Global Clear Aligners Market By Age (Adults & Teens), By End-use (Hospitals, Standalone Practices, Group Practices, & Other End-uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 64714

- Number of Pages: 301

- Format:

- keyboard_arrow_up

Clear Aligners Market Overview:

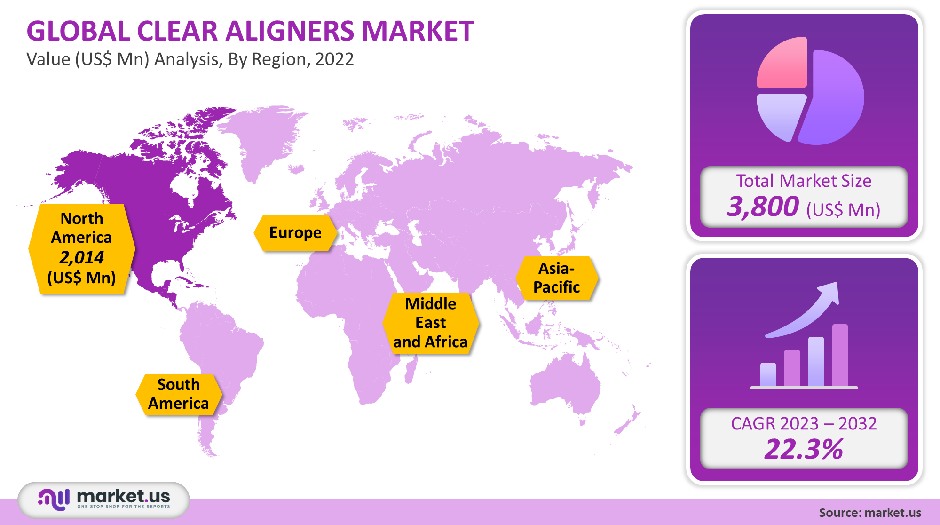

The market for clear aligners was worth USD 3,800 million in 2021. It is projected to grow at a CAGR of 22.3% between 2023 and 2032.

Clear aligners are a custom-made set of orthodontic systems that fit tightly to the teeth. Clear aligners are discreet alternatives to braces and can be removed. They can be removed easily and are convenient for patients.

Market forces include the growing number of patients with malocclusions and technological advancements in dental treatment. Clear aligners that are custom-made are also in high demand. The pandemic had a positive impact on the global market. Key players saw an increase in revenues in 2021, compared to the previous year.

Global Clear Aligners Market Scope:

Age Analysis

The adult segment was responsible for 57% of all revenue in 2021. Malocclusion is a common condition within the dental industry. Malocclusion can impact your quality of life and cause impairments in dentofacial aesthetics as well as problems with oral function. A society’s key component is an acceptable aesthetic appearance. This includes dental appearance. Teenagers care more about their teeth.

Aligner therapy is the fastest-growing area of orthodontics. Aligner therapy is gaining popularity because patients consider it to be a more discreet and comfortable option for fixed appliances. The teen segment will see the most growth over the estimated period. Align Technology’s FDA-approved Invisalign clear aligners were used to treat over 4.5 million patients.

Invisalign shipped to teens worldwide in 2018 was 86.8 000 cases. The NCBI states that Class I and Class 2 malocclusions are most common in the population. Clear aligners, which can be used to treat these conditions effectively, have been steadily growing in popularity. Clear aligners are attractive and can be removed easily.

End-use Analysis

The standalone practices segment which had the highest revenue share at 53.0% or more in 2021, will also experience a CAGR over this estimated period. The end-user category can be distributed into hospitals, groups, and standalone, as well as others. The standalone practice segment was the market leader for 2021. They are using clear aligner technology.

RDH, a digital media platform for Registered Dental Professionals, today states that both private and standalone services offer many benefits. This includes a wider selection of dental treatments, specialist and high-quality service, shorter wait time, as well as the adoption of the best equipment & quality materials both for diagnostics/treatment.

The American Association of Orthodontics estimated that there are 9,300 Orthodontists in the United States. 780 share or own a business. Group practices will experience the highest CAGR for the estimated period. They can reduce their costs, increase their earning potential and minimize risk by using the most advanced technology.

Key Market Segments:

By Age

- Adults

- Teens

By End-use

- Hospitals

- Standalone Practices

- Group Practices

- Other End-uses

Market Dynamics:

Dental Tribune reports that Align Technology sold 1.7 Million clear aligners in 2020. This is a record compared to the 1.7 Million in 2019. During the pandemic, aligners were also popular among teens and younger patients. Because people were less likely than ever to see an orthodontist for traditional braces, this market grew. Clear aligners are more popular. The pandemic was a catalyst to industry growth in terms of sales and revenue. This trend is expected not to stop.

The advancements in orthodontic treatment have been made easier, more predictable, and more effective by digital scanning technology, additive fabrication, Nickel Titanium Wires, and 3D impressions. Align Technology’s iTero technology has allowed for the creation of customized aligner systems that can be used in cases with mild to moderate misalignment.

These invisible aligners can be created using digital models, computer-aided designing (CAD-CAM), or thermoformed materials such as polyester and polycarbonate plastic. Clear aligners have been adopted by dentists and patients to decrease the discomfort and long-term gum irritation caused by metal braces.

The Aligner is comfortable and flexible. Clear aligner technology is becoming more popular than fixed appliances for teeth straightening. It’s a convenient and attractive choice. Clear Correct is the largest distributor and manufacturer of clear aligners. Clear Correct and Inman Aligner also have other brands. Market conditions, such as high prices of clear aligners and a shortage of dentists in new areas, will likely lead to a slowdown. There may not be enough insurance coverage to cover orthodontic treatment.

Covid-19’s arrival was a major development in the dental market. Covid-19’s introduction was crucial because elective procedures were often delayed. Dentistry is an elective procedure that requires close contact. Most dental offices were closed. However, 26 US states allowed elective care to be offered by dental offices starting in May 2020. By June, 47 states had opened for elective dentistry.

American Dental Association believes that spending projections have become more optimistic due to the recovery of patient volume and the resumption of dental practices. According to the ADA, dental spending will rise and rebound to pre-pandemic levels.

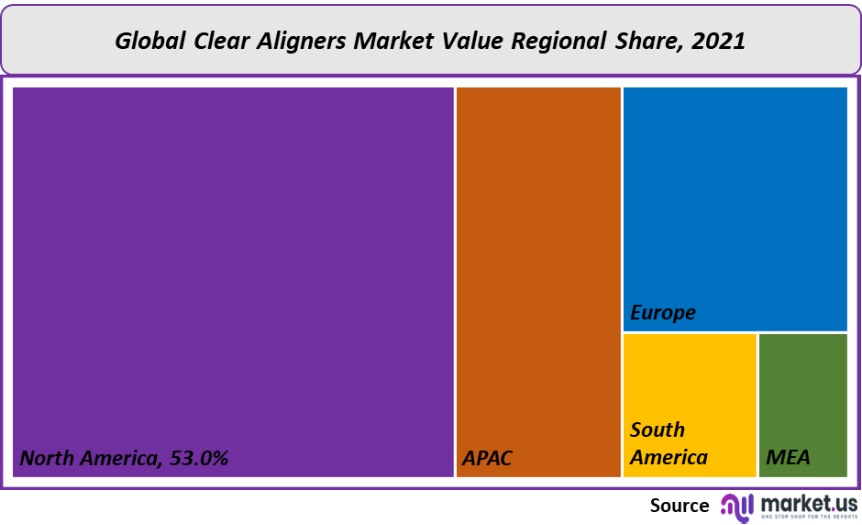

Regional Analysis

North America held the largest market share of 53.0% in 2021. This is due to increased R&D investment, the present global players in local markets, & their efforts to obtain new patents. The American Dental Association reports that 80% of Americans value oral health & consider it a key part of overall health. Braces are used by nearly four million Americans, with 30% of them being adults.

Patients who don’t want braces but want to improve the appearance of their smiles have been attracted to clear tray-style aligners. Aligners are becoming more popular due to the many options obtained for aligning teeth and increasing awareness about hygiene.

The APAC region will experience the highest CAGR (33.6%) due to increased demand for clear aligners in China and India over the forecast period. The aesthetic appeal and ease of use of the aligner systems is the reason. Align Technology introduced clear aligners Invisalign Teen, Full, and Teen in India in February 2016. These systems are intended for urban residents of over 75 million. These systems account for a large share of India’s premium dental care product sales.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

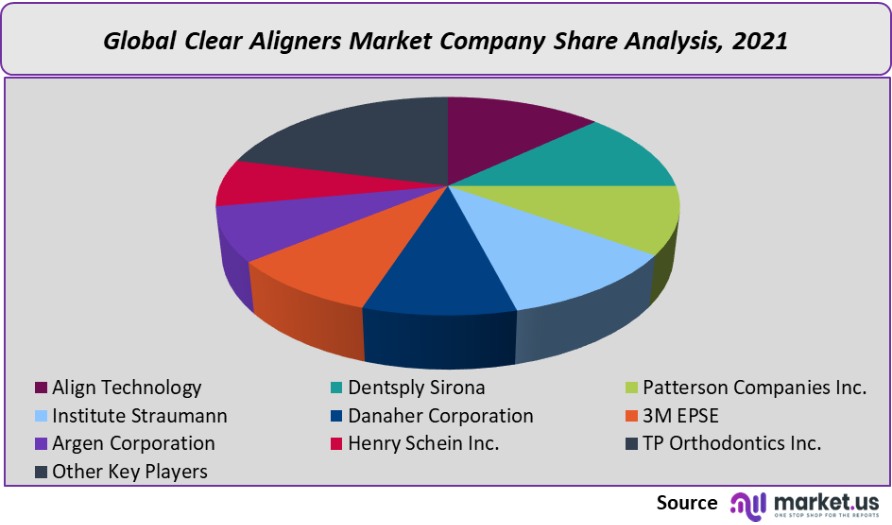

The global market has seen intense competition. The rapid adoption of digital technology such as intraoral scans and digital tooth setups, 3D printers, and CAD/CAM devices is a key factor in ensuring market competitiveness. A significant number of these market players are also looking for partnerships and strategic expansions to expand their geographic presence, increase sales volume in economically-friendly regions, and launch new products.

Align Technology, for example, opened a Polish manufacturing plant in April 2021 to expand its global operations. The company will be able to serve a vast and underserved market for Invisalign throughout Europe, the Middle East, and Africa. Dentsply Sirona purchased Straight Smile LLC (BYTE), a leader in direct-to-consumer and doctor-directed clear aligner markets. This acquisition will allow the company to expand its SureSmile aligner market.

Envista Holdings Corporation announced in April 2021 a partnership with Curaeos Clinics, which will provide the company with the most recent dental technology. Curaeos Clinics operates a large network of dental clinics in the Netherlands, Belgium, and Denmark as well as Germany, Germany, and Italy.

The following are some of the major players in the global market for clear aligners:

Market Key Players:

- Align Technology

- Dentsply Sirona

- Patterson Companies Inc.

- Institute Straumann

- Danaher Corporation

- 3M EPSE

- Argen Corporation

- Henry Schein Inc.

- TP Orthodontics Inc.

- Other Key Players

For the Clear Aligners Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Clear Aligners market in 2021?A: The Clear Aligners market size is US$ 3,800 million in 2021.

Q: What is the projected CAGR at which the Clear Aligners market is expected to grow at?A: The Clear Aligners market is expected to grow at a CAGR of 22.3% (2023-2032).

Q: List the segments encompassed in this report on the Clear Aligners market?A: Market.US has segmented the Clear Aligners Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Age, the market has been segmented into Adults & Teens; by End-use, the market has been segmented into Hospitals, Standalone Practices, Group Practices, & Other End-uses.

Q: List the key industry players of the Clear Aligners market?A: Align Technology, Dentsply Sirona, Patterson Companies Inc., Institute Straumann, Danaher Corporation, 3M EPSE, Argen Corporation, Henry Schein Inc., TP Orthodontics Inc., and Other Key Players are the key vendors in the Clear Aligners market.

Q: Which region is more appealing for vendors employed in the Clear Aligners market?A: North America accounted for the highest revenue share of 53.0%. Therefore, the Clear Aligners industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for the Clear Aligners Market.A: The US, Canada, U.K., Germany, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, etc., are leading key areas of operation for Clear Aligners Market.

Q: Which segment accounts for the greatest market share in the Clear Aligners industry?A: With respect to the Clear Aligners industry, vendors can expect to leverage greater prospective business opportunities through the standalone practices, as this area of interest accounts for the largest market share.

![Clear Aligners Market Clear Aligners Market]()

- Align Technology

- Dentsply Sirona

- Patterson Companies Inc.

- Institute Straumann

- Danaher Corporation Company Profile

- 3M EPSE

- Argen Corporation

- Henry Schein Inc.

- TP Orthodontics Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |