Global Biostimulant Market By Type (Acid-based, Extract-based, and Others), By Application (Row Crops & Cereals, Fruits & Vegetables, Turf & Ornamentals, and Other Crops), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2020-2029

- Published date: Jul 2022

- Report ID: 47860

- Number of Pages: 360

- Format:

- keyboard_arrow_up

Biostimulants Market Overview

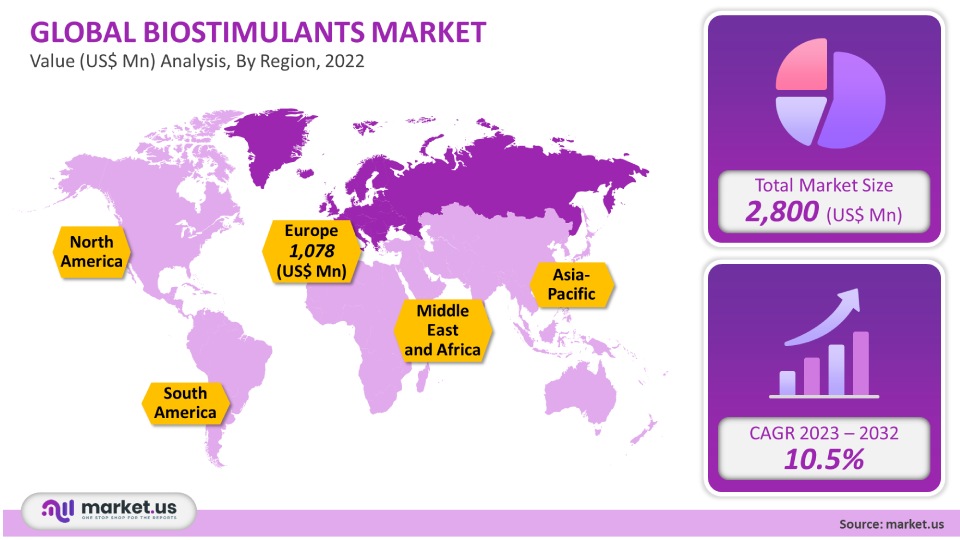

The Biostimulant Market size is expected to be around USD 3799 million by 2031 from USD 2800 million in 2021, growing at a CAGR of 5.99% during the forecast period 2021 to 2031.

This can be attributed to increasing soil degradation and stringent regulations regarding the use of chemicals in agriculture. There is also a need for sustainable and eco-friendly options to increase the productivity and growth of the agricultural sector. Biostimulant markets are substances or microorganisms added to plants to improve crop yield and characteristics.

Global Biostimulants Market Scope:

Active Ingredients Analysis

Globally, the acid-based active ingredients segment was dominant and accounted for over 49.5% of total revenue in 2021. These ingredients are highly sought after due to their potency enhancement properties and sustainability. They are also economically viable. They are also economically feasible. amino acids like fulvic acid and humic acid are key instigators for plant hormones that stimulate metabolic processes and improve seed germination.

Seaweed extracts are biostimulants because they present plant growth hormones such as auxins and cytokines. The most widely used seaweed extracts are brown, green, and red algae. The growth rate of microbial biostimulants is expected to be moderate over the predicted time. These include using microorganisms or a combination of microorganisms to stimulate plant growth. Bacteria, yeasts, and fungi commonly use microbial biostimulants. They aid the plant in coping with stress and rise its nutritional absorption.

Crop Type Analysis

With the largest market share of over 60.5%, the row crops and cereals segment was dominant in 2021. This segment includes crops like cotton, soybean, millet, and barley. These crops provide companies with growth opportunities and can be grown over vast agricultural land areas. It increases the size and harvest of the seeds as well as the rate of cell division. The key biostimulants in cereals and row crops are amino acids, Polyamines (IAA), and Indole-3-acetic Acid. It can overcome different barriers that prevent cell division and development. multinationals and agricultural experts are increasingly using the demand for the biostimulant industry to cultivate cereals and row crops.

The demand for organic cereals like oats or millet is expected to boost the segment’s growth. The market is expected to see tremendous growth opportunities due to increasing acceptance and recognition of sustainable and ecological organic farming to meet rising food demand. Due to increased turf and ornamental usage worldwide, Turf and Ornamental were the second-largest segments in 2021. This segment mainly uses acid-based biostimulants to increase yield. Due to the many players in this market, it is very competitive. This market has a high potential for growth, particularly in emerging economies like India, China, Brazil, and Brazil.

Application Insight

Foliar treatment has many benefits, including increased cellular activity and faster absorption of nutrients. Foliar treatment involves directly applying biostimulants to plant leaves to aid the rapid absorption of nutrients. The epidermis, stomata, and other surface elements of the leaves facilitate absorption. To facilitate easy application and absorption, biostimulants are often in liquid form for foliar treatment. Seed treatment is cost-effective and efficient. It requires less labor than other methods.

The industry is also driven by an increasing population, rising demand for organic products, and encouragement from the government to use biostimulants. In 2021, the soil treatment segment was responsible for a large revenue share. Biostimulants are used in soil treatment to increase fertility and productivity. The four main soil treatment methods are physical, chemical, biological, and mechanical. A decrease in chemical use in agriculture will increase soil treatment product usage. Acid-based and microbial biostimulants are the most commonly used biostimulants in soil treatment.

Key Market Segments

Active Ingredients

- Acid-based

- Seaweed Extract

- Microbial

- Other Active Ingredients

Crop Type

- Row Crops & Cereals

- Fruits & Vegetables

- Turf and Ornamentals

- Other Crop Type

Application

- Foliar Treatment

- Soil Treatment

- Seed Treatment

Market Dynamics:

The growing consumer demand for this product is due to growing awareness of artificial chemicals’ long-term, harmful effects on plant growth. The market is seeing positive changes in APAC, with a growing demand for natural and organic goods.

The United States has an advanced agricultural sector adapting to organic and natural farming methods. The region is noticing a large intake of biostimulants. The country is adapting to the use of the product in its application segment of seed treatment to increase crop growth yield and potency during the early stages of plant development. The U.S. supports biostimulants for balanced agricultural and other economic growth. This development is mainly achieved using synthetic chemicals, pesticides, and fertilizers. These are prerequisites for large-scale industrial production.

Acid-based products hold the majority of the regional market share. This includes the humic acid segment. It is expected to see rapid growth. Biostimulants increase microflora which in turn improves plant nutrient intake. They increase antioxidant activity and decrease plant strain due to various infections and environmental conditions. Hormones are essential for root growth, cell growth, and overall plant health. They are natural, non-toxic, and eco-friendly. They are attracting a lot of organic farming practices.

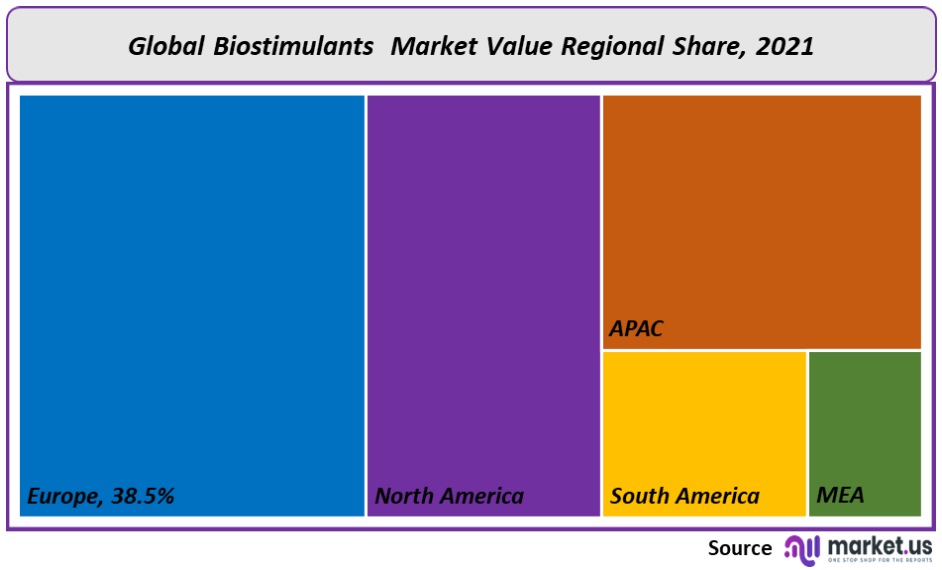

Regional Analysis

Europe was the dominant marketplace in 2021, accounting for more than 38.5% of total revenue. This can be attributed to a growing demand for organic foods and manufacturers’ increasing preference for eco-friendly, sustainable production methods. The Asia Pacific was the second largest regional market in 2021 due to the growth of agricultural-based economies like India and China. Market growth will be supported by increased product utilization, population, soil erosion, and growing awareness among farmers.

According to estimates, Central & South America will experience the second-highest revenue growth rate over the forecast period. The region’s growth rate is slow, but it still has great potential for growth due to the presence of economies like Brazil, which are primarily agricultural-based. The region’s entire industry will experience exponential growth over the next few years. This is due to the increasing population, increased use of technology in the agriculture sector, growing awareness among farmers, and decreasing use of chemical fertilizers that degrade the soil quality.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

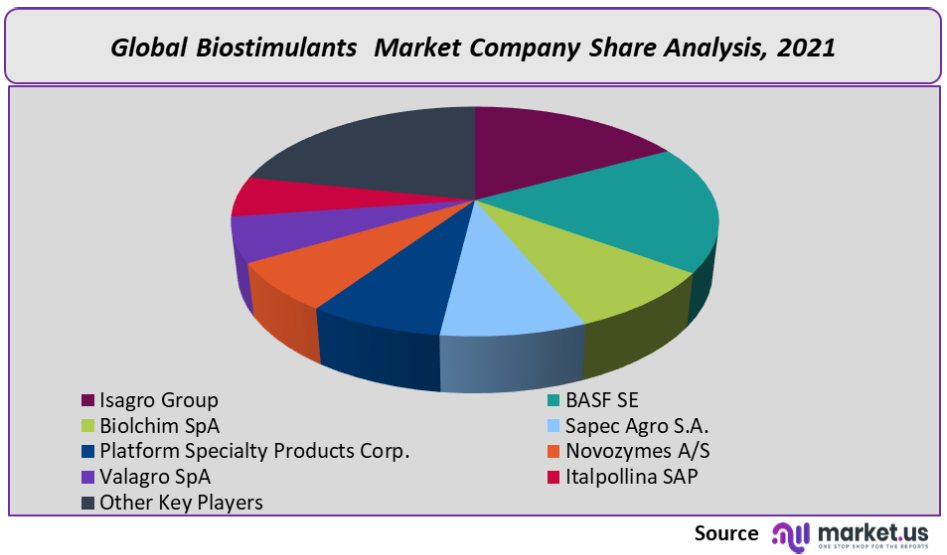

Market Share & Key Players Analysis:

The competition in this market is highly dependent on the crop type, active ingredient type, grade of products, number of sellers/manufacturers, and geographical location. Key companies engage in continuous R&D, mergers and acquisitions, capacity expansion, and other strategies to gain a competitive landscape in this market. Manufacturers focus on increasing their product portfolios through strategic joint ventures and high R&D investments.

Major players have made substantial investments in innovation in recent years to meet the growing demand for agricultural products globally. They also help companies develop new sustainable products and increase their profit margins. Isagro Group purchased Phoenix Del in 2020 to expand its product range of copper-based fungicides. This acquisition promoted technological advancement and revolutionized products under the “BioSolutions” segment. The following are some of the most prominent market players in the global biostimulant market: Isagro Group, BASF SE, Biolchim SpA, Sapec Agro S.A., Platform Specialty Products Corp., Novozymes A/S, Adama ltd, Valagro SpA, Italpollina SAP, biostat India limited Other Key Players.

The market leader in Biostimulants are as follows,

Market Key Players:

- Isagro Group

- BASF SE

- Biolchim SpA

- Sapec Agro S.A.

- agriculture solutions inc.

- Platform Specialty Products Corp.

- Novozymes A/S

- Valagro SpA

- Italpollina SAP

- Adama ltd

- Other Key Players

For the Biostimulant Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Whаt іѕ thе ѕіzе оf thе Віоѕtіmulаntѕ mаrkеt іn 2021?Тhе Віоѕtіmulаntѕ mаrkеt іѕ еѕtіmаtеd tо bе vаluеd UЅ$ 2,800 mіllіоn іn 2021.

Whаt іѕ thе рrојесtеd САGR аt whісh thе Віоѕtіmulаntѕ mаrkеt іѕ ехресtеd tо grоw?Тhе Віоѕtіmulаntѕ mаrkеt іѕ ехресtеd tо grоw аt а САGR оf 10.5% (2023-2032).

Lіѕt thе ѕеgmеntѕ еnсоmраѕѕеd іn thіѕ rероrt оn thе Віоѕtіmulаntѕ mаrkеt?Маrkеt.UЅ hаѕ ѕеgmеntеd thе glоbаl Віоѕtіmulаntѕ Маrkеt Vаluе (UЅ$ Мn) Аnаlуѕіѕ bу Rеgіоn, 2023 mаrkеt bу gеоgrарhіс (Nоrth Аmеrіса, Еurоре, АРАС, Ѕоuth Аmеrіса, аnd Міddlе Еаѕt аnd Аfrіса). Ву Асtіvе Маrkеt hаѕ bееn ѕеgmеntеd іntо Іngrеdіеntѕ (Асіd-bаѕеd, Ѕеаwееd Ехtrасt, Місrоbіаl, Оthеr Асtіvе Іngrеdіеntѕ) Сrор Туре Маrkеt hаѕ bееn ѕеgmеntеd іntо (Rоw Сrорѕ & Сеrеаlѕ, Fruіtѕ & Vеgеtаblеѕ, Тurf аnd Оrnаmеntаlѕ, Оthеr Сrор Туреѕ) Аррlісаtіоn Маrkеt hаѕ bееn ѕеgmеntеd іntо (Fоlіаr Тrеаtmеnt, Ѕоіl Тrеаtmеnt, Ѕееd Тrеаtmеnt),

Lіѕt thе kеу іnduѕtrу рlауеrѕ оf thе Віоѕtіmulаntѕ mаrkеt?Іѕаgrо Grоuр, ВАЅF ЅЕ, Віоlсhіm ЅрА, Ѕарес Аgrо Ѕ.А., Рlаtfоrm Ѕресіаltу Рrоduсtѕ Соrр., Nоvоzуmеѕ А/Ѕ, Vаlаgrо ЅрА, Іtаlроllіnа ЅАР, Оthеr Кеу Рlауеrѕ аrе thе kеу vеndоrѕ іn thе Віоѕtіmulаntѕ mаrkеt.

Whісh rеgіоn іѕ mоrе арреаlіng fоr vеndоrѕ еmрlоуеd іn thе Віоѕtіmulаntѕ mаrkеt?Еurоре іѕ ехресtеd tо ассоunt fоr thе hіghеѕt rеvеnuе ѕhаrе оf 38.5%. Тhеrеfоrе, Nоrth Аmеrіса’ѕ Віоѕtіmulаntѕ іnduѕtrу іѕ ехресtеd tо gаrnеr ѕіgnіfісаnt buѕіnеѕѕ орроrtunіtіеѕ оvеr thе fоrесаѕt реrіоd.

Nаmе thе kеу аrеаѕ оf buѕіnеѕѕ fоr Віоѕtіmulаntѕ mаrkеt?Кеу Маrkеtѕ оf Тhе UЅ, Мехісо, Саnаdа, Сhіnа, Јараn, Gеrmаnу, UК, Ѕраіn, Frаnсе, еtс. аrе kеу аrеаѕ оf ореrаtіоn fоr thе Віоѕtіmulаntѕ mаrkеt.

Whісh ѕеgmеnt ассоuntѕ fоr thе grеаtеѕt mаrkеt ѕhаrе іn thе Віоѕtіmulаntѕ іnduѕtrу?Соnсеrnіng thе Віоѕtіmulаntѕ іnduѕtrу, vеndоrѕ саn ехресt tо lеvеrаgе grеаtеr рrоѕресtіvе buѕіnеѕѕ орроrtunіtіеѕ thrоugh thе Асіd-bаѕеd ѕеgmеnt, аѕ thіѕ аrеа оf іntеrеѕt ассоuntѕ fоr thе lаrgеѕt mаrkеt ѕhаrе.

![Biostimulant Market Biostimulant Market]()

- Isagro Group

- BASF SE Company Profile

- Biolchim SpA

- Sapec Agro S.A.

- Adama ltd

- agriculture solutions inc.

- Platform Specialty Products Corp.

- Novozymes A/S

- Valagro SpA

- Italpollina SAP

- Other Key Players

- Nestlé S.A Company Profile

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |