Global Dental Practice Management Software Market By Deployment Mode (On premise, Cloud-based, and Web-based), By Application (Patient Communication, Payment Processing, Invoice/Billing, Insurance Management, and Others), By End-use (Hospitals, Dental Clinics, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Jul 2022

- Report ID: 54353

- Number of Pages: 372

- Format:

- keyboard_arrow_up

Dental Practice Management Software Market Overview

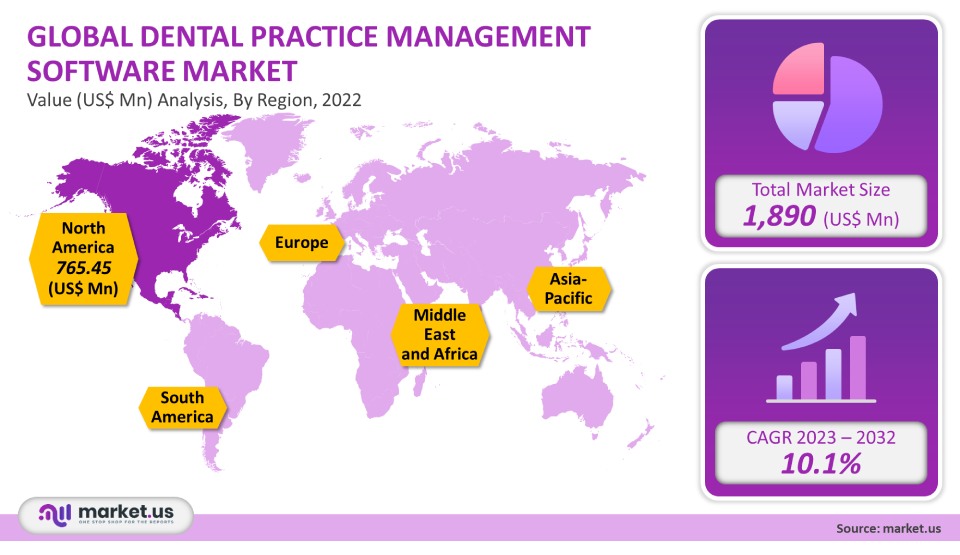

The market for dental practice management software was worth USD 1,890 million in 2021. This market is projected to grow at a compound annual growth rate of 10.1% between 2023-2032.

Market growth is due to rising geriatric populations, increased awareness and focus on oral health in Europe & the United States, and technological advancements. The Health Information Technology for Economic and Clinical Health Act, (HITEC), encourages and accelerates the use of health information technology within the United States. Insurance coverage is expected to increase with the adoption of healthcare information solutions, particularly by specialty clinics like oral practices. These factors are expected to increase the demand for oral services, driving the demand for DPM software.

Global Dental Practice Management Software Market

Deployment Analysis

On-premise, web, and cloud-based deployment modes are the segments of the market. The market was dominated by the web-based segment with a 55.3% share in 2021. This is due to its lower cost, greater security, fast updates, unrestricted storage, and increased speed. This segment will see a rise in the adoption of DPM software within oral practices for billing and reporting, patient charts, scheduling, treatment planning, and billing. However, the cloud-based market is expected to grow at the highest rate between 2023-2032. This segment will see growth due to new software releases, mergers, collaborations, and other activities that are aimed at offering cloud-based solutions to consumers.

Planet DDS launched internal and external referral management tools in June 2021. Denticon software allows dentists to track and manage referrals within their group or with external providers. On-premise software is installed at the site, on the user’s computer, or a server. This generally involves high upfront investment fees. The cost of ownership is relatively low because there are little or no annual or monthly subscription fees. On-premises software offers more customization and control of data. DPM solutions are preferred by clinics that have more specific needs. This will be negatively affected by the introduction of the advanced web- and cloud-based solutions.

Application Analysis

According to the application, the market can be segmented into invoice/billing, patient communication, and payment processing. 34.9% accounted for the largest market share in 2021. The segment is expected to grow due to increased acceptance, such as text message reminders and family reminders, as well as patient satisfaction surveys. DentSoft, which is the majority of DPM software, creates customer profiles based on basic demographic information, national identification numbers (NIN), contact information, and medical conditions.

This allows you to perform advanced and quick searches. Patients can also schedule appointments online. This facilitates patient communication, which in turn favors the growth segment. The segment of insurance management is forecast to grow at the fastest rate of CAGR over the forecast period. This is because the U.S. has a higher reimbursement rate for oral care. According to the ADA, 51.3% of children between 2 and 18 years old in the United States have dental insurance. 38.5% of them have Medicaid Children’s Health Insurance Program coverage. 7.4% of American children aged 19-64 get coverage through Medicaid. While 59.0% of Americans have private dental coverage,

End-Use Analysis

Based on the end-user, the market is further segmented into hospitals, dental clinics, and others. The market was dominated by the dental clinic sector in 2021. They accounted for 48.5% of the highest revenue share. The segment will be dominant even in the forecast period. This segment has seen a rise in the adoption of dental practice management software by oral care clinics around the world. The software helps improve clinic efficiency and manages clinic operations like billing, accounting, and scheduling. This is expected to lead to increased demand for DPM software among clinics.

Additionally, many local practices are merging with greater clinic networks or buying out smaller ones. This is further fueling the growth of this sector. The fastest CAGR is expected to be seen in the hospital’s segment over the forecast period. This growth can be attributed to the increased frequency of oral care visits as well as the adoption of DPM solutions in hospitals. DPM software can perform monthly or annual company analyses and assist in devising efficient treatment strategies. These data can be used to help manage finances and resources in individual practices or offices. This is driving the growth in the other segment.

Key Market Segments

Deployment Mode

- On-premise

- Cloud-based

- Web-based

Application

- Patient Communication

- Payment Processing

- Invoice/Billing

- Insurance Management

- Others

End-use

- Hospitals

- Dental Clinics

- Others

Market Dynamics

A rise in life expectancy is leading to an increase in the number of geriatrics, which will likely continue in the future. According to a United Nations report, the global geriatric populace was almost 962,000,000 in 2017. World Population Prospects 2019’s report states that by 2050, 16% would be over 65. There is a high demand per capita for oral care services. DPM solutions are needed. According to the American Dental Association, dry mouth is the leading cause of cavities in older adults. It can also be a side effect of medications for high BP & cholesterol and pain, anxiety, Parkinson’s disease, Alzheimer’s disease, and asthma.

Geriatrics are more likely to have problems with their teeth because they use these medications in large numbers. This will increase the demand for DPM software. Because of the support from the government and growing awareness about oral hygiene, the number and quality of independent practitioners have increased in the U.S. and Australia. Independent practitioners are usually more affordable than large clinics. This is because many patients needing oral care are not covered by their insurance or are uninsured.

According to ADA, the number of dental clinics that employ more than 20 staff has increased while those with fewer than 5 staff have decreased in the U.S. over the past few years. This is due to rising dental care spending and supportive government policies. Companies are expanding their presence in key emerging markets like India, Australia, and Japan. Henry Schein acquired Dental Cremer S.A. in January 2017. This acquisition allowed Henry Schein to increase its geographical reach and expand its product line.

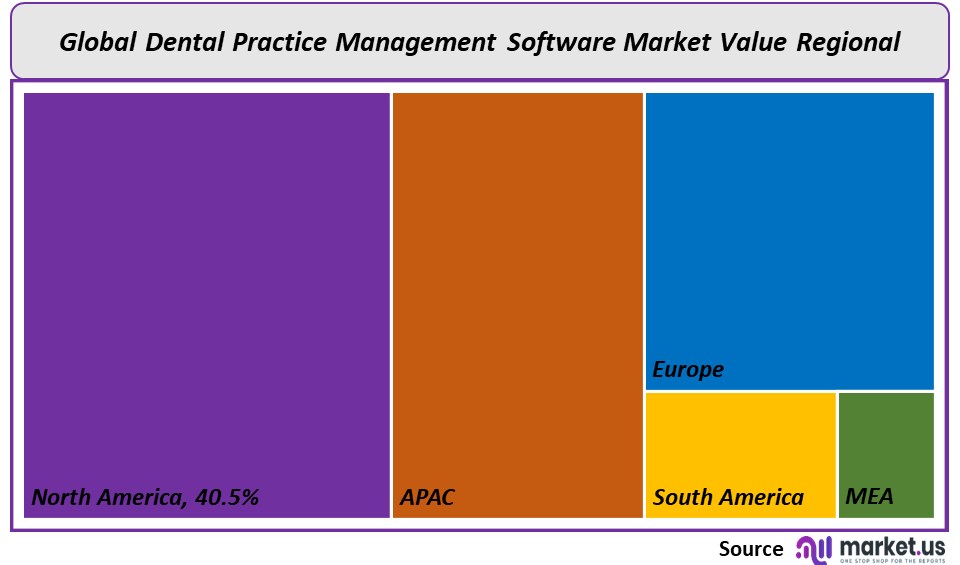

Regional Analysis

North America had a greater revenue share of 40.5% in 2021. Key factors driving market growth in the U.S. include the strategic presence and rapid adoption of baby boomers’ dental care services, as well as Henry Schein One & Curve Dental. Market growth is also likely to be aided by increased funding for start-ups. CaseStack received funding of US$ 22.25 million from Delta Dental of California, Accel Partners, SteadView Capital, and F-Prime Capital in April 2021. The same investor provided funding for the company in 2019 with US$ 28 million.

The market will be driven by such large investments in start-ups. The Asia Pacific, on the other hand, is expected to experience the fastest CAGR in the forecast period. Market growth is being supported by the increasing investments made in healthcare IT companies within the region, as well as improving economic and healthcare structures. China is forecast to see significant growth in the future. This can be attributed largely to China’s aging population, increased spending on oral health care, and rapid adoption of the most recent technologies.

Europe’s market will also experience significant growth due to technological advancements and increased spending. NHS Dental Statistics for England reports that 21 million adults were treated by an NHS dentist between January 2020 and June 2020. This includes 6.3 million children and 6.3 million kids. Additionally, the funding from NHS primary care dentistry will provide significant growth opportunities for the U.K. The NHS spent US$ 2,359.6 Million on primary care dentistry between 2018 and 2019.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

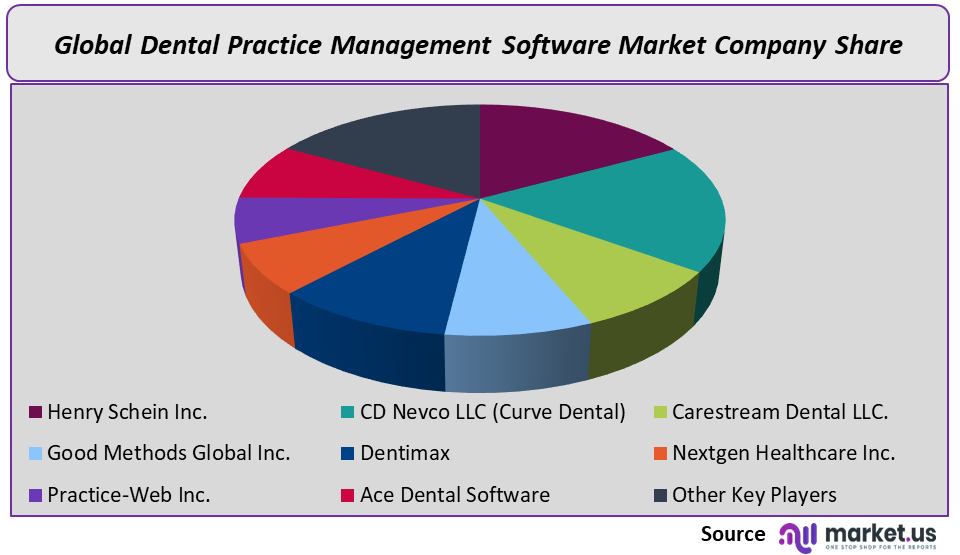

Market Share Analysis

The market is very competitive and is dominated primarily by a few large players. There are a few other smaller competitors in the industry that are expected to gain a large share of the market, due to the increasing geriatric population. Market players adopt key strategies such as acquisitions, collaborations with partners, and the launch of new products. Curve Dental, for instance, announced a June 2021 collaboration with Dental Intelligence. This will allow Curve Dental to access the LocalMed online scheduling system by Dental Intelligence. This agreement will allow clinics to incorporate the company’s practice software. It allows patients to book virtual appointments.

Key Market Players

These are the top players in the global dental software market:

- Henry Schein Inc.

- CD Nevco LLC (Curve Dental)

- Carestream Dental LLC.

- Good Methods Global Inc.

- Dentimax

- Nextgen Healthcare Inc.

- Practice-Web Inc.

- Ace Dental Software

- Other Key Players

For the Dental Practice Management Software Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Dental Practice Management Software market in 2021?The Dental Practice Management Software market size was US$ 1,890 million in 2021.

Q: What is the projected CAGR at which the Dental Practice Management Software market is expected to grow at?The Dental Practice Management Software market is expected to grow at a CAGR of 10.1% (2023-2032).

Q: List the segments encompassed in this report on the Dental Practice Management Software market?Market.US has segmented the Dental Practice Management Software market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Deployment Mode, market has been segmented into On premise, Cloud-based, and Web-based. By Application, the market has been further divided into Patient Communication, Payment Processing, Invoice/Billing, Insurance Management, and Others. By End-use, market has been segmented into Hospitals, Dental Clinics, and Others.

Q: List the key industry players of the Dental Practice Management Software market?Henry Schein Inc., CD Nevco LLC (Curve Dental), Carestream Dental LLC., Good Methods Global Inc., Dentimax, Nextgen Healthcare Inc., Practice-Web Inc., Ace Dental Software, and Other Key Players engaged in the Dental Practice Management Software market.

Q: Which region is more appealing for vendors employed in the Dental Practice Management Software market?North America is accounted for the highest revenue share of 40.5%. Therefore, the Dental Practice Management Software industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Dental Practice Management Software?The U.S., Canada, U.K., Germany, France, Italy, Spain, Japan, China, India, Brazil, Mexico, South Africa are key areas of operation for Dental Practice Management Software Market.

Q: Which segment accounts for the greatest market share in the Dental Practice Management Software industry?With respect to the Dental Practice Management Software industry, vendors can expect to leverage greater prospective business opportunities through the web-based segment, as this area of interest accounts for the largest market share.

![Dental Practice Management Software Market Dental Practice Management Software Market]() Dental Practice Management Software MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Dental Practice Management Software MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Henry Schein Inc.

- CD Nevco LLC (Curve Dental)

- Carestream Dental LLC.

- Good Methods Global Inc.

- Dentimax

- Nextgen Healthcare Inc.

- Practice-Web Inc.

- Ace Dental Software

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |