Global Craft Spirits Market By Product (Vodka, Whiskey, Rum, Other Products), By Distribution Channel (On-trade and Off-trade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 66158

- Number of Pages: 296

- Format:

- keyboard_arrow_up

Craft Spirits Market Overview:

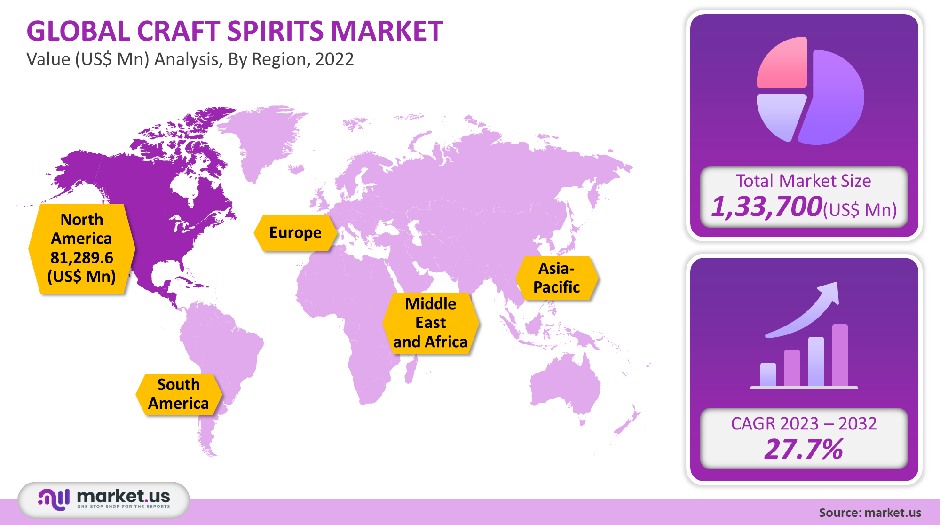

The global craft spirits industry was valued at USD 1,33,700 million in 2021. From 2023 to 2032, it is expected that it will grow at a CAGR of 27.7%.

The market’s growth is primarily due to rising demand and the increase in craft distilleries. Also, rising disposable incomes are a major factor. Market growth will be driven by a millennial population with high purchasing power.

Global Craft Spirits Market Scope:

Product type analysis

The whiskey market was the most dominant and accounted for 45.8% of global revenue for 2021. This is due in part to the exceptional and unique flavor the above-mentioned product domain provides. Whiskey was able to offer certain medical welfare over the years due to product improvements.

The offering of whiskey is being extended by distillers adding many herbs and spices for both medical and flavor purposes. The whiskey’s high levels of polyphenols (an antioxidant) have been shown in studies to lower LDL cholesterol and increase HDL. The United States population has approximately 51% high levels of cholesterol. However, whiskey can lower that number.

Gin is predicted to grow at a 29.2% CAGR between 2023-2032. Brands are growing consumer demand by using regional botanicals and aged expressions.

Distribution Channel analysis

At a CAGR of 28.35% from 2023-2032, off-trade was considered the fastest rising channel for distribution. These categories include hypermarkets/supermarkets, micro-markets, convenience stores, spirit shops, and wine as well as supermarkets. These establishments provide significant discounts and offer exclusive incentives.

The market shares of the on-trade channel, which is estimated to reach 59.9% by 2021 will be its largest. It is due in large part to the increased sales of various ancillaries such as bars, restaurants, and pubs that have opened up. Customers also favor drinking craft spirits where they can make friends and bond with fellow students.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Vodka

- Gin

- Liqueur

- Rum

- Whiskey

- Other Product Types

By Distribution Channel

- On-trade

- Off-trade

Market Dynamics:

Licensee distillers produce craft spirits. They must be independently-owned businesses with less than 26% capital and operating control. The United States Tobacco and Trade Bureau and Alcohol Tax must certify the product’s label. This sector is concentrated in North America because of its high demand. Due to the positive sanction rules, investments have increased in the US at a very promising rate. In 2012, 13,867 new applications were submitted to the Tobacco and Alcohol Tax & Trade Bureau.

Generation Y was born in the 1980 & the 2000s. They are among the most influential customers of a wide variety of beverages, which includes craft spirits. Several craft distilleries closed down their tasting rooms in recent months to fulfill local and state health guidelines as they protect their employees.

A survey of over 300 American distilleries by the Distilled Spirits Council of the US revealed that August 2021 was the most popular month. In August 2021, the American Distilling Institute and the Distilled Spirits Council of the US conducted a survey of 300 American distilleries. It was discovered that only a small number of legal customers could open legal distilleries. It was significant to see a drop in sales at craft distilleries exceeding 40%. Nearly 25% stated that their tasting area was closed.

The US Craft Spirits Association states that even though COVID-19 had a negative impact on 2020, there’s still a large market for craft spirits. Surprisingly booze is the most resilient product, and it was not affected in any way by the pandemic. The quantity of craft distilleries has increased by 1.1% in the period August 2020-2021.

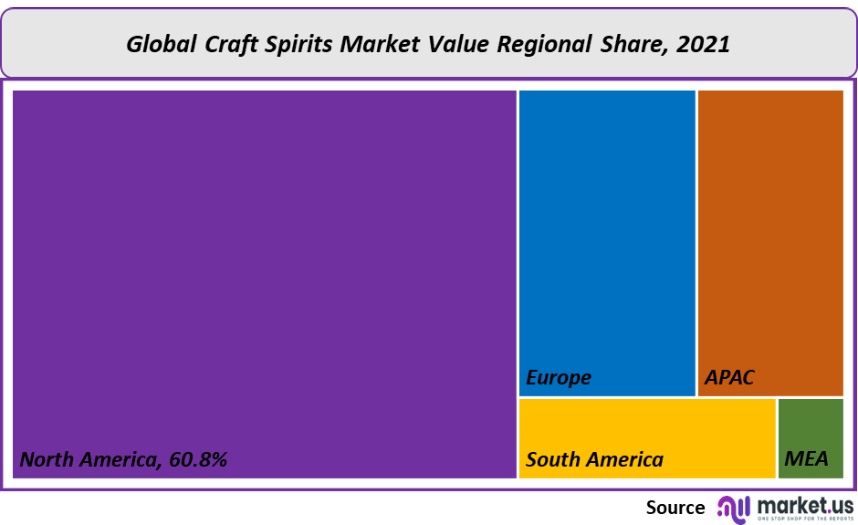

Regional Analysis

North America contributed the most to the world’s market with a contribution of 60.8% by 2021. In the future, demand will be driven by the region’s growing millennial population. The United States’ number of manufacturers has enlarged quickly due to secure sanction policies by regulatory agencies.

Asia Pacific is expected to see a significant CAGR between 2023-2032. Due to increasing purchasing parity, as well as the significant rise in the millennial generation in developing countries like China, Malaysia, India, & Thailand, the market will expand at the fastest pace. There is enormous potential in the underdeveloped markets of these countries, which could provide profitable openings for this region.

In the Asia Pacific, financially independent millennials live with their parents which allows them to spend more. This has led to millennials living in India and China spending more on easy activities. It is estimated that this will have an effect on the region’s craft spirit market.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

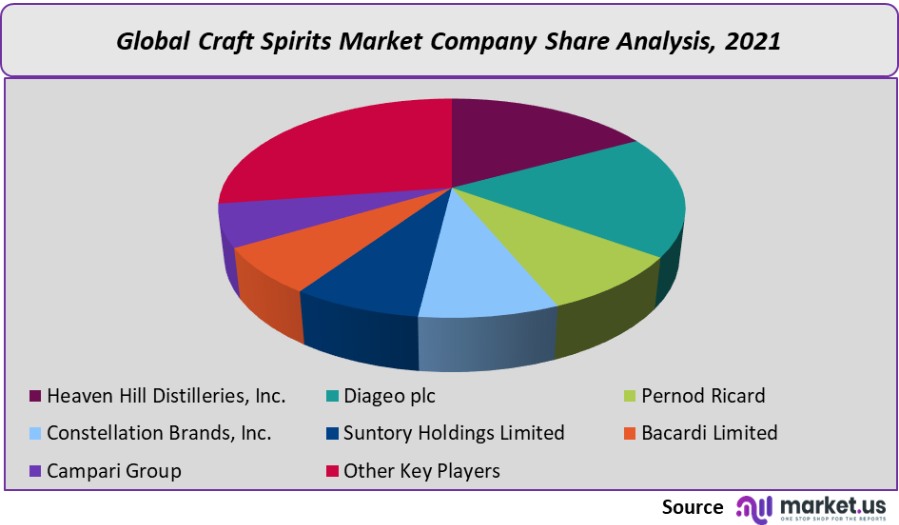

Market Share & Key Players Analysis:

International and domestic players can participate in this market. To improve their portfolio, the key market players are focused on strategies such as innovation and product launches in retail.

Diageo, the world’s largest alcohol company, today revealed plans for two new US$ 245 million distilleries in support of Crown Royal Canadian Whisky’s growth goals and momentum. It will utilize resource efficiency technology, and run on 100 % renewable electricity to ensure that the new distillery produces no waste and is carbon neutral.

Diageo plc, a global beverage company, launched its latest manufacturing plant in 2022. The facility features two high-speed can lines and the capability to produce more than 25 million cases of malt, spirits, Ready-to-Drink (RTD), and cocktails.

Маrkеt Кеу Рlауеrѕ:

- Heaven Hill Distilleries, Inc.

- Diageo plc

- Pernod Ricard

- Constellation Brands, Inc.

- Suntory Holdings Limited

- Bacardi Limited

- Campari Group

- Sazerac Company, Inc.

- Highwood Distillers

- Other Key Players

For the Craft Spirits Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Craft Spirits Market in 2021?A: The Craft Spirits Market size is estimated to be US$ 1,33,700 million in 2021.

Q: What is the projected CAGR at which the Craft Spirits Market is expected to grow at?A: The Craft Spirits Market is expected to grow at a CAGR of 27.7% (2023-2032).

Q: List the segments encompassed in this report on the Craft Spirits market?A: Market.US has segmented the Craft Spirits Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Whiskey, Vodka, Gin, Rum, Brandy, Liqueur, and Other Products. By Distribution Channel, the market has been further divided into On-trade and Off-trade.

Q: List the key industry players of the Craft Spirits market?A: Heaven Hill Distilleries, Inc., Diageo plc, Pernod Ricard, Constellation Brands, Inc., Suntory Holdings Limited, Bacardi Limited, Campari Group, Sazerac Company, Inc., Highwood Distillers, and Other Key Players engaged in the Craft Spirits market.

Q: Which region is more appealing for vendors employed in the Craft Spirits market?A: North America is expected to account for the highest revenue share of 60.8%. Therefore, the Craft Spirits Technology industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Craft Spirit?A: China, Japan, U.K., South Africa, Germany & The US, are key areas of operation for Craft Spirits market.

Q: Which segment accounts for the greatest market share in the Craft Spirits industry?A: With respect to the Craft Spirits industry, vendors can expect to leverage greater prospective business opportunities through the Whiskey segment, as this area of interest accounts for the largest market share.

![Craft Spirits Market Craft Spirits Market]()

- Pernod Ricard

- R?my Cointreau

- Diageo Plc

- Anchor Brewers & Distillers

- House Spirits

- William Grant & Sons

- Rogue Ales

- Copper Fox Distillery

- Chase Distillery Ltd.

- Constellation Brands Inc.

- Woodinville Whiskey Co.

- Tuthilltown Spirits

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |