Global Defibrillator Market By Product (Implantable Cardioverter Defibrillators (ICD), External Defibrillators (ED)), By End-use (Pre Hospital, Hospital, Alternate Care Market), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 19315

- Number of Pages: 335

- Format:

- keyboard_arrow_up

Defibrillator Market Overview:

The Defibrillator Market Market size is expected to be around USD 24.19 Bn by 2031 from USD 10.90 Bn in 2021, growing at a CAGR of 8.3% during the forecast period 2021 to 2031.

Defibrillators deliver an electric shock or pulse to the heart to restore a normal heartbeat.

This market is driven by increasing product development, an increase in sudden cardiac arrest, and growing awareness. Governments and healthcare organizations have also been supportive. Rapid Response Revival Research Ltd., an Australian company, received a CE marking in 2021 for its CellAED-the first personal AED designed for home use. This was a major step in the company’s growth strategy.

Global Defibrillator Market Scope:

Product Analysis

With a market share of more than 71%, implantable cardioverter-defibrillators were the dominant segment in 2021. These devices are being increasingly adopted due to high rates of cardiovascular disease, high geriatric populations in key markets, and large companies’ product improvements. Medtronic reported that its compatible Claria CRT–D devices were still being accepted and expanded in 2020.

In addition, strong growth was recorded for the Crome & Cobalt CRT-D portfolio and ICDs. Over the forecast period, the segment of external defibrillators is expected to experience the fastest annual growth rate at 10.02%. This is partly due to technological advances and public access initiatives to AEDs.

A bill (Public Access) to increase availability and accessibility to AEDs in the U.K. will soon be introduced. If the bill passes, it will be mandatory to place defibrillators in public places. This will increase the demand for AEDs. There are already favorable regulatory policies and initiatives from public and private health agencies to increase public access to defibrillators in many key markets including the U.S. and Canada.

End-Use Analysis

In 2021, hospitals held the highest revenue share at over 81.01%. This is brought on by the rise in the number of cardiac patients receiving hospital care and the rise in hospital-based operations. Hospitals are increasingly using ICDs and external Defibrillators to treatment to patients with sudden cardiac arrest or for other purposes.

Defibrillators have been installed in public places like corporate offices, government & community centers, hotels and restaurants, schools, stadiums, health clubs, shopping malls, and airlines. Defibrillator devices need proper maintenance and periodic servicing, number of initiatives are taken by private organizations and public organizations as well as key market players for providing emergency services.

Boston Scientific reported that there were approximately 659,000 ICDs worldwide as of 2021. This is a significant increase of 59,000 compared to 600,000. ICDs were distributed in 2020.

The public access market is expected to grow at 10.3% the fastest due to rising initiatives to improve public access AEDs and train personnel to respond to sudden cardiac arrest. According to a 2020 Global Times story, AED deployments have surged since 2019 in many popular tourist locations, first-tier cities, and coastal regions in China. Hangzhou was also the first Chinese city to require the distribution of AEDs in public places such as airports, stations, and ships.

Defibrillator Market Кеу Ѕеgmеntation:

By Product Type

- Implantable Cardioverter Defibrillators (ICD)

- T-ICD

- S-ICD

- External Defibrillators (ED)

- Automated ED

- Manual ED

- Wearable Cardioverter Defibrillators

By End-use

- Pre Hospital

- Hospital

- Alternate Care Market

- Public Access Market

- Home Healthcare

Market Dynamics:

The market was adversely affected the COVID-19 pandemic, particularly the ICDs market. This led to a decrease in sales and demand for ICDs during 2020. As hospitals resumed elective surgery, the sales increased. The year was marked by uncertainty due to the emergence of COVID-19, which has been affecting key markets.

For example, Abbott reported improvements in its hospital-based business during Q2 2020 and Q3 2020. The sudden rise in COVID-19 impact on hospitalizations and cases in many countries meant that the positive trends in hospitals remained stable or declined in Q4 2020. Nihon Kohden reported strong sales growth in defibrillators for 2020, despite reduced sales activity caused by the pandemic.

Despite advances in treatment and prevention, nearly half of all deaths due to cardiovascular disease are caused by sudden cardiac arrest. This will drive innovation and increase demand for defibrillators and ICDs. Ami Italia manufactures a variety of defibrillators in its Saver One, Geo Saver, and Smarty Saver series.

For example, the Smarty Series can be used in a variety of settings such as emergency rooms, ambulances, and public or private areas. Microport is the market leader in China for cardiac rhythm management. Microport saw a 95% increase in revenue in H1 2021 due to its extensive product portfolio and robust product pipeline.Another key driver is the growing awareness of cardiovascular events in developing countries. The UAE has a low number of defibrillators and very low usage. The market will grow due to the increased awareness and presence of local distributors. The Dubai Corporation for Ambulance Services (DCAS), announced in 2019 that it would donate 80 AEDs to various venues, including churches, government agencies, and private businesses.

Key factors of the defibrillator market are an increase in adoption of the technologically advanced defibrillator devices, an increase in the prevalence of SCA, and rising demand for quality medical care.

It also trained volunteers. This was part of the My City Saves Me campaign, which aims to connect and train a network of volunteers through DCAS’ Help Me App. Defibrillator Dubai and Atlas Medical Group are some of the top distributors in the UAE.

Regional Analysis

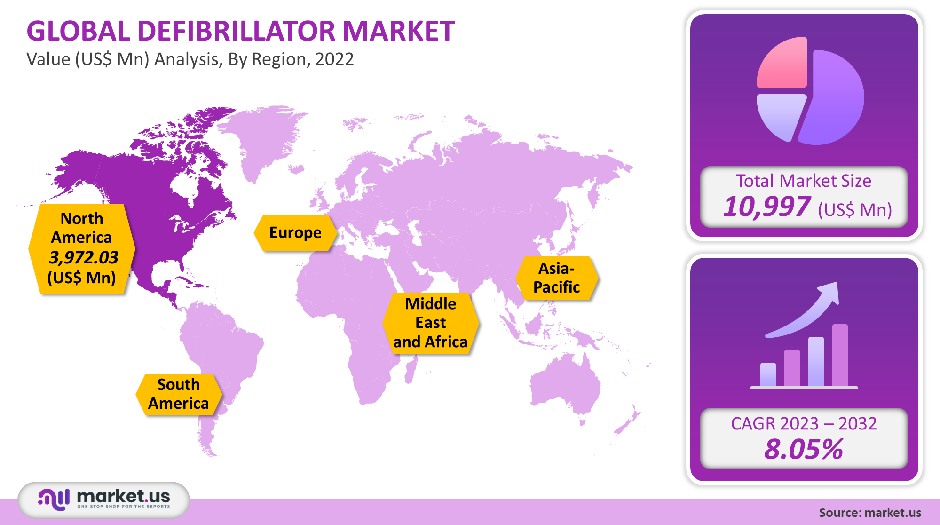

In 2021, North America accounted for the highest revenue share at more than 36.1%. Key players’ initiatives, favorable regulations, and technologically advanced healthcare facilities in Canada and the U.S. can all be credited for the growth of North American defibrillators. By 2020, 33,000 of Boston Scientific’s CRT/Ds line-up, which includes the Autogen, Dynagen, and Incepta devices, had been deployed globally. 16.500 were registered in the United States alone, indicating high adoption rates.

Asia Pacific is expected to grow at an 8% CAGR over the forecast period. This is due to the high prevalence of cardiac disease, developing healthcare infrastructure, and high patient populations. The Japanese market is driving regional expansion due to its high defibrillator penetration and supporting legislation. Nihon Kohden is a Japanese market leader and has recorded over US$ 66,000 in manual external defibrillator sales in 2020.

Key Regions and Countries covered іn thе rероrt:- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Competitive Landscape:

There has been intense competition in the market. To increase their market share, market players employ a variety of strategic initiatives. These initiatives include product development, regional expansion and partnerships, collaborations, and mergers and acquisitions.

ZOLL Medical Corporation bought Cardiac Science Corporation, a major AED manufacturer in the U.S. in 2019. This acquisition strengthened ZOLL’s AED product range and helped accelerate the company’s global expansion plans. Abbott received CE Mark in 2020 for its Gallant ICDs, and CRT-D devices. This was a significant step toward the company’s growth goals.

The prominent players in the global defibrillators market are Schiller AG, Abbott, Stryker, Koninklijke Philips N.V., and Boston Scientific Corporation. There are some more major players in the market Stryker Corporation, Nihon Kohden Corporation, Mediana Co. Ltd., Electronics Pvt. Ltd., Axion Medical Equipment Ltd., Avive Solutions Inc., Asahi Kasei Corporation, LivaNova Plc, Metrax GmbH, Shenzhen Comen Medical Instruments Ltd., Abbott, Boston Scientific Corporation and others.

Global Defibrillator Маrkеt Кеу Рlауеrѕ:

- Medtronic

- Schiller AG

- Abbott

- Stryker Corporation

- Koninklijke Philips N.V.

- BIOTRONIK SE & Co. KG

- Asahi Kasei Corporation

- Boston Scientific Corporation

- Nihon Kohden Corporation

- MicroPort Scientific Corporation

- Other Key Players

For the Defibrillator Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Defibrillator market in 2021?The Defibrillator market size is US$ 10,997 million in 2021.

What is the projected CAGR at which the Defibrillator market is expected to grow at?The Defibrillator market is expected to grow at a CAGR of 8.05% (2023-2032).

List the segments encompassed in this report on the Defibrillator market?Market.US has segmented the Defibrillator market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). Basis of Product, the market has been segmented into Implantable Cardioverter Defibrillators (ICD) and External Defibrillators (ED). By End User, the market has been further divided into Pre Hospital, Hospital, Alternate Care Market, Public Access Market, and Home Healthcare.

List the key industry players in the Defibrillator market?Medtronic, Schiller AG, Abbott, Stryker, Koninklijke Philips N.V., BIOTRONIK SE & Co. KG, Boston Scientific Corporation, Nihon Kohden Corporation, Mediana Co. Ltd., MicroPort Scientific Corporation, Medical Equipment Solutions, Mindray Medical International Ltd., Bexen Cardio MicroPort Scientific Corporation, Stryker Corporation, Asahi Kasei Corporation, and Other Key Players engaged in the Defibrillator market.

Which region is more appealing for vendors employed in the Defibrillator market?North America accounted for the largest revenue share of 36.12%. Therefore, the Defibrillator industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Defibrillator?The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc., are key areas of operation for the Defibrillator Market.

Which segment accounts for the greatest market share in the Defibrillator industry?With respect to the Defibrillator industry, vendors can expect to leverage greater prospective business opportunities through the implantable cardioverter defibrillators segment, as this area of interest accounts for the largest market share.

![Defibrillator Market Defibrillator Market]()

- Implantable Cardioverter Defibrillators (ICD)

- Medtronic

- Schiller AG

- Abbott Laboratories

- Stryker Corporation Company Profile

- Koninklijke Philips N.V.

- BIOTRONIK SE & Co. KG

- Asahi Kasei Corporation

- Boston Scientific Corporation Company Profile

- Nihon Kohden Corporation

- MicroPort Scientific Corporation

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |