Global Canned Seafood Market By Product Type (Tuna, Salmon, Sardines, and Other Seafood’s), By Distribution channel (Foodservices, and Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 56150

- Number of Pages: 389

- Format:

- keyboard_arrow_up

Canned Seafood Market Overview:

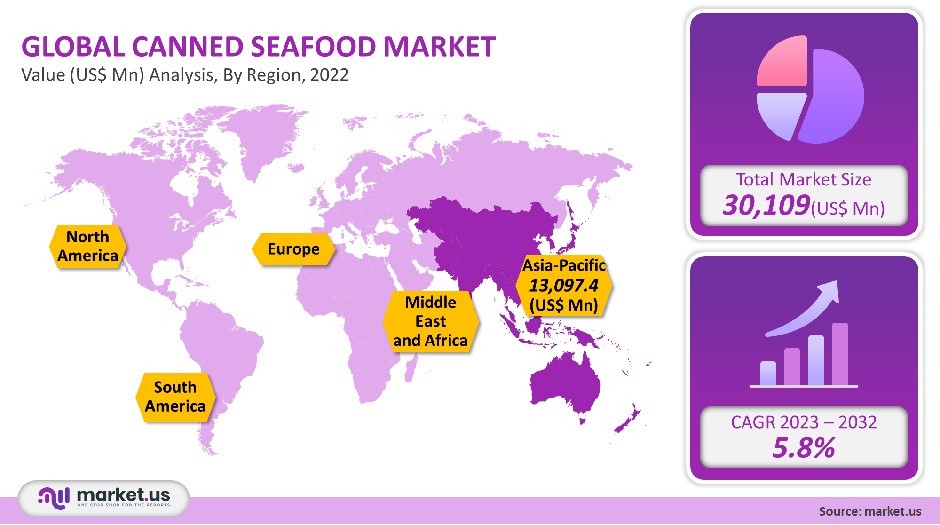

The global canned seafood market was worth USD 30,109 million in 2021. It is projected to grow at a CAGR of 5.8% between 2023 and 2032.

Industry growth is expected to be driven by the increasing popularity of ready-to-eat seafood products, which has been facilitated by improvements in distribution infrastructure. The Food and Agriculture Organization of the United Nations reported that canned-tune imports to the United States increased by 15.2% in 2020. The industry’s growth is likely to be driven by factors like changing lifestyles and increasing affordability.

The COVID-19 pandemic saw a spike in canned seafood demand, particularly among those who don’t like cooking. People who work from home or prefer to stay at home preferred canned food because it is quick and easy to prepare. Restaurants also restricted their services to prevent an increase in coronavirus infections. Therefore, consumers made more canned seafood at home.

Global Canned Seafood Market Scope:

Product Type Analysis

Tuna accounted for 42.3% of the total market in 2021. It is expected to continue its dominance throughout the forecast period, due to the high consumption of ready-to-eat meals by working-class people all over the world. National Fisheries Institute published a 2020 article that found nearly 88% of American households had consumed canned tuna.

Nearly half of American households consume canned tuna every month, while 17% consume canned tuna at most once per week. New product launches are expected to further increase the market. Mind Fish Co., for example, launched 2021 the first Fair Trade Certified canned tuna product that is available for purchase on the North American market.

From 2023 to 2032, however, the CAGR for sardines is 7.7%. Canisters of sardines are more popular than fresh ones because they can be taken with you wherever you go. To expand their product range and appeal to a wider consumer base, manufacturers are creating new product variants.

Minnow, a tinned seafood business, introduced its first line of products in 2022. Initial products included Icelandic cod liver, Alaskan salmon, Spanish sardines, and a private-label range of shelf-stable, tinned seafood products.

Distribution Channel Analysis

With a market share of 61% or more in global revenue, retail was the largest distribution channel in 2021. This includes hypermarkets and convenience stores as well as grocery stores, supermarkets, and local shops. This has led to a rise in canned seafood distribution in the market due to the increasing number of these stores in different regions.

Supermarket News reported that convenience stores were the largest distributors of canned seafood in February 2021. However, the retail sector accounts for 48.2% of the market. The segment’s momentum is expected to continue to grow as brick-and-mortar stores have easy access to these products on a global scale over the next few decades.

Foodservice distribution channels are expected to grow faster during the forecast years, with a 6.4% CAGR from 2023 to 2032. This segment will be a reliable source of revenue over the forecast period. The growth in canned seafood consumption in restaurants and hotels will drive this segment. Because of the increasing awareness about food safety, restaurants, cafes, and eateries now serve seafood directly from cans.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Tuna

- Salmon

- Sardines

- Other Seafood’s

By Distribution channel

- Foodservices

- Retail

Market Dynamics:

The canned seafood market is experiencing a boom due to increased awareness of the many health benefits that canned seafood products offer. Canned seafood contains high levels of omega-3 fatty acid, which is important for overall well-being and health.

Can-based canned seafood is expected to grow in popularity due to the growing demand for them. According to Bloomberg Intelligence, the market for plant-based canned seafood will reach US$ 165 billion by 2032, up from US$ 30 billion in 2021. Scientists and marketers are now creating plant-based, healthy seafood products that taste like real food due to increased demand.

Startups and large corporations also show interest in plant-based fish. Atlantic Natural Foods began offering TUNO, a fishless alternative to tuna made from yeast, soy, and sunflower extract. Impossible Foods was another brand that announced it would be working on plant-based fish in 2019.

As a result of growing concerns about sustainable seafood procurement, consumers are now choosing seafood products that are sustainably sourced. As a result, there has been an increase in canned salmon suppliers looking to source raw materials from fisheries that have been Aquaculture Stewardship Council and Marine Stewardship Council certified. This will help to boost canned seafood sales.

Bumble Bee Seafoods LLC acquired Marine Stewardship Council as well as other certification programs that are acknowledged by the Global Sustainable Seafood Initiative.

Additionally, increased demand for high shelf-life sea products will likely lead to an increase in canned seafood consumption. Market growth will be driven by increased disposable income and the preference of gyrating customers for ready-to-eat food. Market growth is expected to be driven by increased seafood consumption due to its health benefits.

Regional Analysis

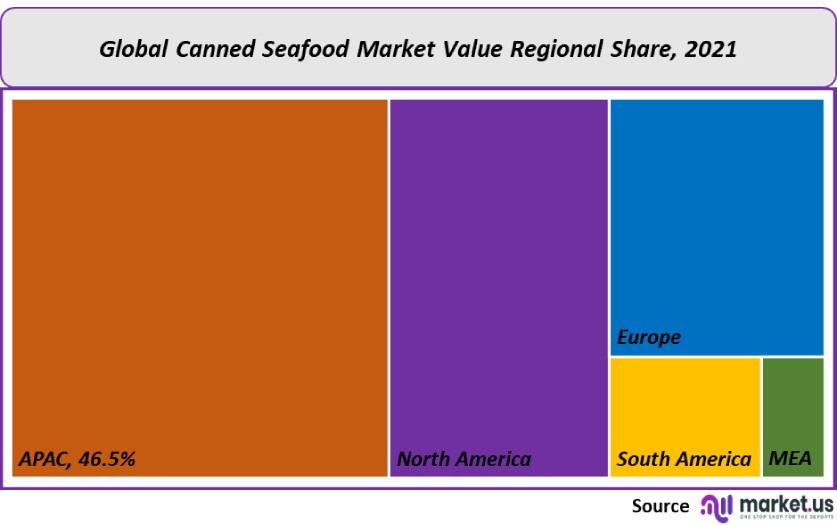

The Asia Pacific contributed 46.5% to the global market in 2021, making it the most important region. The availability of large quantities of raw material and many canneries in the region are the reasons for the increased adoption of canned seafood products.

From 2023 to 2032, the Middle East will see a 5.8% CAGR. Due to its many health benefits, the region’s market is growing. Many retail distributors have started private-label brands to sell canned seafood. This is due to the growing demand and the potential growth opportunities in the canned seafood market.

Woolworths, a multinational South African retail company, sells its wide range of canned seafood products through its retail outlets as well as via online delivery. The market is expected to grow because of the increasing number of players. Oceana Group Limited, Saldanha, and Goody are some of the top brands that offer canned seafood products in this region.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

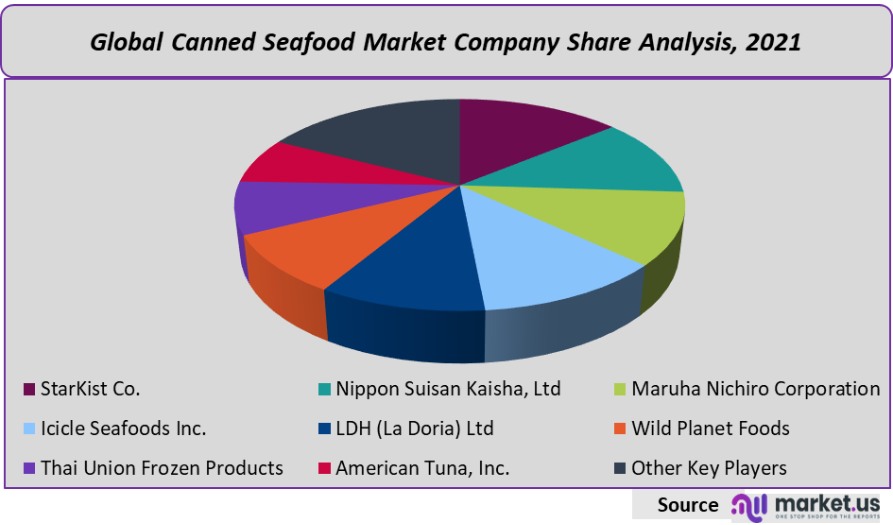

The market for canned seafood is fragmented due to the presence of many international players. Market players are subject to intense competition, particularly from top market players, who have large consumer bases, strong brand recognition, and extensive distribution networks. To stay on top of the market, companies have implemented various expansion strategies such as partnerships and product launches.

Маrkеt Кеу Рlауеrѕ:

- StarKist Co.

- Nippon Suisan Kaisha, Ltd

- Maruha Nichiro Corporation

- Icicle Seafoods Inc.

- LDH (La Doria) Ltd

- Wild Planet Foods

- Thai Union Frozen Products

- American Tuna, Inc.

- Universal Canning, Inc.

- Tri Marine Group

- Trident Seafoods Corporation

- Connors Bros. Ltd.

- Other Key Players

For the Canned Seafood Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the canned seafood market in 2021?A: The Canned seafood market size is US$ 30,109 million in 2021.

Q: What is the projected CAGR at which the Canned seafood market is expected to grow at?A: The Canned seafood market is expected to grow at a CAGR of 5.8% (2023-2032).

Q: List the segments encompassed in this report on the Canned seafood market?A: Market.US has segmented the Canned seafood market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into Tuna, Salmon, Sardines, and Other Seafood. By Distribution channel, the market has been further divided into Foodservices and Retail.

Q: List the key industry players of the Canned seafood market?A: StarKist Co., Nippon Suisan Kaisha, Ltd, Maruha Nichiro Corporation, Icicle Seafoods Inc., LDH (La Doria) Ltd, Wild Planet Foods, Thai Union Frozen Products, American Tuna, Inc., and Other Key Players engaged in the Canned Seafood market.

Q: Which region is more appealing for vendors employed in the Canned seafood market?A: APAC is expected to account for the highest revenue share of 46.5%. Therefore, the Canned seafood industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Canned seafood?A: India, China, The US, Canada, UK, Japan, & Germany are key areas of operation for the Canned Seafood Market.

Q: Which segment accounts for the greatest market share in the canned seafood industry?A: With respect to the Canned seafood industry, vendors can expect to leverage greater prospective business opportunities through the Tuna segment, as this area of interest accounts for the largest market share.

![Canned Seafood Market Canned Seafood Market]()

- StarKist Co.

- Nippon Suisan Kaisha, Ltd

- Maruha Nichiro Corporation

- Icicle Seafoods Inc.

- LDH (La Doria) Ltd

- Wild Planet Foods

- Thai Union Frozen Products

- American Tuna, Inc.

- Universal Canning, Inc.

- Tri Marine Group

- Trident Seafoods Corporation

- Connors Bros. Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |