Global Cell Culture Market By Consumable (Media, Reagents, and Sera), By Product (Incubators, Culture Systems, and Others), By Application (Biopharmaceuticals, Drug Development, Cancer Research,and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 19074

- Number of Pages: 261

- Format:

- keyboard_arrow_up

Cell Culture Market Overview:

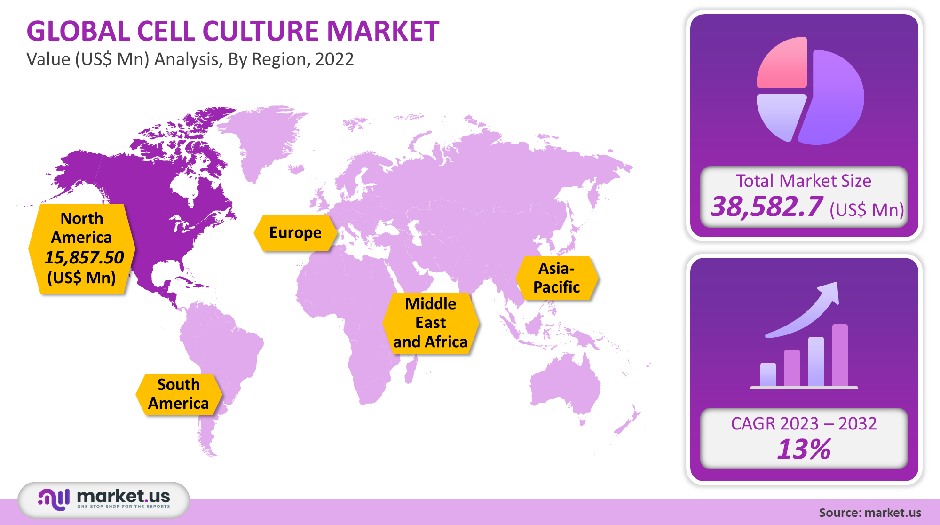

In 2021, the global cell culture market accounted for USD 38,582.7 million. It is excepted to register a CAGR of 13% between 2023 to 2032.

Demand is anticipated to be driven by an increase in revenue and the creation of new three-dimensional cell culture techniques.

Global Cell Culture Market Scope:

Consumable analysis

The market can be divided into three segments based on consumables: cell culture media, sera, and reagent. The media market is the segment with the highest growth. Vertical integration and growth in the biopharmaceutical sector are driving cell culture markets. This is due to the growing demand for alternative media.

Cell culture media is the most popular type of culture preparation by volume. Media is much more affordable than the average market price of sera and other reagents. Therefore, even though it has a larger volume consumption, it accounts for a smaller percentage of the revenue. The forecast period will see a significant increase in demand for culturing in research projects cytological.

Product analysis

Cell culture products have higher profit margins. Technological advancements are crucial for their growth. Research laboratories and cell-culture application development companies are the primary customers. The major segments include culture systems, incubators and centrifuges, cryo safety equipment, cryostorage equipment, and pipetting tools.

The largest market share is held by cell culture systems. This is due to technological advances in the operation and design of these systems. Automated robotic liquid handling systems are expected to increase culture capacity and maintain high purity levels in a reproducible fashion.

Application analysisBiopharmaceuticals accounted for the largest portion of 2021 revenue in cell culture applications. This segment will see a significant increase in demand due to its primary use of mammalian cell cultures for the production of mammalian drugs and the growing demand for non-conventional drugs that have been developed through bio-production of genetically and proteomically enhanced drugs.

The advancement of technologies that allow for the cultivation and development of tissue from cells to be used in grafting, and the use of techniques for personalized genomics and proteomic surgery therapies, will drive the demand for cell culture over the forecast period.

Кеу Маrkеt Ѕеgmеntѕ

By Consumable

- Media

- Reagents

- Sera

By Product

- Incubators

- Culture Systems

- Centrifuges

- Biosafety Equipment

- Pipetting Instruments

- Cryostorage Equipment

By Application

- Biopharmaceuticals

- Drug Development

- Cancer Research

- Tissue Culture & Engineering

- Gene Therapy

- Vaccine Production

- Toxicity testing

Market Dynamics:

The distinction between pharmaceuticals is being blurred by the advent of cell culture technology. Many pharmaceutical companies are merging or buying biotechnology businesses in order to expand their product lines and improve their market position. Researchers, academics, and labs involved in bioprocessing and manufacturing are all looking for cell culture technology. Due to the high investment and cost of cell culture technology infrastructure, contract research and manufacturing companies are growing.

New cell cultures and 3D cell culture techniques will be in demand due to advances in proteomic gene expression, biopharmaceuticals, and vaccine development. Cell culture market growth will likely increase over the forecast period due to increased gene therapy applications and increasing numbers of cancer research projects.

Additionally, the rise in chronic diseases has led to an increase in cell culture usage. According to World Health Organization statistics in 2021, 41 million people will die from chronic diseases. Heart disease is the most common chronic disease. It kills 18 million people annually. Market leaders are forced to innovate and improve biologics products because of the high number of chronic disease deaths.

Biopharmaceuticals are drugs of microbiological sources, such as hormones and vaccines, monoclonal antibodies, therapeutic enzymes, blood factors, and monoclonal antibodies. Biopharmaceuticals have a high degree of specificity, which has opened up new opportunities in healthcare, such as personalized medicine. This allows patients to be treated for specific conditions or diseases using biomolecules that are specific to their biological, physiological, and genetic makeups.

Cell culture technology has grown because of the limited applicability of traditional pharmaceuticals and the relatively small number of biotechnology players.

Cell culture involves several stages that must be closely monitored for different parameters, including temperature, humidity, and nutrients. Because of the potential for errors in handling components, the final product, which could be a cell line or tissue, an organ, or biomolecules, will not work as well.

This requires strict control systems that add to the manufacturing and development costs. These constraints can cause a blockage in cell culture technology development and may limit the market growth.

Cell culture uses serum from many sources, with the most common being bovine fetus.According to The Biomedical Scientist, more than two million bovine fetuses suffer from severe pain each year due to the inhumane process of collecting blood from their heart. This is done without the use of anesthesia.

Scientists and manufacturers have become extremely concerned about the issue, which will likely limit the growth of cell culture markets. The government has taken stringent measures and implemented regulations to regulate the use of living organisms.

Regional Analysis

North America was the dominant market for cell culture and held the largest revenue share at 41.1% in 2021. North America continues to be a leader in cell culture application and instrumentation innovation. The market will see more investments in media markets to support the entire cell culture industry, as there is a growing preference for animal-free media. This region has seen significant growth due to technological innovations in the field of cell culture equipment and instruments.

American healthcare and the life science industry were among the first to adopt cell culture techniques. This has resulted in a high market share for this country. The U.S. cell-culture market is driven by continued research and expansion in the biopharmaceutical industry.

A large number of biotherapeutics currently in clinical development are produced using a variety of cell lines including mammalian, transgenic, and others. This growth drives the development and demand for novel solutions to meet local consumer demand.

Mammoth Biosciences, for example, signed a collaboration agreement with Bayer in 2022 to develop in-vivo gene editing therapies by Mammoth’s CRISPR technology. These collaborative initiatives are driving demand.

Germany is a major player in stem cell research in the regenerative medicine field. It is expected to be the dominant country in the cell culture market, along with France and UK. Germany’s cell culture market is growing due to the high volume of stem cell research and cell culture research in oncology. This market is also supported by the advancement of cell culture testing equipment and techniques.

Medigene and BioNTech teamed up to develop TCR-based immunotherapy for cancer in 2022. This collaboration will last for 3 years. These collaborations are driving the German market. The country’s adoption and demand will be limited by ethical concerns regarding embryonic stem cell research, as well as the growing trend to outsource clinical research to developing nations.

India’s cell culture market is driven by continuous advancements and the development of regenerative medicine with increasing cases of chronic and genetic diseases. Due to India’s rapidly growing healthcare sector and the rapid rise in medical spending and R&D investments in healthcare, there are high unmet medical needs.

The market is driven by government initiatives that are in line with the growing trend of drug development in the industry. In India, the Union Health Ministry amended the New Drugs & Clinical Trials in 2022 to include cell-culture-derived products in the definition of new drugs. These government initiatives will likely drive the market.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

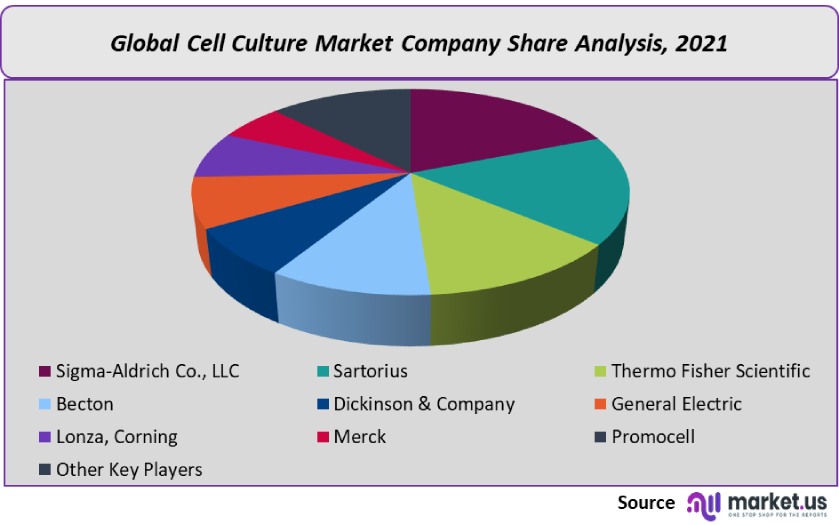

The cell culture market is dominated by Sartorius, Sigma-Aldrich Co., LLC, Becton, Thermo Fisher Scientific, General Electric, Lonza, Corning, Dickinson & Company, Merck, Promocell, as well as Eppendorf.

In order to increase their product ranges and strengthen their market position, many pharmaceutical companies have merged with biotechnological businesses.

Маrkеt Кеу Рlауеrѕ:

- Sigma-Aldrich Co., LLC

- Sartorius

- Thermo Fisher Scientific

- Becton

- Dickinson & Company

- General Electric

- Lonza, Corning

- Merck

- Promocell

- Other Key Players

For the Cell Culture Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Cell Culture market in 2021?A: The Cell Culture market size is US$ 38,582.7 million in 2021.

Q: What is the projected CAGR at which the Cell Culture market is expected to grow at?A: The Cell Culture market is expected to grow at a CAGR of 13% (2023-2032).

Q: List the segments encompassed in this report on the Cell Culture market?A: Market.US has segmented the Cell Culture market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Consumable, market has been segmented into Media, Reagents, and Sera. By Product, market has been segmented into Incubators, Culture Systems, Centrifuges, Biosafety Equipment, Pipetting Instruments, and Cryostorage Equipment. By Application, the market has been further divided into Biopharmaceuticals, Drug Development, Cancer Research, Tissue Culture & Engineering, Gene Therapy, Vaccine Production, and Toxicity testing.

Q: List the key industry players of the Cell Culture market?A: Sigma-Aldrich Co., LLC, Sartorius, Thermo Fisher Scientific, Becton, Dickinson & Company, General Electric, Lonza, Corning, Merck, Promocell, Eppendorf, and Other Key Players engaged in the Cell Culture market.

Q: Which region is more appealing for vendors employed in the Cell Culture market?A: North America accounted for the highest revenue share of 41.1%. Therefore, the Cell Culture industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Cell Culture?A: U.S., Canada, Germany, UK, China, Japan, Brazil, South Africa, are key areas of operation for Cell Culture Market.

Q: Which segment accounts for the greatest market share in the Cell Culture industry?A: With respect to the Cell Culture industry, vendors can expect to leverage greater prospective business opportunities through the media segment, as this area of interest accounts for the largest market share.

![Cell Culture Market Cell Culture Market]()

- Sigma-Aldrich Co., LLC

- Sartorius

- Thermo Fisher Scientific Company Profile

- Becton, Dickinson and Company Profile

- Dickinson & Company

- General Electric

- Lonza, Corning

- Merck KGaA Company Profile

- Promocell

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |