Global Coated Paper Market By Type (Mechanical and Woodfree), By Application (Printing, Packaging & Labeling, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2022

- Report ID: 61804

- Number of Pages: 310

- Format:

- keyboard_arrow_up

Coated Paper Market Overview:

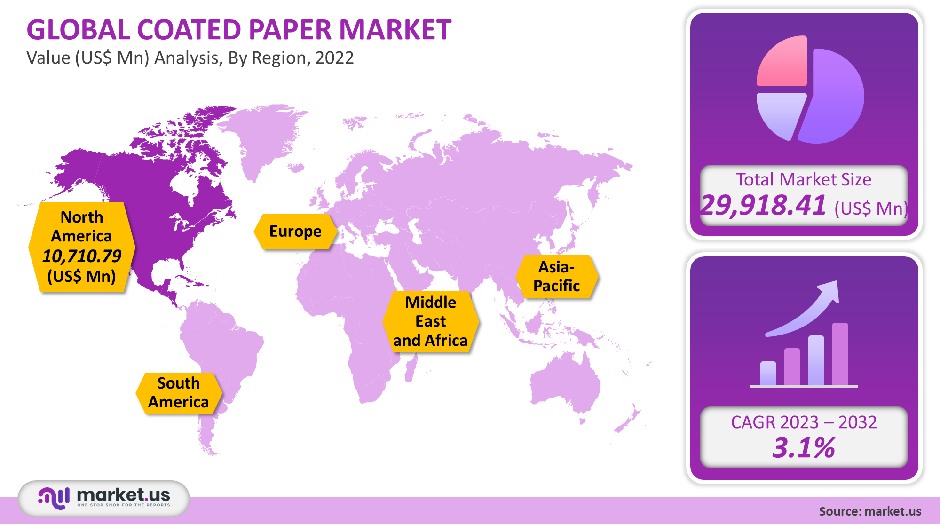

In 2021, the global coated paper market was worth USD 29,918.41 million at a CAGR of 3.1%.

The forecast period will see a rise in demand for packaging and advertising materials across different industries.

Advertising in magazines, newspapers, brochures, catalogs, and other media has a significant impact on product demand. The market is also driven by the rise of bio-degradable packaging options.

Global Coated Paper Market

Product Analysis

Coated mechanical was the most popular category by-product in 2021, accounting for 50.6%. These products consist mainly of mechanical wood pulp and are made from base sheets. The surface is then coated with chemical pulp and minerals to create a smooth, bright surface. They can improve the ink holdout, which results in less ink use and better prints. These lightweight coated papers can also be called decorative pages, magazines, inserts, and catalogs. These can also be printed with offset printing.

The increasing popularity of agro-based and fiber-based papers will result in a 3.6% revenue-based CAGR in coated woodfree between 2023 and 2032.

These papers are produced using chemical processing of wood pulp and not mechanical processes. In the coated woodfree paper, the chemical content of wood pulp should be less than 90%. These sheets are useful for general writing and printing, stationery, copying, as well as magazine applications.

Application Analysis

Globally, packaging and labeling had a remarkable revenue share of 63.7% for 2021. Flexible paper packaging solutions are becoming more popular than flexible plastics, which has made it possible to use coated paper. This product is used to pack flour, sugar, and medical products.

The rapid rise of e-commerce has allowed for the development of premium packaging and decorative packaging. This has expanded the market for coated paper. Due to the increasing popularity of home delivery services and the growing presence of online retailers, the coated paper has seen an increase in its use in packaging activities. Companies have been investing in brand promotion via various forms of advertising, which is also a key driver for this segment.

A wide range of applications across different industries gave the printing application a 32.1% market share in 2021. The widespread digitalization of the printing industry has had a negative impact on this application and is likely to make it saturated. The segment is expected to grow steadily over the forecast period due to the continued use of coated paper for currency, security documents, checkbooks, and checkbooks.

Demand will remain steady due to the steady use of this product in brochures and product guides for smartphones, computers, tablets, and other electronic devices.

Key Market Segments

Type

- Mechanical

- Woodfree

Application

- Printing

- Packaging & Labeling

- Others

Market Dynamics

Coated papers are made with a layer of clay, polymer, or both. Coated papers produce sharper and more vivid images than those without a coating. They also have better reflectivity than their uncoated counterparts.

The paper is also given a glossy, shiny texture by the layer. This makes it more professional for use in magazines and other publications. Because the ink is not able to seep through, sharp images are possible with these papers. They are resistant to dust and require less ink due to their better ink retention. They are therefore suitable for different finishing techniques like spot varnish.

There are many opportunities for growth in coated paper printing, including invitations and decorations. The rise in popularity of online and digital platforms has fueled the e-commerce sector, which has also led to an increasing number of home delivery services. This has increased the demand for packaging and labeling solutions.

But, the widespread digitization across industries is a significant challenge to coated paper market growth. Digital alternatives have replaced manuals, catalogs, and brochures in companies, which has led to a decline in paper use.

This is due in part to rising deforestation, as well as the increase in carbon emissions that occur during product manufacturing. These effects are detrimental to the environment. These challenges have been overcome by players turning to technological innovations and improvements in product manufacturing.

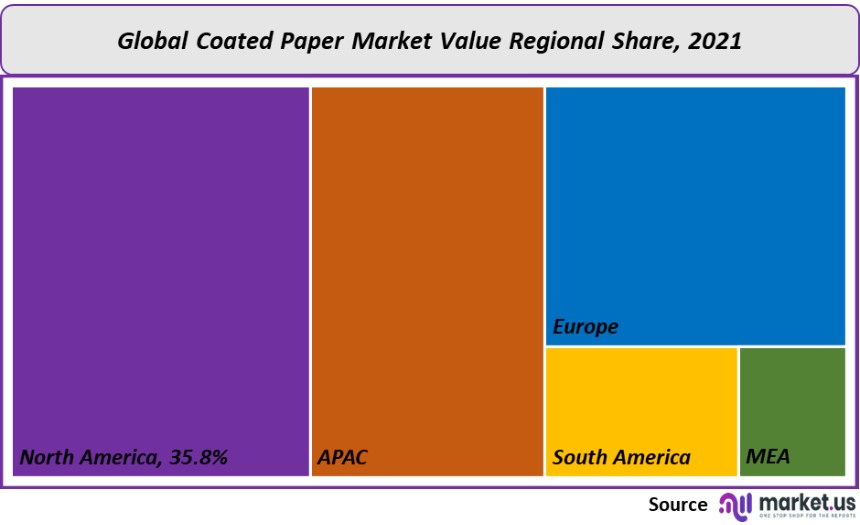

Regional Analysis

North America had the largest volume share of North America in 2021, with 35.8%. This is due to the country’s high production rates. Many of the world’s leading manufacturers are also located here, which has allowed for large-scale production.

North America is projected to see a 3.5% annual growth rate in revenue from 2023-2032. Corporation profit is a key contributor to the U.S. Economy. Therefore, businesses heavily rely on paper products which offer significant growth potential.

The Asia Pacific is expected to show a revenue-based growth rate of 3.7% between 2023-2032, due to increased production and consumption in the global market for coated paper. It is home to some of the most important paper-consuming countries, such as India and China. This has increased the potential for the product to be used in many industries. The region’s booming e-commerce sector has also fueled product demand for printing and packaging goods. Advertising and print media are also growing markets.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

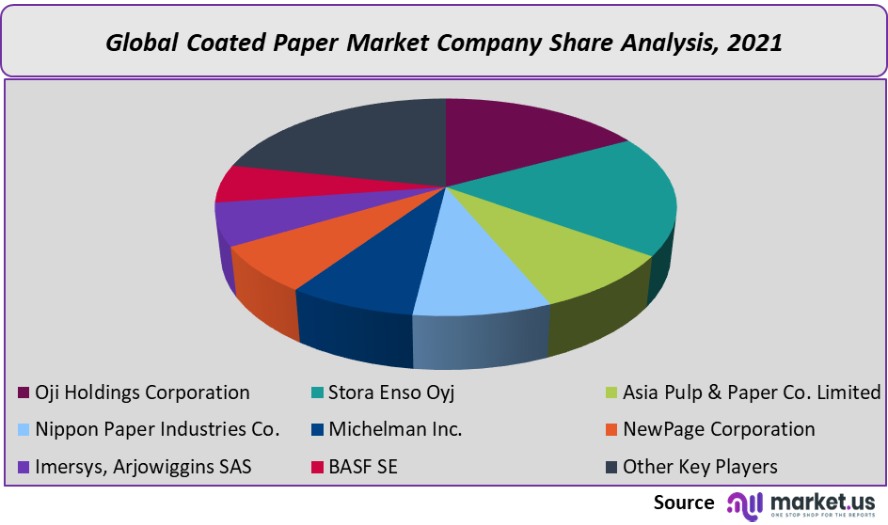

Market Share Analysis

To retain consumers’ interest and increase market share, the top players have focused on product innovation. Players have a lucrative opportunity to capitalize on the increasing preference for biobased papers across the majority of regions.

Key Market Players

Some of the key product manufacturers

- Oji Holdings Corporation

- Stora Enso Oyj

- Asia Pulp & Paper Co. Limited

- Nippon Paper Industries Co.

- Michelman Inc.

- NewPage Corporation

- Imersys, Arjowiggins SAS

- BASF SE

- Other Key Players

For the Coated Papers Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Coated Paper market in 2021?A: The Coated Paper market size was US$ 29,918.41 million in 2021.

Q: What is the projected CAGR at which the Coated Paper market is expected to grow at?A: The Coated Paper market is expected to grow at a CAGR of 3.1% (2023-2032).

Q: List the segments encompassed in this report on the Coated Paper market?A: Market.US has segmented the Coated Paper market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Mechanical and Woodfree. By Application, the market has been further divided into Printing, Packaging & Labeling, and Others.

Q: List the key industry players of the Coated Paper market?A: Oji Holdings Corporation, Stora Enso Oyj, Asia Pulp & Paper Co. Limited, Nippon Paper Industries Co., Michelman Inc., NewPage Corporation, Imersys, Arjowiggins SAS, BASF SE, and Other Key Players engaged in the Coated Paper market.

Q: Which region is more appealing for vendors employed in the Coated Paper market?A: North America is accounted for the highest revenue share of 35.8%. Therefore, the Coated Paper industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Coated Paper?A: The U.S., U.K., Germany, China, India, and Brazil are key areas of operation for Coated Paper Market.

Q: Which segment accounts for the greatest market share in the Coated Paper industry?A: With respect to the Coated Paper industry, vendors can expect to leverage greater prospective business opportunities through the Coated mechanical segment, as this area of interest accounts for the largest market share.

![Coated Paper Market Coated Paper Market]()

- Oji Holdings Corporation

- Stora Enso Oyj

- Asia Pulp & Paper Co. Limited

- Nippon Paper Industries Co.

- Michelman Inc.

- NewPage Corporation

- Imersys, Arjowiggins SAS

- BASF SE Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |