Global Cyclohexane Market By Application (Adipic acid, Caprolactam, and Other Applications), By End-Use (Nylon 6, Nylon 66, and Other End-Uses) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 58832

- Number of Pages: 380

- Format:

- keyboard_arrow_up

Cyclohexane Market Overview:

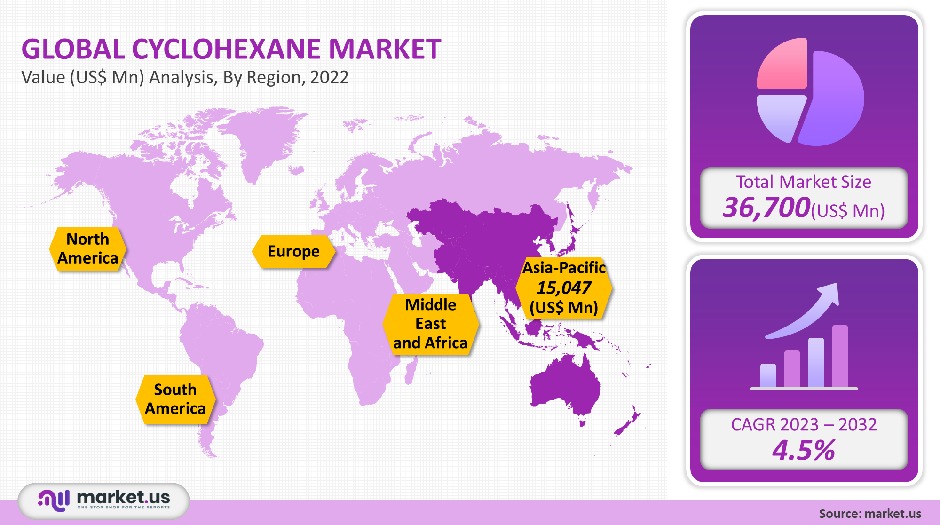

In 2021, the global market for cyclohexane was USD 36,700 million. It is expected to grow at a compound annual growth rate of 4.5% between 2023 and 2032.

The key driver of growth is expected to be the increasing use of cyclohexane in textile and automotive applications.

Cyclohexane, an intermediate product, is used to produce adipic Acid and Caprolactam. The global cyclohexane industry is experiencing significant growth due to increased applications of cyclohexane across a variety of industries and the increasing demand for nylon products in engineered and automotive plastics. It is also gaining popularity in the areas of food and beverage packaging, textile, electrical & electronic, and other industries. This has led to several regulations and legislative actions regarding safe use.

Global Cyclohexane Market Scope:

Application Analysis:

Cyclohexane can be used to make adipic and Caprolactam, which is then used to create many end-use products like nylon 6, nylon 66, and others. Nylon can be used as an end-use product to make threads that can be further processed into textile and clothing. Caprolactam is used as the primary feedstock to make nylon 6; however, adipic acids are used to make nylon 66.

Caprolactam prices are low because Asian plants operate at their maximum capacity. Post-shale gas boom, prices have fallen by more than 30%, leaving manufacturers bankrupt. The prices rose in 2023-2032 as manufacturers stopped producing. However, they have not reached the optimal level to make a profit.

For perfect supply-demand balance, it is possible that Asian producers will need to reduce their production by up to 50%. Prices hovered around USD 1.2-1.4 per kg in the first quarter of 2021, as global crude oil prices reached their highest peak. This resulted in producers making a low profit because operating costs were high in areas where energy costs were high.

End-Use Analysis:

The global nylon market is seeing aggressive acquisitions and mergers at the production level. Current trends show that nylon resin producers are considering the low cost of nylon for backward integration. This led to increased capacity in APAC, North America, and Europe.

The majority of nylon manufacturers produce nylon resins and Caprolactam, thus allowing them to position themselves at all stages of the nylon value chain. Due to increasing awareness among consumers, the global demand for nylon is changing. Nylon 6 was the largest end-use category and accounted for over 56% of total revenue for 2021.

Маrkеt Ѕеgmеntѕ:

By Application

- Adipic acid

- Caprolactam

- Other Applications

By End-Use

- Nylon 6

- Nylon 66

- Other End-Uses

Market Dynamics:

Technical ceramic is also known as advanced ceramic. It offers enhanced electrical, magnetic, thermal, and optical conductivity. Cyclohexane provides high efficiency and has helped end-users reduce production costs and energy consumption. Cyclohexane is most popular in the Asia Pacific, where they are consumed in large quantities.

In the United States, there is an increase in demand for cyclohexane due to a preference for lighter materials across various industries. The market is expected to grow due to increased production and consumption of these components and materials for the electronic and electrical sectors.

Market growth is expected to be further accelerated by the widespread use of cyclohexane in EVs. Piezo-ceramic parts, for example, act as sensors to transmit information about the engine’s operation.

Electronic components made from ceramic substrates receive the information and control motor management as well as safety systems such ABS, ASR, and airbag release. The market is expected to grow due to the increasing production of EVs in the future.

Regional Analysis

The Asia Pacific was the largest cyclohexane user; it accounted 41% of total revenue in 2021. The region’s emerging economies, including India and China, are undergoing major economic changes. Cyclohexane has been in high demand due to the growing population and rising living standards.

China is the world’s largest consumer and producer of cyclohexane. China’s rapid urbanization and strong economic growth have resulted in a vibrant cyclohexane industry. The country is seeing a shift away from traditional to bio-based cyclohexane manufacturing due to increasing awareness and rising disposable income.

Europe accounted for more than 25% of global volume in 2021. The industry will continue to be driven by increasing consumption in the U.S. and China’s easy quality regulations. The industry will also be driven by the availability of abundant raw materials over the forecast period.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

The global market for cyclohexane has a high level of competition and is very concentrated. The six largest companies accounted for the highest share of global production. The key players include Sinopec Limited and Sigma-Aldrich Corporation.

App development and customization are key elements to being competitive. There are frequent mergers to increase market share and diversify the application portfolio.

Маrkеt Kеу Рlауеrѕ:

- Sinopec Limited

- BASF SE

- BP PLC

- Koninklijke DSM N.V.

- Sigma-Aldrich Corporation

- СЕРЅА

- Сhеvrоn Рhіllірѕ Сhеmісаl

- ЕххоnМоbіl

- Нuntѕmаn

- Other Key Players

For the Cyclohexane Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the cyclohexane market size in 2021?A: The cyclohexane market size is US$ 36,700 million in 2021.

Q: What is the CAGR for the cyclohexane market?A: The cyclohexane market is expected to grow at a CAGR of 4.5 % during 2023-2032.

Q: What are the segments covered in the cyclohexane market report?A: Market.US has segmented the Global Cyclohexane Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Application, the market has been segmented into Adipic acid, Caprolactam, and Other Applications. By End-Uses, the market has been further divided into nylon 6, nylon 66, and other End-Uses.

Q: Who are the key players in the cyclohexane market?A: Sinopec Limited, BASF SE, BP PLC, Koninklijke DSM N.V., Sigma-Aldrich Corporation, СЕРЅА, Сhеvrоn Рhіllірѕ Сhеmісаl, ЕххоnМоbіl, Other Key Players, are the key vendors in the Cyclohexane market

Q: Which region is more attractive for vendors in the cyclohexane market?A: APAC accounted for the highest revenue share of 41% among the other regions. Therefore, the cyclohexane market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for cyclohexane?A: Key markets for cyclohexane are The U.S., Germany, U.K., China, India, Brazil, and GCC Region.

Q: Which segment has the largest share in the cyclohexane market?A: In the cyclohexane market, vendors should focus on grabbing business opportunities from the Caprolactam application segment as it accounted for the largest market share in the base year.

![Cyclohexane Market Cyclohexane Market]()

- Sinopec Limited

- BASF SE Company Profile

- BP PLC

- Koninklijke DSM N.V.

- Sigma-Aldrich Corporation

- СЕРЅА

- Сhеvrоn Рhіllірѕ Сhеmісаl

- ЕххоnМоbіl

- Нuntѕmаn

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |