Global Autonomous Mobile Robots Market By Type , By Application , By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019–2028

- Published date: May 2021

- Report ID: 22894

- Number of Pages: 250

- Format:

- keyboard_arrow_up

Autonomous Mobile Robots Market Overview:

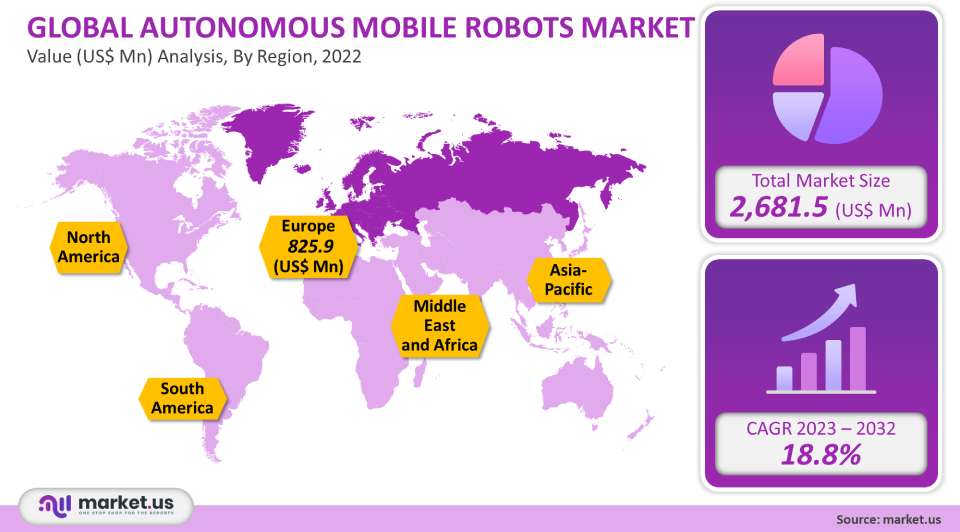

The global market for autonomous mobile robots was valued at US$ 2.68 Billion in 2021 and is forecast to grow at a CAGR of 18.8% between 2023-2032. Autonomous mobile robots (AMRs), are used to pick, sort, transport, and organize items within manufacturing and distribution plants without the need for manual intervention. AMRs can use vision cameras, sensors onboard, and the facility map, which is integrated with the warehouse execution system (WES), to perform various operations. This includes moving raw materials and manufactured goods. AMRs have a multitude of benefits that can be offered, including preventing product damage, increasing productivity, and reducing labor costs.

Global Autonomous Mobile Robots Market Scope:

Type Analysis

Over 49.6% of the global market revenue was accounted for by the goods-to-person picking robots segment in 2021. The continued deployment of autonomous robotics to replace manual and paper-based picking systems can explain the high share. Robots for goods-to-person picking can be programmed so that they can carry and navigate carts, and to move goods between workers. GreyOrange Robotics, Bleum Robotics, and IAM Robotics all offer mobile robotic picking systems that are autonomous and mobile and can be used to increase manufacturing and warehousing efficiency. In the forecast period, the self-driving pick lifts segment will experience a significant CAGR of 27.8%.

Self-driving forklifts work well for repetitive load-handling tasks that often require long distances. Linde Material Handling, a German manufacturer and supplier of forklift trucks and warehouse machinery, offers automated forklifts that are equipped with navigation lasers, front and back scanners, and acoustic & visible warning indicators. The company claims its autonomous forklift trucks can sense obstacles and adjust the route accordingly. ZF Friedrichshafen AG (a German car parts manufacturer) launched the self-driving ZF Innovation Forklift in May 2018. This forklift can potentially improve the efficiency of industrial applications.

Battery Type Analysis

Because of their low cost, lead batteries accounted for 51.9% of the market. Lead batteries can be used in a variety of industrial applications because they have stable voltage, long service life, excellent reversibility, and are therefore well-suited. Kuka AG’s KMR QUANTEC AMR Mobile Industrial Robot System is a good example of a lead-based AMR. It uses industrial wireless LAN technology to reduce the need for wiring and offer greater flexibility.

The lithium-ion battery segment will experience the fastest expected CAGR over the forecast. The cost of lithium-ion batteries is higher than lead batteries. But lithium-ion battery has the ability to sustain the high-power charge and discharging while still meeting the demands of industrial environments like high energy density, high-temperature performance, and a long life cycle. These are the benefits that will encourage AMR companies to adopt lithium-ion cells.

End Use Analysis

Due to continued process automation within the global manufacturing industry, the manufacturing segment was the largest market share in 2021. The segment is further broken down into electronics, automotive, pharmaceuticals, chemicals, and plastics as well as FMCG and defense. AMRs were widely used in the automotive sector to perform various tasks. This includes assembly, coating, sealing, part transfer, machine tending, and materials removal.

The forecast period will see significant growth in the aerospace and defense sectors. Large-sized components such as wings, nacelles, engine pods and fuselages require large production facilities. These parts must be transported through narrow pathways within the production facility. In order to prevent any accidents or mishaps caused by human error while transporting heavy parts through narrow paths, aerospace and defense companies have aggressively deployed autonomous mobile robots to move heavy parts within the facility using predefined or dynamic routes.

Key Market Segments

Type

Self-driving forklifts

Goods-to-person picking robots

Unmanned aerial vehicles

Autonomous inventory robots

Battery Type

Lithium-Ion Battery

Lead Battery

Nickel-based Battery

Other Battery Types

End-Use

Manufacturing

Automotive

Electronics

Aerospace

Chemical

- Others

- Wholesale & Distribution

Retail Chains/Conveyance Stores

E-commerce

Others

Market Dynamics

AMRs have already been adopted by several industries and verticals. Technology companies and providers of automation solutions are joining forces with warehousing, retailing, and warehouse companies to improve their material handling operations. To help its customers in the manufacturing, logistics, and retail sectors, Tompkins Robotics, an American-based manufacturer of AMRs partnered up with PULSE Integration in October 2019.

Murata Machinery Ltd., a Japanese industrial automation company, formed a partnership with Alert Innovation, based in the U.S. in August 2019. Murata Machinery Ltd. is a strategic partner for Alert Innovation Inc., an automation company based in the U.S. The partnership will allow Murata Machinery Ltd. to transfer technical knowledge regarding the Alphabot picking solution. Murata Machinery Ltd. is granted exclusive rights to market, design, service, manufacture, and sell Alphabot-based systems in Japan. Alert Innovation also transformed the grocery industry by utilizing Alphabot technology in the creation of NOVASTORE. This format allows its customers to access the requested products by Alphabot.

To expand their warehouse operations, large e-commerce companies are increasingly focusing on the acquisitions of robotics vendors. Shopify Inc., an international provider of tools and services for multi-channel commerce, bought 6 River Systems Inc., an American provider of mobile robotics fulfillment systems. 6 River Systems Inc. will be adding cloud-based software to the Shopify Fulfillment Network, along with a fleet of “Chuck” mobile robots. Amazon.com Inc. purchased Canvas Technology, a U.S.-based warehouse robotics startup. The acquisition will enable it to focus on automating different aspects of eCommerce fulfillment.

AMRs play an important role in lean operations across a wider range of industrial situations. They are specifically designed to tackle the challenges of traditional industrial environments. These robots are built to navigate in dynamic environments like construction sites. Robots that can operate in these dynamic environments and navigate efficiently are highly desirable because they are more flexible and efficient than ever. Warehouses and production facilities can also use autonomous robots to add process automation to their existing environment without needing to change it.

Autonomous robots allow for process automation, but they do not eliminate the need to remold in the manufacturing environment. In January 2021, OTTO Motors announced a partnership agreement with PULSE Integr, a specialist in material handling, to deploy autonomous mobile robotics for material handling in manufacturing. AMRs can be used to transport raw material pallets, process pallets, and finished goods. They are also used in lieu of forklifts. AMRS is used to increase productivity in manufacturing and warehouse logistics. This helps eliminate waste movement and create a more efficient Lean operation that maximizes profit and productivity.

AMRs are autonomous robots that follow pre-defined paths. Robots are pre-programmed so that they can stop when they encounter obstacles. AMRs improve the reliability and tracking of material transport. This results in tracking, increased safety, as well as reliability. Robots can gather data from laser scanners 3D cameras accelerometers, gyroscopes, wheel encoders, and 3D cameras to help them make informed decisions in critical situations.

Warehouse workers face constant pressure when it comes to packing, shipping, and other logistical activities. The rapid growth of the e-commerce market has made order fulfillment productivity a priority. Warehouse operators are able to reduce their workload with AMRs. This includes order pickers, and safety. Forklift accidents and musculoskeletal injuries can also be avoided. United Parcel Service of America Inc., a US supply chain management and parcel delivery company, launched Warehouse Execution System (WES), in April 2020 to increase order intake, and improve fulfillment efficiency. Softeon, an international supply chain management company, was the partner of the former company in creating the WES, which leverages autonomous robotic capabilities.

Regional Analysis

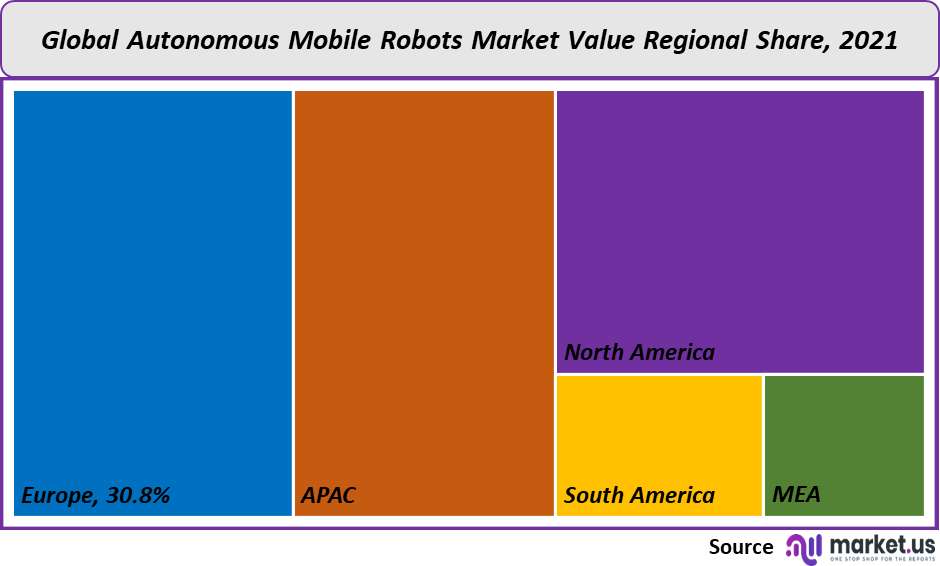

In 2021, Europe dominated all other regional markets. It had a 30.8% share of global revenue. This resulted from the producers’ desire for material handling equipment. Process automation across other industries and verticals would make it possible for the market in this region to grow even more. FAST MOVE, an autonomous ultra flat transport robot, was introduced in March 2018 by E&K Automation GmbH, a robotics business with headquarters in Germany. This was a part of their initiatives to assist the adoption of Industry 4.0 and industrial automation.

Many manufacturing and distribution centers across the country have adopted autonomous mobile robots for multiple functions, including moving and sorting products within an inventory system. AMRs are being deployed by the transportation and logistics sector to help them increase production and distribute services in line with increasing demand. Due to the COVID-19 crisis, workplace safety has been a top concern for the manufacturing sector. AMRs can be used in manufacturing to help with social distancing. The impact of harmless mobile robotics on ROI is also significant. Because workers are not at risk, it reduces medical expenses, compensation payments, and legal costs.

Asia Pacific is expected to experience the fastest CAGR at 20.7% between 2023-2032. AMRs are being promoted in the Asia Pacific because of the growing e-commerce market. AMRs are used to automate intralogistics tasks like picking, palletizing, and sorting, by E-commerce businesses. Alibaba Group Holding Ltd., China’s e-commerce & retail firm, opened a warehouse in October 2018, with 700+ mobile robots, to handle the large demand for Singles Day. North America will continue to enjoy a large market share thanks to its key suppliers of AGV Robots, and Autonomous Mobile Robots, and also keeping an eye on Asian AMRs producers expanding their operations within the region. In addition, there will be an increase in investments by the government, academia, and private sectors in innovation and R&D to explore technology related to surveillance robots. In January 2021, for example, the Universal Robots A/S senior manager, strategic market and application development, and head of North America stated that companies of all sizes are trying to find a way to regain full productivity and maintain social distancing with robots that can be used in close proximity to humans.

Key Regions and Countries covered іn thе rероrt:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

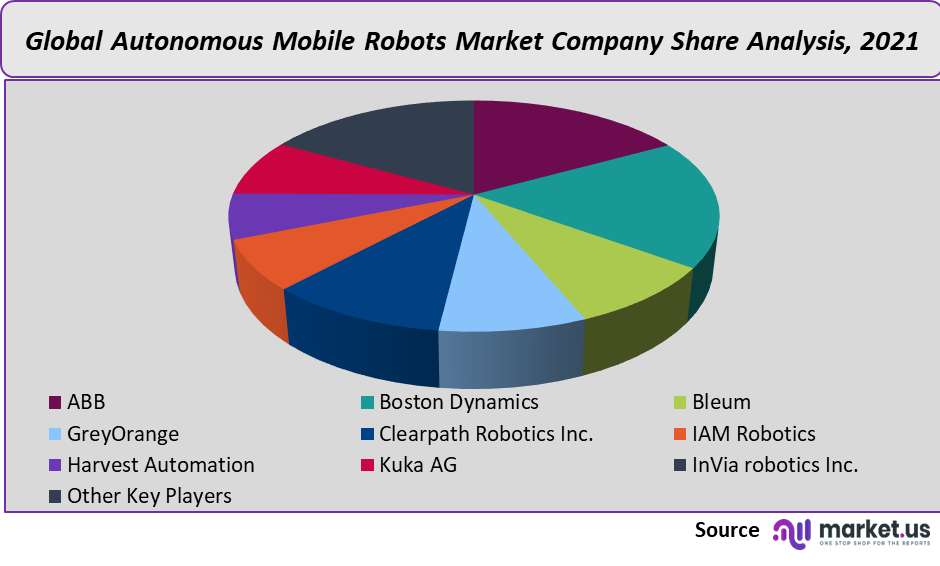

Market Share Analysis

In order to increase their customer base and be competitive, key players have embarked on several strategic initiatives. These include collaborations, M&A, and collaborations. GreyOrange, for instance, entered into partnership agreements in August 2019 to offer complete warehouse management solutions.

Key Market Players

The market leader in autonomous mobile robots worldwide is:

- ABB

Boston Dynamics

Bleum

GreyOrange

Clearpath Robotics Inc.

IAM Robotics

Harvest Automation

Kuka AG

InVia Robotics Inc.

Other Key Players

For the Autonomous Mobile Robots Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

2.68 Billion

Growth Rate

18.8%

Forecast Value in 2032

17.84 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Autonomous Mobile Robots market in 2021?The Autonomous Mobile Robots market size was US$ 2,681.5 million in 2021.

What is the projected CAGR at which the Autonomous Mobile Robots market is expected to grow at?The Autonomous Mobile Robots market is expected to grow at a CAGR of 18.8% (2023-2032).

List the segments encompassed in this report on the Autonomous Mobile Robots market?Market.US has segmented the Autonomous Mobile Robots market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Self-driving forklifts, Goods-to-person picking robots, Unmanned aerial vehicles, and Autonomous inventory robots. By Battery Type, the market has been further divided into Lithium-Ion Battery, Lead Battery, Nickel-based Battery, and Others. By End-use, market has been segmented into Manufacturing and Wholesale & Distribution.

List the key industry players of the Autonomous Mobile Robots market?ABB, Boston Dynamics, Bleum, GreyOrange, Clearpath Robotics Inc., IAM Robotics, Harvest Automation, Kuka AG, InVia robotics Inc., and Other Key Players engaged in the Autonomous Mobile Robots market.

Name the key areas of business for Autonomous Mobile Robots?The US, Germany, U.K., France, China, Japan, Brazil are key areas of operation for Autonomous Mobile Robots Market.

Which segment accounts for the greatest market share in the Autonomous Mobile Robots industry?With respect to the Autonomous Mobile Robots industry, vendors can expect to leverage greater prospective business opportunities through the goods-to person picking robots segment, as this area of interest accounts for the largest market share.

![Autonomous Mobile Robots Market Autonomous Mobile Robots Market]() Autonomous Mobile Robots MarketPublished date: May 2021add_shopping_cartBuy Now get_appDownload Sample

Autonomous Mobile Robots MarketPublished date: May 2021add_shopping_cartBuy Now get_appDownload Sample - ABB Ltd Company Profile

- Boston Dynamics

- Bleum

- GreyOrange

- Clearpath Robotics Inc.

- IAM Robotics

- Harvest Automation

- Kuka AG

- InVia Robotics Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |