Global Business Process Outsourcing Market By Service Type (Human Resource, KPO, Finance & Accounting, and Other Service Types), By End-use (BFSI, IT & Telecommunications, Manufacturing, and Others End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 57779

- Number of Pages: 234

- Format:

- keyboard_arrow_up

Business Process Outsourcing Market Overview:

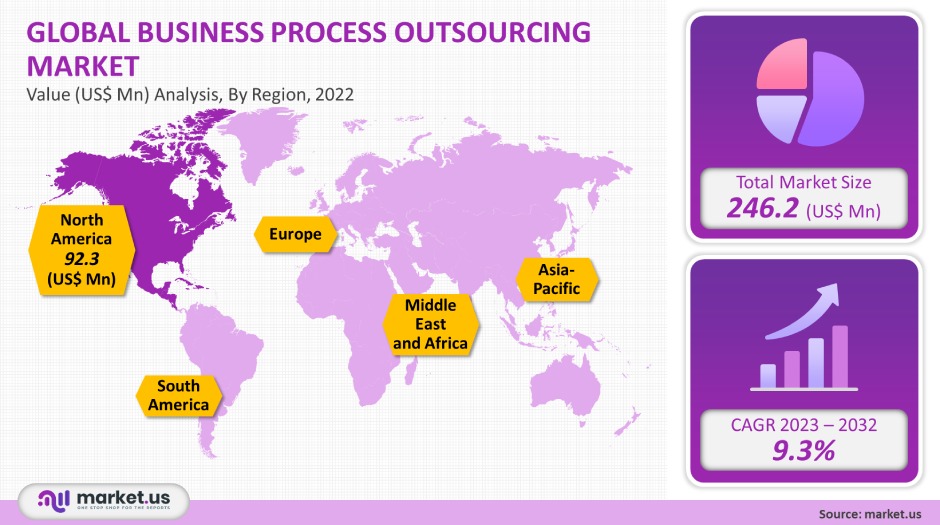

The global outsourcing market for business processes was worth USD 246.2 million (in 2021) and is expected to expand at a compound annual growth rate of 9.3% in 2023-2032.

The increasing focus on efficiency and business agility is driving the market. Operating costs are decreasing and core competencies are being emphasized to stay relevant in the ever-changing business environment.

Global Business Process Outsourcing Market Scope:

Service Type Analysis

The market was dominated by the customer services segment in 2021 with the highest revenue share. It is expected to continue its dominance as it has the fastest CAGR for the forecast period. The growing number of service centers around the world, who require both online and offline technical assistance, is responsible for the segment’s dominance.

BPO companies based in customer service handle customer queries and requirements via emails, chats, and other channels. Many also offer self-service support which allows customers to find the answers to their questions at any moment.

Forecasts show that the finance and accounting industry will experience significant growth. This can be explained by the growing number of bank facilities and stringent regulatory demands in the banking industry, which has led to the demand for outsourcing services that can reduce operating expenses.

The growth in demand for human resource services will also be significant during the forecast period. This is due to the increased need for resources in areas like payment processing, recruitment, relocation, and administration.

End-Use Analysis

The largest revenue shares for the IT & telecom segment in 2021. BPO services are increasingly needed by IT and telecommunication companies because of rapid industrialization around the world and an increase in the number of IT companies. IT and telecom BPO solutions address increasing connectivity demand, address security issues and invent new services for the latest devices.

Telecom companies outsourcing business functions include call-center outsourcing, billing operations, finance, and accounting. Outsourcing allows telecom firms to lower their capital expenses and create a flexible strategy for acquiring new customers and maintaining existing ones, as well as access to specialized resources, optimize investments, manage costs and manage risk.

Key Market Segments:

Service Type

- Human Resource

- KPO

- Finance & Accounting

- Customer Services

- Supply Chain & Procurement

- Other Service Types

End-use

- BFSI

- IT & Telecommunications

- Manufacturing

- Retail

- Healthcare

- Others End-Uses

Market Dynamics:

BPO services have seen a significant increase in popularity due to cloud computing. BPO providers are able to increase time to market and improve quality control. They can also reduce costs.

BPOs can also use cloud computing to provide instant computing support, system access, and flexible provisioning. They also have universal access when needed for business purposes. These benefits will be a major driver for cloud computing adoption in the outsourcing of business processes market.

However, concerns about confidentiality and intellectual property rights will likely limit the market’s growth prospects during the forecast period. In order to cut operational costs, outsourcers often end up in countries with no established legal framework for protecting them from violations of intellectual and confidentiality rights.

Outsourcing companies are often concerned about how they outsource handling information. This is because even a slight error can lead to a loss of market position. Market growth can also be supported by increasing government initiatives to promote cloud technology adoption in BPOs.

The rapid rise in COVID-19 case numbers at the start of 2020 caused severe social and financial disruptions. It also presented challenges to outsourcing functions. The disruptions caused by these disruptions will have a positive impact on the market over the long term.

BPO companies are changing their business models through restructuring their Business Continuity Plans, or BCPs to a distributed workforce.

To be able to survive an unprecedented disruption such as the COVID-19, businesses have learned the importance of continuous operations planning and disaster relief.

Accenture and Infosys Limited (Infosys BPM), which are the main vendors in the BPO industry, stated that by 2020, 80-90% more of their employees were working remotely because of the COVID-19 pandemic.

The disruption caused in the workforce management process resulted from a lack of infrastructure equipment and increased security risks. This caused a drop in work efficiency and delayed the completion of projects in the BPO industry.

Regional Analysis

North America accounted for the largest market share, with 37.5% in 2021. The region is expected to grow steadily throughout the forecast period. Because of rising demand from tech giants for BPO services, the region is expected to continue its dominance.

In addition to the rising demand for cloud computing, regional growth is expected to be further supported by customized service offerings that better suit individual needs. European markets are also expected to see healthy growth. This is due to the availability of skilled labor and the quality of service.

Asia Pacific market will register the highest expected CAGR between 2022- 2032. This is due in part to the growing demand for highly skilled professionals, low labor costs, and significant digital investments by prominent vendors such as HCL Technologies Limited, Infosys Limited., Accenture, and Wipro.

HCL Technologies Limited has entered Vietnam as an example. The company was able to increase its IT services and employ highly qualified professionals. It allowed the company expands its market presence in the Asia Pacific.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

Accenture, Amdocs Limited, and Infosys Limited dominated the global market for 2021. HCL Technologies Limited, CBRE Group Inc., and Wipro Limited were also key market players. To remain competitive in this highly competitive market, companies employ inorganic strategies like mergers &acquisitions, partnerships, geographical expansion, and partnerships.

Amdocs, a connectivity and Internet service provider, signed a seven-year agreement with VEON Ltd. on October 20, 2021. The partnership will allow Amdocs to offer digital services from Uzbekistan to customers of VEON.

In order to increase their market reach and size, companies also look at market trends to create differentiated and technologically superior services. This will help them gain a competitive advantage. These outsourcing services have become more flexible, which is helping market growth. They are used by many industries including IT and telecom and banking, financial services, and insurance.

Infosys McCamish, a leading industry platform, announced the launch of Infosys McCamish NGIN. The platform is designed for the global life insurance and the annuity industry and uses an evolutionary architecture. It is flexible enough to be customized to suit the requirements of individual insurance companies.

Market Key Players:

- Accenture

- Amdocs

- Capgemini

- CBRE Group Inc.

- HCL Technologies Limited

- Infosys Limited (Infosys BPM)

- NCR Corporation

- Sodexo

- TTEC Holdings, Inc.

- Wipro Limited

- Other Key Players

For the Business Process Outsourcing Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Business Process Outsourcing Market size in 2021?A: The Business Process Outsourcing Market size is US$ 246.2 million for 2021.

Q: What is the CAGR for the Business Process Outsourcing Market?A: The Business Process Outsourcing Market is registered to grow at a CAGR of 9.3% during 2023-2032.

Q: What are the segments covered in the Business Process Outsourcing Market report?A: Market.US has segmented the Global Business Process Outsourcing Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Service Type, market has been segmented into Finance & Accounting, Human Resource, KPO, Procurement & Supply Chain, Customer Services, Others. By End-use, market has been further divided into BFSI, Healthcare, Manufacturing, IT & Telecommunications, Retail, Others

Q: Who are the key players in the Business Process Outsourcing Market?A: Accenture, Amdocs, Capgemini, CBRE Group Inc., HCL Technologies Limited, Infosys Limited (Infosys BPM), NCR Corporation, Sodexo, TTEC Holdings, Inc., Wipro Limited

Q: Which region is more attractive for vendors in the Business Process Outsourcing Market?A: North America accounted for the highest revenue of 37.5% among the other regions. Therefore, the Business Process Outsourcing Market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Business Process Outsourcing?A: Key markets for Business Process Outsourcing Are The US, china, Japan, India, France, Germany, and the UK

Q: Which segment has the largest share in the Business Process Outsourcing Market?A: In the Business Process Service Type vendors should focus on grabbing business opportunities from the IT & telecom segment as it accounted for the largest market share in the base year.

![Business Process Outsourcing Market Business Process Outsourcing Market]() Business Process Outsourcing MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Business Process Outsourcing MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Accenture plc Company Profile

- Amdocs

- Capgemini SE Company Profile

- CBRE Group Inc.

- HCL Technologies Limited

- Infosys Limited (Infosys BPM)

- NCR Corporation

- Sodexo

- TTEC Holdings, Inc.

- Wipro Limited

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |