Global Bio Simulation Market By Product (Services and Software), By Application (Drug Discovery, Drug Development, and Other Applications), By End-Use (CROs, Pharmaceutical & Biotechnology Companies, Academic Research Institutions, and Regulatory Authorities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 53570

- Number of Pages: 312

- Format:

- keyboard_arrow_up

Bio Simulation Market Overview

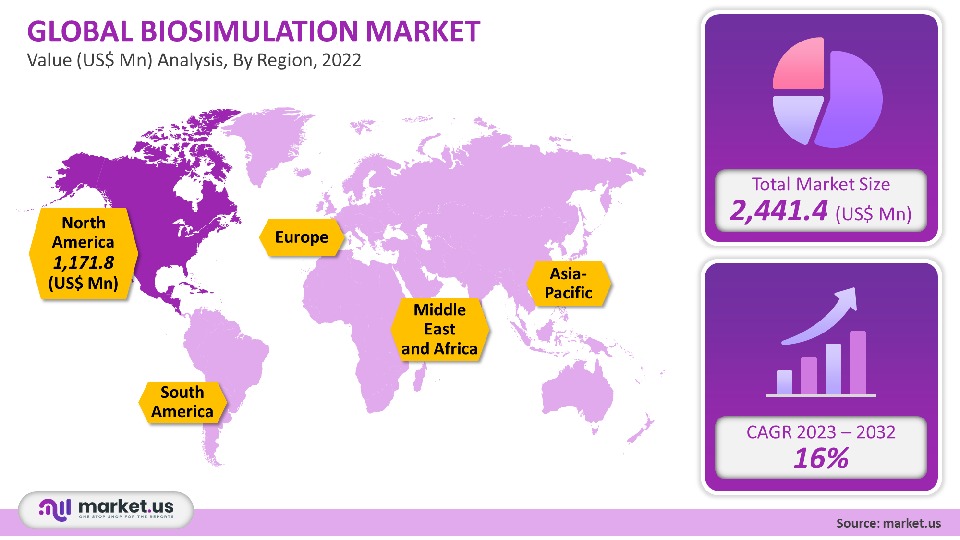

The global biosimulation industry was valued at USD 2,441.4 million in 2021. This market is forecast to grow at a CAGR of 16% between 2023-2032. Biosimulation allows you to simulate biological processes by using a computer program. Biosimulation is an analytical and predictive tool used during drug discovery to predict the outcome of future experimental trials. Running disease simulations on computers can allow virtual clinical trials of newly developed pharmaceutical drugs. Biosimulation software can be used in many pharmaceutical drug discovery and development areas. This software can help pharmaceutical companies save both time and money when trying to discover new drugs to bring to market.

Global Bio Simulation Market Analysis

Product Analysis

Software dominated the market with a 62% revenue share in 2021. Many software applications meet specific research and development requirements. Rhenovia Pharma is a software company specializing in the simulation of CNS-specific drugs. Software and services are the two main product segments.

CAGR for the services segment is forecast to reach its highest level during the forecast period. Biosimulation services could prove crucial in the increasingly complex and multi-layered drug design systems driving this segment’s growth. More precise combination therapies will be able to achieve the above. The services provided simplify the drug discovery and development process by key players. Certara’s Phoenix Technology Services was launched in February 2016 by Certara. This range of services is used to maximize R&D productivity and facilitate data transfer. It also helps with regulatory submission protocols.

Application Analysis

The drug development held a significant revenue share in 2021. This segment is growing because of a rising number of government initiatives encouraging the incorporation of advanced software. For example, FDA’s Critical Path Initiative report emphasizes the importance of this approach in drug development and suggests that it may be used as a predictive tool. Drug discovery, drug design, and drug development are all included in this application segment.

The forecast period will see drug discovery experience the highest CAGR at 17.1%. Biosimulation is a growing field adopted in pharmacogenomics, pharmacogenetics, and other areas. This is boosting the segment’s growth. Certara bought Silico Biosciences Inc., a modeling and simulation technology platform developed to study neurodegenerative conditions. This helped the company’s quantitative pharmacology (QSP), the business model for its research on neurodegenerative diseases.

End-Use Analysis

Biotechnology and pharmaceutical companies had a greater revenue share in 2021. Companies that focus on biosimulation have been able to sustain their off-patent drug lifecycles and develop new drug varieties through computer modeling. This is why there is such high demand. The end-use sector includes biotechnology and pharmaceutical companies, regulatory agencies, CROs, and academic research institutes. The fastest growth rate for the CROs sector is expected during the forecast period. CROs are expected to see an increase in growth due to companies’ increasing desire to reduce overall expenditure. Other key drivers have increased productivity and the flexibility to focus on core development areas, which are crucial to the company’s growth.

Key Market Segments

By Product

- Services

- Software

By Application

- Drug Discovery

- Drug Development

- Other Applications

By End-Use

- CROs

- Pharmaceutical & Biotechnology Companies

- Academic Research Institutions

- Regulatory Authorities

Market Dynamics

One of the main trends driving the market growth is the increasing incidence of drug-relapse cases in patients with drug-resistant diseases like tuberculosis, cancer, or other bacterial infections. This will increase the need for biosimulation to develop new drugs. The COVID-19 epidemic significantly impacted the healthcare industry and the biosimulation sector. Biosimulation software was needed to develop COVID-19-vaccinating vaccine candidates quickly.

Certara a market leader, collaborated with several pharmaceutical companies. This collaboration was meant to assist in the development of a biosimulation program that makes it easier to develop vaccine candidates across multiple patient populations. It also allows for virtual trials and patients to be used. It was also designed to give Analysis before real-life trials. This module is part of the Quantitative Systems Pharmacy (QSP) platform. The company also introduced the COVID-19 global clinical outcomes database. It provides current information on COVID-19 observational and clinical trial results and updated data about COVID-19 clinical trials.

Market growth is expected to be driven by the need for high-potency, advanced drugs. Biosimulation has been increasingly used to simulate diseases such as diabetes mellitus. It is combined with genomic and proteomic technology to develop models that can be used for advanced therapeutics.

Researchers are expected to become more interested in biosimulation through technological advances and frequent up-gradations of the software. This will be a major boost to the market. These technological innovations include the adoption of microarrays as well as predictive models. Another advancement is semantic technology, which supports a finite amount of elements of biosimulation. This simplifies the process and complexity, cost, and overall time.

Innovative ideas are emerging in digital and virtual healthcare processes after COVID. Future drug development will be more efficient thanks to the widespread use of biosimulation and decentralized trials during the pandemic. Machine learning algorithms and AI have been a boon for future research and development. There are many online tools and biosimulation software available that can be used to create peptide vaccines for COVID-19. These tools have been used for therapeutic applications for other chronic conditions. Bioinformatics experts began to use bio simulation platforms like Universal Immune System Simulator after the pandemic. This platform is a great way to identify pipeline products. These tools have helped improve the therapeutic design and ushered in a bright future for healthcare.

Regional Analysis

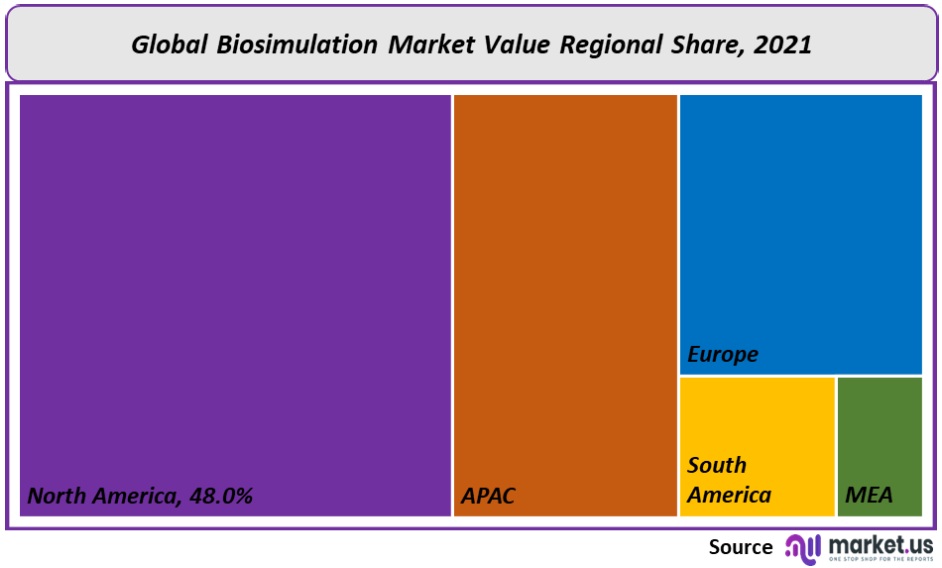

North America will dominate the revenue share by over 48% by 2021. This is due to the presence of key players, growing digitization in healthcare, and the increasing prevalence of chronic conditions. The regional market is also growing due to the adoption of in-silico models to enforce regulatory policies to ensure patient safety.

The Asia Pacific will see rapid growth over the forecast period due to increasing initiatives by both the public and private sectors and continuous improvement in healthcare infrastructure. Additionally, the region’s emerging economies have significant R&D potential. Certara, a Chinese company, opened a Shanghai office in November 2020. This allowed Certara to increase its relationships with Chinese customers in the fast-growing Chinese biopharmaceutical industry.

Key Regions and Countries covered in thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

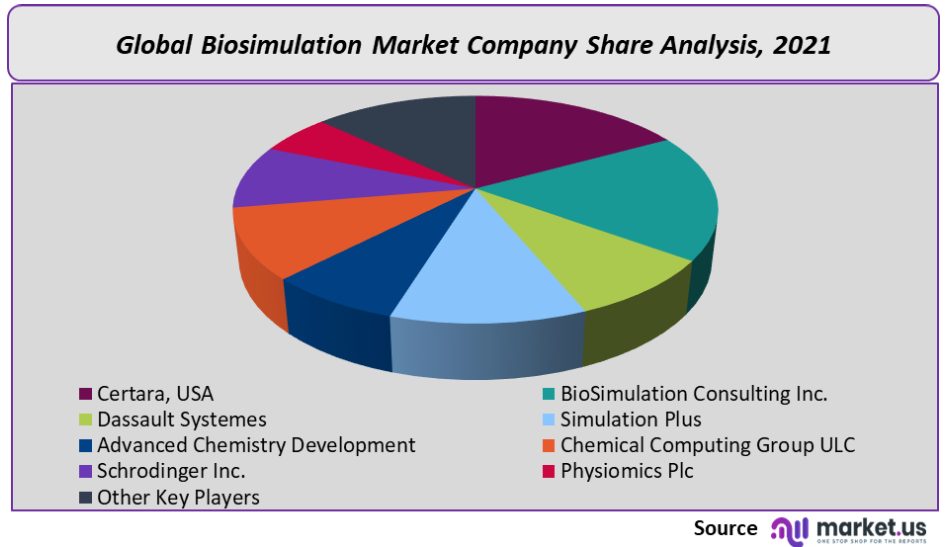

Market Share & Key Players Analysis:

To increase market share, key players used competitive sustainability strategies like product development and expansion of geographical presence. Market leaders are inclined to address unmet needs and provide economic value by delivering consistent product improvements. Simulation Plus partnered up with a pharmaceutical firm in January 2022 to modify the GastroPlus Advanced Compartmental Absorption & Transit (ACAT). This was in support of ongoing research programs to treat gastrointestinal diseases.

Маrkеt Кеу Рlауеrѕ:

- Certara, USA

- BioSimulation Consulting Inc.

- Dassault Systemes

- Simulation Plus

- Advanced Chemistry Development

- Chemical Computing Group ULC

- Schrodinger Inc.

- Physiomics Plc

- Other Key Players

For the Biosimulation Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Bio Simulation Market in 2021?The Bio Simulation Market size is US$ 2,441.4 million in 2021.

What is the projected CAGR at which the Bio Simulation Market is expected to grow at?The Bio Simulation Market is expected to grow at a CAGR of 16% (2023-2032).

List the segments encompassed in this report on the Bio Simulation Market?Market.US has segmented the Bio Simulation Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been further divided into Services and Software. By Application, the market has been further divided into Drug Discovery, Drug Development, and Other Applications. By End-Use, the market has been further divided into CROs, Pharmaceutical & Biotechnology Companies, Academic Research Institutions, and Regulatory Authorities.

List the key industry players of the Bio Simulation Market?Certara, USA, Bio Simulation Consulting Inc., Dassault Systemes, Simulation Plus, Advanced Chemistry Development, Chemical Computing Group ULC, Schrodinger Inc., Physiomics Plc, and Other Key Players are engaged in the Bio simulation market

Which region is more appealing for vendors employed in the Bio Simulation Market?North America is expected to account for the highest revenue share of 48%. Therefore, the Bio simulation industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Bio simulation?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Bio Simulation Market.

Which segment accounts for the greatest market share in the Bio simulation industry?With respect to the Bio simulation industry, vendors can expect to leverage greater prospective business opportunities through the software segment, as this area of interest accounts for the largest market share.

![Biosimulation Market Biosimulation Market]()

- Accelrys

- Certara

- Simulation Plus

- Dassault Systems SA

- Schrodinger

- Advanced Chemistry Development

- Chemical Computing Group

- Entelos Holding Corporation

- Genedata AG

- Physiomics PLC

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |