Global Cleanroom Technology Market By Product (Equipment and Consumables), By End-use (Medical device industry, Pharmaceutical industry, Hospitals and diagnostic centers, and Biotechnology industry), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Jul 2022

- Report ID: 60916

- Number of Pages: 247

- Format:

- keyboard_arrow_up

Cleanroom Technology Market Overview:

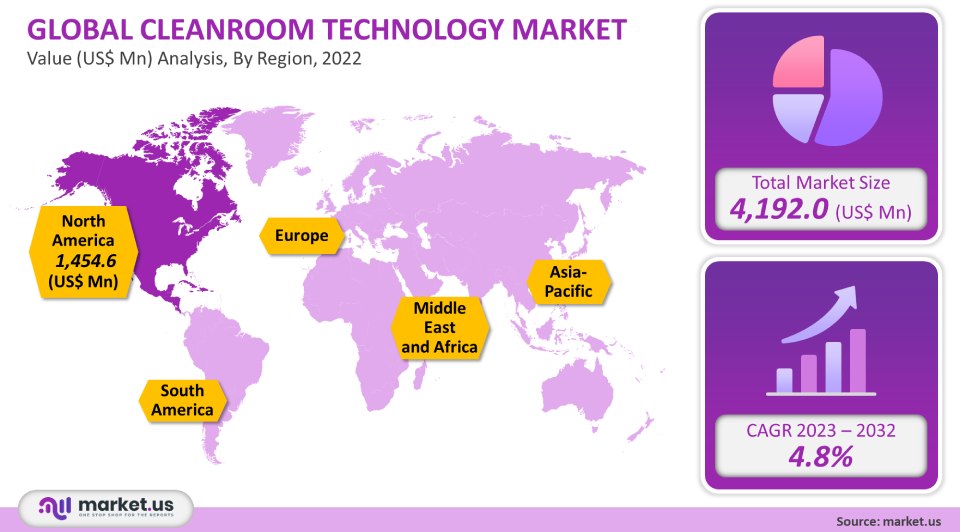

The global cleanroom market is estimated to reach USD 4,192 million in 2021. This market will continue to grow at a compound annual growth rate (CAGR) of 4.8%, from 2023-2032.

The superior ranking is possible due to increased demand for products that meet regulatory standards. The key factors driving the market are customized solutions, reduced time and costs, and an improvement in product flow between cleanrooms. The market for cleanroom technologies will be boosted by technological advances, such as HEPA technology, unidirectional airflow systems, and modular cleanroom technologies.

Global Cleanroom Technology Market:

Product Analysis

The consumables segment was the dominant market for cleanroom tech in 2021. It accounted for 53.7% of the total revenue. This segment holds the largest share due to its high usage and high sales of cleanroom supplies, particularly gloves. The consumables used in cleanrooms are either disposable or reusable and are required for production in many end-use sectors, such as hospitals and biotech companies. The growth of this segment can also be attributed to bulk purchase by manufacturing firms, high demand for preventing contamination from personnel, convenience, as well as various other factors such as the development of alternative options by the key players. Equipment is expected to grow the fastest due to increased use of equipment, including heating ventilation and air conditioning system (HVAC), laminar units, laminar water flow units, air diffusers, and fume hoods. Key players offer cost-effective customized products. Additionally, innovations such as the flexibility of facility construction are driving the demand for equipment in different industrial sectors.

End Use Analysis

In 2021, the pharmaceutical sector dominated the cleanroom technology market. It accounted for 40.1% of total revenue. This growth can be attributed to the strict approvals of pharmaceutical products which have led to an increased demand for cleanroom technology. It is essential to have low-particulate air for pharmaceutical production. The installation of cleanroom technology equipment like HVAC, air showers, and diffusers will ensure the highest quality product with minimal wastage, maximize yield, and optimize the production process. Cleanroom technology has a high potential to grow the pharmaceutical industry because of the above-mentioned factors.

Due to greater acceptance of biotechnology products around the world, however, the industry segment will experience the fastest growth rate at 6.9%. Due to the high sensitivity of biotechnology-based processes, cleanroom technology plays a critical role in R&D and bio-contamination control as well as pilot studies and production facilities. The global growth of the biotechnology industry is forecast to lead to an increase in cleanroom technology demand.

Key Market Segments:

Product

- Equipment

- Cleanroom air filters

- Heating Ventilation and Air Conditioning System (HVAC)

- Laminar air flow unit

- Air shower and diffuser

- Others

- Consumables

- Wipes

- Gloves

- Apparels

- Disinfectants

- Cleaning Products

End-use

- Medical device industry

- Pharmaceutical industry

- Hospitals and diagnostic centers

- Biotechnology industry

Market Dynamics:

The market has seen positive changes due to the increasing need for a clean environment during the collection of samples and testing of COVID-19 cases. The market has seen a significant increase in research and development to develop vaccines for COVID-19. This has prompted pharma companies and biopharmaceutical businesses to make substantial investments in order to keep the environment clean. Due to the expiration of 20-year patents for several branded drugs, significant investments in generic development are expected to drive demand for these products. These products will also include equipment to eliminate contamination during production.

Due to their many benefits, there has been an increase in hospitals and Ambulatory Surgery Centers (ASCs). This increases the need for antimicrobial environments by minimizing airborne particulates. Cleanroom technology continues to grow thanks to government initiatives. KOLMI-HOPEN, a Medicom Group company, launched the production of masks at a 14,300-square-meter production site. It is equipped with an ISO 8-classified cleanroom of more than 1,000 square meters. Cleanroom technology will see a rise in demand due to the COVID-19 pandemic.

Additionally, the COVID-19 epidemic has had an impact on the manufacturing and design of medical equipment, devices, and consumables. Due to the increasing demand for medical devices, many manufacturers have increased production to keep up with ever-increasing customers. These products are an integral part of the production process of the medical sector. Therefore, the demand is expected to grow during pandemics. Additionally, because of the increasing demand for personal safety equipment (PPE), there have been short-term agreements with providers. These contracts are meant to guarantee an uninterrupted supply of cleanroom consumables and equipment in the COVID-19 environment. Most manufacturers have increased their production to meet this growing demand.

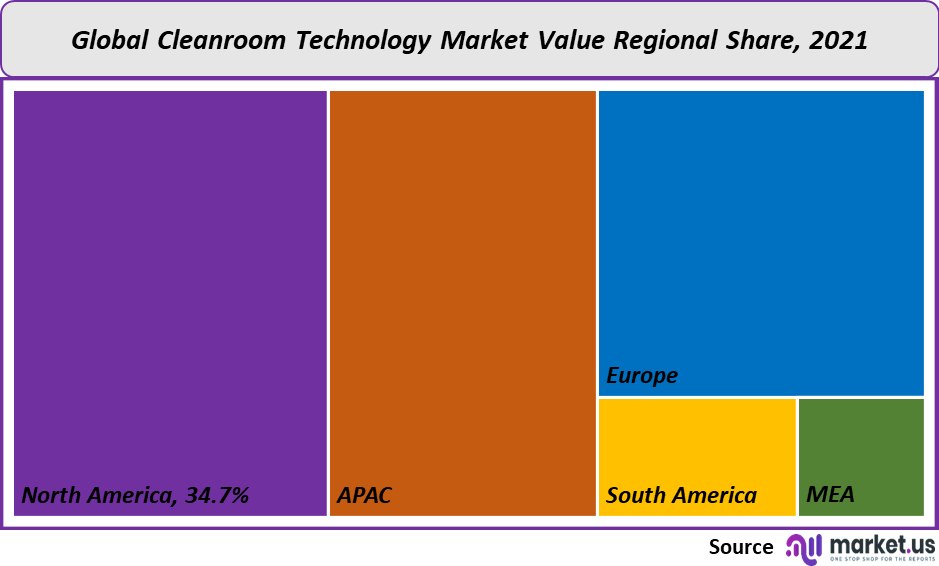

Regional Analysis:

North America was the leading market for cleanroom technologies in 2021 with a 34.7% revenue share. This can be explained by the region’s well-established healthcare system, the presence of important pharmaceutical and medical device companies, an increase in the prevalence of non-communicable illnesses, and a greater awareness of cosmeceuticals. Additionally, strict regulations in this region regarding the approval and use of healthcare products, such as those from the U.S. have resulted in a rise in cleanroom technology demand.

The market for the Asia Pacific is expected, however, to grow quickly over the forecast period. Asia Pacific’s pharmaceutical market is the third largest after Europe and North America. In this region, investments in healthcare are also increasing. The main factors behind the rapid growth of Asia Pacific’s pharmaceutical sector are patent expirations and growing geriatric populations.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share Analysis:

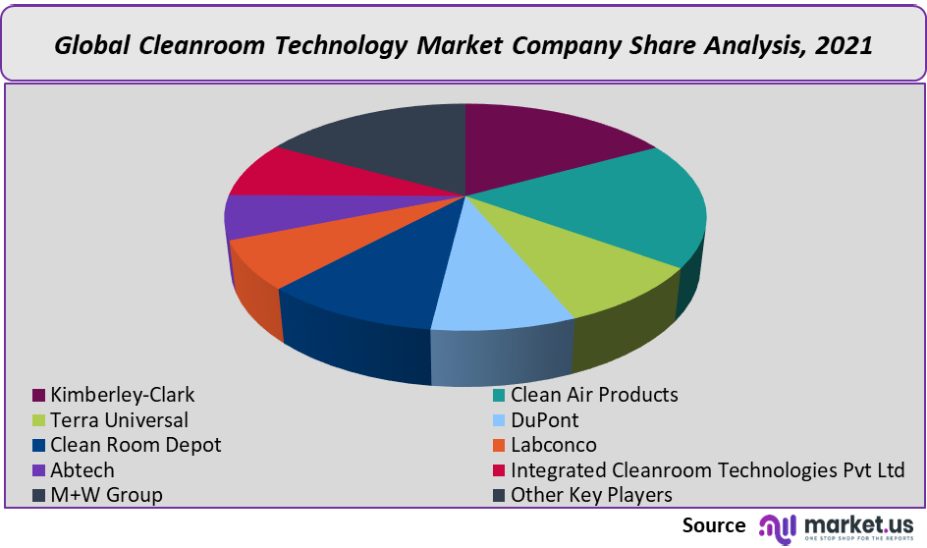

The market is fragmented and there are more regional players than international players. Key players are pursuing several strategies to increase their market share.

Key Market Players:

These are the major players in the cleanroom tech market:

- Kimberley-Clark

- Clean Air Products

- Terra Universal

- DuPont

- Clean Room Depot

- Labconco

- Abtech

- Integrated Cleanroom Technologies Pvt. Ltd

- M+W Group

- Other Key Players

For the Cleanroom Technology Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Cleanroom Technology market in 2021?The Cleanroom Technology market size was US$ 4,192 million in 2021.

Q: What is the projected CAGR at which the Cleanroom Technology market is expected to grow at?The Cleanroom Technology market is expected to grow at a CAGR of 4.8% (2023-2032).

Q: List the segments encompassed in this report on the Cleanroom Technology market?Market.US has segmented the Cleanroom Technology market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Equipment and Consumables. By End Use, the market has been further divided into Medical device industry, Pharmaceutical industry, Hospitals and diagnostic centers, and Biotechnology industry.

Q: List the key industry players of the Cleanroom Technology market?Kimberley-Clark, Clean Air Products, Terra Universal, DuPont, Clean Room Depot, Labconco, Abtech, Integrated Cleanroom Technologies Pvt Ltd, M+W Group, and Other Key Players engaged in the Cleanroom Technology market.

Q: Which region is more appealing for vendors employed in the Cleanroom Technology market?North America is accounted for the highest revenue share of 34.7%. Therefore, the Cleanroom Technology industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Cleanroom Technology?The U.S., Canada, U.K., Germany, Spain, France, Italy, Russia, etc., are key areas of operation for Cleanroom Technology Market.

Q: Which segment accounts for the greatest market share in the Cleanroom Technology industry?With respect to the Cleanroom Technology industry, vendors can expect to leverage greater prospective business opportunities through the consumables segment, as this area of interest accounts for the largest market share.

![Cleanroom Technology Market Cleanroom Technology Market]()

- Equipment

- Kimberley-Clark

- Clean Air Products

- Terra Universal

- DuPont

- Clean Room Depot

- Labconco

- Abtech

- Integrated Cleanroom Technologies Pvt. Ltd

- M+W Group

- Other Key Players

- Nestlé S.A Company Profile

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |