Global Dental 3D Printing Market By Technology (Vat Photopolymerization, Digital Light Processing, and Other Technologies), By Application (Orthodontics, Implantology, and Prosthodontics), By End Use (Dental Clinics, Academic and Research Institutes, and Dental Laboratories), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2022

- Report ID: 12413

- Number of Pages: 255

- Format:

- keyboard_arrow_up

Dental 3D Printing Market Overview:

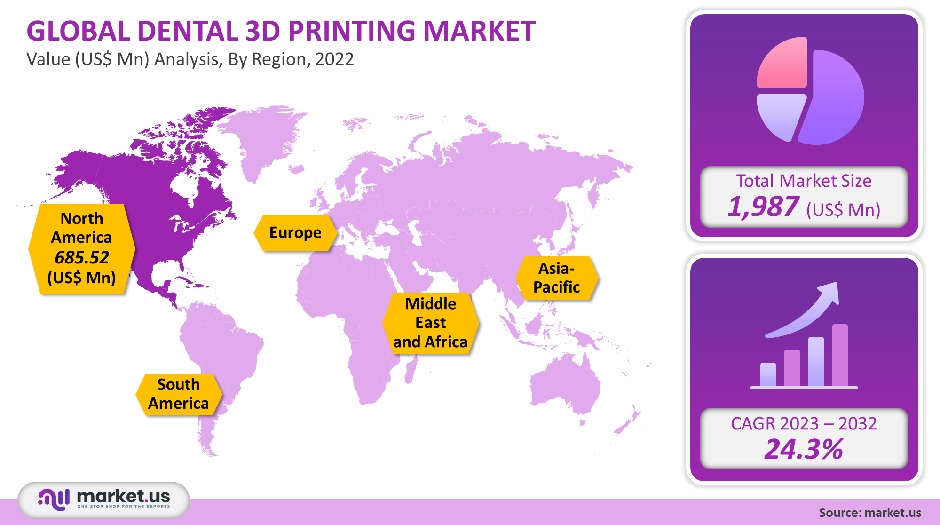

The Global Dental 3D printing market was worth USD 1,987 million in 2021. It is forecast to grow at a CAGR of 24.3% over the forecast period.

Due to the COVID-19 pandemic, there was a decrease in demand for dental 3D printing machines in 2020. The combination of state-of-the-art 3D printing technology and a footprint has made dental 3D printing dentistry a prominent part of today’s dental products.

More people are adopting dental 3D printers due to the development and design of advanced products, such as advanced fabrication for an aesthetic appearance, invisible aligners, and positioning. 3D printing is easy and user-friendly, which has encouraged the dentistry industry to produce products that meet different dental needs. These printers will improve the output and reduce the fabrication time. The digitalized workflow will reduce customer discomfort and improve customer satisfaction.

Global Dental 3d Printing Market Analysis

Technology Analysis

In 2021, the market was dominated by selective laser sintering which held 37.6%. This segment will likely maintain its position through the forecast period due to its advantages over other techniques such as high chemical resistance, biocompatibility, and excellent surface finishing.

Fused deposition modeling will show the highest CAGR at 25.1% over the forecast period. This is due to rising investment in R&D. Due to the availability of strong, biocompatible, and sterilizable

thermoplastics, fused deposition modeling is becoming more popular in dentistry. FDM is a cost-effective method that can produce complex shapes and designs.

Application Analysis

In 2021, the orthodontics segment held a significant market share and is expected to continue growing at a rapid pace during the forecast period. This is due to an increasing number of patients with misalignment or gaps in their teeth. It is estimated that around 4.2 million American and Canadian teens have braces.

The number of adults who start orthodontic treatment is also increasing. According to the American Association of Orthodontists, children should have their first orthodontic treatment before age 8. The overall growth of dental 3D printing is driven by the rising demand for and increased need for orthodontics treatment.

Prosthodontics is expected to grow at a high rate, slightly higher than orthodontics over the forecast period. The growing incidence of tooth decay and edentulism is a major reason for the segment’s growth.

End-use Analysis

In 2021, the laboratories segment was one of the profitable segments, in terms of revenue. This segment will likely experience the greatest CAGR during the forecast period. This segment is also experiencing a rise in the use of advanced technologies in laboratories. Additionally, rise in outsourcing of manufacturing functions to dental laboratories, the surging number of dental laboratories, and the increase in demand for customized dental framing solutions which are required for many applications, in turn fueling the demand for dental 3D printing technologies.

Key Market Segments

By Technology

- Vat Photopolymerization

- Digital Light Processing

- Stereolithography

- Polyjet Technology

- Selective Laser Sintering

- Fused Deposition Modelling

- Other Technologies

By Application

- Orthodontics

- Implantology

- Prosthodontics

By End-use

- Dental Clinics

- Academic and Research Institutes

- Dental Laboratories

Market Dynamics

The market for dental 3D printing is expanding at an impressive rate. It is also expected to expand further in emerging countries. According to the American College of Prosthodontists, approximately 14.8% of the world’s edentulous make dentures every year. Edentulism is most common in the economically disadvantaged and elderly. More than 36 million Americans are without teeth, and around 120 million Americans have lost at least one tooth. These numbers will continue to rise over the next 20 years.

Most of the elderly population will need to have their teeth replaced. Even people who are partially or completely toothless, young and old, can have dental procedures. They consider dental implants a viable option.

The COVID-19 pandemic has caused major disruptions in the supply chain for the entire medical device industry. The industry has seen a decline in its overall performance due to the pandemic. Due to global lockdowns and restrictions in many countries, the demand for and sales of dental equipment and procedures was negatively affected. Many device manufacturers also switched their attention to fighting coronavirus.

The medical device market has seen a lot of consolidations over the past few years. To expand their business operations, major manufacturers are using collaboration and acquisition strategies. They leverage their product portfolios worldwide. With product innovations, service extensions and M&A, the market will become more competitive.

The U.S. market for dental 3D printing is the dominant market. This market will continue to grow during the forecast period. Market growth is being driven by the rising demand for cosmetic dentistry and technological advances. The market outlook is also positive due to the growing geriatric population and favorable government policies. To launch new product variants, leading manufacturers engage in research and development (R&D).

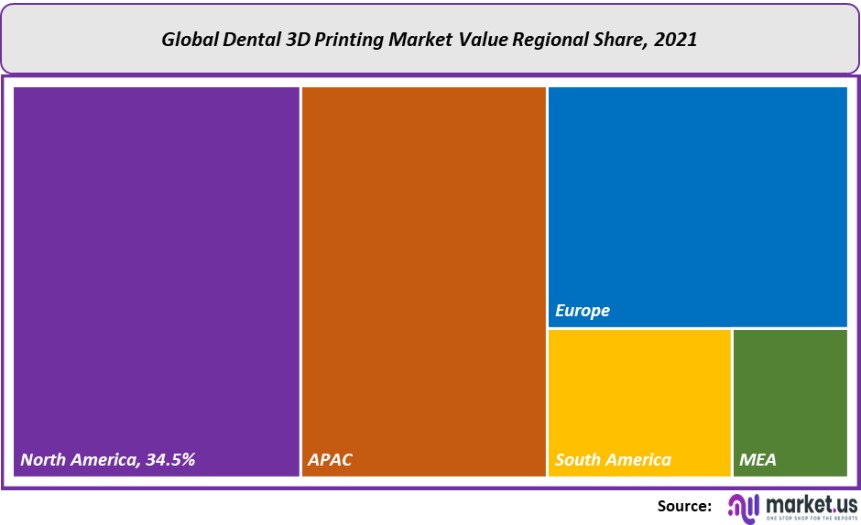

Regional Analysis

In 2021, North America was the dominant market for dental 3D printing worldwide accounting to a revenue share of 34.5%. It is expected that the region will maintain its dominance throughout the forecast period.

The region’s dominance in the global market is due to its high purchasing power, growing population of edentulous, availability of appropriate reimbursement policies, and strong government support for healthcare in Canada and the U.S. Obamacare provides affordable and high-quality insurance plans to its citizens. The rising popularity of dental 3D printing technology is also being boosted by positive government initiatives.

Over the forecast period, the Asia Pacific region is expected to experience the highest growth. The rising commercial activities of major industry players, the increase in dental 3D printing, the increased number of patients who need to have their teeth replaced, and the improvement of healthcare infrastructure in emerging countries can all be attributed as the reason for the market’s rapid growth.

A growing geriatric population and flourishing dental tourism are just some of the reasons for the region’s growth. Market players want to invest in India and China, as they are expected to lead the Asia Pacific region’s growth.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

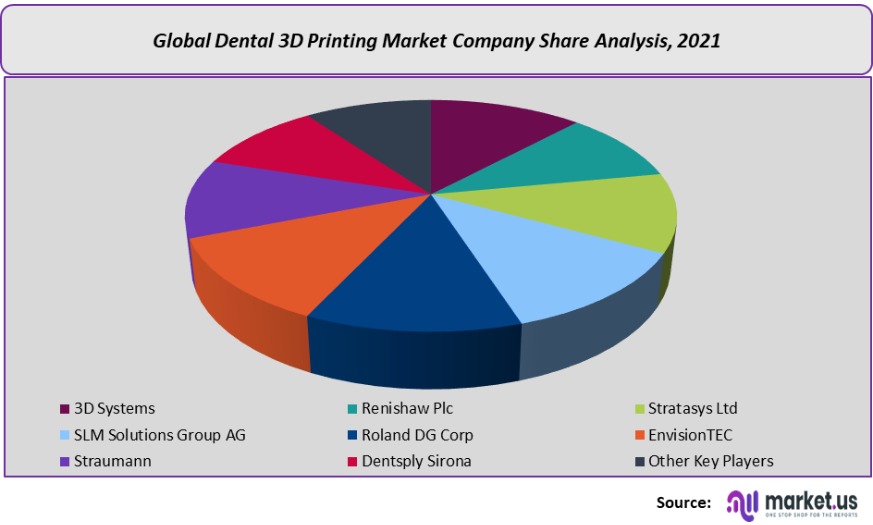

Market Share & Key Players Analysis:

Two obstacles could hinder the growth of players in the dental 3D printing industry: a shortage of qualified dental professionals and the high costs of dental 3D printers. This industry is highly competitive and includes large and medium-sized businesses. Manufacturers in dentistry are attempting to meet the growing demand for high-tech dental products by increasing their R&D budgets.

Manufacturers also concentrate on growth strategies like mergers & acquisitions, and the launch of new products. 3D Systems, a Formlabs Massachusetts-based company announced in February 2020 a partnership with Germany’s BEGO, a provider for prosthodontics and implants for the dental industry.

In June 2018, 3D Systems also launched the DMP Flex 100 3D printers and DMP Dental 100 3D printers. These 3D printers are superior in quality, versatility, and throughput and can be used for entry-level metal 3D printing as well as dental applications. They are collaborating to create temporary and permanent 3D-printed crowns and bridges for dental applications.

Маrkеt Kеу Рlауеrѕ:

- 3D Systems

- Renishaw Plc

- Stratasys Ltd

- SLM Solutions Group AG

- Roland DG Corp

- EnvisionTEC

- Straumann

- Dentsply Sirona

- Other Key Players

For the Dental 3D Printing Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Dental 3D Printing market?A: The Dental 3D Printing market size is projected to generate revenues of approx. US$ 1,987 million (2023-2032).

Q: What is the projected CAGR at which the Dental 3D Printing market is expected to grow at?A: The Dental 3D Printing market is expected to grow at a CAGR of 24.3% (2023-2032).

Q: List the segments encompassed in this report on the Dental 3D Printing market?A: Market.US has segmented the Dental 3D Printing market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Technology, market has been segmented into Vat Photopolymerization, Digital Light Processing, Stereolithography, Polyjet Technology, Selective Laser Sintering, Fused Deposition Modelling, and Other Technologies. By Application, the market has been further divided into Orthodontics, Implantology, and Prosthodontics. By End Use, the market has been further divided into Dental Clinics, Academic and Research Institutes, and Dental Laboratories.

Q: List the key industry players of the Dental 3D Printing market?A: 3D Systems, Renishaw Plc, Stratasys Ltd, SLM Solutions Group AG, Roland DG Corp, EnvisionTEC, Straumann, Dentsply Sirona, and Other Key Players engaged in the Dental 3D Printing market.

Q: Which region is more appealing for vendors employed in the Dental 3D Printing market?A: North America is expected to account for the highest revenue share of 34.5%. Therefore, the Dental 3D Printing Technology industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Dental 3D Printing?A: The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc. are key areas of operation for Dental 3D Printing Market.

Q: Which segment accounts for the greatest market share in the Dental 3D Printing industry?A: With respect to the Dental 3D Printing industry, vendors can expect to leverage greater prospective business opportunities through the selective laser sintering Dental 3D Printing segment, as this area of interest accounts for the largest market share.

![Dental 3D Printing Market Dental 3D Printing Market]()

- Stratasys Ltd. Company Profile

- 3D Systems

- EnvisionTEC

- DWS Systems

- Bego

- Prodways Entrepreneurs

- Asiga

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |