Global Chemical Distribution Market By Product (Specialty Chemicals and Commodity Chemicals), By End-Use (Specialty Chemicals and Commodity Chemicals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Dec 2021

- Report ID: 67398

- Number of Pages: 389

- Format:

- keyboard_arrow_up

Chemical Distribution Market Overview:

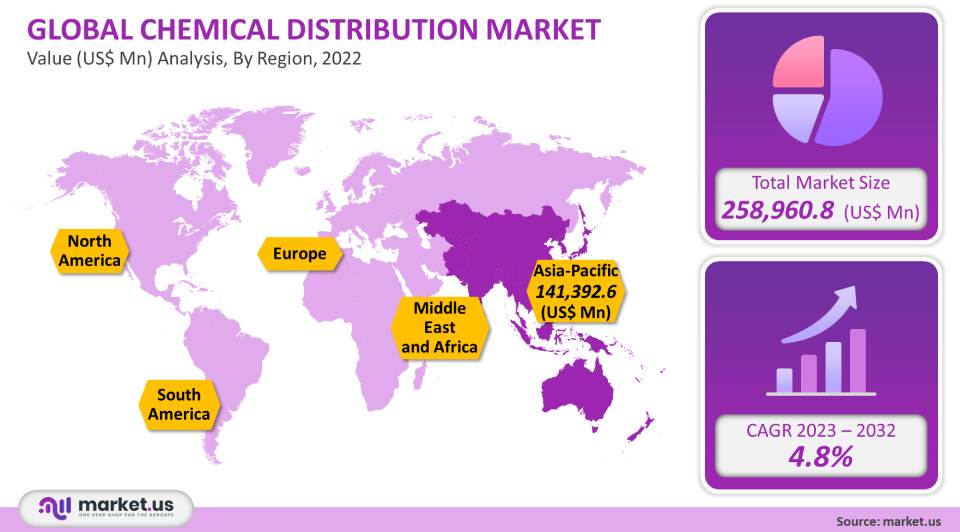

The global chemical distribution market value was USD 258,960.8 million in 2021. This is expected to increase at a compound annual growth rate of 4.8% between 2023-2032.

Chemical distributors are likely to see increased demand for chemicals in the future, especially in the construction, pharmaceutical, and polymers industries. This is coupled with the high difficulty of reaching customers.

Global Chemical Distribution Market Scope:

Product Analysis

Global chemical distribution market segments by-products into a basic, commodity, and specialty products. A supplier’s product range is usually interchangeable with other suppliers. This allows consumers to be more competitive and reduces switching costs. Price is an important differentiation factor for market competitors.

The commodity chemicals industry includes plastics and rubber, synthetic rubber, and explosives. It also includes petrochemicals and other bulk polymers, fibers, basic organics, or aromatics. This segment, which has experienced a 14% increase in total return to shareholders (TRS) between 2000 and 2015, is collectively the best. During the same period, specialty compounds only increased by about 12%. Despite a drop in sales caused by the crash in crude oil price, the commodity chemicals segment was able to maintain selling prices in certain markets.

The dominance of commodity compounds in the global supply chain was due to their huge consumption in major end-use industries like automotive, electronics, and consumer goods. This segment has experienced a 4.8% CAGR from 2023-2032 due to its large consumption in various industries. The specialty product category refers to high-performance and customized chemical products that are tailored to specific consumer needs. Coatings Adhesives Sealants, Coatings, Elastomers(CASE), construction materials, cosmetic additives, polymers, and lubricant additives are some examples of specialty compounds. These compounds are widely used in end-use industries like automotive, construction, electronics, and pharmaceuticals.

Because of the availability of cheap petrochemicals, large manufacturers are moving to the Middle East/Africa (MEA) as their manufacturing base. Due to the high labor costs and economic growth, other industries are expanding production in Asia. Trade liberalization, the elimination of economic barriers, advanced processing technology, and rapid growth in industrialized Asian countries have all contributed to the rise in the standard of living in many of these developing countries. This has also influenced specialty chemical consumption and distribution. Specialty chemicals will be the fastest-growing segment. The future will see a rise in demand for applications-specific chemicals in various industries, as well as technological advances in terms of production.

End Use Analysis

Many specialty and commodity chemicals are used in common end-use sectors like textiles and automotive. Specialty chemicals can also be used for pharmaceutical purposes, while commodity products are used in the downstream industry. The market was dominated by the construction industry, which held 16.7% of the total revenue share in 2021.

In the United States, and in China, there has been an increase in pollution. This has prompted innovation in building materials. One of these businesses, Boral Roofing, has created a smog-repellent substance that eliminates nitrogen oxides (NOx). The air quality is raised by using this tile. Additionally, the demand for specialized chemicals will be fueled by increased construction investment in developing nations throughout Asia and the Pacific. With a 34.9% share of total revenue in 2021, the downstream market has been the dominant market for commodity chemicals. The downstream sector covers petroleum crude oil refining, process, and purification of natural gas. This sector also includes the marketing, distribution, and sale of many petroleum-derived products.

Key Market Segments:

Product

- Specialty Chemicals

- Agrochemicals

- CASE

- Specialty Polymers & Resins

- Electronic

- Others

- Commodity Chemicals

- Synthetic Rubber

- Plastic & polymers

- Petrochemicals

- Explosives

- Others

End-Use

- Specialty Chemicals

- Automotive & Transportation

- Agriculture

- Construction

- Pharmaceuticals

- Others

- Commodity Chemicals

- Downstream Chemicals

- Automotive & Transportation

- Textiles

- Electrical & Electronics

- Others

Market Dynamics:

The growing trend toward sustainable and green infrastructure in the United States is driving demand for specialty chemicals. The demand for specialty chemicals is a boon to distributors of specialty products, even in developed countries like the U.S. and Germany.

The chemical industry produces essential raw materials and supplies them to manufacturing companies. This feedstock may be sold directly or distributed by third-party suppliers to end-users. Due to the outsourcing and provision of value-added services such as logistics and packaging, waste removal, inventory management, and technical training, the distribution of commodity and specialty chemicals will see significant growth.

Strong consumer purchasing power and continued construction activities drive the U.S. chemical distribution market. Businesses investing in the housing market are seeing an increase in traction, and this is helping to create momentum for the chemical business. A report by American Chemistry Council Inc., June 2019, revealed that 334 new production projects were announced, with a total value of over US$ 204 million. This indicates a steady increase in U.S. investment. This trend is expected to have a significant impact on the overall market and result in an increase in manufacturing.

Global demand for chemicals is expected to grow due to strong growth in industrial manufacturing and other end-use industries like electronics, automotive, pharmaceuticals, and electronics. Third-party distributors will benefit further from this trend. To be competitive in a fragmented marketplace, global distributors are implementing differentiated channel strategies like product knowledge, local expertise, and strong logistics networks to gain an advantage.

In addition to fierce industry competition, third-party suppliers are expected to be in direct competition with them. Many of these multinational companies are such as Arkema SE, Lanxess AG, and Honeywell International. These companies are well-equipped with high investment capacity, strong relationships with end users, and a broad geographical reach. Direct distribution channels allow for bulk discounts and decrease third-party profit margins.

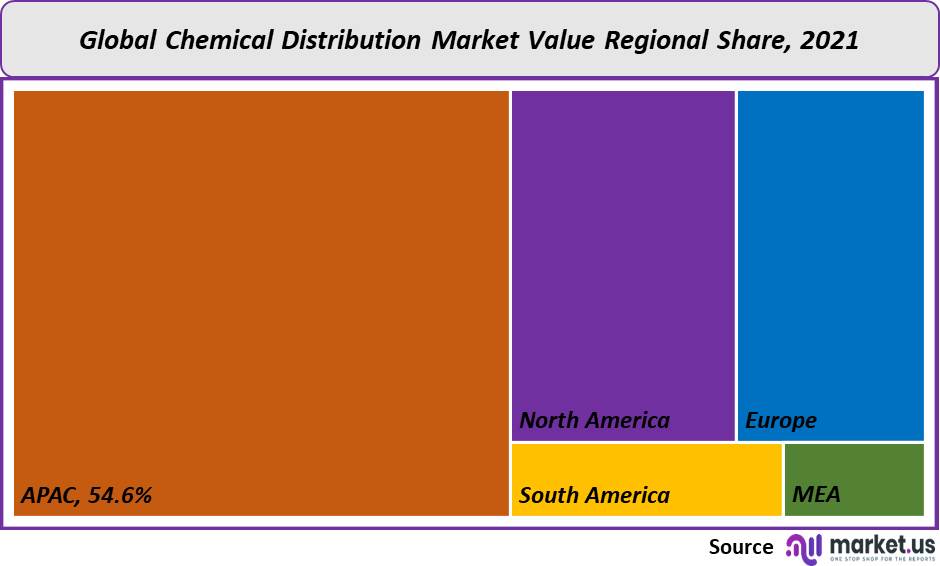

Regional Analysis:

The Asia Pacific emerged as the largest regional market and accounted for 54.6% overall revenue share for 2021. The forecast period will see an increase in manufacturing activities and a significant rise in per capita disposable income. China, India Malaysia, Vietnam, and Thailand are experiencing the growth of various industries, including automotive, construction, electrical, and electronics.

The region’s chemical production is expected to increase at an incredible rate as major players shift to high-opportunity markets. With a higher CAGR (5.9%) in specialty chemicals between 2023 and 2032, commodity compounds will continue to be the dominant segment of Asia Pacific.

North America’s chemical industry is one the most consolidated, with Univar and Brenntag holding a 30-40% market share. The market will see increased capital investment from international chemical producers due to labor market upgrading, easy access to credit, and abundant feedstock. The trend to use third-party distributors has changed as a platform for expansion into untapped regions. Major chemical companies in North America have been increasing their production capabilities in recent years. In North America, however, the petrochemical market has seen a slowdown in recent years due to low crude oil prices and a weaker GDP in Latin America. The United States gulf coast is home to a number of planned projects, notably South Louisiana Methanol and Nat gasoline, which are scheduled to produce 1.75 million MT and 1.8 million MT per year, respectively, of petrochemicals.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

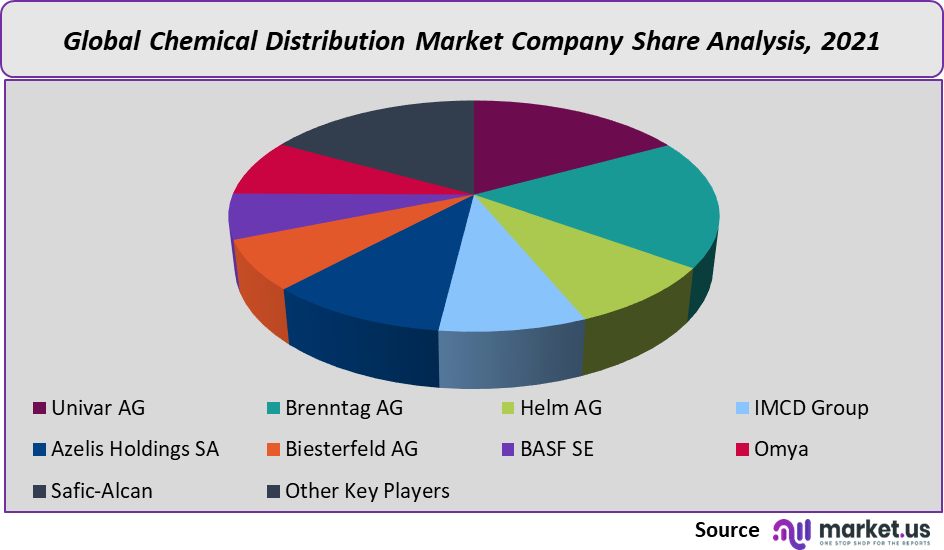

Market Share Analysis:

Global distributor companies like Millipore Sigma, Brenntag, and Univar Solutions have acquired small distributors to help them achieve economies of scale. This has allowed them to concentrate on special sales channels, rationalizing their distributor base and strengthening their supply chain networks. To diversify their product lines and increase market share globally, companies use major strategies such as acquisitions, mergers, and capacity expansion. Major companies are increasing the number of specialty products in their product portfolios to consolidate growth.

Key Market Players:

The chemical distribution market is dominated by the following players:

- Univar AG

- Brenntag AG

- Helm AG

- IMCD Group

- Azelis Holdings SA

- Biesterfeld AG

- BASF SE

- Omya

- Safic-Alcan

- Other Key Players

For the Chemical Distribution Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Chemical Distribution market in 2021?The Chemical Distribution market size was US$ 258,960.8 million in 2021.

What is the projected CAGR at which the Chemical Distribution market is expected to grow at?The Chemical Distribution market is expected to grow at a CAGR of 4.8% (2023-2032).

List the segments encompassed in this report on the Chemical Distribution market?Market.US has segmented the Chemical Distribution market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Specialty Chemicals and Commodity Chemicals. By End-Use, the market has been further divided into Specialty Chemicals and Commodity Chemicals.

List the key industry players of the Chemical Distribution market?Univar AG, Brenntag AG, Helm AG, IMCD Group, Azelis Holdings SA, Biesterfeld AG, BASF SE, Omya, Safic-Alcan, and Other Key Players engaged in the Chemical Distribution market.

Which region is more appealing for vendors employed in the Chemical Distribution market?Asia Pacific is accounted for the highest revenue share of 54.6%. Therefore, the Chemical Distribution industry in Asia Pacific is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Chemical Distribution?China, India, Japan, South Korea, Taiwan, Brazil, Argentina, Etc. are key areas of operation for Chemical Distribution Market.

Which segment accounts for the greatest market share in the Chemical Distribution industry?With respect to the Chemical Distribution industry, vendors can expect to leverage greater prospective business opportunities through the commodity chemicals segment, as this area of interest accounts for the largest market share.

![Chemical Distribution Market Chemical Distribution Market]() Chemical Distribution MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Chemical Distribution MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - Specialty Chemicals

- Univar AG

- Brenntag AG

- Helm AG

- IMCD Group

- Azelis Holdings SA

- Biesterfeld AG

- BASF SE Company Profile

- Omya

- Safic-Alcan

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |