Global Dental Burs Market By Material (Diamond Burs, Stainless Steel, and Carbide), By Application (Oral surgery, Implantology, Orthodontics, Cavity preparation, and Other Applications), By End-Use (Hospitals, Dental clinics, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 28232

- Number of Pages: 343

- Format:

- keyboard_arrow_up

Dental Burs Market Overview:

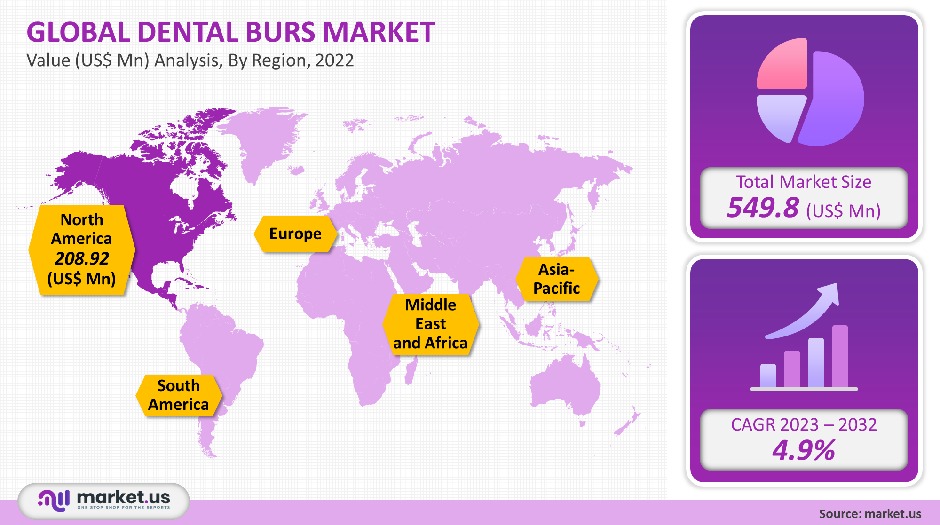

The global dental burs market was valued at USD 549.8 million in 2021. It is expected to grow at a compound annual rate (CAGR of 4.9%) between 2023 and 2032.

This market is experiencing growth because of factors such as an increasing number of people with oral diseases and evolving medical tourism that relates to dental treatment and multiple government initiatives to improve dental health and increase access to care. The COVID-19 pandemic caused a major setback in the market. Due to their lack of medical necessity and high transmission risk, the pandemic led to a decrease in dental treatments. This resulted also in the closing of many dental clinics.

Global Dental Burs Market Scope:

Material analysis

The market was dominated by the diamond burs segment, which held 44.6% of the total revenue in 2021. This segment is expected to experience the greatest growth over the forecast period. The material segment can be divided into carbide burs, stainless steel, and diamond burs. The market share of the diamond burs segment was the largest due to its ability to polish and shape enamel with precision. These materials can also be used to cut through zirconia and grind porcelain for the preparation and placement of veneers and crowns.

These materials can be cut with great precision and last longer than other burs. Carbide burs are expected to see significant market growth in the future. This is due to its use for tooth shaping, cavity preparation, and removing old fillings. Carbide burs have been shown to produce a smoother surface and less vibration than diamond burs. While tungsten carbide burs are more expensive than their steel counterparts, they have a longer working life and are less costly.

Application analysis

In 2021, the market share for cavity preparation was 28.5%. Cavity preparation is used to remove infected and demineralized dentin. This procedure is in high demand due to an increase in dental caries. There are many risk factors that increase the likelihood of developing dental caries, including a shift in lifestyle and high sugar-based diets. If a tooth is damaged, chipped, cracked, or has suffered from erosion, it may be necessary to prepare the cavity.

According to NCBI (National Center for Biotechnology Information), the most common types of oral traumas are tooth fracture, tooth avulsion, and tooth subluxation. These are the reasons that the procedure will be in high demand. Because this area of dentistry deals with the implantation of dental implants, and there is an increasing number of dental treatments worldwide, the implantology segment will see high growth.

The American Association of Oral and Maxillofacial Surgeries estimates that approximately 500,000 Americans undergo dental implantation each year in the United States. Key players are expected to introduce new implant systems with the goal of improving the design and construction of dental restorations.

End-Use analysis

In 2021, the hospital segment held 47.9% of the market. This is due to the presence in these settings of dental professionals, such as dental surgeons, who are highly skilled and certified. Modern equipment is available in hospitals to diagnose and treat dental conditions efficiently. Patients prefer to have their dental procedures done in a dental hospital because of the high quality of the care and the service they receive.

The segment of dental clinics is expected to grow strongly over the forecast period. Because of the low risk of infection, most dental procedures aren’t performed in a clinic. These factors are driving market growth in the dental clinic segment. They are focusing more on personal attention, personalized treatment plans, a shorter waiting time, specialist treatment, as well as providing cost-effective and efficient treatment.

Кеу Маrkеt Ѕеgmеntѕ

By Material

- Diamond Burs

- Stainless Steel

- Carbide

By Application

- Oral surgery

- Implantology

- Orthodontics

- Cavity preparation

- Other Applications

By End-Use

- Hospitals

- Dental clinics

- Other End-Uses

Market Dynamics:

Dental procedures such as root canalling and implants will resume after the second quarter of 2020. The market has seen some growth, as it has begun to recover. Dental burs are an essential part of many dental procedures. They are used to reduce the interproximal area of the tooth, shape and polish it, prepare cavities for fillings, remove old fillings, and make bone and other adjustments.

Most dental burs attach to a driver motor-equipped handpiece and are made from stainless steel, tungsten carbide, or diamond grit particles. Every material has its advantages and disadvantages. Dentists will choose the right material based on the treatment required.

According to the FDI World Dentist Federation, 3.9 billion persons globally are affected by oral diseases. More than half (44%) of these individuals are affected by untreated tooth decay (dental caries), which is the most common of the 291 oral conditions as per the Study of Burden of Disease.

U.S. News reports that in 2019, 33% of Americans under 65 didn’t have a dental check-up or cleaning within the last 12 months. According to the news, an increase in income can directly correlate with visiting a dentist. This could boost the use of dental care in the country.

This market is growing because of the gradual rise in Oro-related dental injuries, such as oral cancers and periodontal disease.

Bur selection by a clinician is based on the individual’s preference, the type, and effectiveness of the procedure, as well as the clinical situation. They can be used for restorative procedures, tooth preparation, and crown preparation. The market will grow because of the increasing request for dental burs and advancements in bur materials and designs.

According to the WHO, dental conditions are more common in Asian and European countries than in the West. Due to a rise in sugary foods and poor tooth brushing habits as well as a lack of awareness about dental care, developing Asian countries such as India, China, and China are experiencing an increase in dental problems.

The COVID-19 pandemic, however, has had a major impact on the oral hygiene and dental market. In most countries, regular dental appointments, consultations, and appointments were stopped. Dental treatments are high-contact services, which means that the risk of infection was high.

The market is expected to rebound as 39.0% of U.S. dental practices are operational and have the same number of patients as before the pandemic. Dentsply Sirona, a major market player in the dental industry reported that its technology and equipment segment (which includes dental burs) saw 6.8% growth in quarter four of 2021 compared to quarter two of 2020. This shows that the market for dental products is recovering from the effects of the pandemic.

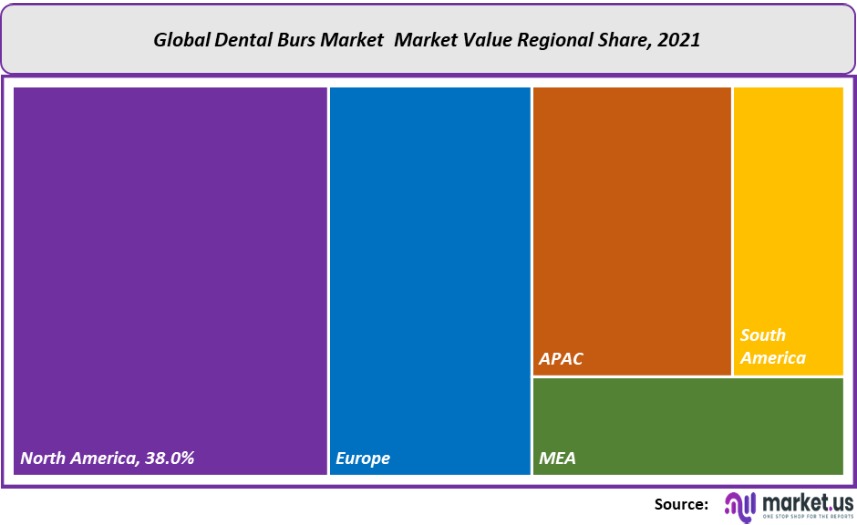

Regional Analysis

North America was the dominant market for dental burs and held the largest share of revenue at 38.0% in 2021. This segment is expected to grow significantly over the forecast period. According to the U.S. CDC, one in four Americans has an untreated dental problem. 46% of those aged over 30 experience signs of gum disease. The prevalence of dental caries was 13.0%. The region’s high market share can be attributed to the growing population, increasing R&D activities, and a rising number of dentists and clinics. Also, the growing preference for root canal procedures and the growing importance of dental care.

As the U.S. population ages 65 and over, the demand for preventive and/or restorative services in dentistry is expected to increase. The Asia Pacific market is expected to grow rapidly due to the growing number of dental care centers, increasing dental tourism, and increased R&D in this area. There is a high prevalence of dental diseases in developing countries, such as India. This is because there is very little or no access to quality oral health services.

Positive government initiatives such as the Healthy China 2030 initiative which includes special provisions to improve dental health and implement special campaigns to increase awareness about oral disease are likely to boost the market.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

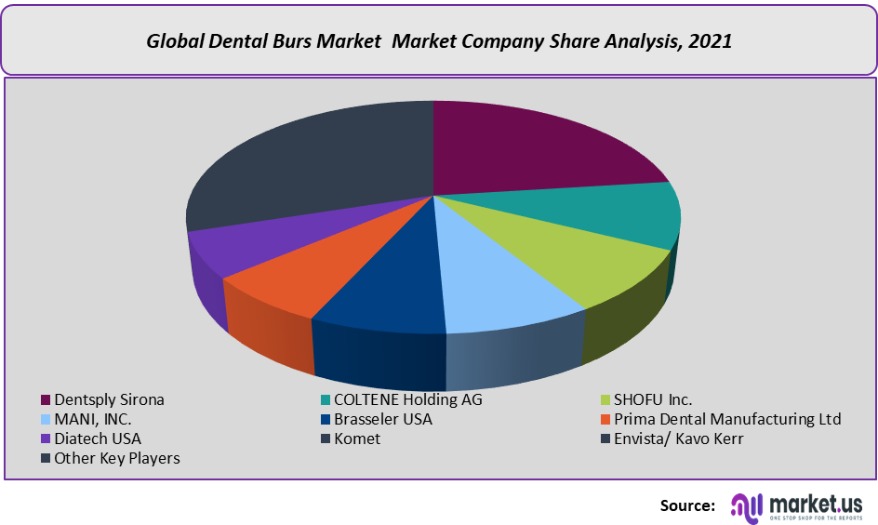

Market Share & Key Players Analysis:

Many key players are increasingly opting to expand geographically, for strategic collaborations, partnerships, and mergers and acquisitions in economically-friendly regions. Dentsply Sirona, Inc. announced in June 2021 that it had acquired Propel Orthodontics, a company worth USD 131 million. It is expected that this acquisition will strengthen its market position.

Маrkеt Кеу Рlауеrѕ:

- Dentsply Sirona

- COLTENE Holding AG

- SHOFU Inc.

- MANI, INC.

- Brasseler USA

- Prima Dental Manufacturing Ltd

- Diatech USA

- Komet

- Envista/ Kavo Kerr

- Other Key Players

For the Dental Burs Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Dental Burs market size in 2021?A: The Dental Burs market size is projected to generate revenues of approx. US$ 549.8 million (2023-2032).

Q: What is the CAGR for the Dental Burs market?A: The Dental Burs market is expected to grow at a CAGR of 4.9% during 2023-2032

Q: What are the segments covered in the Dental Burs market report?A: Market.US has segmented the Dental Burs market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Material, market has been segmented into Diamond Burs, Stainless Steel, Carbide. By End-Use, the market has been further divided into Hospitals, Dental clinics, and Other End-Uses.

Q: Who are the key players in the Dental Burs market?A: Dentsply Sirona, COLTENE Holding AG, SHOFU Inc., MANI, Inc., Brasseler USA, Prima Dental Manufacturing Ltd., Diatech USA, Komet, Envista/ Kavo Kerr, and Other Key Players

Q: Which region is more attractive for vendors in the Dental Burs market?A: North America is expected to account for the highest revenue share of 38.0% among the other regions. Therefore, the Dental Burs market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Dental Burs?A: South Korea, Germany & The US, are key areas of operation for Dental Burs Market.

Q: Which segment has the largest share in the Dental Burs market?A: With respect to the Dental Burs, vendors can expect to leverage greater prospective business opportunities through the Diamond Burs segment, as this area of interest accounts for the largest market share.

![Dental Burs Market Dental Burs Market]()

- Dentsply Sirona

- COLTENE Holding AG

- SHOFU Inc.

- MANI, INC.

- Brasseler USA

- Prima Dental Manufacturing Ltd

- Diatech USA

- Komet

- Envista/ Kavo Kerr

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |