Global Construction Equipment Rental Market By Product Type (Loaders, Crawler Dozers, Cranes, Concrete Pumps, Others), By Equipment (Earthmoving, Material Handling, Road Building & Concrete), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Aug 2022

- Report ID: 40457

- Number of Pages: 395

- Format:

- keyboard_arrow_up

Report Overview

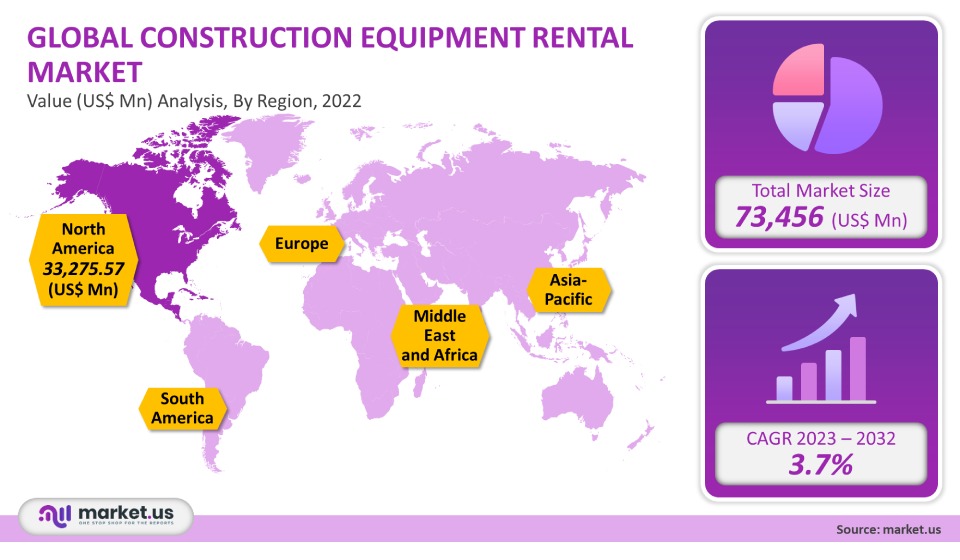

The global construction equipment rental market was valued at US$ 73,456 million in 2021. It is expected to grow at a CAGR of 3.7% between 2023 and 2032. The rise in government spending on public infrastructure development has accelerated construction and mining activities across emerging economies. This has led to a large demand for construction machinery on the market. Construction companies and contractors are shifting their focus to renting equipment due to rising prices for new machines. The market will continue to grow due to the increasing use of automation and advanced technologies. Market growth is expected to be driven by technological advances such as equipment service tracking and mapping, and digital service for automated services improvements. The market growth in construction equipment rental is influenced by many factors, including the pandemic. The pandemic of 2019-20 has caused disruptions in the global supply chain, closing down many production facilities. This adversely affected the infrastructure sector, and subsequently, the equipment rental market.

Global Construction Equipment Rental Market Scope:

Product type analysis

The segment crane is expected to see the greatest CAGR over the forecast period. This is due to the growing use of cranes in construction. Equipment rental companies account for 60-65% and 60% respectively of the crane fleet. This is a clear indication of the explosive growth in this segment during the forecast.

Equipment analysis

The global rental market for construction equipment is split into earthmoving, material handling, and concrete & roadway construction machinery segments. A major market share of 52% was held by the earthmoving machine segment in 2021. Segmental growth is due to the increased use of earthmoving excavators in the mining, agriculture, and construction industries. Other earthmoving equipment like crawler excavators or backhoes, as well as mini excavators, have a greater load capacity and higher engine performance. These properties make Earthmoving Equipment ideal for use in harsh environments. The growing demand for earthmoving equipment by contractors and construction firms has led to a greater interest in leasing it.

Between 2023 and 2032, concrete and road machinery will experience a 6.5% compound annual rate. Because of its importance in improving commerce and trade, road connectivity could be the key to the future economy. The U.S. federal government approved the Bipartisan Infrastructure deal (Infrastructure Investment and Jobs Act) on November 20, 2021. It allows for $110 billion in investment to repair roads and bridges within five years. Roads and streets will be made safer to reduce traffic deaths and improve connectivity. Many countries in the Asia Pacific, like India and China, focus on better road connectivity. China’s “One Belt, One Road,” initiative will connect China to European countries. The estimated total cost of the project is US$1.3 trillion. The new budget 2022-22-23 reveals that the Indian government plans to invest $529.7billion to improve road connectivity through new highways. This is why the increasing investments in mega roads and highway construction projects by the Indian government are expected to increase demand for concrete and road-construction machinery all over the world.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Loaders

- Cranes

- Concrete Pumps

- Crawler Dozers

- Others

By Equipment

- Material Handling

- Earthmoving

- Road Building & Concrete

Market Dynamics:

The market experienced higher growth in 2021 due to many rental companies taking advantage of the uncertainty resulting from pandemics. Construction activities have been moving at an irregular rate since each Covid-19 attack, which has led to small and medium-sized companies renting the equipment rather than purchasing them. Inflation in raw material prices, shortage of skilled labor, and high-interest rates are all factors that will increase uncertainty in construction. This will likely lead to more rental equipment being adopted in the market.

The performance and efficiency of construction machines have been greatly improved by the rapid technological developments in the automobile and heavy-equipment sectors. Major players in the market for equipment are focusing on creating smarter machines through the incorporation of propriety tech systems. The Telematics system allows for quick information about both the location and the level of performance of the construction equipment. The system transmits information such as the engine hours idling time, GPS location, and fuel consumption. But, these systems are expensive and prohibitive for many small contractors and builders. Construction equipment rental services have solved this problem by taking out the ownership cost and offering rental options.

It is possible to rent construction equipment, which saves money on initial equipment, maintenance, and inventory. Renting equipment is more profitable because rental companies make more money by repairing and maintaining it. In order to increase their product and service offerings, rental companies offer remote support services.

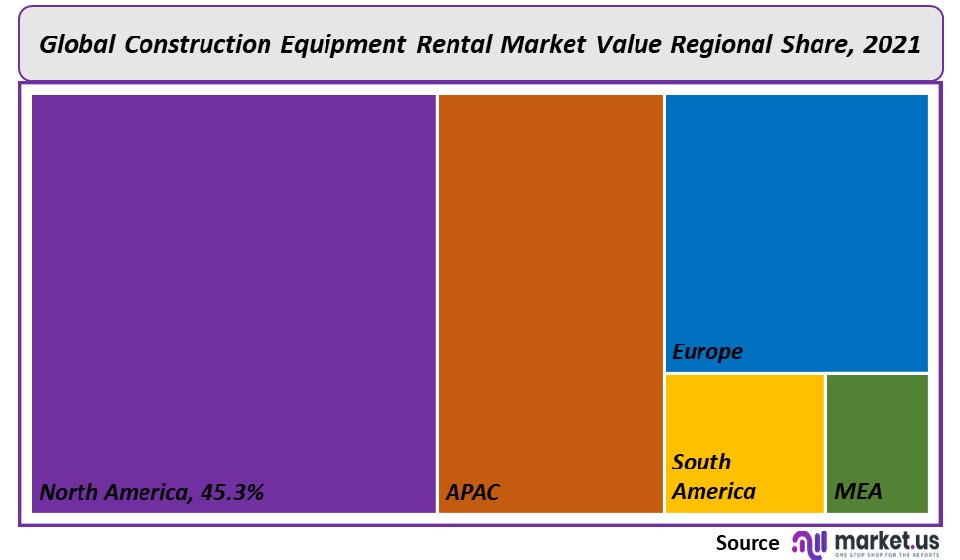

Regional Analysis

North America has a 45.3% market share in 2021. It is expected to continue its dominance in the future. The availability of highly-technologically advanced machinery for specific projects has contributed to the growth of construction equipment companies in the area. This equipment is highly preferred because it reduces operation time, eliminates the idle time, and optimizes overall construction or mining activity. There is a high demand for rental services and solutions from prominent U.S. construction equipment rental companies, including Ashtead Group and Ahern Rentals.

The Asia Pacific region will experience significant growth of 6.2% over the forecast period. In order to increase connectivity, and trade and boost the overall economy, the governments of the emerging Asian economies are investing heavily in the construction of highways, airports, and dams. These projects are attracting the attention of global construction equipment companies. They are highly motivated to invest and establish their business in the region. Caterpillar, Hitachi, and Liebherr are global construction equipment companies that provide their products, services, and products in the region.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

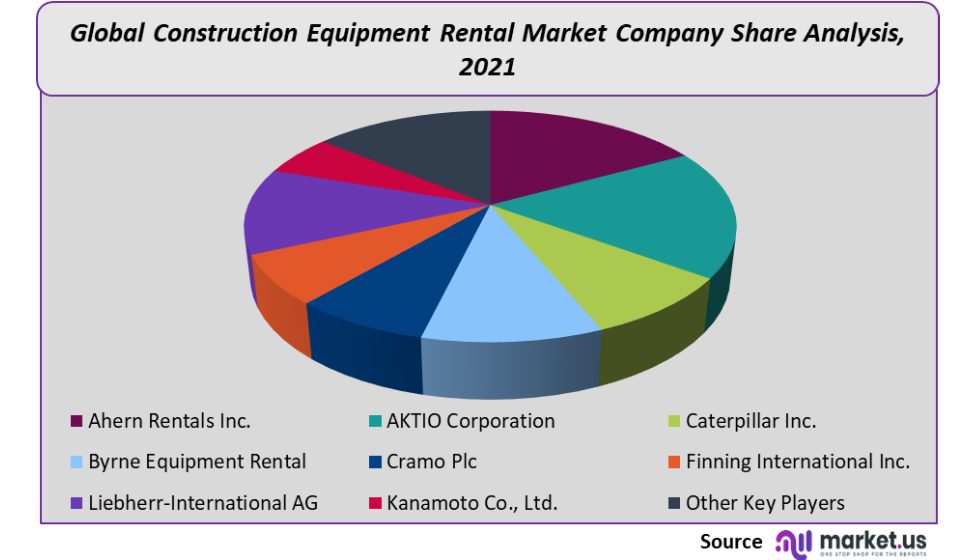

Global Construction Equipment Rental market prominent players Caterpillar Inc. Ashtead Group United Rental, Ahern Rentals Aktio Corp. are dominating the global market by 2021. To expand their market reach, these players implement strategies such as geographical expansion and new product launches. To be competitive in the market, they concentrate on expanding their product lines and increasing brand awareness. These companies often merge and acquire other companies to broaden their product lines and increase market share. Some prominent players in the construction equipment rental market include:

Маrkеt Кеу Рlауеrѕ:

- Ahern Rentals Inc.

- AKTIO Corporation

- Caterpillar Inc.

- Byrne Equipment Rental

- Cramo Plc

- Finning International Inc.

- Liebherr-International AG

- Kanamoto Co., Ltd.

- Other Key Players

For the Construction Equipment Rental Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Construction Equipment Rental market in 2021?The Construction Equipment Rental market size is US$ 73,456 million in 2021.

Q: What is the projected CAGR at which the Construction Equipment Rental market is expected to grow at?The Construction Equipment Rental market is expected to grow at a CAGR of 3.7% (2023-2032).

Q: List the segments encompassed in this report on the Construction Equipment Rental market?Market.US has segmented the Construction Equipment Rental market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Loaders, Crawler Dozers, Cranes, Concrete Pumps, Others. By Equipments, the market has been further divided into Earthmoving, Material Handling, Road Building & Concrete.

Q: List the key industry players of the Construction Equipment Rental market?Ahern Rentals Inc., AKTIO Corporation, Caterpillar Inc., Byrne Equipment Rental, Cramo Plc, Finning International Inc., Liebherr-International AG, Kanamoto Co., Ltd., and Other Key Players engaged in the Construction Equipment Rental market.

Q: Which region is more appealing for vendors employed in the Construction Equipment Rental market?North America accounted for the highest revenue share of 45.3%. Therefore, the Construction Equipment Rental industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Construction Equipment Rental?The US, Canada, Mexico, and Others., are key areas of operation for Construction Equipment Rental Market.

Q: Which segment accounts for the greatest market share in the Construction Equipment Rental industry?A: With respect to the Construction Equipment Rental industry, vendors can expect to leverage greater prospective business opportunities through the earthmoving segment, as this area of interest accounts for the largest market share.

![Construction Equipment Rental Market Construction Equipment Rental Market]() Construction Equipment Rental MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample

Construction Equipment Rental MarketPublished date: Aug 2022add_shopping_cartBuy Now get_appDownload Sample - Ahern Rentals Inc.

- AKTIO Corporation

- Caterpillar Inc.

- Byrne Equipment Rental

- Cramo Plc

- Finning International Inc.

- Liebherr-International AG

- Kanamoto Co., Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |