Global Carrageenan Market By Processing technology (Alcohol, Precipitation, Gel Press, Semi-refined), By Function (Thickening Agent, Gelling Agent, Stabilizer, Others), By Product Type (Kappa, Iota, Lambda), By Application (Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Mar 2022

- Report ID: 31475

- Number of Pages: 263

- Format:

- keyboard_arrow_up

Carrageenan Market Overview:

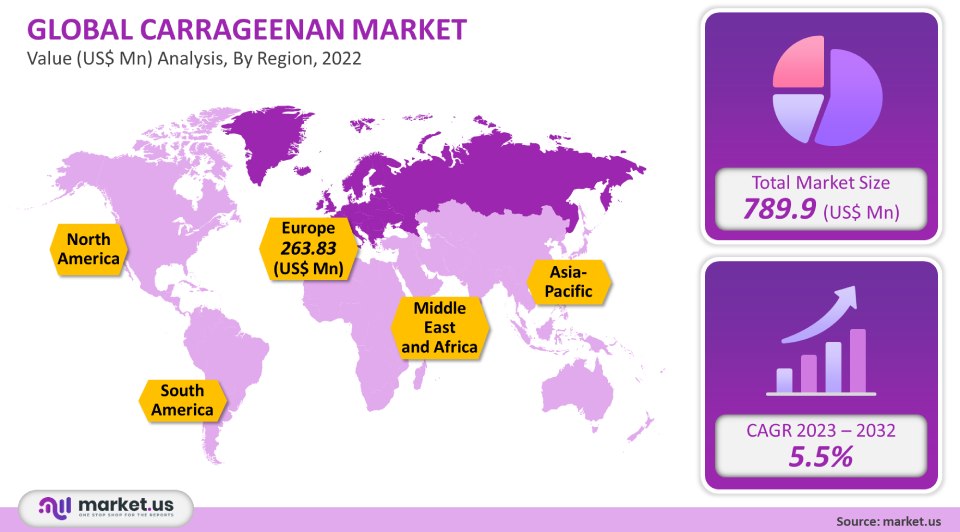

The global carrageenan market accounted for USD 789.94 million in 2021. This market is expected to expand at a 5.5% CAGR, from 2023 to 2032.

Market growth is expected to be boosted by increased product penetration in processed meat and dairy products due to carrageenan’s mouth feel properties to imitate fatty taste. Carrageenan’s ability to bind water and enhance food ingredients’ properties is the primary reason that it is so widely used in the food sector. There is likely to be a rise in demand for products made from plant-derived ingredients.

Global Carrageenan Market Scope:

Processing technology analysis

Semi-refined technologies dominated the market, with a greater than 53% revenue share in 2021. These processes are cost-effective, which is why they have gained popularity in the market. Semi-refined carrageenan contains insoluble material, such as cellulose. Technological advances have led to semi-refined, food-grade carrageenan being made, which has increased its use in food products and thus boosted its demand.

Semi-refined carrageenan can be used in food applications in many countries worldwide. It has been proven safe for human use in the majority of countries. The traditional method of alcohol precipitation is used to extract carrageenan from seaweed. This gives the product a refined and purified form. Multiple steps in alcohol precipitation increase the cost of total processing, which will limit segment growth.

Function analysis

Thickening agents accounted for 41.6% of revenue share in 2021 and factor in the growing request for clean label thickeners in both the pharmaceutical and food industries. A significant revenue portion was held by gelling agent category in 2020 due to increased demand for plant-derived, vegan-friendly gelling additives. Stabilizers are expected to see rapid growth due to increased demand from bakeries, confectionery, as well as beverages. Stabilizers are used in order to prevent the formation of ice crystals from forming and improve the product texture. Stabilizers can, for example, improve the mouthfeel in beverages such as kombucha, and coconut water. Other carrageenan functionalities include binding agents, emulsifiers, and other carrageenan functionalities. Because of the growing demand for packaged food products and ready-to-eat foods, the Others segment is expected to expand at the highest annual rate. Industry growth is likely to be supported by constant efforts to eradicate genetically modified organisms and partially hydrogenated oils.

Product Type Analysis

In 2021, the largest revenue share was 69.7% for the kappa category. It is the most commonly used product type in puddings, creams cheese, and chocolates. MCLS EUROPE, a wholly owned subsidiary of Mitsubishi Corporation, sells pure Kappa carrageenan. This can be used in dessert and dairy products as gelling agents, swelling agents, or fat replacements. The anti-viral qualities of Iota Carrageenan are being researched. According to a study published in the Journal of Pharmacology Research & Perspectives, nasal administration of iota-carrageenan resulted in a rise in common cold recovery rates. The recovery rate for coronavirus and influenza A infection was up 139%, and 119% respectively, and 70% for rhinovirus infection.

Application analysis

Food and beverages dominated the market, with 75.3% of the value in 2021. Carrageenan can be used in bakery, dairy, and meat products, as well as beverages. Carrageenan can be added to these products in order to modify their texture or viscosity, which improves their sensory qualities. It is used as an excipient in drug delivery systems. It is used as an excipient in drug delivery systems. This segment will see a rise in R&D investment to develop drug formulations that can produce effective and stable products. Due to the increasing applications of the product within the end-use market, the personal care and makeup segment will experience the highest revenue-based compound annual growth rate over the period. Due to its water-binding property, it is often added in water-based cosmetic and personal care products as a viscosity controller agent. Agriculture is another potential application. The potential for plant growth and protection techniques is enhanced by the use of this product in agriculture applications. Carrageenan is also used in textile printing to thicken and modify the rheology of fabrics.

Кеу Маrkеt Ѕеgmеntѕ:

By Processing Technology

- Alcohol Precipitation

- Semi-refined

- Gel Press

By Function

- Stabilizer

- Thickening Agent

- Gelling Agent

- Others

By Product Type

- Iota

- Kappa

- Lambda

By Application

- Food & Beverage

- Bakery

- Dairy Products

- Confectionery

- Meat Products

- Others

- Personal Care & Cosmetics

- Pharmaceutical

- Others

Market Dynamics:

It is widely used due to its high water-binding power as a viscosity agent in personal and cosmetic products. It can be used in sunscreens as a stabilizing, thickening, and suspending ingredient. The positive socioeconomic development of coastal countries has been made possible by the cultivation and sale of the product. Due to the favorable climatic environment, carrageenan cultivation in the Asia Pacific is on the rise. Because of their simplicity and lower processing costs, semi-refined process technology is widely used by small- and large-scale players in these nations.

This industry relies on the quality of raw materials and the extraction methods used to differentiate products. Both kappa and iota can be used for gelling agents. But lambda can only thicken the product because it cannot form a solid gel. Its antiviral properties make it an attractive option for COVID-19 treatment. In December 2020, Cardiff University, Walgreens Boots Alliance, Marino med Biotech AG, and Abertawe Bro Morgannwg University Health Board began a clinical study to analyze the effectiveness of carrageenan throat and nasal sprays against COVID-19.

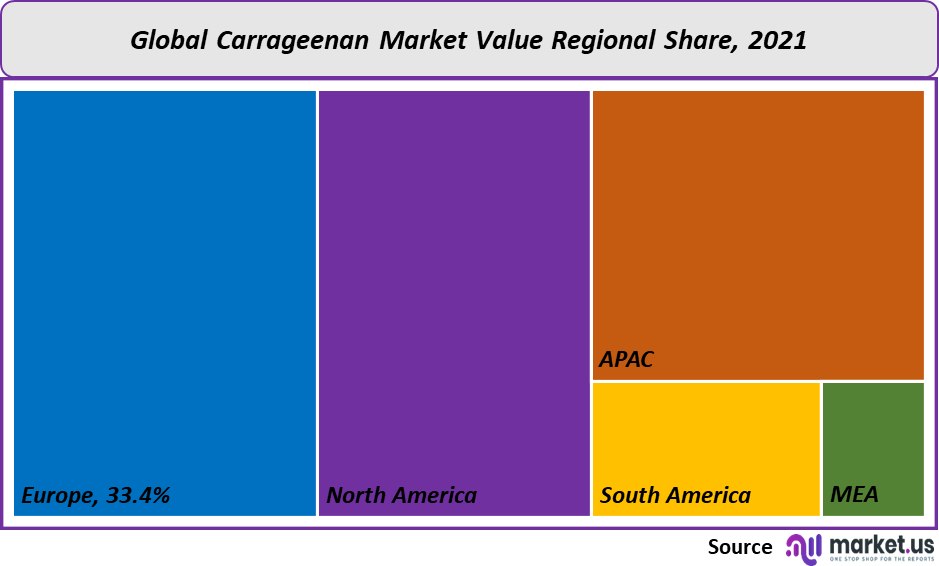

Regional Analysis:

Europa accounted for 33.4% revenue share in 2021. Positive government policies can be blamed for the rapid growth in Europe. Since the demand for alcohol-affected carrageenan roots in higher manufacturing costs, gel-press is becoming more popular in the region. The European Union approves both semi-refined as well as refined carrageenan for use in food products.

North America held a large revenue share in 2020. Seaweed processing in the U.S. is growing, as is Canada. This will help to boost the region’s market growth. The organization of Agriculture and Food stated that the U.S. was one of the top exporters of hydrocolloids in 2019. This represented a 4.8% market share. The Asia Pacific will likely experience the fastest revenue growth over the forecast period. China Mengniu Dairy Co. Ltd. is a major player in the food and beverage industry. This has helped to fuel product demand. Brazil’s growth in the end-use industries is driving product demand across Central and South America. The USDA predicts that the Brazilian food retail industry will grow by 4.1% in 2021. This should be propelling the industry’s growth.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

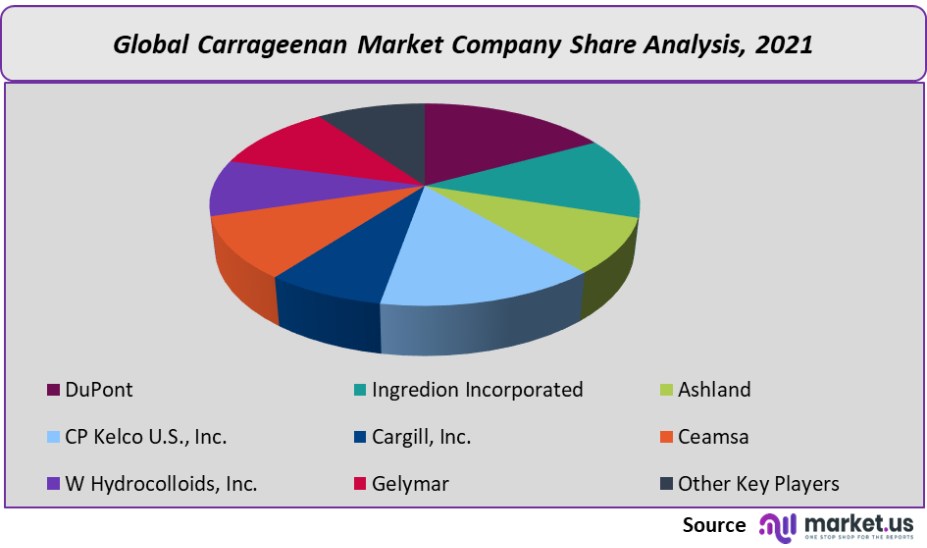

The global Carrageenan market is fragmented Companies in this market are now focusing on partnerships and small-sized businesses with strong footholds in the local markets. Biesterfeld and CP Kelco also announced in August 2020 an expansion of their partnership within the European food and nutrition market. Biesterfeld, as part of the partnership, will distribute carrageenan products made by CP Kelco in European markets. The global reach of major players in carrageenan manufacturing is due to their extensive geographical presence. They have several manufacturing facilities and offices across the continents. The global carrageenan market is dominated by the following players:

Маrkеt Кеу Рlауеrѕ:

- DuPont

- Ingredion Incorporated

- Ashland

- CP Kelco U.S., Inc.

- Cargill, Inc.

- Ceamsa

- W Hydrocolloids, Inc.

- Gelymar

- Other Key Players

For the Carrageenan Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Carrageenan market in 2021?The Carrageenan market size is US$ 789.9 million in 2021.

Q: What is the projected CAGR at which the Carrageenan market is expected to grow at?The Carrageenan market is expected to grow at a CAGR of 5.5% (2023-2032).

Q: List the segments encompassed in this report on the Carrageenan market?Market.US has segmented the Carrageenan market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Processing Technology, the market has been further divided into Alcohol, Precipitation, Gel Press, Semi-refined. By Function, the market has been further divided into Thickening Agent, Gelling Agent, Stabilizer, Others. By Product Type, market has been segmented into Kappa, Iota, Lambda. By Application, the market has been further divided into Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, Others.

Q: List the key industry players of the Carrageenan market?DuPont, Ingredion Incorporated, Ashland, CP Kelco U.S., Inc., Cargill, Inc., Ceamsa W Hydrocolloids, Inc., Gelymar, and Other Key Players engaged in the Carrageenan market.

Q: Which region is more appealing for vendors employed in the Carrageenan market?Europe accounted for the highest revenue share of 33.4%. Therefore, the Carrageenan industry in Europe is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Carrageenan?France, Germany, Spain, Russia, The US, Canada and Others, are key areas of operation for Carrageenan Market.

Q: Which segment accounts for the greatest market share in the Carrageenan industry?With respect to the Carrageenan industry, vendors can expect to leverage greater prospective business opportunities through the Kappa segment, as this area of interest accounts for the largest market share.

![Carrageenan Market Carrageenan Market]()

- DuPont

- Ingredion Incorporated

- Ashland Global Holdings Inc. Company Profile

- CP Kelco U.S., Inc.

- Cargill, Inc.

- Ceamsa

- W Hydrocolloids, Inc.

- Gelymar

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |