Global Automotive Turbochargers Market By Fuel Type (Diesel and Gasoline), By Vehicle Type (Heavy Commercial Vehicles, Light Commercial Vehicles and Passenger Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Sep 2021

- Report ID: 58439

- Number of Pages: 253

- Format:

- keyboard_arrow_up

Automotive Turbochargers Market Overview:

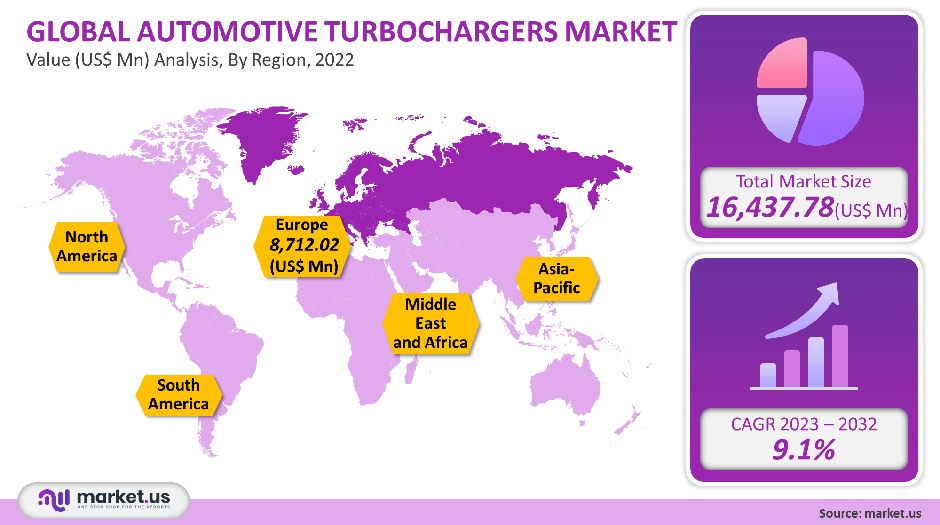

The global automotive turbochargers market was valued at USD 16,437.78 million in 2021. It is projected to grow at a 9.1% CAGR, between 2023 to 2032.

The shift to direct gasoline engines is being driven by the growing trend of lighter-weighting commercial vehicles. This positively influences the growth of vehicular Turbo. Original Equipment Manufacturers (OEMs), due to increasing stringent automotive emission standards around the world, are using engine-downsizing strategies in order to maximize the vehicle’s fuel efficiency.

Turbochargers will be in high demand as they play an important role in reducing vehicle emissions and improving fuel efficiency.

Global Automotive Turbochargers Market Scope:

Vehicle type analysis

The market for automotive turbochargers can be divided by vehicle type into light commercial vehicles, passenger vehicles, and heavy commercial vehicles. Due to a large number of passenger cars in the world, the passenger vehicle turbochargers held a greater share than 61% of the overall market.

Many top companies have already commercialized turbochargers for fuel cell vehicles. This contributes to power generation efficiency by delivering clean air to fuel cell batteries. This development will be further influenced by the growing popularity of passenger vehicle fuel cell technology, which is expected to drive the turbocharger market growth.

Commercial vehicles are primarily diesel-powered, and many of them have turbochargers. This makes the turbocharger segment mature. To reduce emissions and to maintain regulatory standards, manufacturers of commercial vehicles are shifting rapidly towards gasoline engines.

Over the forecast period, heavy commercial vehicles will also see a significant growth rate of 9.6%. Due to their high replacement rates and exposure to extreme working conditions, heavy commercial vehicles make up a greater share of the turbochargers market. This drives the overall market growth.

Fuel Type analysis

With over 53% of the market, the gasoline fuel segment will continue to be the dominant category. The forecast period will see it grow at a 9% CAGR. Turbocharged Gasoline Direct Injection Engines, (TGDI), is expected to be a major driver of the segment’s demand.

To reduce particulate matter levels in automotive exhaust gases, OEMs are shifting rapidly from diesel engines to gasoline engines. This will allow OEMs to keep the emission standards set by regulatory bodies. These factors will likely limit the growth of the diesel engine turbochargers industry to a certain extent.

Another fuel type is one of the fastest-growing segments in the automotive turbocharger market. It is expected to grow at a 15.8% CAGR between 2023 to 2032. The growth of alternative fuel vehicles is expected to be driven by their advantages, which include cleaner fuel sources, higher fuel efficiency, and lower costs.

The industry’s top players have created electrical assist turbos which are expected to improve fuel efficiency and system performance in electric cars. They combine the power of a motor with turbos. The growing popularity of electric vehicles is expected to drive market growth.

Кеу Маrkеt Ѕеgmеntѕ

By Vehicle Type

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Passenger Vehicles

By Fuel Type

- Diesel

- Gasoline

- Other Fuel Types

Market Dynamics:

Turbochargers are key to increasing fuel efficiency by up to 23% for automotive. They also maintain the output and torque of the engines through the injection of high-pressure air. It also helps to increase the power output by recovering thermal energy from the engine.

Turbos are used in automotive engines to allow for acceleration with light pedal action and allow for driving at low engine loads. It is also a key component in reducing particulate matter emissions, which leads to cleaner exhaust. These characteristics result in lower fuel consumption and a minimal environmental impact.

The existing turbocharger market is expected to slow down due to a mature market and a swift transition to hybrid cars amid strict regulations. The key players are working together to develop superior turbos for electric and fuel cell vehicles. This will create a large potential market.

Industry leaders are implementing several growth strategies, including strengthening procurement through the reinforcement of central purchasing and global supply chains to accelerate cost reductions. They are also keen to shift from the ‘local production for consumption’ model to a global production approach in order to strengthen their market position.

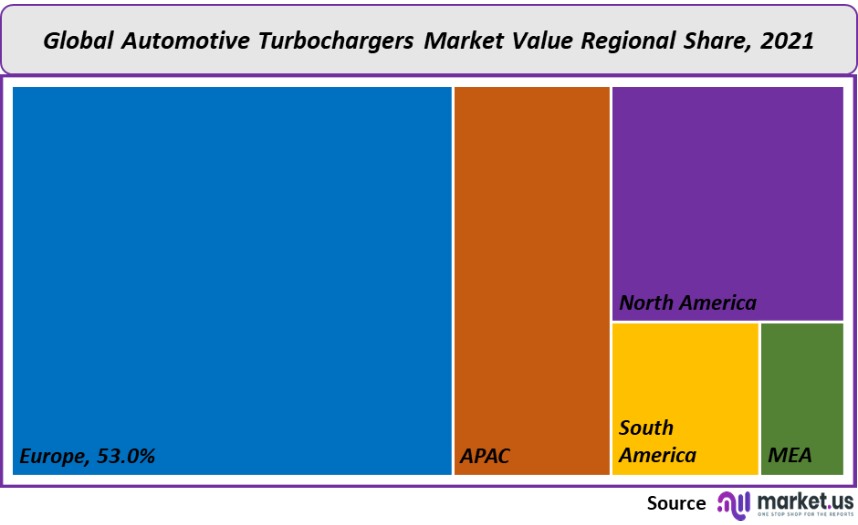

Regional Analysis

In 2021, Europe held roughly 53% of the total revenue. The top brands of automobiles have always been based in Europe, such as Germany and France. The region was the dominant market in the entire world and will continue to enjoy high growth over the forecast period.

The COVID-19 pandemic has impacted Europe, particularly Spain and Italy. Due to the combined impact of COVID-19, Brexit, and slow growth in the U.K., expect slow growth. Regional growth will be limited by the expected contingency regarding the recovery time from the pandemic effect.

Asia Pacific will see a fast CAGR of 11.1% during the forecast period. This is in addition to rising automotive production in countries such as China, India, and Southeast Asia. The market growth is likely to be affected by the uncertainty surrounding the regional automotive manufacturing trends following the COVID19 pandemic.

Due to its high production of turbochargers, China was the dominant market in the region. China is also among the first countries to fully recover from COVID-19, and restart

manufacturing. It is therefore expected to see a higher demand for turbochargers during the forecast period.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

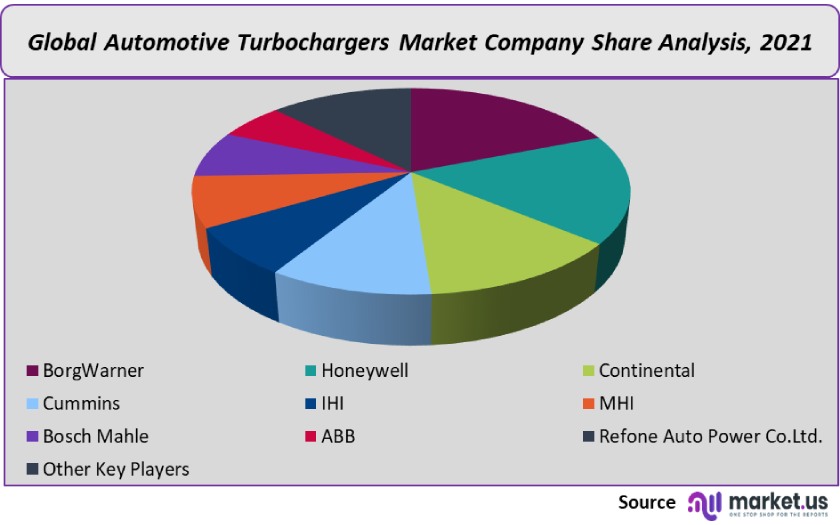

Market Share & Key Players Analysis:

Industry leaders are focused on developing key components of turbochargers, including a compressor that is more efficient, a bearing that optimizes load and reduces mechanical loss, as well as a turbine that performs better in the low-speed region. These elements are provided as samples to automobile manufacturers.

To produce high-quality products, the top players continue to improve their production automation processes and develop new manufacturing techniques. They have the equipment to test turbochargers’ durability and performance under extreme temperatures and pressures. They are also working with the corporate research & development department to develop new products.

Маrkеt Кеу Рlауеrѕ:

- BorgWarner

- Honeywell

- Continental

- Cummins

- IHI

- MHI

- Bosch Mahle

- ABB

- Refone Auto Power Co.Ltd.

- Other Key Players

For the Automotive Turbochargers Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Automotive Turbochargers market in 2021?A: The Automotive Turbochargers market size is US$ 16,437.78 million in 2021.

Q: What is the projected CAGR at which the Automotive Turbochargers market is expected to grow at?A: The Automotive Turbochargers market is expected to grow at a CAGR of 9.1% (2023-2032).

Q: List the segments encompassed in this report on the Automotive Turbochargers market?A: Market.US has segmented the Automotive Turbochargers market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Fuel Type, market has been segmented into Diesel and Gasoline. By Vehicle Type, the market has been further divided into Heavy Commercial Vehicles, Light Commercial Vehicles and Passenger Vehicles.

Q: List the key industry players of the Automotive Turbochargers market?A: BorgWarner, Honeywell, Continental, Cummins, IHI, MHI, Bosch Mahle, ABB, Refone Auto Power Co.Ltd., and Other Key Players engaged in the Automotive Turbochargers market.

Q: Which region is more appealing for vendors employed in the Automotive Turbochargers market?A: Europe accounted for the highest revenue share of 53%. Therefore, the Automotive Turbochargers industry in Europe is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Automotive Turbochargers?A: Germany, U.K., France, Italy, Spain, China, Japan, India, U.S., Canada, Mexico, are key areas of operation for Automotive Turbochargers Market.

Q: Which segment accounts for the greatest market share in the Automotive Turbochargers industry?A: With respect to the Automotive Turbochargers industry, vendors can expect to leverage greater prospective business opportunities through the passenger vehicle segment, as this area of interest accounts for the largest market share.

![Automotive Turbochargers Market Automotive Turbochargers Market]() Automotive Turbochargers MarketPublished date: Sep 2021add_shopping_cartBuy Now get_appDownload Sample

Automotive Turbochargers MarketPublished date: Sep 2021add_shopping_cartBuy Now get_appDownload Sample - BorgWarner

- Honeywell International, Inc. Company Profile

- Continental

- Cummins, Inc Company Profile

- IHI

- MHI

- Bosch Mahle

- ABB Ltd Company Profile

- Refone Auto Power Co.Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |