Global Corneal Implants Market By Type (Intracorneal Ring Segments (ICRS), and Keratoprosthesis), By Application (Hospitals, Diagnostic Laboratories, Research & Academic Laboratories, and others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 61508

- Number of Pages: 255

- Format:

- keyboard_arrow_up

Corneal Implants Market Overview

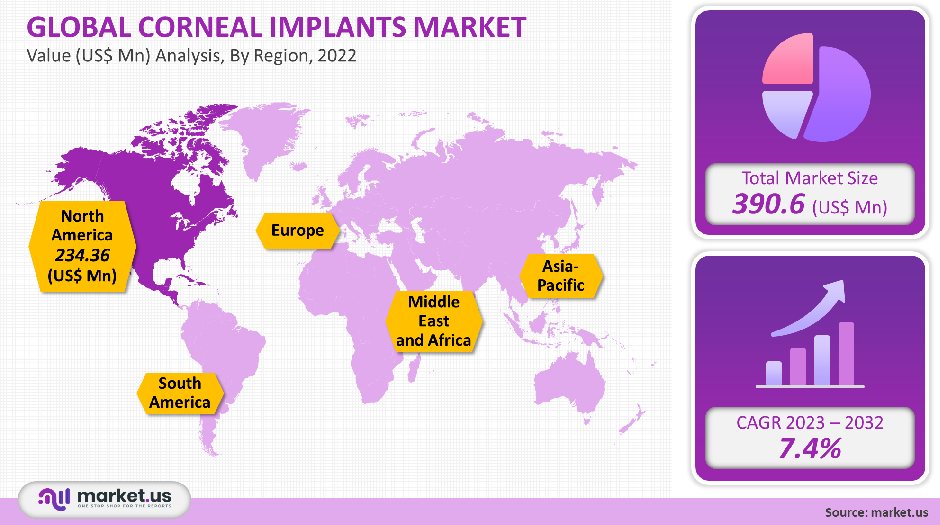

The global market for corneal implants was valued at USD 390.6 million in 2021 and is projected to experience a CAGR of 7.4% between 2022-2032.

The key driver of market growth is the rising incidence of ophthalmic disorders such as Fuchs dystrophy, Keratoconus, and infectious keratitis.

The NCBI report states that approximately 10-15% of patients diagnosed with Keratoconus will need to undergo a corneal transplant procedure. Corneal blindness affects 10,000,000 people worldwide and is the third leading cause of blindness after glaucoma or cataract. An estimated 200,000 corneal transplant procedures are performed annually.

While this is true, there are still 12.7 million patients who need corneal implant procedures. The gap between demand and supply for corneal implants is expected to drive market growth during the forecast period.

Global Corneal Implants Market Analysis

Type Analysis

The fastest CAGR for the synthetic type segment is 7.7% between 2023 and 2032. These implants are known as artificial corneas.

They can be classified into semi-synthetic (collagen-based), purely synthetic(Polymethyl Methacrylate, PMMA), or titanium-based. Segment growth will be driven by the decreasing availability of human corneas and the increasing incidence of visual impairment caused by corneal opacification.

The market share for human corneas was more than 45% in 2021. It is expected that the segment will grow at a healthy CAGR during the forecast period. The largest market share comes from enhanced visual acuity (VA), which results in a high success rate, reported at as high as 95%, with few repeated follow-ups.

Surgery Method Analysis

Penetrating Keratoplasty held a significant market share in 2021 and will continue to be dominant for the foreseeable future. The segment for endothelial and keratoplasty will see the highest CAGR between 2023-2032. Because of its safety record and effectiveness, penetrating Keratoplasty is the most popular procedure for corneal surgery.

The Eye Bank Association of America reports that 48% of corneas produced by the eye bank were used to perform keratoplasty. The availability of other promising methods has led to a slow decline in its popularity.

The market share of the product will be maintained due to its relative advantage over more modern approaches such as its ability to avoid stromal interface and its efficiency in treating large central perforations.

Endothelial corneal keratoplasty (EK) is the most recent method of corneal transplant. This involves replacing only the affected tissue, and not the whole thickness.

This allows for faster and more effective visual restoration, with a lower chance of infection and accidents to your eye surface. Fuchs Dystrophy is on the rise and the segment is expected to grow significantly over the forecast period.

Corneal Implants Market End-User Analysis

Hospitals held the largest market share, with over 56%, in 2021. They are expected to enjoy a healthy CAGR over the forecast period. This segment is expected to grow due to the availability of highly skilled surgeons, a rising number of patients, and access to transnational eyes banks.

Ophthalmic centers accounted for the second-largest market share in 2021. They are expected to experience a healthy growth rate during the forecast period.

This segment will be driven by a growing number of ophthalmologists who are entering the field, a greater acceptance of keratoprosthesis, shorter wait times, and an increase in the number of doctors accepting it.

The Ambulatory and Surgical Center (ASC), segment is predicted to experience the greatest CAGR over the forecast time. Corneal implant procedures can be done in most hospitals as outpatient procedures.

It is expected that its popularity will increase in ASCs due to its single-day nature. These centers receive funding from both the public and private sectors.

Corneal Implants Market Application Analysis

The segment Fuchs dystrophy held a considerable market share in 2021. It is projected to grow at the fastest CAGR over the forecast period.

Fuchs Dystrophy is expected to see a rise in the aging population. Keratoconus was also a major market player in 2021. According to the Cancer Research Foundation of America (CRFA), one in five keratoconus sufferers will reach the point where a corneal transplant is required to restore normal sight.

The growth of the segment is expected to be boosted by FDA-approved corneal implants and advanced corneal procedures such as Deep Anterior Lamellar Keratoplasty. Fuchs dystrophy (keratoconus), corneal ulcers (corneal ulcers), keratoconus, and Fuchs disease are some of the applications.

Other segments include the use of corneal implants for post-surgical cataract edema and congenital corneal opaqueness, as well as mechanical or chemical damage to corneas.

Key Market Segments

By Type

- Human Cornea

- Synthetic

By Surgery Method

- Penetrating Keratoplasty

- Endothelial Keratoplasty

By Application

- Keratoconus

- Fuchs Dystrophy

- Infectious Keratitis

- Corneal Ulcers

- Other Applications

By End-user

- Hospitals

- Ophthalmic Center

- Ambulatory Surgical Center

Corneal Implants Market Dynamics

Due to their high demand, collagen-based bioengineered artificial corneas are in high demand. LinkCor, a linkoCare Life Sciences Ltd. collagen-based artificial cornea, is being considered a replacement for human corneas.

Market growth is expected to be boosted by increased awareness of the importance of eye donation. Market growth can also be supported through the development of improved eye care facilities and eye banking infrastructures in developing countries.

Corneal Implants Market Regional Analysis

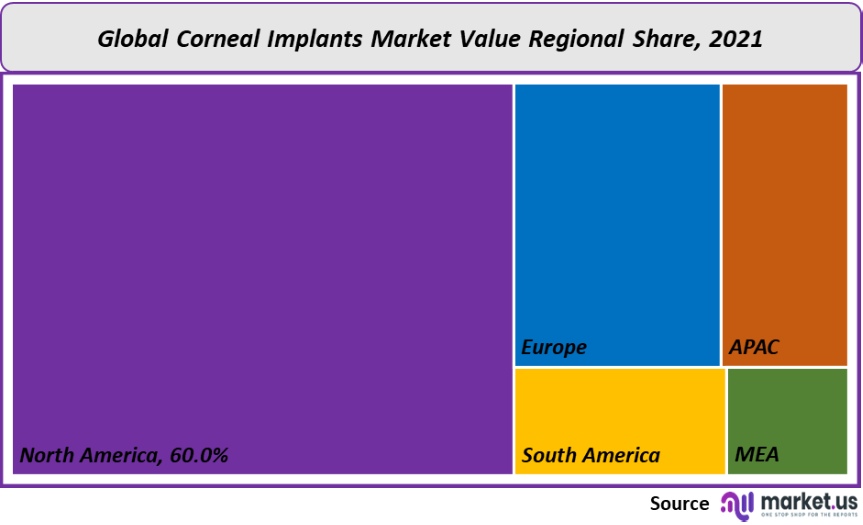

North America held 60% of the market share in 2021, which was the largest. These factors include the proximity to major market players, the availability of reimbursement policies, and the increased R&D activity related to corneal implant research.

CorneaGen and the Institute of Regenerative Medicine have teamed up to develop corneas based on the replication of embryonic stem cells. Europe had the second-largest market share for 2021. In Europe, the second-largest market share was held by Italy in 2021.

A decrease in corneal transplants has led to a shortage of corneal tissue. The cost of importing cornea from another country is high and should be comparable to the local resources.

In view of this, the Optout system for organ donation has been adopted by all countries in the region. It promotes corneal donation and drives market growth.

The Asia Pacific will likely be the fastest-growing area over the forecast period. Market growth is expected to be driven by the existence of many emerging markets as well as unmet clinical needs in countries such as China, Indonesia, and the Philippines.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

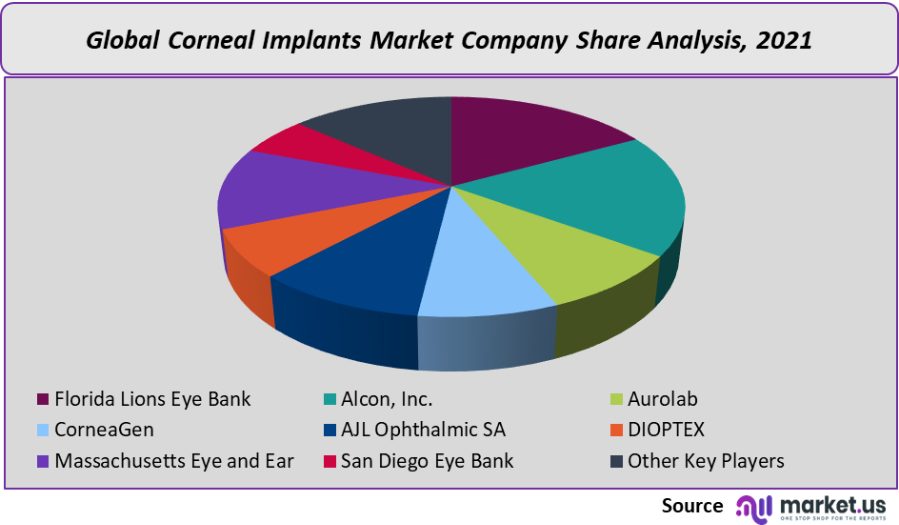

Key Companies & Market share Analysis:

Globally, the market is fragmented. Major companies are using various business strategies to increase their market share, including mergers and acquisitions and product launches.

CorneaGen was able to raise USD 25 million in equity funding for its global market expansion plan by raising $25 million in October 2019.

Key Market Players:

- Florida Lions Eye Bank

- Alcon, Inc.

- Aurolab

- CorneaGen

- AJL Ophthalmic SA

- DIOPTEX

- Massachusetts Eye and Ear

- San Diego Eye Bank

- Other Key Players

For the Corneal Implants Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Corneal Implants Market Products market size in year 2021?A: The Corneal Implants Market Products market size was $390.6 million in 2021.

Q: What is the CAGR for the Corneal Implants Market Products market?A: The Corneal Implants Market Products market is expected to grow at a CAGR of 7.4% during 2023-2032.

Q: What are the segments covered in the Corneal Implants Market Products market report?A: Market.US has segmented the Corneal Implants Market Products market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Type, the market has been segmented into human cornea and synthetic. By Surgery method, the market has been further divided into penetrating keratoplasty, and endothelial keratoplasty. By Application, the market has been further divided into keratoconus, fuchs dystrophy, infectious keratitis, corneal ulcers, and other applications.

Q: Who are the key players in the Corneal Implants Market Products market?A: Florida Lions Eye Bank, Alcon, Inc., Aurolab, CorneaGen, AJL Ophthalmic SA, DIOPTEX, Massachusetts Eye and Ear, San Diego Eye Bank, KeraMed, Inc., Alabama Eye Bank, Inc., and Other Key Players

Q: Which region is more attractive for vendors in the Corneal Implants Market Products market?A: North America is the region having largest revenue share of 60% among the others. Therefore, North America Corneal Implants Market Products market is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Corneal Implants Market Products ?A: Key markets for Corneal Implants Market Products are the US, Canada, Mexico, etc.

Q: Which segment has the largest share in the Corneal Implants Market Products market?A: In the Corneal Implants Market Products market, vendors should focus on grabbing business opportunities from the hospitals application segment as it accounted for the largest market share in the base year.

![Corneal Implants Market Corneal Implants Market]()

- Florida Lions Eye Bank

- Alcon, Inc.

- Aurolab

- CorneaGen

- AJL Ophthalmic SA

- DIOPTEX

- Massachusetts Eye and Ear

- San Diego Eye Bank

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |