Global Craft Beer Market; By Product Type (Ale and Lagers), By Distribution Channel (On-Trade and Off-Trade), By Age Group, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2022-2032

- Published date: May 2022

- Report ID: 13559

- Number of Pages: 253

- Format:

- keyboard_arrow_up

Craft Beer Market Overview:

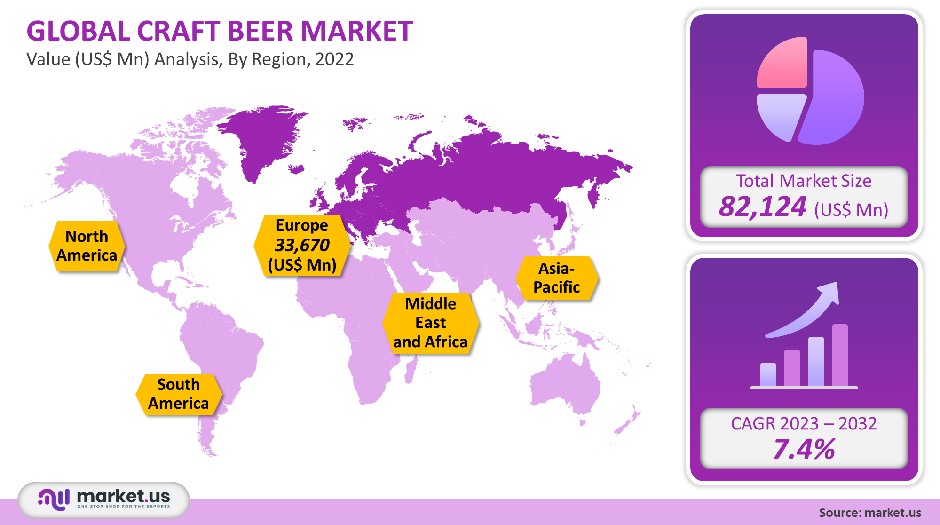

In 2021, the global market for craft beer was valued at USD 82,124 million. This industry is expected to grow at a CAGR rate of 7.4% over the forecast period, 2023-2032.

This is due to increased product penetration in countries such as South Africa, Australia, and New Zealand. Market growth is expected to be driven by a growing consumer inclination for flavored, low-ABV beers.

Over the forecast period, demand is slated to be driven by increasing awareness of the wide variety of styles and flavors of craft beer. This is due to the low alcohol content, Alcoholic strength by Volume (ABV). This market will also benefit from the increasing number of craft beer lovers in the U.S., Germany, and Belgium, as well as in the UK and Japan. As per the brewers association study, in US total brewery sales went down in May by 30.5% compared to the previous year.

Market Scope:

Product Type Analysis

Ale accounted for the highest market share of craft beer of all product types. Furthermore, the ale market can be divided into brown ale, pale ale, Scottish-style ale, and porters. Over the years, most beer-loving customers have developed a preference for traditional beers like a pale ale, porters, or stout. Some of the major players in the global beer industry have decided to bring back traditional beers. Heineken, for example, launched a new brand of craft beer in the UK in 2019.

Distribution Channel Analysis

The market share for craft beer was higher in the on-trade segment. On-trade outlets include bars, restaurants, coffee shops, and clubs. On-trade distribution and sales practices are very different from those used in the off-trade market. The on-trade market continues to be dominated by the bar/restaurant manager and any trade professional (bartenders and waiters) who play a crucial role in the sales process.

On-trade launches that offer tasting rooms, tiki bars, and brewpubs provide a more luxurious and comfortable experience for customers. This is what drives millennials to increase their pub and bar culture. This encourages growth in the craft beer market.

Age-wise Analysis

21-35, 40-54, and 55 years and over. Those between the ages of 21 and 35 are referred to as millennials. This demographic has played a major role in shaping the product and service offerings of many industries. Millennials are the main customers in the global craft beer market. Craft beer brewers are constantly working to improve their product offerings in order to cater to the diverse tastes and preferences of the millennial market. The global craft beer market is expected to grow in the future, thanks to the growing number of millennials.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Ale

- Lager

By Distribution Channel

- On-Trade

- Off-Trade

By Age Group

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

Demand Analysis:

Market.US, an intelligence and market research provider, proposes that the global craft beer market will grow by almost 7.4%, between 2023 and 2032. Every day, craft beer culture increases in prominence. Without consumers and brewers, craft beer culture wouldn’t exist.

Sales fell dramatically during the onset of the pandemic, particularly in the first half of 2020. Global lockdowns hampered supply chains and disrupted logistic arrangements that made the product available to customers. These restrictions were eventually lifted as the rate of infection declined, subsequently leading to an improvement in sales.

There is a community of craft beer lovers who are passionate about beer and love to celebrate it. People now drink craft beer more often because they love sampling new types of beer.

Market Dynamics:

Drivers

“Increasing health-conscious consumers is key to the growth of this market.”

Craft beer is made in small breweries using natural, locally sourced ingredients, and as such has been found to have many health benefits. Beer’s creativity and variety are the reasons beer continues to grow in popularity.Recent advancements in craft beer development have led to the integration of Go-green technology in beer production. This has helped to increase market growth and decrease overall waste. Over the last few years, canning has played a significant role in the growth of craft beer.

The rise of bars and restaurants in cities is driving up the demand for craft beer. Due to the proliferation of social trends among millennials, there has also been a surge in the number of craft breweries.

Canning is a seven-step process that has been proven to be technologically beneficial for small beer breweries. A spike in awareness among millennials and health-consciousness individuals concerning non-alcoholic craft beer has led to an increase in sales.

Restraints

“Accessibility to other alcoholic craft drinks may hamper growth.”

While alcoholic beverages are very popular, there are other alcoholic craft beverages such as gin or whiskey that are limiting market growth potential. Consumers are open to trying new types of craft spirits and there is a growing demand for them. Other alcoholic craft drinks can also be more diverse than this alcoholic beverage. They are subject to multiple distillation processes in order to make high-quality liquor. There are many flavors available in alcoholic craft beverages, including grapefruit, raspberry, and lemon, among others. This also limits the market growth.Opportunities

Consumers are more conscious about their health and tend to gravitate towards low-alcohol beverages. Due to the increased competition from better-tasting, lower-alcohol beverages, the sale of zero-alcohol and low-alcohol beers is on the rise.

Due to increasing awareness of alcohol consumption and the desire for new beverages, ciders and beers that have low alcohol levels are becoming more popular. This can be seen in record-breaking sales at both the off-license and supermarket levels of low-alcohol beverages in the United Kingdom.

Low-alcohol beers or those that have less than 2.8% ABV are also more affordable. Low-alcohol beer may be more popular than craft beer and offers significant growth potential.Craft Beer Market Trends

Cannabidiol (CBD) is rapidly gaining consumer interest. Infused beverages are also quickly becoming a market favorite. New product launches and strategic mergers are key trends in the craft beer market.

This industry is expanding as new breweries are being opened all over the world. Brewers are constantly creating new products to meet, if not supersede, consumer demand. To stay ahead of their competitors, these brewers aim to create new styles of craft beer. Infused with CBD, the non-psychoactive component of cannabis. Long Trail Brewing Company in Vermont has launched a limited-edition line IPAs and APAs brewed using hemp oil. CBD-infused beer is becoming more popular because it has a mildly bitter flavor and lower calories than traditional hops beers. The hop’s flavor is enhanced by the terpenes’ citrus notes.Regional Analysis

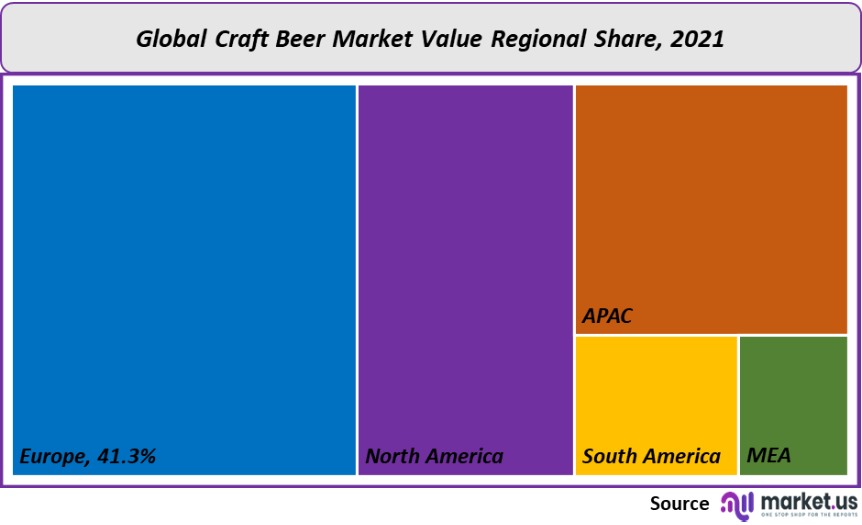

Europe will account for the largest share of the market with 41.3% in volume and value. High consumption and preference for flavored beverages are anticipated to continue to drive the projected growth trajectory of the craft beer market. Germany and the UK are the largest consumers of this spirit, accounting for more than 25% of total revenues. In the U.S. the rapid expansion of craft breweries is an important factor contributing to regional market growth.

The fastest growing regions will be the Middle East & Africa, Central & South America, and Brazil due to the increased product penetration. Due to their low ABV, and wide range of flavors, these countries are expected to experience strong market growth. The United Arab Emirates will see a significant increase in its penetration over the next nine years. This will allow for greater market growth prospects.

The shift in preference for craft beer over mainstream beer is expected to boost markets in North America. The US is expected to be the country with the market’s major share, as it is the fastest growing nation, product consumption-wise, in this region.

Key Regions and Countries Covered In This Rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

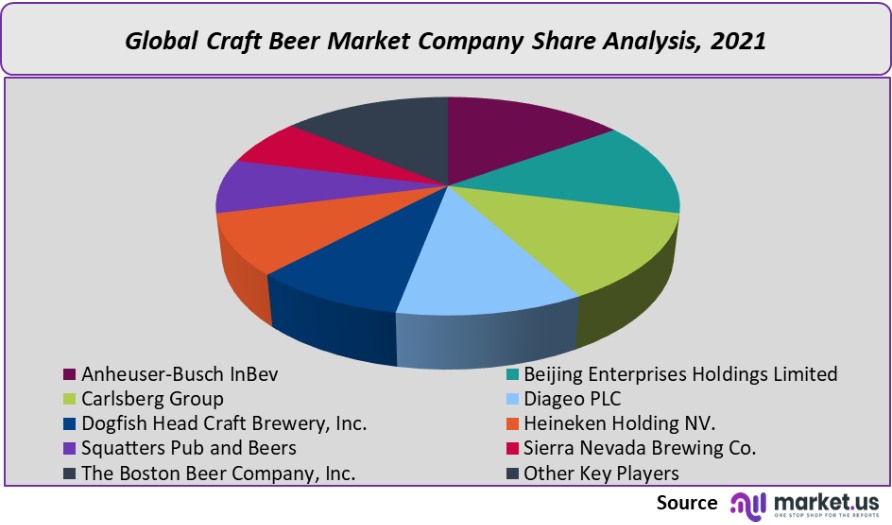

Two key strategies are used by major market players to expand their global reach: product innovation and the introduction of their products in high-potential countries. D.G. Yuengling and Son, The Boston Beer Company, The Gambrinus Company, as well as Chimay Beers and Cheeses are apt examples.

Companies like Chimay Beers and Cheeses have a near monopoly of the local market because they are globally present. In 2021, Buxton brewery created a new brand name as bishop and launched a new craft beer containing a fruity taste, vibrant, catering to the young consumers in the UK. Boston Beer Company distributes through direct and indirect trade channels and outsources production.

Маrkеt Кеу Рlауеrѕ:

- Anheuser-Busch InBev

- Beijing Enterprises Holdings Limited

- Carlsberg Group

- Diageo PLC

- Dogfish Head Craft Brewery Inc.

- Heineken Holding NV.

- Squatters Pub and Beers

- Sierra Nevada Brewing Co.

- The Boston Beer Company Inc.

- United Breweries Limited

- Other Key Players

For the Craft Beer Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

For the Craft Beer Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the craft beer market in 2021?The Craft beer market size is US$ 82,124 million in 2021.

What is the projected CAGR at which the Craft beer market is expected to grow at?The Craft beer market is expected to grow at a CAGR of 7.4% (2023-2032).

List the segments encompassed in this report on the Craft beer market?Market.US has segmented the Craft beer market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Product Type, the market has been segmented into Ale and Lagers. By Distribution Channel, the market has been further divided into On-Trade and Off-Trade. By Age Group, the market has been further divided into 21–35 Years Old, 40–54 Years Old, and 55 Years and Above.

List the key industry players of the Craft beer market?Anheuser-Busch InBev, Beijing Enterprises Holdings Limited, Carlsberg Group, Diageo PLC, Dogfish Head Craft Brewery, Inc., Heineken Holding NV., Squatters Pub and Beers, Sierra Nevada Brewing Co., The Boston Beer Company, Inc., United Breweries Limited, Bells Brewery Inc., and Other Key Players engaged in the Craft beer market.

Which region is more appealing for vendors employed in the Craft beer market?Europe is expected to account for the highest revenue share of 41.3%. Therefore, the Craft beer industry in Europe is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Craft beer?UK, Japan, India, China, The US, Canada, & Germany are key areas of operation for the Craft Beer Market.

Which segment accounts for the greatest market share in the Craft beer industry?With respect to the Craft beer industry, vendors can expect to leverage greater prospective business opportunities through the Ale segment, as this area of interest accounts for the largest market share.

![Craft Beer Market Craft Beer Market]()

- Anheuser-Busch InBev

- Beijing Enterprises Holdings Limited

- Carlsberg Group

- Diageo PLC

- Dogfish Head Craft Brewery Inc.

- Heineken Holding NV.

- Squatters Pub and Beers

- Sierra Nevada Brewing Co.

- The Boston Beer Company Inc.

- United Breweries Limited

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |