Global Chlorine Compressors Market By Product (Centrifugal Compressors and Liquid Ring Compressors), By End-use Industry (Chemical Industry, Oil & Gas Industry, Water and Wastewater Treatment Industry, Petrochemical Industry, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 67403

- Number of Pages: 398

- Format:

- keyboard_arrow_up

Chlorine Compressors Market Overview:

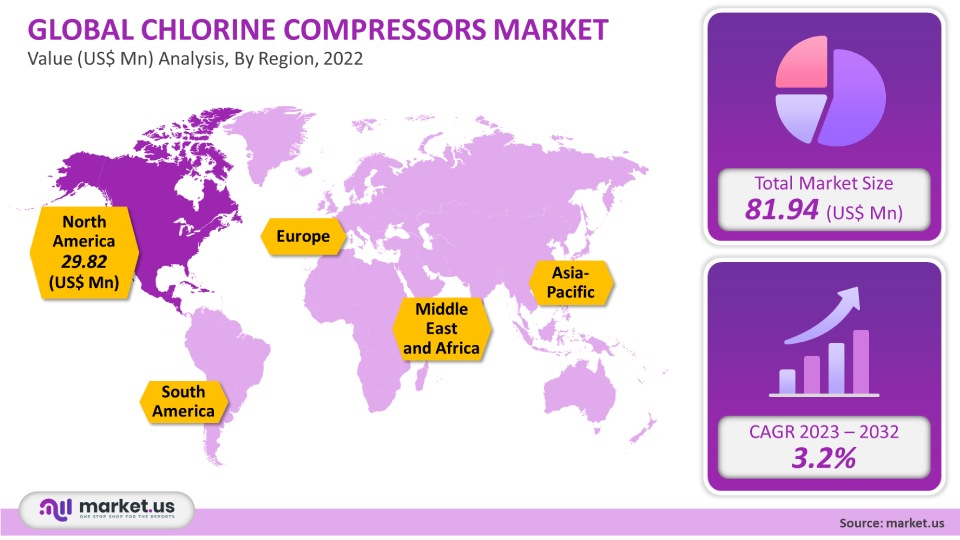

The global market size for chlorine compressors was USD 81.94 million in 2021, and the CAGR of 3.2% between 2023 and 2032. Compressors are essential for chlorine production plants and further industrial processing. These compressors regulate chlorine pressure and control flow rates in industries. The growing demand for PVC will drive a proportional rise in chemical production over the forecast period.

Global Chlorine Compressors Market

Product Analysis

Due to their ability to deal with chlorine in a liquid state, liquid ring compressors enjoy a greater demand than centrifugal. Centrifugal compressors generate significantly less revenue than liquid ring types. The capital investment in liquid ring type is greater than that of centrifugal. The size of the plant and the quality of Cl made will affect the consumption of liquid rings and centrifugal compressors. The complexity and desired discharge pressure are key factors in determining the demand.

End-use Industry Analysis

The global chlorine compressors market can be segmented by end-use industry into chemical, oil & gas, water and wastewater treatment, petrochemical, and others. In 2021, water and wastewater treatment was the largest end-use segment in revenue. The trend is expected to continue during the forecast period. The key drivers of revenue growth in this sector include the growing importance of chlorination for safe water supply and treatment and the rising use of chlorine in sewage treatment plants.

Key Market Segments

Product

- Centrifugal Compressors

- Liquid Ring Compressors

End-use Industry

- Chemical Industry

- Oil & Gas Industry

- Water and Wastewater Treatment Industry

- Petrochemical Industry

- Others

Market Dynamics

The market will see a lot of Cl used as both a raw ingredient and an essential component in producing organic and inorganic chemicals, paper & wood pulp. The market’s steady growth is likely driven by water treatment projects, mainly in North America and Europe. The global chemical industry sees growth in terms of revenue and sales. Global chemicals are also showing omnipresence in all end-user materials. The chemical industry is dependent on chlorine. Along with fluorine or bromine, chlorine is an essential inorganic chemical. According to the United Nations Environment Program (UNEP), China is the biggest consumer and producer of chemicals worldwide. It accounted for approximately 65% of all chemical products globally.

The North American industry is mature. While the region’s demand for chlorine will recover over the next few years, it is unlikely to surpass the 2008 levels. Despite membrane cells and mercury dominating the European market, chlorine production in the United States mainly uses a diaphragm cell. The supply-demand relationship is directly tied to the global Cl requirements in end-use applications. Production is expected to slow during the forecast period because of environmental regulations regarding chlorine, especially in Europe. The European industry has already signed a voluntary agreement to eliminate mercury-based technology. It accounts for approximately 20% of the production capacity. This technological shift is likely will impact product growth.

Gardner Denver Nash LLC, a major player in the industry, is one example. Mikuni Kikai Kogyo Co. Ltd. has established itself as a manufacturer and supplier. Small enterprises can enter the market space for chlorine compressors by becoming dealers. This allows key manufacturers to showcase their products, thereby reducing facility costs.

Regional Analysis

North America is the most important market for chlorine compressors. This market outperforms all other regional markets. In 2021, it accounted for 36.4% of the total revenue. For the forecast period, North America’s PVC producers will see their margins range from US$ 200 to US$ 300 per ton. North America is expected to benefit from factors such as the availability of ethylene in North America and low electricity costs, which are half the price of Europe. In North America, PVC demand will rise due to the expected economic recovery. These compressors will likely be needed in the next few years because of the existing mature chlorine production infrastructure and the planned capacity expansion to meet the PVC market in the Asia Pacific.

European market growth will remain slow as major chlorine-producing companies in Europe are expected to shut down due to the gradual elimination of membrane technology. The region is expected to be heavily dependent upon imports from the Asia Pacific. From the beginning of 2018, capacity utilization is expected to stabilize. The spot price of Cl is currently very high in this region. Major producers from North America and Europe have stopped operations to upgrade their plant infrastructure. This creates a discrepancy in regional demand.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share Analysis

This industry is fragmented by nature. The industry’s key players invest heavily in research and developing compressors with different capacities. This helps them expand their product range. Industry participants are driven to keep their products competitive by the desire to improve their performance and product features. The industry will be competitive due to rising chlorine demand in many end-use markets. It is expected that the supplier power will be moderate. The availability of raw materials and the fluctuating prices due to macroeconomic factors will play a critical role in business profitability. Key players sign deals with suppliers to expand into new product markets. It is unlikely that substitutes will be a problem in this market. Complementary packages that include compressors or filtration equipment are expected to gain a competitive edge. It is expected that after-sales support and maintenance will play a significant role.

Key Market Players

- Devi Hitech Engineers

- Gardner Denver Nash

- Sundyne

- RefTec International Systems

- Elliott

- Mikuni Kikai

- H. Industries

- Mayekawa

- Other Key Players

For the Chlorine Compressors Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Chlorine Compressors market in 2021?The Chlorine Compressors market size was US$ 81.94 million in 2021.

What is the projected CAGR at which the Chlorine Compressors market is expected to grow at?The Chlorine Compressors market is expected to grow at a CAGR of 3.2% (2023-2032).

List the segments encompassed in this report on the Chlorine Compressors market?Market.US has segmented the Chlorine Compressors market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Centrifugal Compressors and Liquid Ring Compressors. By End-use Industry, the market has been further divided into Chemical Industry, Oil & Gas Industry, Water and Wastewater Treatment Industry, Petrochemical Industry, and Others.

List the key industry players of the Chlorine Compressors market?Devi Hitech Engineers, Gardner Denver Nash, Sundyne, RefTec International Systems, Elliott, Mikuni Kikai, M.H. Industries, Mayekawa, and Other Key Players engaged in the Chlorine Compressors market.

Which region is more appealing for vendors employed in the Chlorine Compressors market?North America is accounted for the highest revenue share of 36.4%. Therefore, the Chlorine Compressors industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Chlorine Compressors?The U.S., Germany, France, UK, China, India, and Japan are key areas of operation for Chlorine Compressors Market.

Which segment accounts for the greatest market share in the Chlorine Compressors industry?With respect to the Chlorine Compressors industry, vendors can expect to leverage greater prospective business opportunities through the liquid ring compressors segment, as this area of interest accounts for the largest market share.

![Chlorine Compressors Market Chlorine Compressors Market]()

- Devi Hitech Engineers

- Gardner Denver Nash

- Sundyne

- RefTec International Systems

- Elliott

- Mikuni Kikai

- H. Industries

- Mayekawa

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |