Global Automotive Plastics Market By Product Type (Polypropylene, Polyvinyl Chloride, Acrylonitrile Butadiene Styrene, Polyethylene, Polycarbonate, and Other Product Types), By Process (Injection molding, Blow molding, and Other Processes), By Application (Electrical Components, Exterior Furnishings, Interior Furnishings), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Jul 2022

- Report ID: 59423

- Number of Pages: 383

- Format:

- keyboard_arrow_up

Automotive Plastics Market Overview:

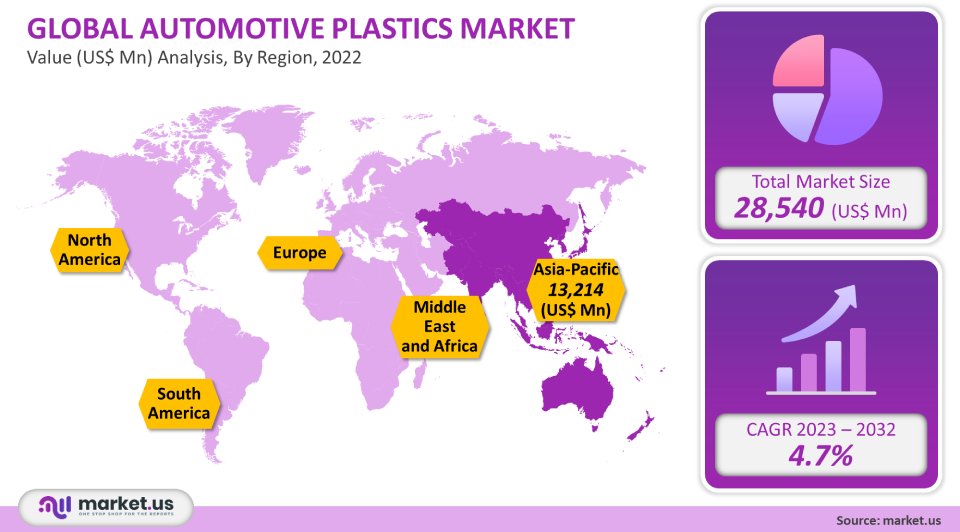

The global market for Automotive Plastics was worth USD 28,540 million in 2021. It is projected to grow at a CAGR of 4.7%, between 2023 and 2032.

The key factors driving the global growth of automotive plastics are recovery in the automotive industry, better vehicle design capabilities, increasing emphasis on vehicle weight reduction, and emission control, and increased focus on vehicle emissions and vehicle weight. Because plastics can be easily manufactured, can be sourced from renewable raw materials, and have improved designs, they are commonly used in automotive parts and components.

Global Automotive Plastics Market Scope:

Product type analysis

The polypropylene segment dominated the market, accounting for over 31.2% of global revenue in 2021. This can be attributed largely to an increase in product demand from end-use industries like construction, electrical and electronic, packaging, and consumer products.

Because of its chemical and physical properties, polypropylene can be used in both rigid and flexible packaging. It is also very resistant to electrical and chemical attacks at extremely high temperatures. PP is lighter than other plastics, making it ideal for automotive applications. This helps to reduce the vehicle’s overall weight and fuel consumption. In 2021, polyvinyl chloride was the second largest product segment. PVC is used in many domestic and industrial products, including raincoats and shower curtains, window frames, indoor plumbing, and even indoor plumbing. PVC is used in many automotive applications, including underbody coatings and sealants, floor modules and wire harnesses, exterior parts, and passenger compartment parts.

Process Analysis

Injection molding dominated the market, accounting for more than 54.3% of all revenue in 2021. This is due to the use of many injection-molded plastics within the automotive industry to make door handles, engine tubes and hoses, dashboard and console covers and brackets, radio covers, other electrical internal components, buttons, bezel panels, knobs, and shifter levers, controls, covers for the roof of convertibles and sunroof assemblies, and buttons and bezels.

Molding through Injection is one of the most popular processes in the industry of automotive for molding plastic. This is the process of injecting molten material under high pressure into a mold to create custom parts and fittings. Injection molding technology has become more important in the mass production of complex plastic molds due to modern innovations that reduce the chance of errors. LyondellBasell, for instance, began making virgin quality polymers in Wesseling (Germany) in May 2021 using raw materials from plastic waste. These raw materials are processed in the company’s manufacturing facilities into ethylene or propylene. They are then used to make polyethylene (PE), and polypropylene(PP) in downstream units for plastics manufacture.

The blow molding process is used widely in the automotive industry. It allows for complex products to be made in a variety of designs and shapes, which can make it more expensive than other technologies. This allows companies to increase production in a short time while still being flexible in design and materials. It does have its limitations, such as high machine costs and large machines taking up more space. This is restricting their use in small-scale industries.

Application Analysis

In 2021, the automotive plastics market was led by interior furnishings. This segment accounted for more than 41% of total revenue. The market is expected to grow due to increased demand for automotive plastics such as body and light panels and seat covers, steering wheels and seat bases, load floor, headliners, and rear package shelves.

In order to support advanced electronics, digitalization has also prompted a demand for plastics that can be integrated into car dashboards. High electrical insulation properties and safety concerns have driven the demand for instrument panels with advanced electronic systems. PVC plastics are highly compatible with instrument panels and other electrical components because they have excellent chemical and solvent resistance, good tensile strength, and flexibility. In June 2021 HDT Automotive Solutions LLC purchased Veritas AG. This alliance would expand HDT’s innovative material science and connection expertise in metal fluid and plastics as well as rubber connecting devices for different automotive applications.

Кеу Маrkеt Ѕеgmеntѕ:

By Product Type

- Polypropylene

- Polyvinyl Chloride

- Acrylonitrile Butadiene Styrene

- Polyethylene

- Polycarbonate

- Polymethyl Methacrylate

- Polyamide

- Other Product Types

By Process

- Injection molding

- Blow molding

- Thermoforming

- Other Processes

By Application

- Electrical Components

- Exterior Furnishings

- Interior Furnishings

- Under The Hood

- Chassis

Market Dynamics:

The COVID-19 pandemic caused a drop in new vehicle sales, shutting down production facilities, a shortage of parts, and a fall in working capital. It caused an interruption in the supply chains and a suspension of production. This resulted in lower retail sales. Many individuals became uncertain about their jobs and the long-term economic and health consequences of the virus, which influenced their buying decisions. The most common materials used for vehicle parts are polypropylene (PP), Polyvinyl Chloride, Acrylonitrile Butadiene Styrene, and Automotive Plastics. Plastics go through five stages during recycling. These include sorting, washing, and shredding. Manufacturers have been forced to use high-performance automotive plastics due to improvements in recycling processes.

Polymerization of plastic monomers is done using chemical reactions and catalysts. They are then transformed into Polycarbonate, Polypropylene and Polyethylene (PP), Polyvinyl Chloride(PVC), Polystyrene, and other polymerized materials. These materials have far superior properties to their monomers and are very stable and can be used in mold making and fabrication.

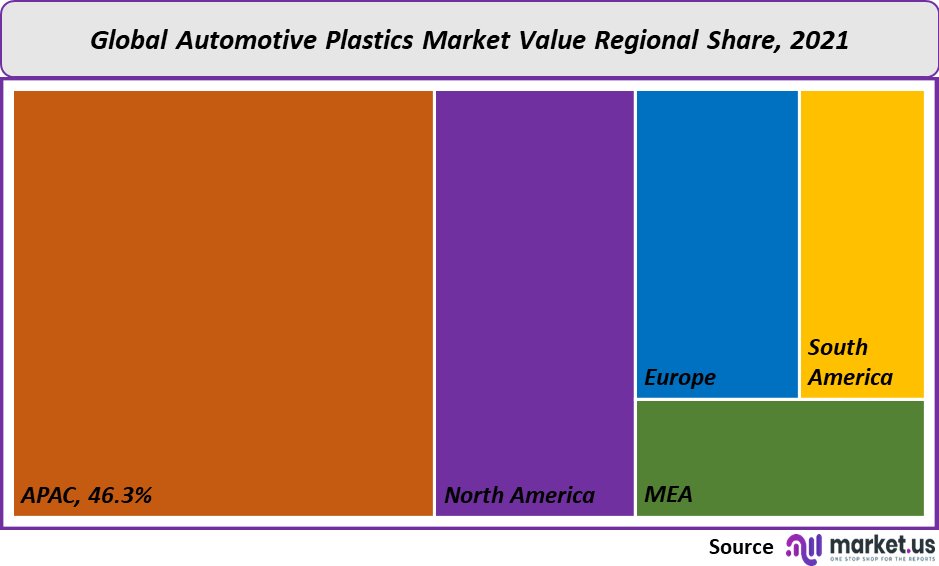

Regional Analysis:

The Asia Pacific was the dominant market, accounting for over 46.3% of global revenue in 2021. Market growth will be boosted by shifting production from developed countries to emerging Asian economies, especially in China, India, and Thailand. The market for automotive plastics will benefit from an improved manufacturing base and increased investments in advanced technologies. APAC and Europe are very conscious of fuel efficiency. This has also fueled the demand for sustainable plastics. In November 2021, for example, the Indian Oil Corporation (IOC), along with two other oil companies from the public sector, announced plans to build 22,000 electric vehicle charging stations over the next three-five years. In 2021, Europe was the second largest market for automotive plastics. High-performance plastics are used by European automobile manufacturers as they are lightweight and energy-efficient. European automakers have had to switch from diesel engines to electric motors due to strict emission standards. This will also increase product demand during the forecast period.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

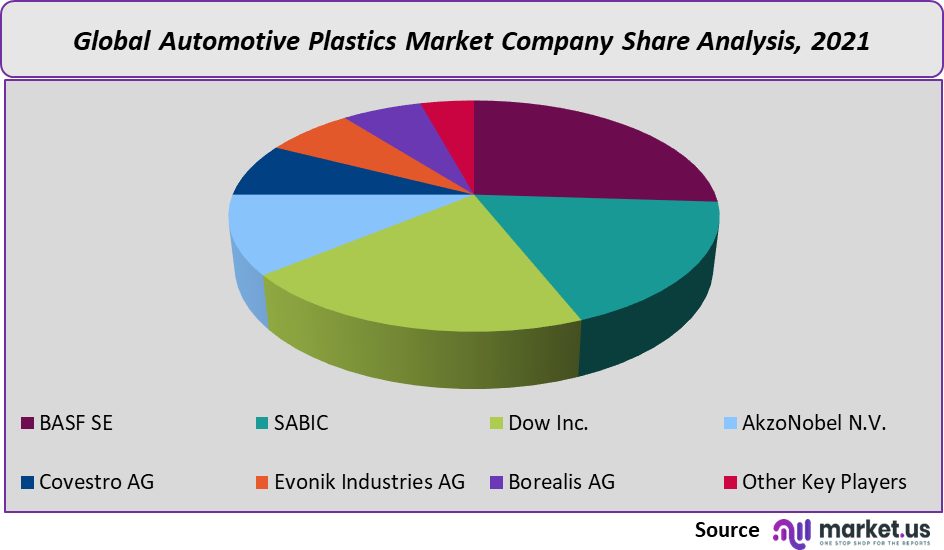

Market Share & Key Players Analysis:

Global players are in fierce competition with each other, as well as regional players who have strong distribution channels and a good understanding of suppliers and regulations. The market is based on the quality of the products offered and the technology used to produce automotive plastics. The application development capabilities and the new technologies used in product formulation are key factors that differentiate major players. BASF SE, an established player, invests in research and development to create new plastics for automotive industries. This gives them a competitive advantage over other players.

Маrkеt Кеу Рlауеrѕ:

- BASF SE

- SABIC

- Dow Inc.

- AkzoNobel N.V.

- Covestro AG

- Evonik Industries AG

- Borealis AG

- Royal DSM N.V.

- Magna International, Inc.

- Teijin Limited

- Other Key Players

For the Automotive Plastics Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Automotive Plastics market in 2021?The Automotive Plastics market size is US$ 28,540 million in 2021.

What is the projected CAGR at which the Automotive Plastics market is expected to grow at?The Automotive Plastics market is expected to grow at a CAGR of 4.7% (2023-2032).

List the segments encompassed in this report on the Automotive Plastics market?Market.US has segmented the Automotive Plastics market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Polypropylene, Polyvinyl Chloride, Acrylonitrile Butadiene Styrene, Polyethylene, Polycarbonate, Polymethyl Methacrylate, Polyamide, and Other Product Types. By Process, the market has been further divided into Injection molding, Blow molding, Thermoforming, and Other Processes. By Application, the market has been further divided into Electrical Components, Exterior Furnishings, Interior Furnishings, Electrical Components, Under The Hood, and Chassis.

List the key industry players of the Automotive Plastics market?BASF SE, SABIC, Dow Inc., AkzoNobel N.V., Covestro AG, Evonik Industries AG, Borealis AG, and Other Key Players are the key vendors engaged in the Automotive Plastics market.

Which region is more appealing for vendors employed in the Automotive Plastics market?APAC accounted for the highest revenue share of 46.3%. Therefore, the Automotive Plastics industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Automotive Plastics?China, Japan, South Korea, Germany & The US, are key areas of operation for Automotive Plastics Market.

Which segment accounts for the greatest market share in the Automotive Plastics industry?With respect to the Automotive Plastics industry, vendors can expect to leverage greater prospective business opportunities through the polypropylene segment, as this area of interest accounts for the largest market share.

![Automotive Plastics Market Automotive Plastics Market]()

- BASF SE Company Profile

- SABIC

- Dow Inc.

- AkzoNobel N.V.

- Covestro AG

- Evonik Industries AG

- Borealis AG

- Royal DSM N.V.

- Magna International, Inc.

- Teijin Limited

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |