Global Computer Vision Market By Type, By Application, By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 56728

- Number of Pages: 253

- Format:

- keyboard_arrow_up

Computer Vision Market Overview

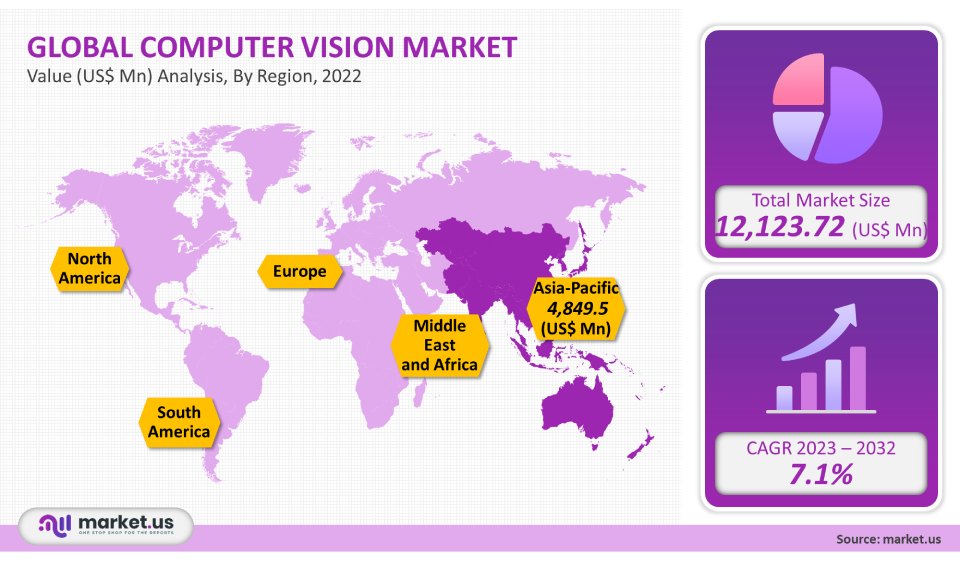

The Computer Vision Market size is expected to be worth around USD 25.73 billion by 2032 from USD 12.1 billion in 2021, growing at a CAGR of 7.1% during the forecast period from 2022 to 2032.

Global Computer Vision Market

Component Analysis

In 2021, hardware components accounted for 72% of the global computer vision market’s revenue. This segment encompasses a range of hardware component benchmarking such as processors and cameras, lenses, frame grabbers, and LED lighting. The largest share can be attributed largely to new hardware platforms, which offer convenient component interconnection and advanced capabilities like faster processing, multi-megapixel resolution, fully digital data handling, and full-digital data handling. The hardware components of a computer vision system are processors and co-processors as well as cameras, lighting & optical components, frame grabbers, and processors & Co-processors. High-performance hardware components make it easier to install vision systems and offer a wide range of diverse applications through various network architectures.

However, the software segment will see a noticeable shift in demand. It is forecast to register a compound annual growth rate (CAGR) of 8.4% during the forecast period. This category includes all software necessary to enable the system to perform optimal inspection and identification. Image classification, object detection, object tracking, and content-based image retrieval are the primary functions of computer vision software. Many organizations’ lack of resources and computing power may limit computer vision applications. A few tech giants are working to overcome computer vision software design limitations. IBM Corporation offers computer vision software programming services to assist companies in developing computer vision applications. These services offer pre-built deep learning models, which can be downloaded from the cloud to address developmental and computing issues.

Product Type Analysis

The PC-based segment of computer vision systems dominated the market, accounting for more than 56% of global revenues in 2021. A PC-based computer vision system is typically used to image processing. This means it requires many peripheral devices for other tasks like data transfer, frame grab, storage, lighting, and even data transfer. This is due to the ease of upgrading and swapping out. The installation of the right hardware and software package can extend the capabilities of a PC-based Computer Vision System. However, PC-based vision systems typically focus on image-processing and require several peripheral devices such as storage, data transfer, frame grab, lighting, and data transfer. This multi-component PC configuration can make the vision system fragile and may limit the market growth for PC-based computer vision systems. The major factor driving AI in the computer vision market is the rising demand for merged reality.

Additionally, the segment smart camera-based system for computer vision is expected to show a shift in its demand. This segment will see a 12.3% CAGR over the forecast period. The open-embedded technology used in smart camera-based vision system construction reduces the need to integrate peripheral devices like an external factor or frame-capture card. This is due to its cost-effectiveness, compact dimensions, and ease of integration of a smart-camera-based computer vision system. Open-embedded, processing-based smart cameras can be used as standalone vision systems to perform tasks that do not require secondary devices. The product’s cost is reduced while the system can still be used effectively.

Application Analysis

The market’s largest segment, quality assurance, and inspection accounted for more than 28% of the total global revenue in 2021. Quality assurance is an integral component of quality management. It ensures that quality customization requirements are met. The assurance provided by quality management is not only for the employees but also for customers, regulators, government agencies, and third parties. This high percentage can be attributed to the rapid adoption of process automatization in the manufacturing industry to improve productivity. Quality inspection automation is possible for all manufacturing products by combining deep learning algorithms with computer vision.

Matrox, a Canada-based digital image company, offers products and solutions for quality assurance and inspection to OEMs, integrators, and others involved in image recognition systems, machine vision, image analysis requests, and medical imaging. Suntory PepsiCo Vietnam Beverage is a consumer product company that has implemented a Matrox Imaging-based system in its factories to simplify code label quality control.

The predictive maintenance segment will expect substantial growth in the forecast period. Predictive Maintenance merges machine learning algorithms with IoT devices to monitor the machinery and other component data. It uses sensors for signal identification and data point collection to make exact decisions before assets or the basis of components are broken down. Tesla, a U.S.-based clean energy company and electric vehicle maker, uses ultrasonic sensor technology to ensure that its autonomous cars are safe and reliable.

Vertical Analysis

The industrial segment led the market and accounted for more than 51% of the global revenue for 2021. The industrial segment covers verticals that employ computer vision applications in manufacturing processes. This includes automotive, consumer electronics, metals, wood & papers, food & packaging, machinery, and textiles. This is due to the rapid adoption and use of computer vision systems in automotive and transportation. Vision systems were used in the assembly of automobiles earlier to automate the process. With the introduction of auto driver assistance and traffic management software, computer vision systems have expanded in this industry. Image Sensing Systems, Inc., a supplier of information management systems, offers real-time traffic management solutions to the ITS sector (Intelligent Transportation Systems). Other solutions include radar detection, wrong-way detection, and license plate identification systems.

Other industrial verticals for computer vision systems include food and packaging, consumer electronics, machinery, rubber, plastics, pharmaceuticals, and consumer electronics. demand for vision can be used in various industrial product verticals for inspection, packaging, product and component assembly, and defect minimization. KLA Corporation is a U.S.-based capital machinery company that provides process control and yield management systems for the electronics and semiconductor industries. It provides automated inspection solutions that support the chip manufacturing process. In non-industrial verticals, healthcare has also adopted computer vision quickly for several applications such as patient monitoring, facial recognition of visually impaired users, medical image analysis, and even image analysis.

Key Market Segments

Component

- Hardware

- Software

Product Type

- Smart Camera-Based Computer Vision System

- PC-Based Computer Vision System

Application

- Quality Assurance & Inspection

- Positioning & Guidance

- Measurement

- Identification

- Predictive Maintenance

- 3D Visualization & Interactive 3D Imaging Modelling

Vertical

- Industrial

- Non-Industrial

Market Dynamics

Artificial intelligence (AI), which uses computer vision technology, is increasingly used in various use in self-driving cars and the Transportation industry. These include computer vision solutions in consumer robots and autonomous or semi-autonomous vehicles. Recent computer visualization advancements, including advanced cameras, image sensors, and deep learning techniques, have expanded the market for computer vision systems across many industries, including healthcare, education, robotics, consumer electronics, retail, and security & surveillancelance. One of the most common bases of computer vision applications is image captioning via social media platforms.

Computer vision systems can improve the security of high-value assets by using facial recognition and biometric scanning. Because computer vision systems can recognize different patterns within the retinas and eyes of people, smartphone security is the most popular use of facial Recognition. Further, facial recognition can be used by business operations and residents to verify their identities. It also controls high-security areas like bank vaults or research labs. FaceKey, a U.S.-based supplier of biometric products, solutions, and tools, offers an Integrated Security Access Control System (ISACS) for several applications within the banking industry. This includes access to vaults, safety deposit boxes, offices, and elevators.

The automotive industry is experiencing a shift away from traditional human-driven vehicles to AI-powered or self-driving ones. Because of the need to make decisions, the application of computer vision systems to self-driving vehicles is expected to increase market growth. Ultrasonic and LiDAR sensors locate signs, other vehicles, and obstacles in self-driving automobiles. These vehicles have cameras with computer vision that can read road signs and calculate steering angles. They also make critical road decisions, such as giving space to ambulances or fire engines.

The major industries have the most widespread use of robotics and industrial automation. The need for smarter systems to monitor and control industrial processes is growing as manufacturing plants move towards fully automated production. Internet of Things is revolutionizing manufacturing and making industrial processes more autonomous. However, computer vision is also helping to improve their Machine Vision class cross. Machine vision, for example, is used to inspect the quality of manufactured products to detect any non-conformities.

Companies of all sizes and industries face difficulties keeping their resources safe, productive, and protected as the COVID-19 novel coronavirus has spread throughout the globe. Computer vision systems have many options to help combat this epidemic. As the effect of COVID-19 spreads, the overall market has been impacted by COVID-19, and the growth rate was also impacted in 2019-2020. Numerous tech start-ups and giants are working to contain, prevent and mitigate the disease. Alibaba’s Damo Academy research institute has created an algorithm that detects new coronavirus infections using the CT scan (Computed Tomography). The AI model was trained with samples of over 5,000 positive coronavirus patients.

Leeway Hertz, a U.S.-based custom programming company, offers technology solutions using computer vision technologies and tools. These include the Human Presence System to remotely monitor patients and the Face Mask Detection System for identifying people without a face mask. Voxel51 Inc. (a U.S. computer vision startup) has created Voxel51 PDI to measure the effects of the outbreak on people’s social behavior. Many applications use AI-powered computer visual platforms or solutions for covid-19 crisis prevention. This includes tracking and prediction, early alarms, data dashboards, diagnosis and prognosis, treatment and cures, social control, and monitoring and controlling. Data dashboards can be used to visualize the current situation of the pandemic. They also provide information that can help track and predict the spread of the coronavirus. Microsoft’s AI tracker, Bing, provides an overview of current statistics on the pandemic.

Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance.

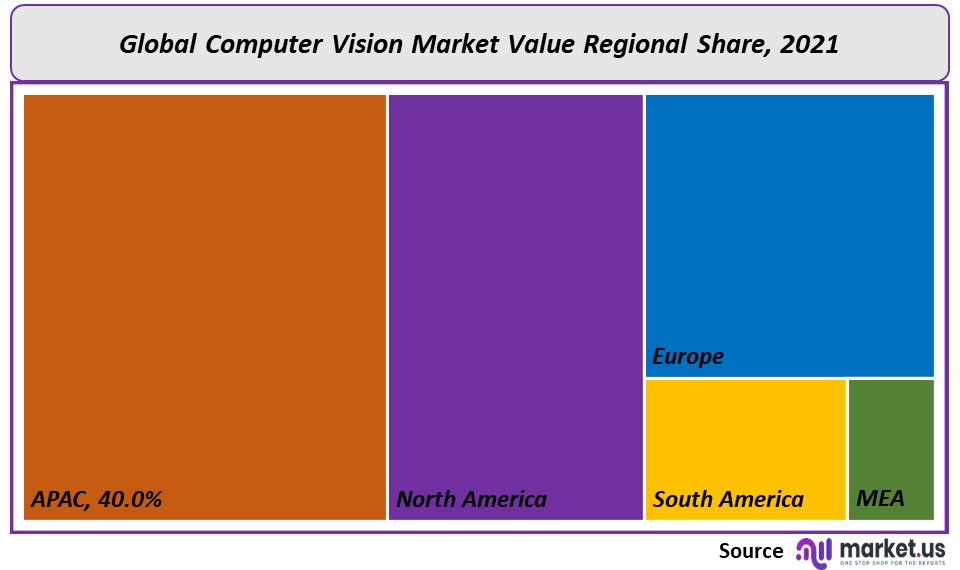

Regional Analysis

The Asia Pacific dominated this market and was responsible for 40% of global revenue in 2021. Major players such as Sony Semiconductor Solutions Corporation, OMRON Corporation, and Sony Semiconductor Solutions Corporation are expected to increase market growth in this major region. A significant increase in Chinese investments in computer vision technology has also contributed to the largest market share. In 2018, 66% of the total capital invested by companies was held by the People’s Republic of China’s economic development, which is almost three times more than the capital invested in U.S. firms. China’s capital investment in computer vision was 20x greater than venture capital in 2016. Strategic initiatives by the government are also helping to increase the growth in computer vision technology within the region. China has already deployed almost 176 million digital cameras to meet its demand for better surveillance. Tech companies have access to huge datasets from the government to help them build models for their computer vision application development.

North America is expected to experience significant growth during the forecast period. Favorable government initiatives have contributed to this increase in computer vision adoption. The National Institute of Standards and Technology was a non-regulatory government agency and a U.S. Department of Commerce physical sciences laboratory. In November 2019, Voxel51 Inc. received support to create an ai-enabled vision system video analysis platform under the PSIAP program (Public Safety Innovation Accelerator Program). The government websites have provided AI and computer vision technology for public safety agencies to use and deploy. U.S. General Services Administration’s domain Artificial Intelligence CoE aids agencies and organizations in creating AI solutions. It incorporates natural language processing, computer learning, computer vision, and intelligent process design throughout the country.

Key geographic regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share Analysis

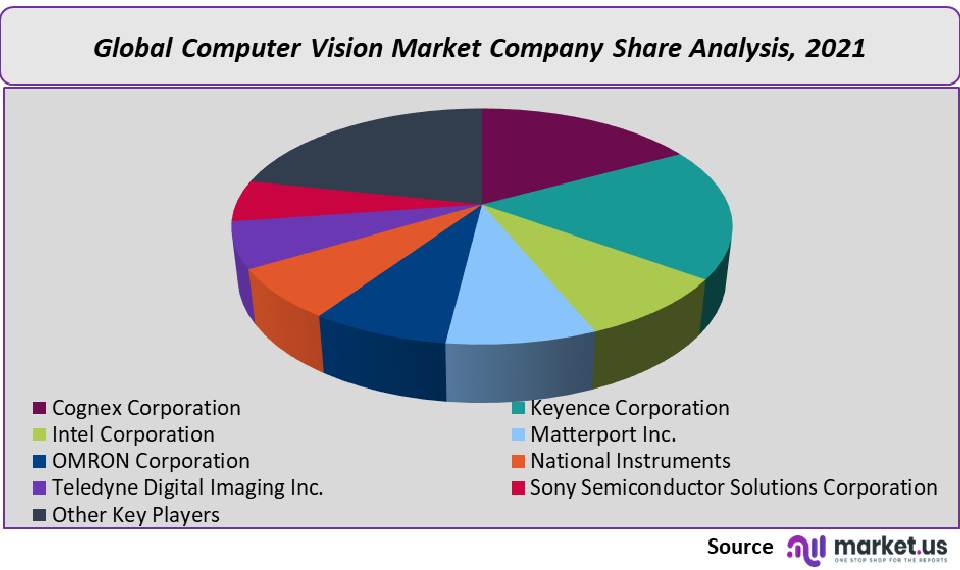

These key players will focus on growing their product line and expanding their reach by purchasing business annual reports and technologies. Probiotics (a China-based computer vision company) acquired AtSite A/S, a visual inspection service provider. Robotics closed this deal to develop an AI-enabled offshore wind turbine inspection technology. Snap Inc., a U.S. social media company, acquired AI Factory, a Ukraine-based computer vision start-up, in January 2020. Snap Inc. hoped to use this acquisition to enhance its social media app with a new Cameos feature. Cameos turn a person’s image into an animated video.

Key Market Players

These are the top players(Industry experts) in the global market for computer vision:

- Cognex Corporation

- Keyence Corporation

- Intel Corporation

- Matterport Inc.

- OMRON Corporation

- National Instruments

- Teledyne Digital Imaging Inc.

- Sony Semiconductor Solutions Corporation

- sony corporation

- cadence design systems, inc.

- teledyne technologies

- Basler ag(Germany

- allied vision technologies

- Other Key Players

For the Computer Vision Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

USD 12.1 Bn

Growth Rate

7.1%

Forecast Value in 2032

USD 25.73 Bn

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Computer Vision market in 2021?The Computer Vision market size is estimated to be US$ 12,123.72 million in 2021.

Q: What is the projected CAGR at which the Computer Vision market is expected to grow at?The Computer Vision market is expected to grow at a CAGR of 7.1% (2023-2032).

Q: List the segments encompassed in this report on the Computer Vision market?Market.US has segmented the Computer Vision market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Component, market has been segmented into Hardware and Software. By Product Type, the market has been further divided into Smart Camera-Based Computer Vision System and PC-Based Computer Vision System. By Application, market has been segmented into Quality Assurance & Inspection, Positioning & Guidance, Measurement, Identification, Predictive Maintenance, and 3D Visualization & Interactive 3D Modelling. By Vertical, the market has been further divided into Industrial and Non-Industrial.

Q: List the key industry players of the Computer Vision market?Cognex Corporation, Keyence Corporation, Intel Corporation, Matterport Inc., OMRON Corporation, National Instruments, Teledyne Digital Imaging Inc., Sony Semiconductor Solutions Corporation, and Other Key Players engaged in the Computer Vision market.

Q: Which region is more appealing for vendors employed in the Computer Vision market?Asia Pacific is accounted for the highest revenue share of 40%. Therefore, the Computer Vision industry in Asia Pacific is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Computer Vision?The U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, and Brazil are key areas of operation for Computer Vision Market.

![Computer Vision Market Computer Vision Market]()

- Cognex Corporation

- Keyence Corporation

- Intel Corporation

- Matterport Inc.

- OMRON Corporation

- National Instruments

- Teledyne Digital Imaging Inc.

- Sony Semiconductor Solutions Corporation

- sony corporation

- cadence design systems, inc.

- Teledyne Technologies International Corp Company Profile

- Basler ag(Germany

- allied vision technologies

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |