Global Cardiac Resynchronization Therapy Market By Product (CRT-Pacemaker and CRT-Defibrillator), By End-user (Cardiac Center and Hospital), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 47673

- Number of Pages: 214

- Format:

- keyboard_arrow_up

Cardiac Resynchronization Therapy Market Overview:

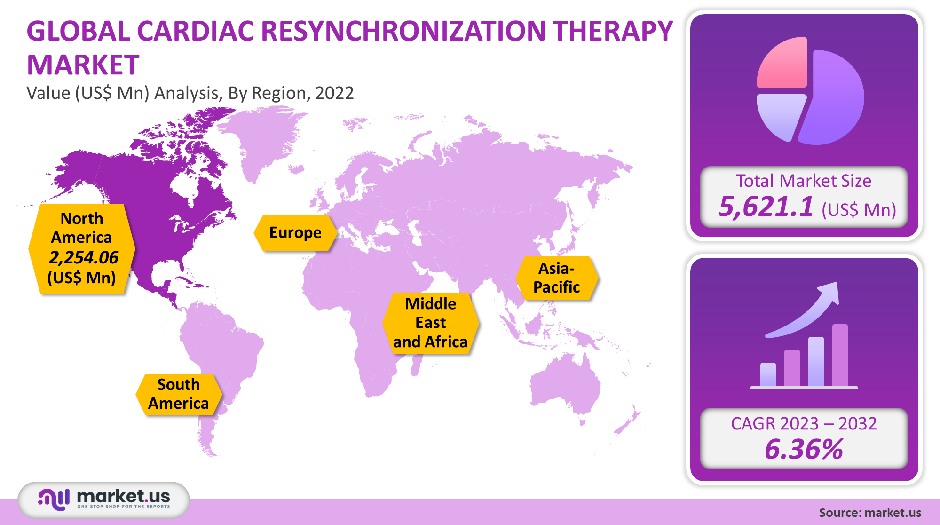

The global cardiac resynchronization therapy market accounted for USD 5,621.1 million in 2021. It is expected to register at a 6.36% CAGR, between 2023 to 2032.

This market is driven by product development, increasing aging populations, key companies’ initiatives, and the prevalence of Cardiovascular Diseases. Boston Scientific reported a global cumulative distribution of approximately 389,000 CRT/Ds as of 2021. The company sold approximately 33,000 CRT-Ds in 2020. About 16,500 of these were registered in the United States, which indicates high demand.

Market sales and demand declined due to the COVID-19 pandemic. This was due to deferred or canceled elective procedures, delays in clinical trials, and supply chain challenges. It also resulted in a decrease in sales and marketing activities.

Global Cardiac Resynchronization Therapy Market Scope:

Product analysis

The global market is divided into CRT pacemakers and defibrillators based on the products. With more than 59.2% of global revenue in 2021, the CRT-defibrillators segment was the most dominant. The fastest expected CAGR for the CRT-pacemaker’s product segment is during the forecast period. This is due to an increasing number of geriatrics, the prevalence, and severity of cardiac conditions, as well as product innovations by key market players.

A 2020 study published by the Journal of Arrhythmia analyzed data from Japan Cardiac Device Treatment Registry. This study showed an increase in de novo implantations of ICDs and CRTaEURDs in patients over 74 years old in Japan. Over a period of 10 years, the number of ICD, CRT-D, and CRT/P patients who received ICD implants, was 17,564, 9,472, and 1,088 respectively.

End-Use analysis

The global market can be divided by end-users into hospitals, cardiac centers, and others. In 2021, the hospital segment was responsible for more than 53.21% of the global market’s revenue. Because most surgeries are performed in hospitals, CRT devices are used in high volumes in hospitals. Aster Hospital in Dubai reported that CRT-D was implanted in a 61-year-old man with severe heart failure and frequent, fast, life-threatening heartbeats.

Due to the increase in cardiac specialty centers and the rising prevalence of the cardiovascular disease across the globe, the segment of cardiac center end-users is expected to experience the fastest growth over the forecast period. The CDC estimates that in 2020, approximately 6.2 million Americans suffered from heart disease. According to the American College of Cardiology Foundation (ACCF), the incidence of cardiovascular disease increased from 271 to 523 million between 1990 and 2019.

Кеу Маrkеt Ѕеgmеntѕ

By Product

- CRT-Pacemaker

- CRT-Defibrillator

By End-user

- Cardiac Center

- Hospital

- Other End-users

Market Dynamics:

Medtronic and Boston Scientific as well as Microport reported that COVID-19 had a negative effect on their financial performance. Microport reported a 16.5% drop in its cardiac rhythm management business. According to Microport, the decrease was due to delayed outpatient visits and surgical procedures caused by the COVID-19 pandemic. This led to a reduction in the number of implantable devices.

Following the shock and confusion over COVID-19, governments and companies began to take corrective measures to help the economy recover. These included policy and monetary stimulation, the easing of restrictions, conditional exclusions, as well as other strategic initiatives.

The COVID-19 taskforce update by the Heart Rhythm Society included guidelines for patients with implantable cardiac electronic devices. It emphasized the importance of limiting exposure for patients and providers.

The Heart Rhythm Society recommended that only serious issues involving device leads, reprogramming, or generators be addressed in person. Biotronik used this information to promote its implantable Cardiac Rhythm Management device lineup, which is equipped with Home Monitoring technology to ensure continuity of care.

These guidelines helped to recover the market for CRT devices. Market growth is expected to be driven by the growing aging population. Statistics Korea estimates that 8.53 million people 66 and over will be living in 2021. This number will rise to 12.98 million in 2032. As the population ages, there is a rising number of people at high risk for chronic diseases such as hypertension, congestive heart disease, and arrhythmia. This will likely contribute to the country’s market growth.

A survey by the European Society of Cardiology, published in the Archives of Cardiovascular Diseases 2019, found that French patients are more likely to have a CRT–P implant than the rest of Europe.

Patients were found to be older than average, with 45% of them being 75 years old or more, had fewer co-morbidities, and suffered from less severe symptoms of heart failure.Market growth is expected to be driven by product improvements, R&D efforts by market players, as well as the prevalence of Cardiovascular Diseases. These devices are compatible with Abbott’s my MerlinPuls app and offer remote monitoring capabilities. This enhances the company’s offering.

MultiPoint Pacing and SyncAV are two additional features that Gallant CRT–D offers to enhance patient response to CRT therapy. This helped the company achieve its growth goals. According to the Spanish Pacemaker Registry, approximately 3,850 CRT devices will be implanted in Spain. 2,387 of the devices were CRT devices while 1,463 were CRT devices. The average age of recipients was 78.8. Syncope was 42% of the most common symptom that led to implantation. Other symptoms included dizziness, heart failure, and syncope.

Regional Analysis

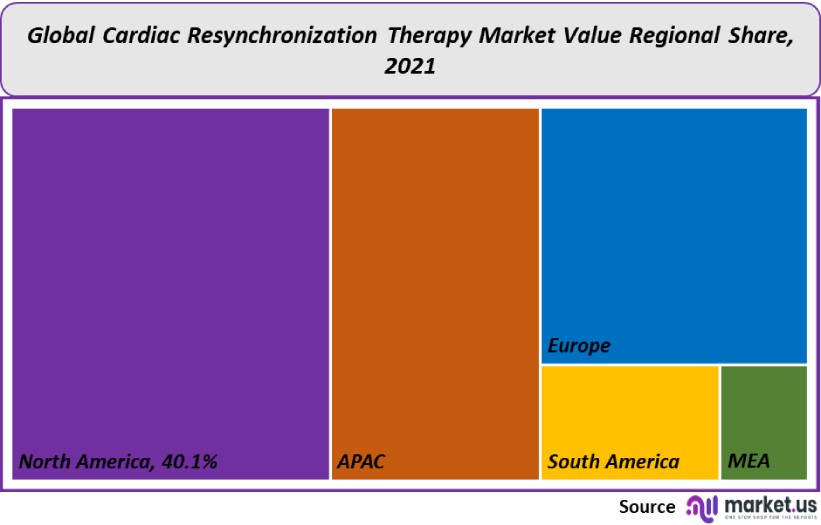

In 2021, North America was responsible for more than 40.1% of the total revenue. This large region’s share is due to growing regulatory approvals and an increasing geriatric population. A sedentary lifestyle and physical inactivity can increase the risk of developing a cardiac disease. This may lead to the need for cardiology care.

The Asia Pacific is expected to experience the fastest growth rate over the next few years. This is due to a rapidly expanding healthcare infrastructure, aging population, improved economic conditions, strategic initiatives taken by key companies, and a rising prevalence of heart disease.

MicroPort is an example of a Chinese company that specializes in medical devices. It is a leader in the domestic market for cardiac rhythm management. The company saw a 96% increase in revenue year-over-year during H1 2021, with a revenue of approximately USD 6 million in China. This was due to its extensive product portfolio and strong product pipeline. The company was able to provide coverage for 584 hospitals in the country due to its cost-effectiveness, brand recognition, and this growth.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

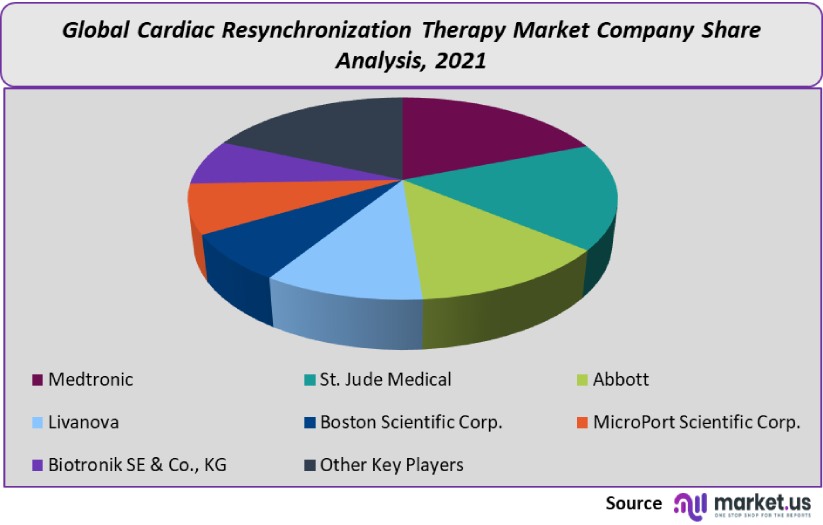

The market will see moderate competition over the forecast period. Market shares are approximately 89% held by the top five companies. These companies also have access to a wide range of resources, market knowledge, and distribution networks, and can participate in strategic initiatives to increase market share. These strategies include mergers and acquisitions, geographical expansion, partnerships, new product launches, R&D, and the launch of new products.

Маrkеt Кеу Рlауеrѕ:

- Medtronic

- St. Jude Medical

- Abbott

- Livanova

- Boston Scientific Corp.

- MicroPort Scientific Corp.

- Biotronik SE & Co., KG

- Other Key Players

For the Cardiac Resynchronization Therapy Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Cardiac Resynchronization Therapy market in 2021?A: The Cardiac Resynchronization Therapy market size is US$ 5,621.1 million in 2021.

Q: What is the projected CAGR at which the Cardiac Resynchronization Therapy market is expected to grow at?A: The Cardiac Resynchronization Therapy market is expected to grow at a CAGR of 6.36% (2023-2032).

Q: List the segments encompassed in this report on the Cardiac Resynchronization Therapy market?A: Market.US has segmented the Cardiac Resynchronization Therapy market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into CRT-Pacemaker and CRT-Defibrillator. By End User, the market has been further divided into Cardiac Center and Hospital.

Q: List the key industry players of the Cardiac Resynchronization Therapy market?A: Medtronic, St. Jude Medical, Abbott, Livanova, Boston Scientific Corp., MicroPort Scientific Corp., Biotronik SE & Co., KG, and Other Key Players engaged in the Cardiac Resynchronization Therapy market.

Q: Which region is more appealing for vendors employed in the Cardiac Resynchronization Therapy market?A: North America accounted for the highest revenue share of 40.1%. Therefore, the Cardiac Resynchronization Therapy industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Cardiac Resynchronization Therapy?A: The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc., are key areas of operation for Cardiac Resynchronization Therapy Market.

Q: Which segment accounts for the greatest market share in the Cardiac Resynchronization Therapy industry?A: With respect to the Cardiac Resynchronization Therapy industry, vendors can expect to leverage greater prospective business opportunities through the CRT-defibrillators segment, as this area of interest accounts for the largest market share.

![Cardiac Resynchronization Therapy Market Cardiac Resynchronization Therapy Market]() Cardiac Resynchronization Therapy MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Cardiac Resynchronization Therapy MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Medtronic

- St. Jude Medical

- Abbott Laboratories

- Livanova

- Boston Scientific Corp.

- MicroPort Scientific Corp.

- Biotronik SE & Co., KG

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |