Global Circuit Breaker Market By Product Type (Circuit breakers and Fuses), By Application (Construction, Consumer Electronics, Power Generation, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 21051

- Number of Pages: 271

- Format:

- keyboard_arrow_up

Circuit Breaker Market Overview:

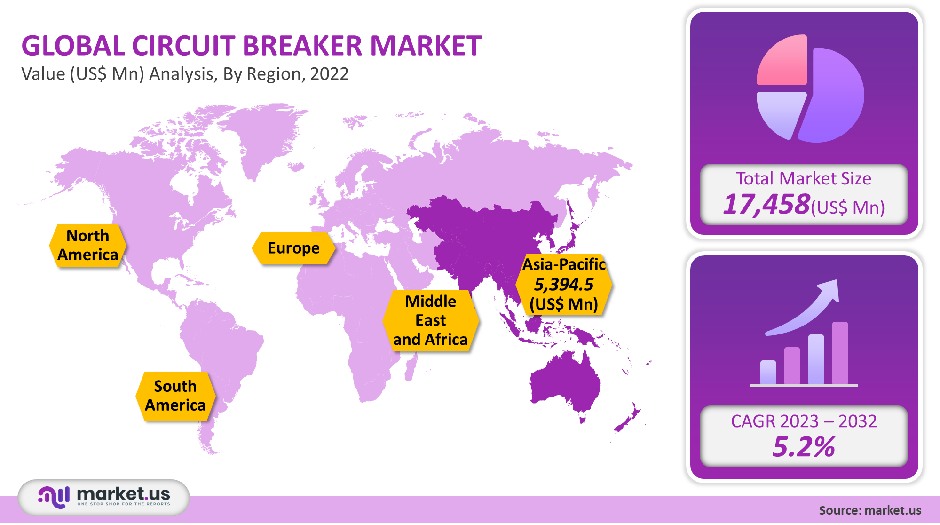

The circuit breaker market size is expected to be worth around USD 30.48 Billion by 2032 from USD 17.45 Billion in 2021, growing at a CAGR of 5.2% during the forecast period from 2022 to 2032.

This market will continue to grow due to the growing need to upgrade to more efficient networks and renewable energy connectivity.

Global Circuit Breaker Market Scope:

Product Type Analysis

Based on the product type, circuit breakers can be divided into breakers and fuses. The market for circuit breaker products accounted for 64.3% in 2021, and it is expected to increase over the next decade.

Circuit breakers have certain advantages over fuses. They are easier to reset and safer than a fuse. All of the electrical connections are contained in the circuit breaker box. Circuit breakers can automatically stop current flow when there’s an increase in load or input current. They can also be easily switched on to reflow current.

The electric fuse is made up of a metallic filament enclosed in a ceramic, plastic, or glass coating. It allows normal current flow through it, but in the event of overload, the filament heats up and stops the flow. To normalize current flow, the fuse must be replaced. Due to their vulnerability and need to be replaced after every overload, the demand for fuses is decreasing over the forecast period.

Application Analysis

The circuit breaker industry can be divided into several sectors based on its application: industrial, transport, and consumer electronics. Construction and power generation are also possible. Other applications include defense, healthcare, and the military. The largest segment of circuit breakers and fuses in 2021 was power generation. It accounted for more than 26.9% and is expected to continue growing at a CAGR of 5.5% during the forecast period.

The increasing use of IT technologies in different operations means that IT products require proper power management to improve performance. This has led to an increase in the need for circuit breakers in the power generation segment. A need for power generation that is efficient for future electricity demand will also be a major concern, which will increase the demand for all types of protection devices.

Construction includes both residential and commercial buildings. The growing construction market will likely increase the demand for circuit breakers and fuses. These devices are more in demand because of the increasing investment in infrastructure projects like roads and rail transport in developing countries like India and Indonesia. Over the next decade, the construction sector is expected to grow at a CAGR of 6%.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Circuit breakers

- Fuses

By Applications

- Construction

- Consumer Electronics

- Power Generation

- Other Applications

Market Dynamics:

There is a growing demand for high-end equipment in electronics, automotive and telecommunications segments due to increased safety concerns about short circuits and damage caused by power fluctuations. Therefore, the market for circuit breakers/fuses will increase over the forecast period.

These devices are used to reduce the electrical load on home appliances, industrial machinery, and other electric tools. They also protect them from power fluctuations that can result from short circuits, overload, or overvoltage. The forecast period will also see an increase in demand for these devices due to the increasing use of circuit breakers/fuses in the automotive sector and rising energy consumption.

The market will also see high growth due to the large investments made by Asian and African countries to improve their electricity infrastructures and supply more power to rural areas. The market is expected to grow further due to the increasing urbanization and industrialization of emerging economies like India, Indonesia, Malaysia, and others.

Circuit breakers and fuse demand will rise over the forecast period due to rising demand for electromechanical and mechanical devices. In addition, strict environmental regulations that delegate the need for advanced transmission or distribution equipment will be a major driver of circuit breaker market growth in the coming decade.

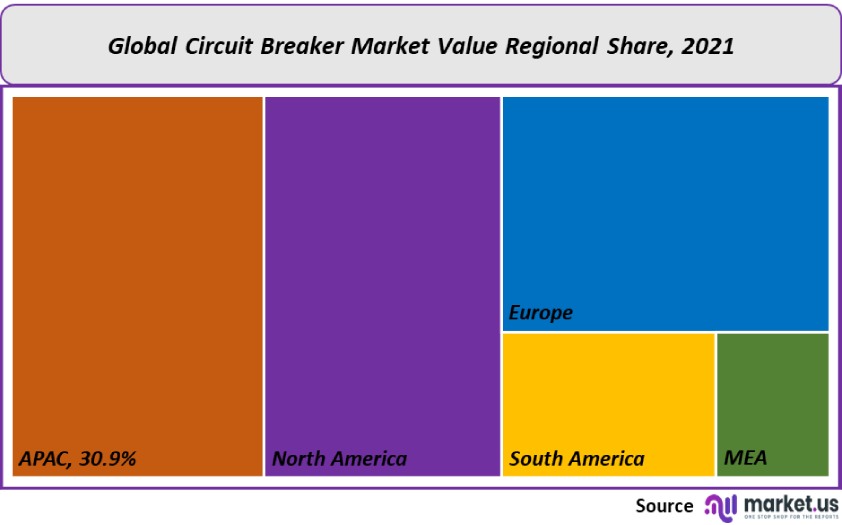

Regional Analysis

Due to the rapid growth of the Asia Pacific construction market, the Asia Pacific region saw the highest demand for circuit breakers with a 30.9% revenue share. This market is seeing increased opportunities due to the increasing use of alternative energy sources like wind and solar, which require large investments in transmission and distribution.

Circuit breakers and fuse demand in North America will rise due to the anticipated expansion in end-user segments like the oil and gas sector, petrochemicals, steel, and cement sectors. Over the forecast period, the North American market is expected to grow at a 6.1% CAGR.

The European government has also taken several initiatives, such as the European Electricity Grid Initiative, to accelerate the development and innovation of electricity networks. This initiative is expected to increase volume demand in the region.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

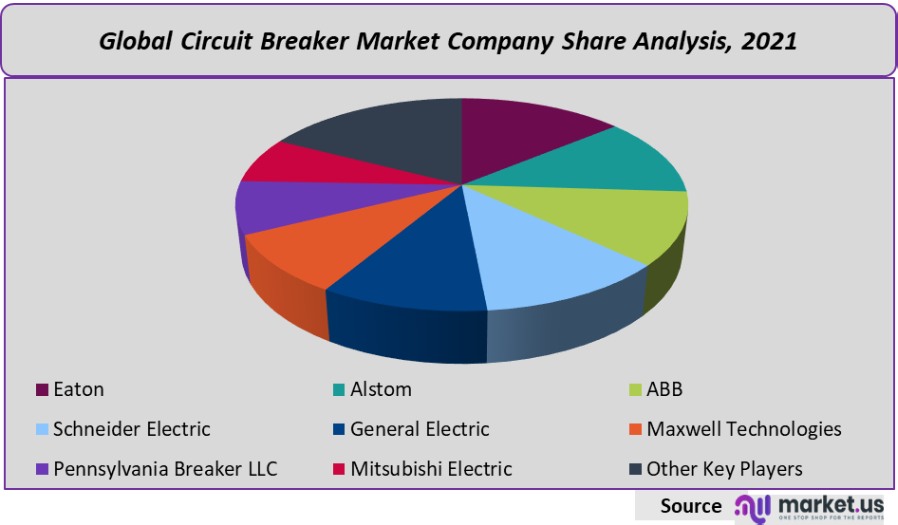

Alstom SA and Eaton Corporation dominated the Circuit breaker market. ABB Ltd, Schneider Electric, and General Electric were also leaders. Maxwell Technologies, Pennsylvania Breaker LLC, and Mitsubishi Electric were also major players in the fuse market. G&W Electric Company was last. To increase industry presence, the industry will continue to be innovation-led with many acquisitions and strategic alliances.

Маrkеt Кеу Рlауеrѕ:

- Eaton

- Alstom

- ABB

- Schneider Electric

- General Electric

- Maxwell Technologies

- Pennsylvania Breaker LLC

- Mitsubishi Electric

- Other Key Players

For the Circuit Breakers Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the circuit breaker market in 2021?A: The Circuit breaker market size is US$ 17,458 million in 2021.

Q: What is the projected CAGR at which the Circuit breaker market is expected to grow at?A: The Circuit breaker market is expected to grow at a CAGR of 5.2% (2023-2032).

Q: List the segments encompassed in this report on the Circuit breaker market?A: Market.US has segmented the Circuit breaker market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into Circuit breakers and Fuses. By Application, the market has been further divided into Construction, Consumer Electronics, Power Generation, and Other Applications.

Q: List the key industry players of the Circuit breaker market?A: Eaton, Alstom, ABB, Schneider Electric, General Electric, Maxwell Technologies, Pennsylvania Breaker LLC, Mitsubishi Electric, and Other Key Players engaged in the Circuit Breaker market.

Q: Which region is more appealing for vendors employed in the Circuit breaker market?A: APAC is expected to account for the highest revenue share of 30.9%. Therefore, the Circuit breaker industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Circuit breaker?A: India, China, The US, Canada, UK, Japan, & Germany are key areas of operation for the Circuit Breaker Market.

Q: Which segment accounts for the greatest market share in the circuit breaker industry?A: With respect to the Circuit breaker industry, vendors can expect to leverage greater prospective business opportunities through the circuit breakers segment, as this area of interest accounts for the largest market share.

![Circuit Breaker Market Circuit Breaker Market]()

- Eaton

- Alstom

- ABB Ltd Company Profile

- Schneider Electric SE. Company Profile

- General Electric

- Maxwell Technologies

- Pennsylvania Breaker LLC

- Mitsubishi Electric Corporation Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |