrow_up

Automotive Metal Market Overview:

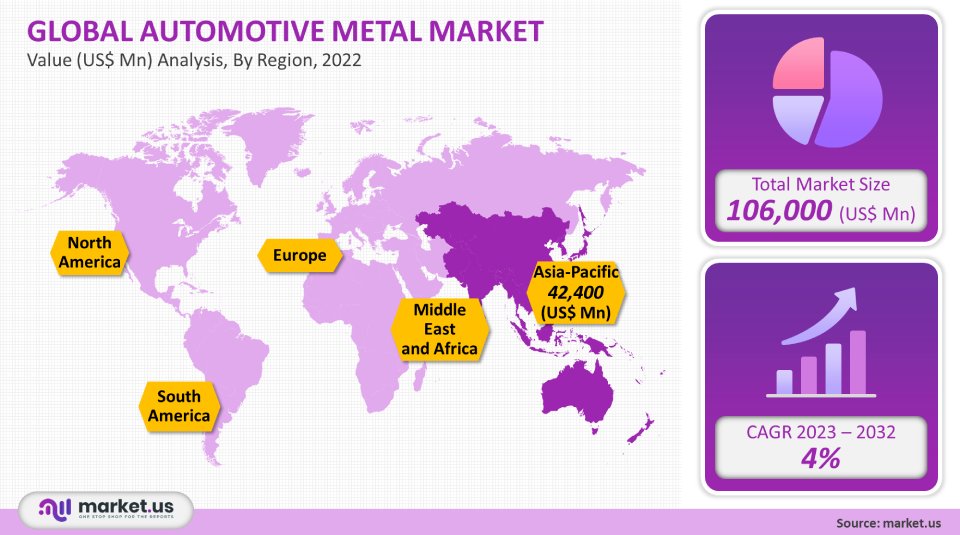

Global automotive metal market was valued at USD 106,000 million in 2021. It is projected to grow at a CAGR of 4% over the 2023-2032 forecast period.

The key driver of global growth is the growing requirement for cars and abundant raw materials. The market will also benefit from government initiatives to improve manufacturing capabilities in emerging economies.

Global Automotive Metal Market Scope:

Product type analysis

In 2021, steel influenced the market globally and held a 61.2% revenue share. Over the next eight years, steel’s use in the automotive industry will be positively affected by its reasonableness and higher qualities. Steel has a high recycling rate contrasted to other metals. In the next few years, the use of steel will be encouraged by the ELV rules in Europe & Japan, and also in South Korea. Magnesium will likely see the CAGR at 4.3% regarding revenue between 2023 and 2032.

While magnesium alloys are widely used in vehicle interiors, there has been significant progress in their utilization in different parts, such as the powertrain and chassis. Due to its lightweight and high recyclability, aluminum has seen notable growth in requirements in the automotive sector. Aluminum is able to absorb twice as much crash energy as mild steel & can reduce weight by up to 50%. This will drive aluminum’s requirement in the future.

Application analysis

In 2021, the automotive metal market was dominated by body structure. It is expected to see a 3.7% increase in revenue between 2023 and 2032. The requirement for vehicle body structure products is increasing due to their ease of repair and maintenance, & the high degree of recyclability compared with plastics and composites. Many manufacturers are moving towards lighter products like aluminum & magnesium to lessen the vehicle weight. For armored vehicle suspension, the military and other specialized uses of titanium alloys are also using them.

For vehicle safety, suspension and frame must be made of sturdy materials. Market growth is being boosted by manufacturers moving to aluminum & magnesium. You will find numerous parts of metals that are forged in the powertrain, along with transmission shafts and gears and also clutch hubs and driveshafts, as well as universal joints. To increase the engine’s durability, pistons that are forged are also used. Metal forged products are highly utilized in high-pressure valves and valve bodies. They have high mechanical strength and resist heat, corrosion, and porosity.

End-Use analysis

In 2021, passenger cars influenced product requirements. The market will be impacted by the rising requirement for passenger cars in APAC and North America over the next few years. There has been a rise in the willingness of consumers to buy vehicles that are longer-lasting and of better quality. Manufacturers are now working to develop new products that offer high-end properties and low prices. These factors will likely raise the requirement for metals in segment passenger types of vehicles.

The government’s initiatives to improve the road armature, including adding roads and managing traffics, are projected to rise the requirement for cars. This will lead to a rise in requirements for automotive metals during the forecast period. The forecast period will see a rise in the requirement for light commercial vehicles, which includes taxis, due to the increasing requirement for commercial transport services.

Кеу Маrkеt Ѕеgmеntѕ:

By Product Type

- Steel

- Aluminum

- Magnesium

- Others

By Application

- Power train

- Body structure

- Suspension

- Others

By End-Use

- Light commercial vehicles

- Passenger cars

- Heavy commercial vehicles

Market Dynamics:

This sector has seen significant progress in materials and technologies for manufacturing vehicle components. R&D has been able to create lightweight and cost-effective materials for the automotive industry due to stringent fuel efficiency regulations. New technologies, such as 3D printing, are being used to manufacture large metal parts. Magnesium and aluminum are the fastest-growing materials in the automotive sector. These lightweight products have led to increased use of them in manufacturing components for cars, bodies, and powertrains. The market will likely see positive growth in the next eight years due to the increased focus on sports cars and car racing.

Manufacturers have spent a lot of time researching how to develop steel grades that are lighter than other metals, and more cost-effective. AHSS is one of the fastest-growing steel grades in automotive. This not only reduces mass but also reduces greenhouse gas emissions. ArcelorMittal SA and Voestalpine Steel Division, Magna International Inc., and Alcoa Corporation are just a few of the major players in the global market. These companies are involved with the production of metals for automobiles. Direct supply agreements are used to distribute the products to end-users. Some companies prefer to use third-party distributors or sources for their products in different countries.

Regional Analysis:

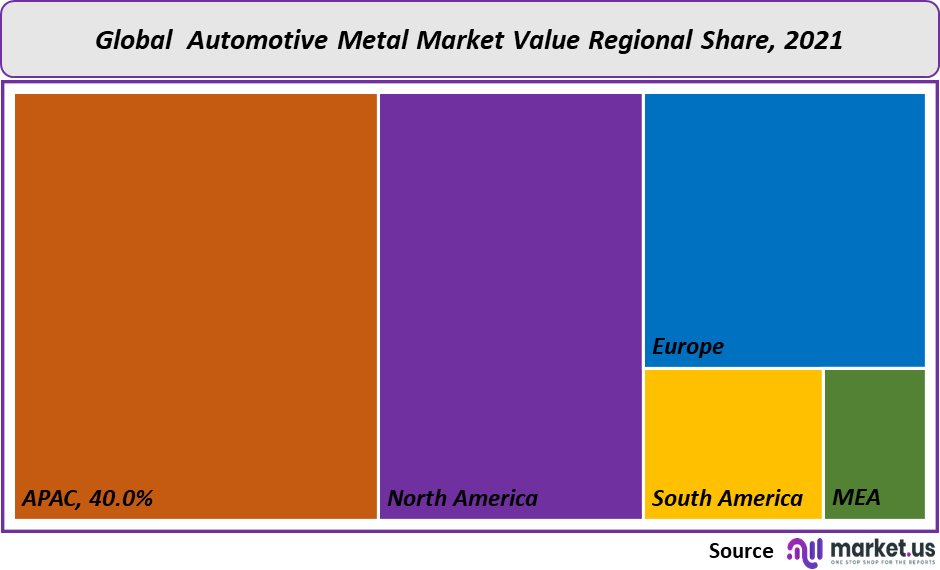

The Asia Pacific was responsible for 40% of complete market revenue in 2021. The key aspect driving the expansion of the automotive industry in the Asia Pacific are consumer preference, government policies, and environmental regulations. To meet quickly changing consumer requirements, manufacturers are constantly innovating the latest designs & making procedures. North America is a key market for automotive metals.

The government’s initiatives to improve vehicle fuel efficacious & lowering carbon dioxide emissions will open up new markets in the future. The United States has 3.9% of the world’s population. This makes it the 3rd biggest economy by inhabitants. The increasing urban inhabitants and the GDP growth rate will likely have a good effect on the automotive industry, which will increase metals requirements over the forecast period. The region has seen rapid industrialization, a move in consumer lifestyles, and technological advances over the years.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

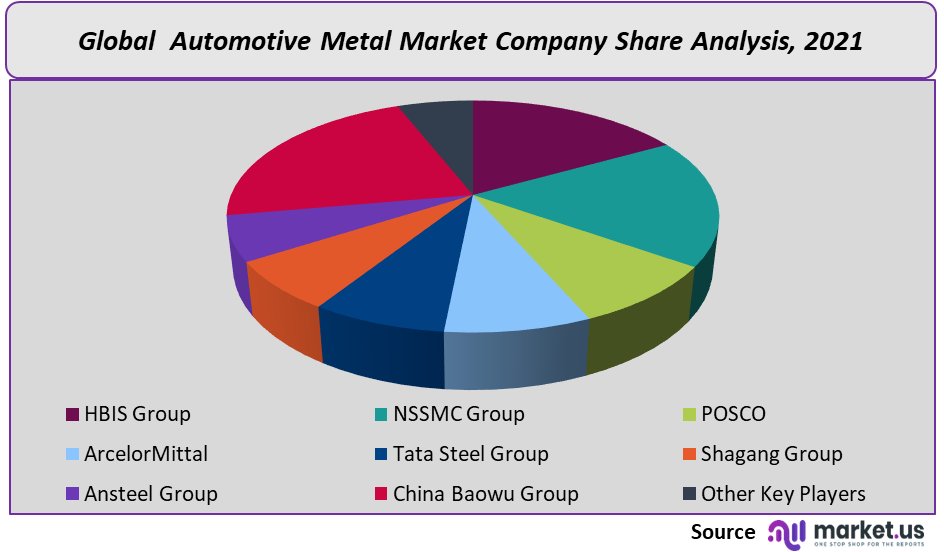

Market Share & Key Players Analysis:

Many manufacturers are present in the automotive metals market. These companies usually serve the Automotive industry’s requirement for specific metals. To expand their market reach and increase their consumer base, the key companies in the industry used growth & mergers, and acquisitions. The establishment of the latest provision in emerging markets was a way to expand.

Маrkеt Кеу Рlауеrѕ:

- НВІЅ Grоuр

- NЅЅМС Group

- РОЅСО

- АrсеlоrМіttаl

- Таtа Ѕtееl Grоuр

- Ѕhаgаng Grоuр

- Аnѕtееl Grоuр

- Сhіnа Ваоwu Grоuр

- Other Key Players

For the Automotive Metal Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Automotive metal market in 2021?The Automotive metal market size is $ 106,000 million in 2021.

Q: What is the projected CAGR at which the Automotive metal market is expected to grow at?The Automotive metal market is projected to grow at a CAGR of 4% during 2023-2032.

Q: List the segments encompassed in this report on the Automotive metal market?Market.US has segmented the Automotive metal market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Aluminum, Steel, Magnesium, Others. By Application market has been segmented into Body structure, Power train, Suspension, Others. By End User, the market has been further divided into Passenger cars, Light commercial vehicles, Heavy commercial vehicles

Q: List the key industry players of the Automotive metal market?НВІЅ Grоuр, NЅЅМС Grоuр, РОЅСО, АrсеlоrМіttаl, Таtа Ѕtееl Grоuр, Ѕhаgаng Grоuр, Аnѕtееl Grоuр, Сhіnа Ваоwu Grоuр, Other Key Players Q: Which region is more attractive for vendors in the Automotive metal market?

Q: Which region is more appealing for vendors employed in the Automotive metal marketAPAC accounted for the highest revenue Share of 40% among the other regions. Therefore, the Automotive metal market in APAC is projected to garner significant business opportunities for the vendors during the forecast period.

Q: Name the key areas of business for Automotive metal?Key markets for Automotive metal are the US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Q: Which segment accounts for the greatest market share in the Automotive metal industry?In the Automotive metal market, vendors should focus on grabbing business opportunities from the Steel product segment as it accounted for the largest market share in the base year.

![Automotive Metal Market Automotive Metal Market]()

- НВІЅ Grоuр

- NЅЅМС Group

- РОЅСО

- АrсеlоrМіttаl

- Таtа Ѕtееl Grоuр

- Ѕhаgаng Grоuр

- Аnѕtееl Grоuр

- Сhіnа Ваоwu Grоuр

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |