Global Cardiac Rhythm Management Devices Market By Product (Pacemakers, Defibrillators, and Cardiac Resynchronization Therapy (CRT)), By End User (Hospitals, Clinics & Cardiac Specialty Centers, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 14832

- Number of Pages: 294

- Format:

- keyboard_arrow_up

Cardiac Rhythm Management Devices Market Overview:

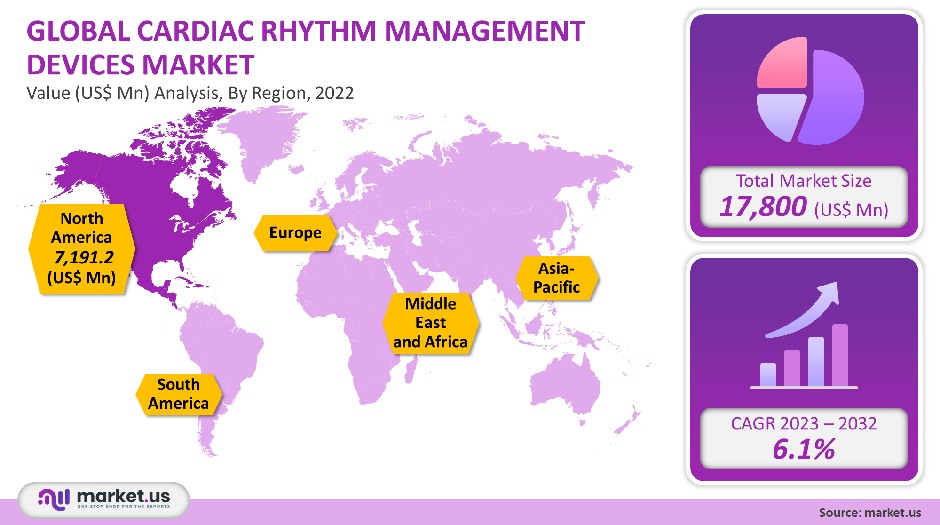

The market for cardiac rhythm management devices was worth USD 17,800 million in 2021. This market is projected to grow at a 6.1% CAGR, from 2023 to 2032.

Growing incidence of many cardiovascular diseases, including arrhythmia and atrial fibrillation. According to the Centers for Disease Control and Prevention, approximately 12.1 million Americans are likely to experience atrial fibrillation (AFib), by 2032. The market is expected to grow due to technological advances.

Global Cardiac Rhythm Management Devices Market Scope:

Product Analysis

Defibrillators held the largest share of revenue in the CRM devices market at 42.8% in 2021. This is due to the increasing adoption of the Subcutaneous Implantable Defibrillator and Transvenous Implantable Cardioverter Defibrillator (T) in major markets such as the U.S. and China.

Defibrillators may also be classified as Implantable Cardioverter Defibrillators, (ICD), and external defibrillators. The fastest-growing segment of external defibrillators is expected to be 8.5%, due to increased adoption, particularly in public places.

The largest revenue shares in the pacemaker segment were held by the implantable segment. Implantable pacemakers have been a popular treatment for conduction disorders as well as sinus dysfunction. The segment’s growth is due to the increased use of the pacemakers for treatment of heart failure and arrhythmias. In the future, the CRT segment will see significant growth. This segment has key benefits like reduced blood transfusion, infection risk, and shorter hospital stays.

In order to reduce the incidence of bradycardia, and cardiac arrest, healthcare practitioners are increasingly recommending minimally-invasive CRT Pacemaker implantation. Forecasts predict that CRT-P sales will rise due to the preference for minimally invasive procedures.

End User Analysis

The global cardiac rhythm management devices market can be divided into three main categories depending on the end user. Hospitals, clinics & cardiac specialist centers, ambulatory care centers, and home care settings. The largest market share in the cardiac rhythm management device market is held by hospitals, clinics, and cardiac specialty centers.

The market for cardiac rhythm management devices and cardiac monitoring is a category that requires prompt attention from both hospital staff and medical specialists. This segment’s growth can be attributed to the rising number of patients who visit hospitals for prediagnosis of their heart conditions, the increasing number of procedures for implanting cardiac devices, and the increased adoption of cardiac monitoring equipment in hospitals during the pandemic.

Key Market Segments

Product

- Pacemakers

- External

- Implantable

- Defibrillators

- External Defibrillator

- Implantable Cardioverter Defibrillators (ICD)

- Cardiac Resynchronization Therapy (CRT)

- CRT-Pacemakers

- CRT-Defibrillator

End User

- Hospitals, Clinics & Cardiac Specialty Centers

- Ambulatory Care Centers

- Home Care Settings

Market Dynamics

All industries were affected by the COVID-19 epidemic, even the market for CRM devices. The postponement or cancellation of cardiovascular procedures has caused market players to suffer huge losses in cardiac rhythm management segments.

Medtronic saw a 12% decline in its cardiac rhythm management device segment in 2020 as compared with 2019. Major losses were seen in ICDs and CRT-Ds as well as the pacemakers’ section. Medtronic will see a recovery in its annual revenue, as well as the segment revenue from cardiac rhythms and heart failure. Between 2020 and 2021, Medtronic saw an increase of 4.16% in its total revenue.

Similar trends can also be seen in the financial results from other market players. Therefore, the initial pandemic had a negative impact on the market for heart rhythm management devices. But, it is now on the rebound in 2021. Physical inactivity, which is the second-leading cause of death in the U.S., is a serious public health concern. Physical inactivity is associated with morbidity and the development of chronic conditions like diabetes and cardiac disorders.

The WHO estimates that around 2 million people are killed each year due to inactivity or sedentary living. A sedentary lifestyle is also a common feature in the developed and developing world. It has been estimated that 60% to 85% of people live in a sedentary environment. This will likely increase the demand in the future.

Patients from nations like Canada, the United States, and the United Kingdom are more likely to adopt medical devices as a result of favorable reimbursement rules, which have increased market penetration. Additionally, during the forecast period, it is anticipated that increasing government activities and the implementation of new CRM technologies will accelerate growth.

For instance, there are rules governing the use of external defibrillators in public areas. AEDs must be installed in all public spaces, including schools and public swimming pools, according to California’s 2018 New Laws. Due to longer lifespans and the accessibility of more cutting-edge technologies, CRM gadgets have become more and more popular in recent years.

In recent years, heart disease is the most common cause of death. According to World Health Organization estimates, cardiovascular diseases (CVDs), cause around 17.9 million deaths annually. Since they rarely show symptoms, cardiovascular diseases are commonly called the ‘silent plague.

These conditions are considered to be the costliest to treat. CRM devices are used not only for monitoring and managing cardiac conditions but also can be used to repair, restore, and heal cardiac disorders. These potential benefits are expected to increase the adoption rate over the forecast period.

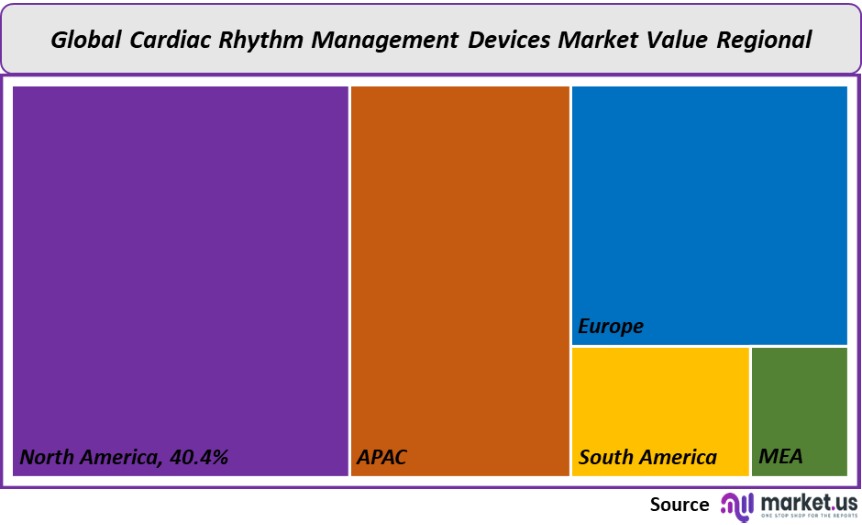

Regional Analysis

North America held the largest share of revenue at 40.4% in 2021 and was the leader in the CRM device market. It is due to a number of factors, such as the well-established healthcare system, an increasing elderly population, rapid adoption of technologically advanced products (such as a long battery lifetime, biocompatible materials, miniaturization, or leadless), and surging regulatory approvals.

Many companies are currently developing new devices using existing pacemakers or Implantable Cardioverter Defibrillator technology (ICD). Market growth is being driven by the rising prevalence of cardiovascular diseases in the region.

The Asia Pacific will see the highest growth rate of 6.8% in cardiac rhythm management devices over the forecast period. This is due mainly to international players such as the American College of Cardiology (China Cardiovascular Association) and the China Cardiovascular Association (American College of Cardiology), which have joined forces to develop new technologies for cardiac care.

OECD countries still have a better record in curbing CVDs than developed Asian nations, such as tobacco smoking. Increased awareness efforts, like Japan’s 2020 Olympic Games smoke-free policy, will likely propel growth.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

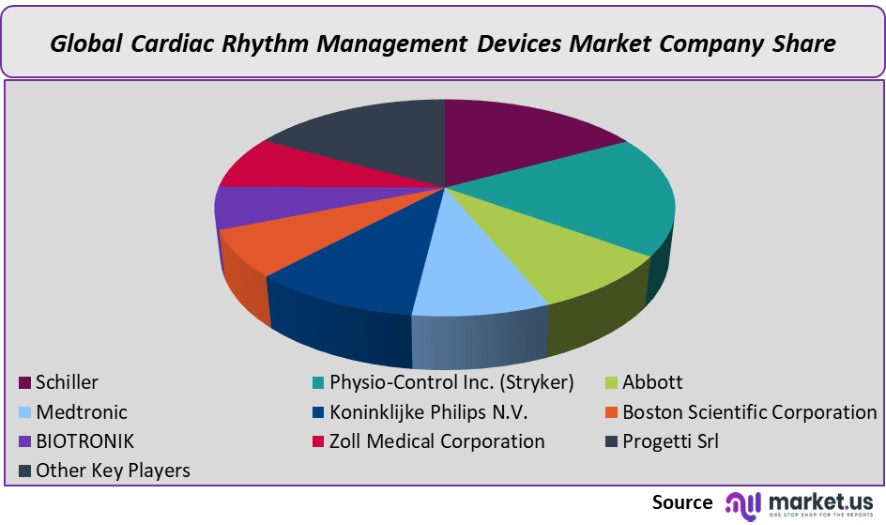

Market Share Analysis

The number of small and major firms in this sector is substantial. It is competitive and dominated by Koninklijke Philips N.V., Boston Scientific Corporation, and Medtronic and Abbott. The major players are concentrating their efforts on cutting-edge tactics like mergers and acquisitions.

Additionally, they intend to boost their earnings through collaborations and distribution contracts. In July 2020, Abbott got approval from the US Food and Drug Administration for the Gallant ICD and CRT-D devices. The business was able to promote the gadget in America and broaden its product offering.

Key Market Players

Some of the most prominent players in the market for cardiac rhythm management devices include:

- Schiller

- Physio-Control Inc. (Stryker)

- Abbott

- Medtronic

- Koninklijke Philips N.V.

- Boston Scientific Corporation

- BIOTRONIK

- Zoll Medical Corporation

- Progetti Srl

- Other Key Players

For the Cardiac Rhythm Management (CRM) Devices Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Cardiac Rhythm Management Devices market in 2021?A: The Cardiac Rhythm Management Devices market size is US$ 17,800 million in 2021.

Q: What is the projected CAGR at which the Cardiac Rhythm Management Devices market is expected to grow at?A: The Cardiac Rhythm Management Devices market is expected to grow at a CAGR of 6.1% (2023-2032).

Q: List the segments encompassed in this report on the Cardiac Rhythm Management Devices market?A: Market.US has segmented the Cardiac Rhythm Management Devices market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Pacemakers, Defibrillators, and Cardiac Resynchronization Therapy (CRT). By End User, the market has been further divided into Hospitals, Clinics & Cardiac Specialty Centers, Ambulatory Care Centers, and Home Care Settings.

Q: List the key industry players of the Cardiac Rhythm Management Devices market?A: Schiller, Physio-Control Inc. (Stryker), Abbott, Medtronic, Koninklijke Philips N.V., Boston Scientific Corporation, BIOTRONIK, Zoll Medical Corporation, Progetti Srl, and Other Key Players engaged in the Cardiac Rhythm Management Devices market.

Q: Which region is more appealing for vendors employed in the Cardiac Rhythm Management Devices market?A: North America is accounted for the highest revenue share of 40.4%. Therefore, the Cardiac Rhythm Management Devices industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Cardiac Rhythm Management Devices?A: The U.S., Canada, U.K., Germany, Italy, France, Spain, Japan, Etc., are key areas of operation for Cardiac Rhythm Management Devices Market.

Q: Which segment accounts for the greatest market share in the Cardiac Rhythm Management Devices industry?A: With respect to the Cardiac Rhythm Management Devices industry, vendors can expect to leverage greater prospective business opportunities through the defibrillators segment, as this area of interest accounts for the largest market share.

![Cardiac Rhythm Management Devices Market Cardiac Rhythm Management Devices Market]() Cardiac Rhythm Management Devices MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample

Cardiac Rhythm Management Devices MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample - Pacemakers

- Schiller

- Physio-Control Inc. (Stryker)

- Abbott Laboratories

- Medtronic

- Koninklijke Philips N.V.

- Boston Scientific Corporation Company Profile

- BIOTRONIK

- Zoll Medical Corporation

- Progetti Srl

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |