Global Ceramic Sanitary Ware Market By Product (Wash Basins, Toilet Sinks & Water Closets, Urinals, and Other Products), By Application (Residential and Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Jul 2022

- Report ID: 58701

- Number of Pages: 256

- Format:

- keyboard_arrow_up

Ceramic Sanitary Ware Market Overview

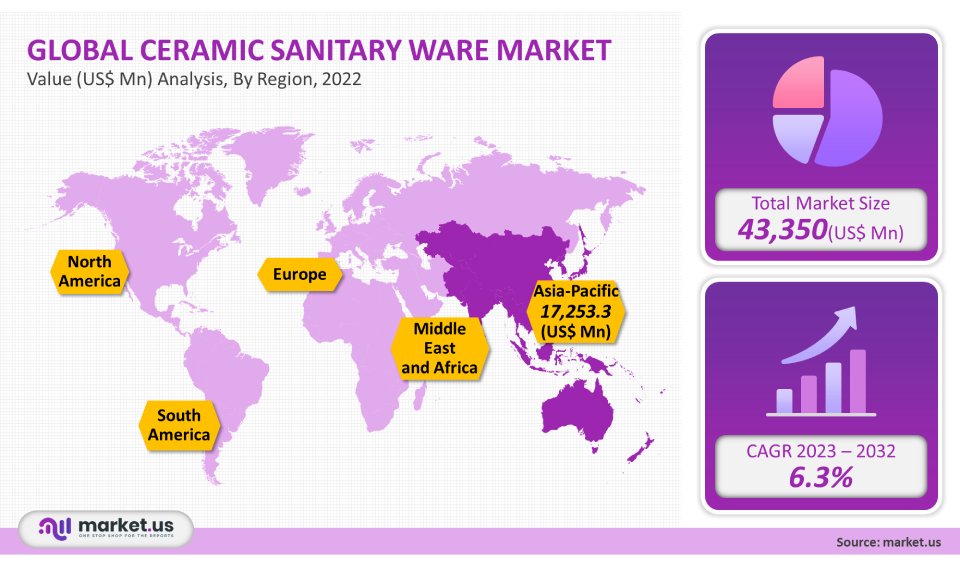

In 2021, the global ceramic sanitary ware market value was USD 43,350 million. This market is expected to grow at a compound annual growth rate of 6.3% between 2023-2032.

A favorable trend will be the continued popularity of ceramic materials in construction due to their low cost and high resistance to chemicals. A shift towards hygiene and sanitation is expected to increase consumer spending on luxury products with aesthetic appeal in near future.

Global Ceramic Sanitary Ware Market Scope:

Product analysis

With more than 43.7% of the market, toilet sinks were followed by water closets in 2021. Increased consumer demand to replace conventional sanitary products and opt for advanced ceramic sanitary ware will increase the market share of toilet sinks.

Parry ware India introduced 16 new sanitary ware products, including 10 water cupboards. These products have technologies such as Jet Flushing (Vortex Flushing) and Jet Flushing (Jet Flushing), which ensure optimum cleaning of the surface of the rim. They also provide excellent hygiene and cleanliness. These products will soon be available in over 7000 retail outlets, starting at INR 10.500.

The market for washbasins is expected to grow at 14.3% annually between 2023-2032. New product launches with urban-inspired shapes are expected to have a major impact on market growth. Grohe, for example, introduced a new ceramic sanitary collection, Cube, in June 2018. The collection features a wall-mounted basin made of white ceramic, as well as advanced taps.

Application analysis

In 2021, the market was dominated by the residential category, which accounted for over 63.6% of all sales. The demand for ceramic sanitary ware is higher in urban areas than it is in rural areas. The main factor driving this segment growth is the rise in residential construction activities, especially in emerging economies such as China and India. The future residential segment will also be expanded due to supportive policies being taken by India and China in order to improve sanitation.

The Commercial category is expected to grow at an 8.4% CAGR between 2023-2032. This growth can be attributed to the global expansion of hospitality industries and commercial properties. Because of their low maintenance costs, ceramic sanitary ware products have been preferred by the hospitality market.

Кеу Маrkеt Ѕеgmеntѕ

By Product

- Wash Basins

- Toilet Sinks & Water Closets

- Urinals

- Other Products

By Application

- Residential

- Commercial

Market Dynamics:

Government agencies and corporate companies are taking various initiatives in order to raise awareness among consumers about the need for proper sanitary products. In India, the government announced that they would spend approximately USD 20 billion on building 111 Million toilets in the country. Promoting the use of sanitary products will help improve the standard of living, particularly in the urban areas of emerging countries like India, China, and Bangladesh.

Furthermore, the positive outlook for the tourism industry in countries like Australia, Japan, China, and China will lead to an increase in demand for ceramic-based advanced products over the coming years. It is expected that rising spending on infrastructure projects, including in China and India, will have a major impact on the growth of ceramic sanitary ware.

Godrej Properties has begun to build premium flats of 3.75million square feet in April 2019. This will generate demand for premium ceramic sanitary ware products. Most companies have increased their investments in automation in manufacturing over the past few years. Some firms have automated their manufacturing processes, which involve the use of machinery to sort and pack the goods. Implementing automation by key industry players has played a crucial role in enhancing productivity.

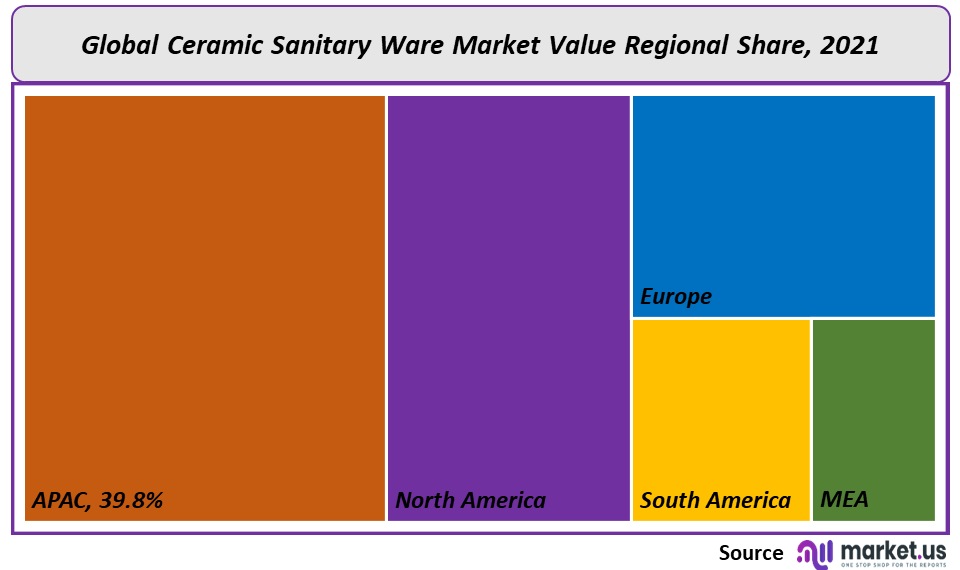

Regional Analysis

The Asia Pacific contributed more than 39.8% to the global revenue in 2021. It is predicted to grow at the fastest CAGR of 16.8% between 2023-2032. It is expected that infrastructure development and the expansion and participation of middle-class income segments in emerging countries like China and India will play an important role in expanding the market size for residential and commercial applications. Toto Inc., LIXIL Corporation, HSIL, and Toto Inc. will launch new products that will increase product visibility in major markets, including China, India, and Japan.

North America contributed more than 26.8% to the global revenue in 2021, It is expected that the industry will continue to enjoy a positive effect from increased consumer awareness in key markets such as the U.S., Canada, and other countries regarding luxury sanitary products. Buyers will also be attracted to the high-gloss surface and availability in a variety of colors in the above-mentioned countries in the coming years.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

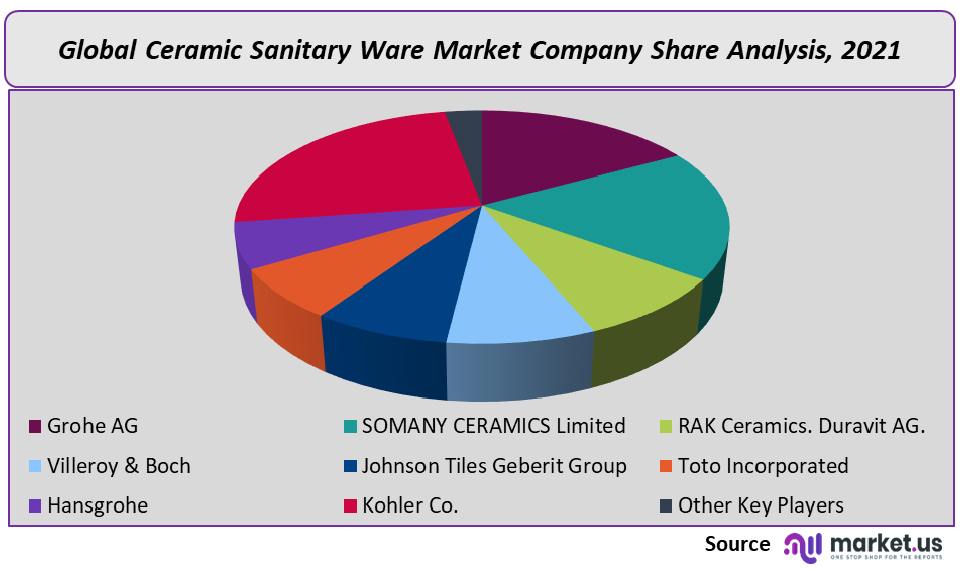

Market Share & Key Players Analysis:

Tokyo-based LIXIL Group purchased Santini Sanitarywares in 2018 for USD 65 million. The industry participants will likely increase their spending on the establishment of strategic business units within emerging economies, including China and India, due to the strength of the domestic middle-class income.

Маrkеt Кеу Рlауеrѕ:

- Grohe AG

- SOMANY CERAMICS Limited

- RAK Ceramics. Duravit AG.

- Villeroy & Boch

- Johnson Tiles Geberit Group

- Toto Incorporated

- Hansgrohe

- Kohler Co.

- Ideal Standard International S.A.

- Other Key Players

For the Ceramic Sanitary Ware Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Ceramic Sanitary Ware market in 2021?The Ceramic Sanitary Ware market size is estimated to be US$ 43,350 million in 2021.

Q: What is the projected CAGR at which the Ceramic Sanitary Ware market is expected to grow at?The Ceramic Sanitary Ware market is expected to grow at a CAGR of 6.3% (2023-2032).

Q: List the segments encompassed in this report on the Ceramic Sanitary Ware market?Market.US has segmented the Ceramic Sanitary Ware market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Wash Basins, Toilet Sinks & Water Closets, Urinals, and Other Products. By Application, the market has been further divided into Residential and Commercial

Q: List the key industry players of the Ceramic Sanitary Ware market?Grohe AG, SOMANY CERAMICS Limited, RAK Ceramics. Duravit AG., Villeroy & Boch, Johnson Tiles, Geberit Group, Toto Incorporated, Hansgrohe, Kohler Co., Ideal Standard International S.A., and Other Key Players engaged in the Ceramic Sanitary Ware market.

Q: Which region is more appealing for vendors employed in the Ceramic Sanitary Ware market?APAC is expected to account for the highest revenue share of 39.8%. Therefore, the Ceramic Sanitary Ware Technology industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Ceramic Sanitary Ware?U.K., Germany, China, India, Brazil, and South Africa & The US, are key areas of operation for Ceramic Sanitary Ware Market.

Q: Which segment accounts for the greatest market share in the Ceramic Sanitary Ware industry?With respect to the Ceramic Sanitary Ware industry, vendors can expect to leverage greater prospective business opportunities through the Toilet Sinks & Water Closets segment, as this area of interest accounts for the largest market share.

![Ceramic Sanitary Ware Market Ceramic Sanitary Ware Market]() Ceramic Sanitary Ware MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Ceramic Sanitary Ware MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Roca Group

- Geberit Group (Sanitec Corporation)

- Toto

- Rak Ceramics

- Lixil Corporation

- Duravit AG

- Ideal Standard International S.A.

- Hsil

- Villeroy & Boch

- Duratex S.A.

- Kohler Co.

- Lecico Bathrooms

- Eczacibasi

- Sanitana

- Catalano

- Porcelanso Group (Noken)

- Jaquar

- Saudi Ceramics

- Shanghai Acquacubic Sanitary Ware Co. Ltd.

- Cera Sanitary Ware Ltd.

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |