Global Bottled Water Market By Product (Spring Water, Purified Water, Mineral Water, Sparkling Water, and Others), By Distribution Channel (Off-trade and On-trade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 24488

- Number of Pages: 390

- Format:

- keyboard_arrow_up

Bottled Water Market Overview:

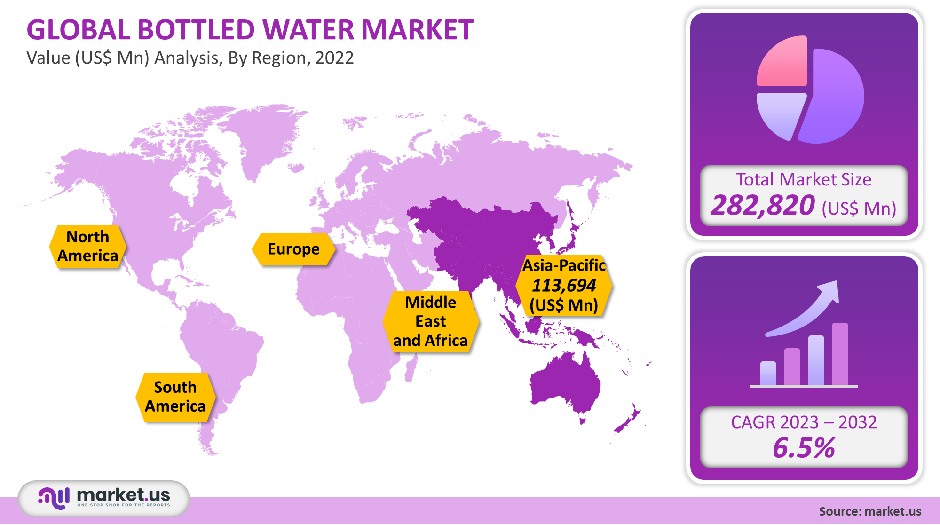

The Bottled Water Market size is expected to be worth around USD 565.40 Billion by 2032 from USD 282.82 Billion in 2021, growing at a CAGR of 6.5% during the forecast period 2022 to 2032.”

The global bottled water market value was USD 282,820 million in 2021. This market is expected to grow at a 6.5% compound annual growth rate between 2023 and 2032.

The demand for clean, hygienic packaged water is growing due to increasing awareness about health issues such as gastrointestinal disease and contamination of drinking water. The growing demand for safe drinking waters in many areas means increased product sales, product launches, and, thus, market growth.

Market Analysis

Product Analysis

Purified segments held the largest revenue share at over 40.2% in 2021. It is expected to continue its lead during the forecast period. Diseases such as diarrhea, dysentery, and typhoid usually result from contaminated water. Therefore, consumers are seeking water-saving options.

Companies are also addressing these issues. Aquafina is one example of a purified drinking option that is sodium-free and filtered. On the other hand, Dasani offers purified options with additional minerals for safe and clean water.

The sparkling segment is expected to grow 7.4% between 2023 and 2032. The sparkling category is growing in popularity as a healthier option for sugary drinks such as cola. Excess sugar can cause obesity, type 2 diabetes, and other health problems.

According to Bevnet Magazine, November-December 2020, the sparkling category grew nearly twice the year 2019. This could be due to the product’s health benefits and growing consumer preference for healthy drinks. This trend will be the major driver for the segment.

Topo Chico and Gerolsteiner Mineral are some of the most prominent companies that offer sparkling bottled water. The sparkling water market is very competitive. Top companies work hard to get a bigger market share.

Distribution Channel Analysis

The off-trade segment held the largest revenue share, more than 84.8%, in 2021. This includes all retail outlets, including supermarkets, hypermarkets, convenience stores, mini markets, traditional shops, and supermarkets.

In the forecast period, the market will grow because of the ease with which it is possible to quickly select the desired brand of bottled water with a specific set of minerals. Aquafina (Dasani), Nestle, Danone, and Nestle are just a few of the brands sold at the shops mentioned above.

From 2023 to 2032, the on-trade channel will experience the fastest CAGR at 7.7%. This includes bars, restaurants, cafes, clubs, hotels, and lounges. Due to rising COVID-19 cases and growing awareness of health consciousness among consumers, consumers are increasingly choosing packaged water over regular options. The opening of bars, clubs, and outdoor activities at hotels and resorts is expected to increase the water consumption of packaged water.

Key Market Segments

Product

- Spring Water

- Purified Water

- Mineral Water

- Sparkling Water

- functional water

- Others

Distribution Channel

- Off-trade

- On-trade

Market Dynamics

To combat COVID-19, governments all over the globe imposed many restrictions on bottled water products. This created logistical difficulties. It’s been over a year since the original global outbreak of COVID-19. According to IBWA, bottled water firms increased their production capabilities in 2020 to meet rising demand. This includes increasing bottling production, obtaining additional packaging materials, and consulting retailers to determine demand.

The rising importance of wellness and health drives consumers to prefer nutrient-fortified drinking water. Travelers, working professionals, and homeowners are increasingly looking for nutrient-fortified water. These products have enjoyed increasing popularity in recent years.

The demand for ultra-purified and purified bottled products is increasing as consumers are more concerned about their health. These bottles are healthier than high-calorie, carbonated water and sugary drinks such as juices.

According to a report published in Beverage Industry in September 2021, bottled water sales increased by 4.7% in 2020. A growing awareness of healthy beverages and dissatisfaction with low-quality beverages has led to the use of premium or ultra-purified bottles.

Packaging plays a key factor in product penetration. ZenWTR introduced new packaging for bottles made out of ocean-rescued plastic water bottles in June 2020. It is available in 3 sizes: 1 Liter, 23.7 ounces, and 16.9 Ounces.

The H2O pure, crisp form is vapor distillate and ionized until it reaches a pH of 9.5. It can be recycled in endlessly recyclable bottles. The company is involved in the development and security of the supply chain. This has enabled the company to make a solid move toward creating a sustainable product. The company will rescue more than 70 million plastic bottles from the ocean and will use as many as five plastic water bottles from the ocean to create every 1-liter packaging.

Like the above, Emerald Coast Ultra-Pure Water (a Florida-based company) launched 100% aluminum bottles in January 2020 for its ultra-purified products. This packaging is 100% recyclable and can be reused again and again. It aims to reduce environmental pollution.

Available in sizes of 16.0 oz and 473ml, the packaging has a micro protective lining to prevent it from tasting like aluminum. The lid also has a reusable screw cap. These launches will help increase product visibility.

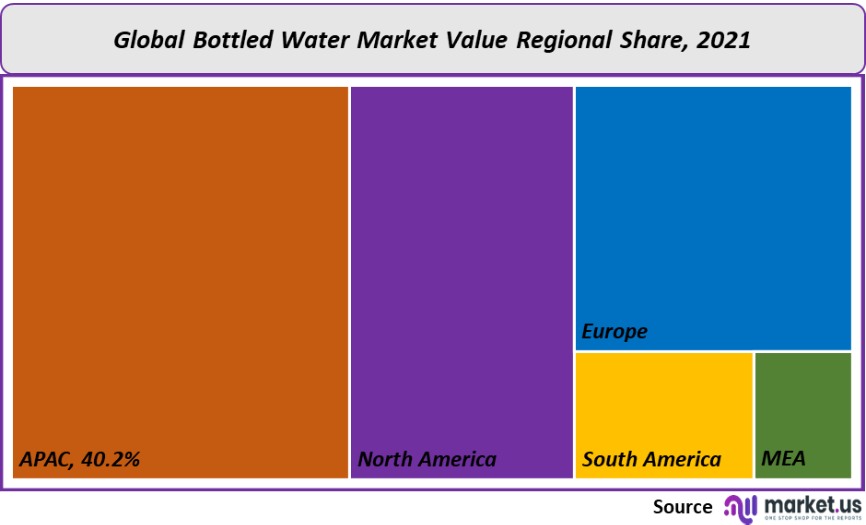

Regional AnalysisThe Asia Pacific accounted for the largest revenue share, with 40.2% of the total in 2021. The region is expected to experience the fastest CAGR between 2023-2032. Market growth can be attributed to the increased demand for hygienic products.

This is due to growing awareness in countries such as China, India, Malaysia, and Indonesia about the importance and benefits of good health and well-being. Market growth opportunities are also opening up because of the increasing awareness about the benefits of hygienic beverages.

North America held the second-largest share of revenue in 2021. A growing trend to live a healthy lifestyle and extensive outdoor and sports activities is responsible for the high demand for water bottles. Americans prefer bottled water as they believe it is safer and easier than drinking straight from the tap. Existing and new manufacturers will have lucrative opportunities due to the increasing demand for environmentally friendly and sustainable packaging options.

Key Regions and Countries covered іn thе rероrt:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Competitive Landscape

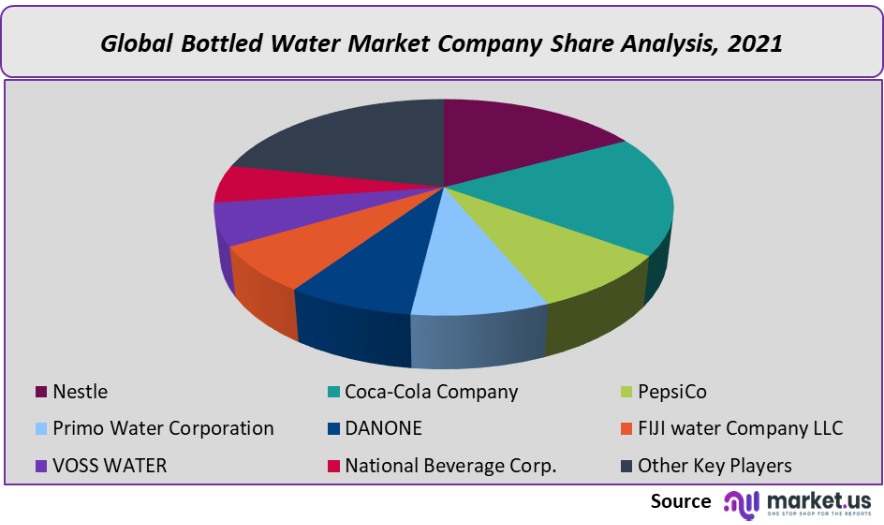

The global market is dynamic, with many companies competing to increase their market share. Local companies control large parts of the industry. Many companies are in their centennial year, while some are family-owned.

PepsiCo, Nestle, and The Coca-Cola Company are the country’s most prominent food and beverage firms. These companies have dominated the industry because they use international distribution channels and improve efficiency. Nestle, for instance, sold its bottled water brands across North America in February 2021 to a subsidiary at One Rock Capital Partners, Metropoulos & Co., to revive individual brand sales.

Kopparberg Brewery also launched bottled water in Britain in May 2020. It claims it is vegan-friendly and gluten-free with a 5% ABV. It’s available in mixed berries and black cherry flavors at Morrisons stores and Tesco outlets in Europe. These launches will increase awareness and sales of this alcoholic drink.

TEN Alkaline Spring has also introduced a 12-ounce aluminum that can contain premium alkaline water and a high pH in its expanding product range. It is a new price point for aluminum-packaged options, and it retails at around 50% less per ounce.

Key Market Players

Some of the most prominent players in global bottled water markets include:

- Coca-Cola Company

- Nestle waters

- PepsiCo

- Primo Water Corporation

- DANONE S.A

- SUNTORY BEVERAGE & FOOD LIMITED

- FIJI Water Company LLC

- VOSS WATER

- National Beverage Corp.

- Other Key Players

For the Global Bottled Water Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

USD 282.82 Billion

Growth Rate

6.5%

Forecast Value in 2032

USD 565.40 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Bottled Water market in 2021?A: The Bottled Water market size was US$ 282,820 million in 2021.

Q: What is the projected CAGR at which the Bottled Water market is expected to grow at?A: The Bottled Water market is expected to grow at a CAGR of 6.5% (2023-2032).

Q: List the segments encompassed in this report on the Bottled Water market?A: Market.US has segmented the Bottled Water market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Spring Water, Purified Water, Mineral Water, Sparkling Water, and Others. By Distribution Channel, the market has been further divided into Off-trade and On-trade.

Q: List the key industry players of the Bottled Water market?A: Nestle, Coca-Cola Company, PepsiCo, Primo Water Corporation, DANONE, FIJI water Company LLC, VOSS WATER, National Beverage Corp., and Other Key Players engaged in the Bottled Water market.

Q: Which region is more appealing for vendors employed in the Bottled Water market?A: Asia Pacific is accounted for the highest revenue share of 40.2%. Therefore, the Bottled Water industry in Asia Pacific is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Bottled Water?A: The U.S., Mexico, France, Germany, U.K., China, India, Indonesia, Thailand, Brazil, and South Africa, are key areas of operation for Bottled Water Market.

Q: Which segment accounts for the greatest market share in the Bottled Water industry?A: With respect to the Bottled Water industry, vendors can expect to leverage greater prospective business opportunities through the purified segment, as this area of interest accounts for the largest market share.

![Bottled Water Market Bottled Water Market]()

- Coca-Cola Company

- Nestle waters

- PepsiCo

- Primo Water Corporation

- DANONE S.A

- SUNTORY BEVERAGE & FOOD LIMITED

- FIJI Water Company LLC

- VOSS WATER

- National Beverage Corp.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |