Global Cyber Insurance Market By Product Type Organization (SMB, and Large Enterprise), By Application (BFS, Healthcare, IT & Telecom, Retail, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 19718

- Number of Pages: 279

- Format:

- keyboard_arrow_up

Cyber Insurance Market Overview:

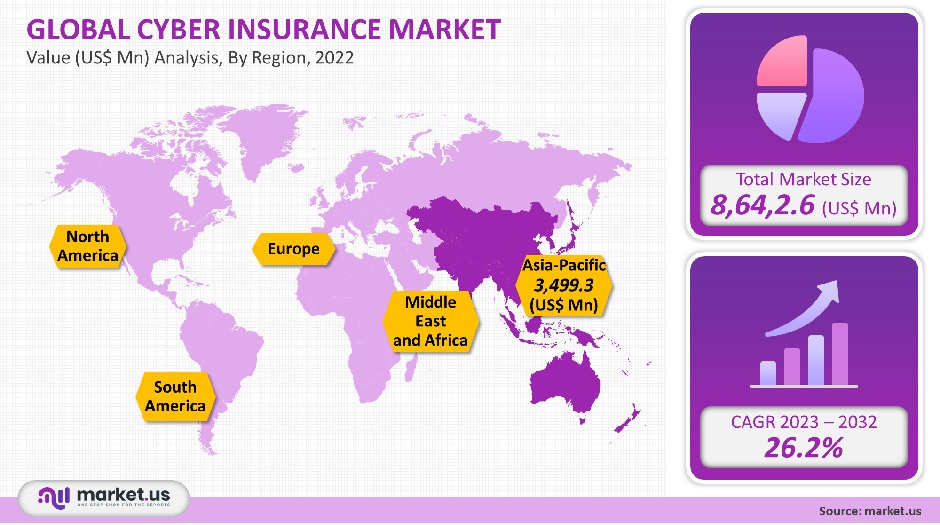

In 2021, the Global Cyber Insurance Market growth was worth USD 8,64,2.6 million. It is projected to grow at a 26.2% CAGR over the forecast period.

The increasing digitalization of businesses and economies has presented many challenges in managing digital security controls and privacy.

Global Cyber Insurance Market Scope:

Organization Analysis

Cyber-attacks can affect organizations of any size due to the rapid growth of technology trends like IoT, artificial intelligence, cloud technologies, big data, and machine learning. Businesses have been able to achieve their business goals and grow with the help of advanced technologies. These technologies, however, have opened up new avenues for attack due to digitalization.

In 2021, the large enterprise segment will dominate this market and continue to dominate the forecast period. Large enterprises have the greater spending power to implement robust cybersecurity solutions.

Large companies are rapidly adopting cyber insurance policies to reduce the risk of a cyberattack. Cyber insurance could also help improve computer security risk management within an organization. This will likely increase the segment’s growth during the forecast period.

SMBs (small and medium enterprises) are more susceptible to cyberattacks because they lack the security infrastructure. They are working to assess and mitigate emerging threats.

The cyber insurance industry can help such companies save money by providing first-party and third-party protection. These include digital asset loss or damage, business interruptions, theft, online extortion, customer notification cost, multi-media liability, and computer forensics investigation.

Application Analysis

In 2021, the largest share of the cyber insurance market was held by the banking and financial services (BFS). Due to increasing monetary operations, it has become a major industry. There are more, including large-scale breaches, cybersecurity incidents, frauds, and heists.

The security of financial services and banking is a particular concern as they are the backbone of many economies. Financial institutions and government agencies have quickly adopted the demand for cyber insurance claims and solutions in response to increasing threats and breaches. This is a way to reduce mounting losses and mitigate systemic risk for all organizations.

Over the forecast period, the healthcare application segment will experience the fastest growth. The widespread digitization of healthcare has created online vulnerabilities to allow customers easy access to their data.

Sensitive data is vulnerable to both internal and external threat actors. Over the past few years, hackers have made healthcare a target of choice. Cyberattacks make it easy for healthcare organizations to seek cyber insurance to help offset some losses.

Key Market Segments:

Organization

- SMB

- Large Enterprise

Application

- IT & Telecom

- BFS

- Healthcare

- Retail

- Other Applications

Market Dynamics:

Due to the rapidly rising incidence of cybercrimes and digital insurance frauds, threats, and data breaches, managing internet, and online risk has become a top priority for businesses. Even though companies have implemented robust cybersecurity solutions to curb and mitigate cyberattacks, the losses due to these breaches are still significant, impacting organizations’ profit margins.

According to the European Network and Data Security Agency’s Threat Landscape Report 2021, the average rate of a data breach was US$ 3.86 million, which is 6.4% more than in 2017. As a result of rising threats like identity theft, ransomware attacks, and information leakage, financial losses are expected to increase steadily. Businesses must eliminate cybersecurity risks and minimize their potential impact. As a viable alternative to strong cyber security, residual risk transfer has emerged.

Insurance plays an important role in helping consumers and businesses with cyber risk management. Policyholders also have financial protection against cyber-attacks that can’t be prevented completely.

Cyber insurance coverage protects companies from internet-based threats and provides policies that cover first-party losses due to hacking, theft, denial-of-service attacks, extortion, and data destruction. They also propose liability cyber incident coverage that covers losses due to omissions, defamation, and failure to protect data.

Cyber insurance is a valuable tool if a large-scale network security breach occurs. Market insurers require adequate cybersecurity to be eligible for coverage. Organizations must adopt cyber insurance policy coverages with appropriate online security and protection practices to receive lower premium rates. Insurance providers provide a flexible funding option to help recover from large losses. This reduces the need for government support.

It is becoming increasingly important to prioritize cyberattacks using a robust risk justification strategy. Organizations will be able to protect themselves against the potentially devastating consequences of cybercrimes by purchasing cyber insurance with the adoption of insurance policies.

Companies are also accepting cyber insurance to be more resilient to online pressures. However, general liability policies do not cover cyber losses. This will limit the market’s average growth, continuous growth, segmental growth, and regional growth.

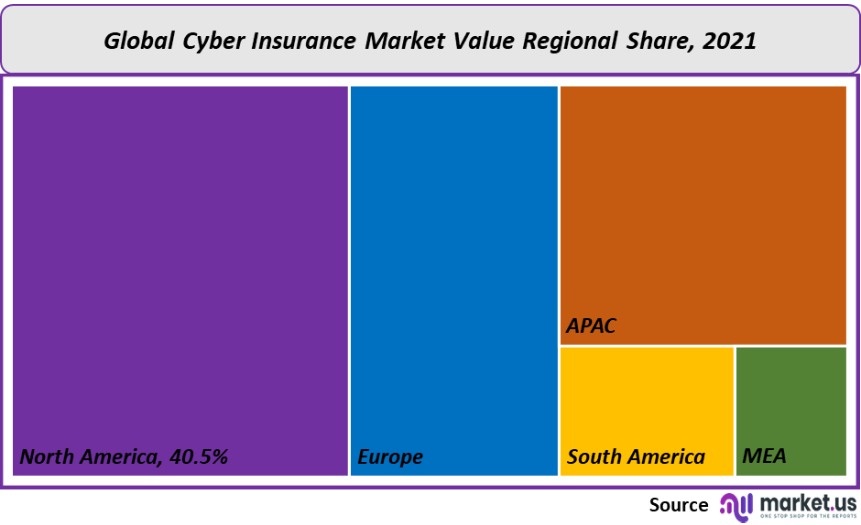

Regional Analysis

In 2021, the largest revenue share was held by North America. The presence of major players like Lockton Companies, Inc., American International Group, Inc., and The Chubb Corporation has contributed to the region’s growth. Demand is expected to rise due to increasing awareness among SMBs of cyber insurance requirements.

Asia Pacific is predicted to experience the fastest CAGR growth over the forecast period. Cybercrimes are rising in emerging countries like India, Australia, and China. These emerging economies have been forced to improve their cybersecurity due to the increasing role of Asian countries in the global economy.

Cyber insurance companies have been able to capitalize on this opportunity and offer policies to cover cyber risks and underwriting cyber products that will help improve their clients’ security strategies.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

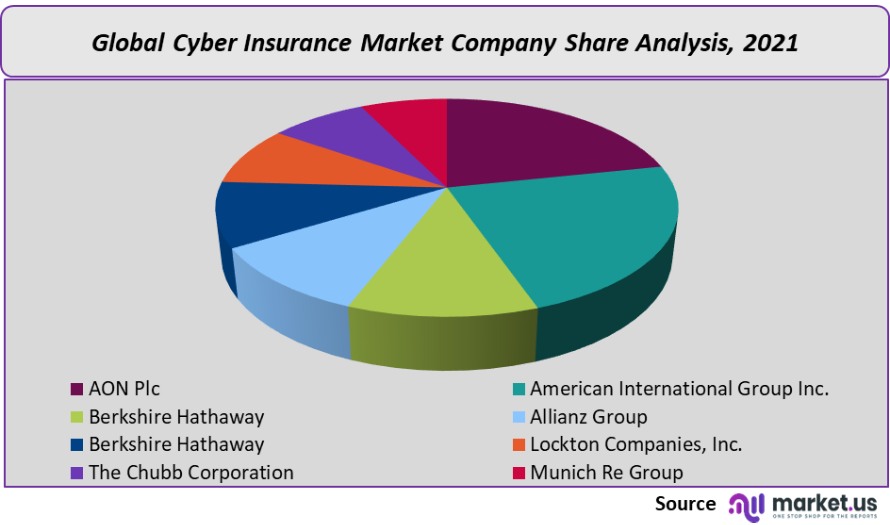

The global market is still in its infancy and protects organizations against digital cyber threats. Limited established insurance providers increase the market’s competitiveness. Insurers will have a significant opportunity to increase customer trust and cyber insurance developments uptake due to the increasing ransom demands for cybersecurity.

The market players are taking advantage of the changing online threat landscape to offer solutions that minimize the impact of successful attacks. To offer customized terms and conditions for their insurance products, market leaders are developing new ways to assess clients’ cyber risk.

Market Key Players:

- AON Plc

- American International Group Inc.

- Berkshire Hathaway

- Allianz Group

- Berkshire Hathaway

- Lockton Companies, Inc.

- The Chubb Corporation

- Munich Re Group

- Other Key Players

Frequently Asked Questions (FAQ)

Q: What is the Cyber Insurance market size in 2021?A: The Cyber Insurance size is US$ 8,64,2.6 Million for 2021.

Q: What is the CAGR for the Cyber Insurance?A: Cyber Insurance is expected to grow at a CAGR of 26.2% during 2023-2032.

Q: What are the segments covered in the Cyber Insurance report?A: Market.US has segmented the Global Cyber Insurance Value (Mn US$) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and the Middle East and Africa Organization wise SMB, Large Enterprise, Application wise BFS, Healthcare, IT & Telecom, Retail, and Other Applications.

Q: Who are the key players in Automotive Cyber Insurance roles?A: AON Plc, American International Group, Inc., Berkshire Hathaway, Allianz Group, Berkshire Hathaway, Lockton Companies, Inc., The Chubb Corporation, Munich Re Group, XL Group Ltd., and Zurich Insurance Co. Ltd. are the key players in cyber insurance.

Q: Which region is more attractive for vendors in Cyber Insurance?A: APAC will register the highest growth rate of 40.5% among the other regions. Therefore, Cyber Insurance in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Cyber Insurance?A: Cyber insurance markets are South Korea, Germany, and the US.

Q: Which segment has the largest share in Cyber Insurance?A: In Cyber Insurance, vendors should focus on grabbing business opportunities from large enterprise segments as they accounted for the largest market share in the base year.

![Cyber Insurance Market Cyber Insurance Market]()

- AON Plc

- American International Group Inc.

- Berkshire Hathaway

- Allianz Group

- Berkshire Hathaway

- Lockton Companies, Inc.

- The Chubb Corporation

- Munich Re Group

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |