Global Commercial Aircraft Landing Gear Market by Product Type (Main landing & Nose landing), By Component Type (Landing Gear Steering System, Wheel & Brake System, Actuation System, and Others), By Aircraft Type (Narrow-Body, Wide-Body, Regional Jet, and Others), By Arrangement Type (Tricycle, Tandem and, Tailwheel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 20000

- Number of Pages: 302

- Format:

- keyboard_arrow_up

Commercial Aircraft Landing Gear Market Overview:

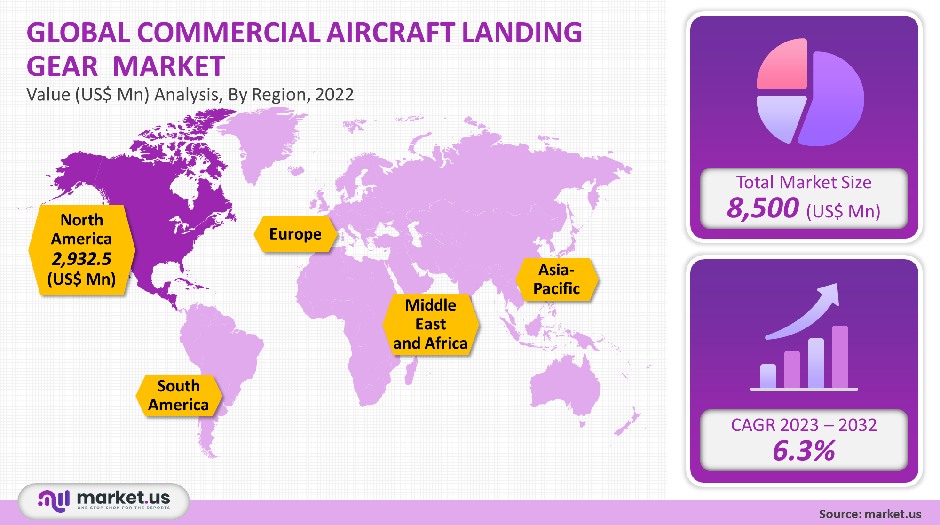

The global Commercial Aircraft Landing Gear Market was valued at USD 8,500 million in 2021 With a 6.3 % CAGR throughout the forecast period.

During the time of the forecast, it is anticipated to expand significantly. The requirement for new aircraft and landing gear will be driven by anticipated expansion in commercial aviation and an increase in the size of major carriers.

The civil aviation industry will expand significantly as a result of the increasing production of next-generation aircraft. The number of passengers flying has increased as a result of the global economic situation. There have been more commercial airplanes built to accommodate the rising demand for air travel. The need for commercial aviation landing gear will rise as a result of the increase in commercial aircraft.

Global Commercial Aircraft Landing Gear Market Scope:

Gear Position analysis

The study includes market information for main and nose landing gears. Main landing gears will rule the market in the following eight years due to their necessity for aircraft. Additionally, the market is anticipated to expand significantly. The segment is anticipated to expand at a CAGR greater than 6.7% between 2023 and 2032.

Landing gear producers are heavily putting money into new replacement touchdown sets. Due to their exorbitant prices, these technologies are losing their appeal to airlines. The majority of airlines favor using products from pools and short-term leases. Due to the insufficient capacity, OEMs are finding it harder and harder to sustain their products. The sales of line-fit systems will increase as a result.

Component analysis

The research looks at the actuation, wheel and braking system, steering system, and other parts. Due to their inherent advantages, such as high precision and the capacity to change various design parameters, electronic control systems are increasingly replacing hydro-mechanical systems (such as steering ratio and steering speed). Similar patterns have been found in the market for brake systems.

Electronic braking systems are taking the place of conventional mechanical ones. Despite the fact that the majority of aircraft have steerable noses, not all do. The cab driver steers in these conditions by using differential brakes. In heavier airplanes, the nose gear is typically controlled by hydraulic power. The touchdown mechanisms were specifically designed to reduce ground stresses on the aircraft.

Aircraft Type analysis

This study covers a wide range of aircraft types, including narrow-body, wide-body, and regional jets. Predictions suggest that the narrow-body segment is the most popular. Demand for these aircraft is expected to increase due to increased passenger numbers from low-cost carriers (LCCs) and increased high-density flights between major airports.

LCCs pose a major threat to airlines in developed countries such as the United States, Germany, and other European countries. These airlines are replacing older fuel-efficient aircraft with low-cost single-aisle models. In addition, demand for commercial aircraft is increasing, especially in emerging markets.

Arrangement Type analysis

Tricycles are the most popular arrangement in the world due to their good visibility from the ground when maneuvering. This arrangement allows for careful central clearance of other aircraft components (such as wings and fuselage) when the aircraft is on the ground.

The tandem segment grows the most because it allows for the use of flexible wings and gear under the fuselage. This arrangement allows the main landing gear and a tail leg to be aligned along the vertical axis of the aircraft.

Tandem transmissions, even gliders, are rare on commercial aircraft. In 2021, the tailwheel market share was just over 8%. These landing gears are most commonly used on small or conventional aircraft.

Key Market Players:

By Gear Position

- Main Landing

- Nose Landing

By Component Type

- Landing Gear Steering System

- Wheel & Brake System

- Actuation System

- Others

By Aircraft Type

- Narrow-Body

- Wide-Body

- Regional Jet

- Others

By Arrangement Type

- Tricycle

- Tandem

- Tailwheel

Market Dynamics:

Due to the increased production of next-generation planes, the civil aviation sector will experience significant growth. Global economic conditions have seen an increase in air passenger traffic. To meet the growing demand for air travel, there has been an increase in commercial aircraft. This increase in commercial aircraft will drive demand for commercial aircraft landing gear.

Manufacturers of aircraft are using lighter materials and electronic technologies to optimize the performance of their aircraft during landing and reduce downtime. These systems are more maintenance-intensive than their older counterparts.

Over the next eight years, the industry will be driven by the increasing demand for eco-friendly and fuel-efficient airliners to replace older models. The commercial aviation landing gear market is growing rapidly. The technologically advanced control system is increasingly replacing manual-controlled hydraulic and mechanical systems. The industry incumbents are also increasingly competing across the value chain.

The global industry is changing to keep up with the global economy’s changes. The industry’s growth will be limited by rising energy costs, high-priced raw materials, and U.S. Dollar inflation. To overcome these challenges, many players in the value chain (OEMs, components,s and raw material suppliers) have developed new business processes to take advantage of the industry’s rapid globalization.

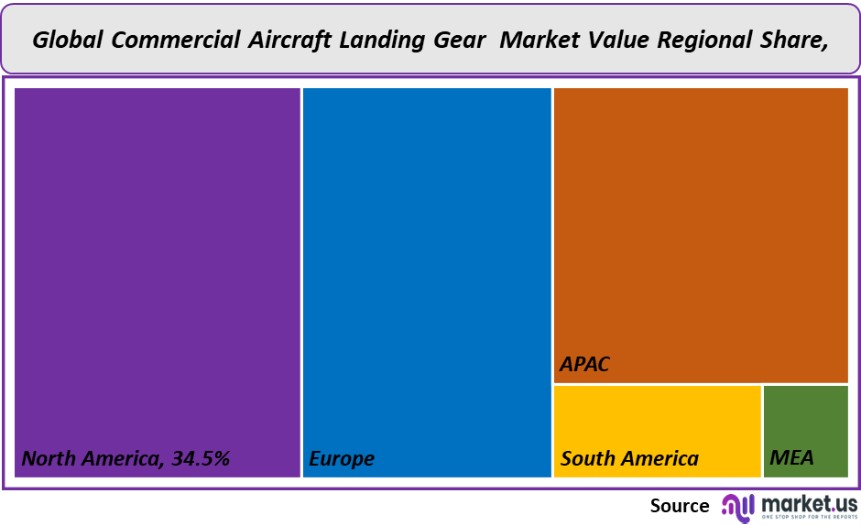

Regional Analysis

With a revenue share greater than 34.5%, The North American region will dominate the global aviation landing gear market over the forecast period. This is due to technological advancements in aircraft landing gear as well as the presence of major aircraft makers such as The Boeing Company (U.S.A) and Bombardier Inc. Canada (Canada).

The market is also being boosted by increasing aircraft orders from these companies by regional airlines in the Asia-Pacific, Middle-Eastern, and Pacific regions. The North American market is expected to grow due to the expansion of military upgrade programs. These include the augmented purchase of unmanned aircraft vehicles and advanced fighter planes.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

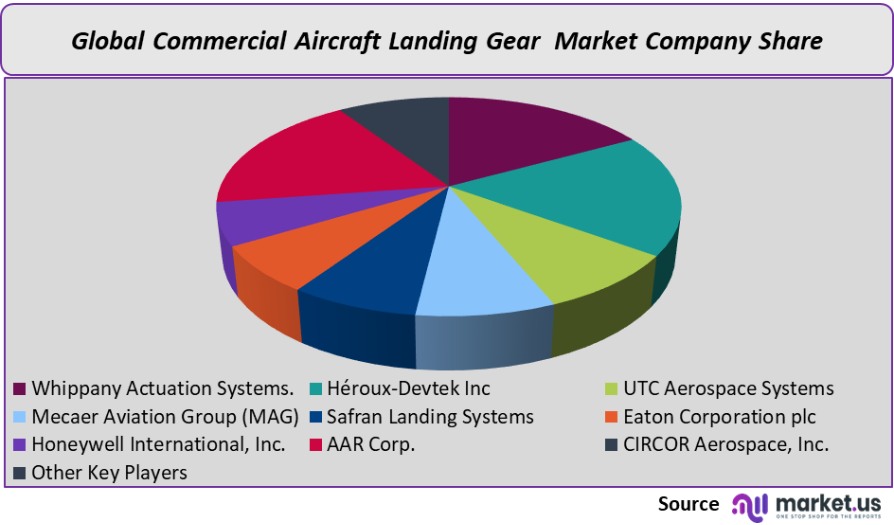

Global commercial aircraft landing gear markets are dynamic. The marketplace is changing its products and solutions to offer aircraft manufacturers cost-effective solutions. To manage their inventory and profit margins, the key manufacturers are forming longer-term agreements to supply partners.

These are the industry incumbents: Whippany Actuation Systems., Héroux-Devtek Inc., UTC Aerospace Systems, Mecaer Aviation Group (MAG), Safran Landing Systems, Eaton Corporation plc, Honeywell International, Inc., AAR Corp., CIRCOR Aerospace, Inc., Liebherr Group,

Market Key Players

- Whippany Actuation Systems

- Héroux-Devtek Inc

- UTC Aerospace Systems

- Mecaer Aviation Group (MAG)

- Safran Landing Systems

- Eaton Corporation plc

- Honeywell International, Inc.

- AAR Corp.

- CIRCOR Aerospace, Inc.

- Liebherr Group

- Other Key Players

For the Commercial Aircraft Landing Gear Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![Commercial Aircraft Landing Gear Market Commercial Aircraft Landing Gear Market]() Commercial Aircraft Landing Gear MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample

Commercial Aircraft Landing Gear MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample - Whippany Actuation Systems

- Héroux-Devtek Inc

- UTC Aerospace Systems

- Mecaer Aviation Group (MAG)

- Safran Landing Systems

- Eaton Corporation plc

- Honeywell International, Inc. Company Profile

- AAR Corp.

- CIRCOR Aerospace, Inc.

- Liebherr Group

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |