Global Development to Operations (DevOps) Market By Deployment (Cloud and On-premise), By Enterprise Size (Small and Medium Enterprise, and Large Enterprise), By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 67475

- Number of Pages: 333

- Format:

- keyboard_arrow_up

Development to Operations (DevOps) Market Overview:

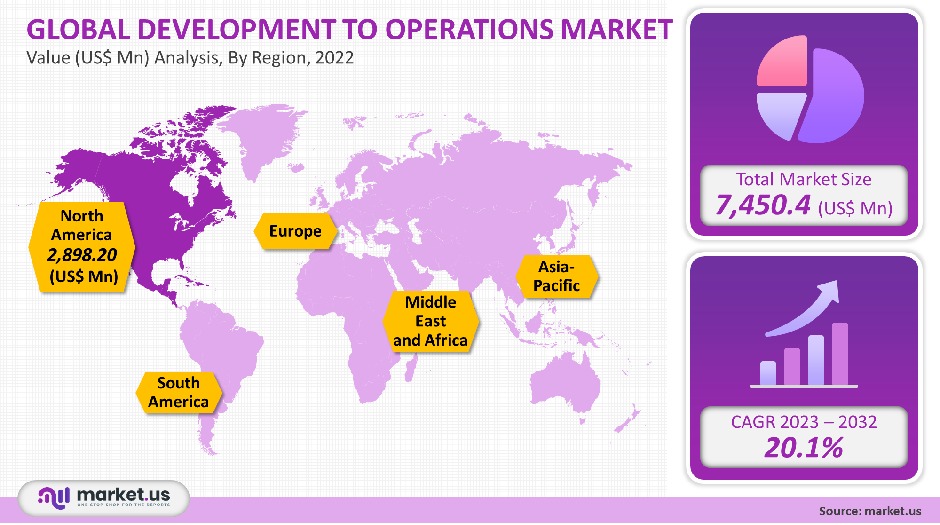

The global development to operations market was valued at approximately USD 7,450.4 million in 2021. It is anticipated to grow at a compound annual rate (CAGR) of 20.1% between 2023 and 2032.

The DevOps market is expected to grow due to improved adoption of cloud technologies, faster application delivery, and advances in AI and software automation. Despite the disruption caused by COVID-19, there was an upsurge in global DevOps demand.

The sudden increase in demand for software and web-based applications was due to businesses attempting to take advantage of the increasing online existence of their customers. This allowed IT businesses to produce software products and enabled cross-functional sides to be more flexible, ensuring greater operational efficiency in the face of the pandemic.

Global Development To Operations Market Scope:

Deployment analysis

In 2021, the cloud segment held a significant market share at 62.3%. Cloud-based solutions allow for outsourcing IT tasks to improve work productivity. Cloud technology provides real-time, on-demand capabilities that include computing, big data and analysis, machine learning, cybersecurity, and DevOps functions, application development. The combination of these offerings results in elastic, agile, and cost-efficient IT delivery to the user.

Development to the operations market is segmented into on-premise and on-cloud. The on-premise segment accounted for the largest revenue share during the forecast period.

It inspires companies to invest in product development in accordance with changing business needs. HSBC, for instance, has entered into a multi-year agreement with Cloud Bees, a DevOps platform Cloud Bees, to standardize software delivery worldwide for over 23,000 developers. Cloud deployment offers many benefits that will help the segment grow.

The forecast period sees the on-premise market expanding at a 19.4% CAGR. It was mandatory for enterprises to buy a license to deploy it on-premise. This increases security and makes it easier for malicious software to be detected. This will increase the demand for on-premise solutions within highly regulated businesses that need to securely stock sensitive data. These primary factors will boost market growth over the forecast period.

Enterprise size analysis

In 2021, the market share for large enterprises was 60.3%. Large enterprises were the first to adopt DevOps in order to increase quality and productivity, reduce time to market, improve workflows, speed up development, and lower costs for IT operations like software delivery, maintenance, and communication of software development.

The enterprise segment is divided into Small Enterprises, Medium Enterprises, and Large Enterprises. During the forecast period, the Large enterprise segment is expected to account for the largest revenue share.

In order to reduce manual work, Large enterprises are working toward adopting rapid development of software lifecycles along with increasing adoption of automation, which will increase profitability and scalability.

As a primary strategy of Cloud service providers and large IT organizations to manage the software development lifecycle, they are expected to increasingly invest in the development of operations toolchains.

Large IT companies and cloud service providers are expected to invest more in the development-to-operation toolchain to manage the entire software development lifecycle. Amazon Web Services, for example, invested USD 236 million in February 2020 to form a data center facility in Sao Paulo located in Brazil. The company was able to continue the adoption of DevOps services cloud-powered in both public and private companies through this investment.

The SME market is expected to grow at a rate of 21.9% over the forecast period. DevOps is becoming more popular among SMEs in order to increase deployment frequency and reduce development cycles to remain competitive. This will help to accelerate the market’s annual growth rate over the forecast period.

DevOps also has many benefits, including the ability to save time on ideas, testing, and designing, as well as other aspects of business growth. Many SMEs are now implementing DevOps technology to automate their software development processes. The segment growth is expected to be driven by the increasing use of DevOps technologies by SMEs in software development and software optimization.

End-Use analysis

In 2021, the IT segment held 37.2% of the market and is expected to be the dominant player by 2030. There are many challenges facing the IT sector, including application downtime, quality assurance, release timelines, and quality control.

The lack of standardized DevOps tools and solutions has led to an undefined process framework resulting in automation without a structured approach.

DevOps tools for development are designed to improve business efficiency and meet changing business needs. They can address the IT industry’s challenges. DevOps solutions are being used by the IT industry to automate the processes related to software development, testing, and operations.

This helps improve software quality, reduce delivery times, and improve customer experience. BFSI is predicted to grow at the highest CAGR of 21.7% over the forecast period. This is primarily due to technological and economic changes, as well as the increasing popularity of smartphones and smart devices that can carry out banking and commercial transactions. DevOps solutions are the best way to speed up the delivery of financial services and banking services to consumers.

Кеу Маrkеt Ѕеgmеntѕ

By Deployment

- Cloud

- On-premise

By Enterprise Size

- Small and Medium Enterprise

- Large Enterprise

By End-Use

- IT

- BFSI

- Retail

- Telecom

- Other End-Uses

Market Dynamics:

Development to Operations is a collection of tools and practices that drive collaboration, integration, and automation in development and IT operations within an enterprise. It helps companies increase efficiency and productivity, improve workflows, and improve operating activities.

Operations and development teams work together, dividing responsibilities and combining workflows to save time and reduce inefficiencies. Continuous integration and streamlined Delivery are two DevOps practices that can guarantee the quality of app updates and infrastructure changes. They also ensure reliable delivery and an excellent end-user experience.

Market growth is expected to be driven by the rise in demand for advanced technology to improve business operations and the increased need for enterprise optimization. The continuous development to operations approach allows for greater speed and agility in the entire lifecycle of an application. Additionally, better collaboration between IT teams helps make the organization more proactive and efficient.

The COVID-19 pandemic also accelerated the development of the operation market’s growth, due to the increasing importance of cloud platforms, systems, and systems for enhancing business growth opportunities through digital transformation. Businesses around the globe are also implementing digital transformation services and solutions to continue and sustain operations during the epidemic.

Cloud-based services are often used to link tools like query surge and slack from development to operations. Continuous testing is possible with the integration of the query surge tool into the DevOps pipeline. It also allows for separate operations so that each developer can focus on one tool and not the whole toolchain. It allows for faster turnaround and better collaboration across development. Additionally, it is more efficient which results in a faster development process that is less likely to make mistakes.

Automating DevOps tasks is possible with methods such as a continuous integration server, which automates the code testing and reduces the amount of manual work. Cloud-based platforms and other scalable infrastructures like cloud-based platforms can increase team accessibility while also addressing issues of distributed complexity. This increases the growth potential during the forecast period by speeding up testing and deployment.

Businesses face many challenges when it comes time to implement DevOps solutions. Unstandardized DevOps tools have led to a lack of process guidelines, which has resulted in automation that is not structured.

Enterprise Sizes face many challenges when implementing DevOps tools and lack expertise in software development services. This makes it difficult to deliver seamless results, monitor progress, and integrate with existing infrastructure. These are the main growth factors that will hinder the market. Enterprise Sizes are working to overcome these obstacles by creating standard workflows, processes, and protocols that will help drive the rapid growth rate of the market.

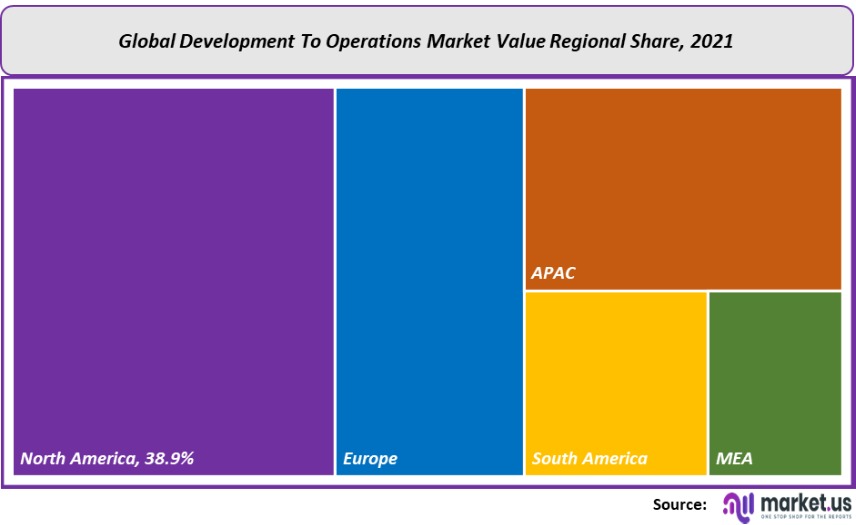

Regional Analysis

North America accounted for 38.9% of the global DevOps Market share. It held the largest market share at 38.9% in 2021. Regional market growth has been rapidly increasing market penetration for software automation tools to deliver efficient outcomes across all sectors (BFSI, retail).

It is easier to deliver solutions quickly to ever-changing user requirements, which has led to wider adoption of operations to the largest development. CollabNet VersionOne teamed with Xebia Labs in order to create a DevOps platform.

The collaboration would allow the companies to offer their customers end-to-end management capabilities as well as the visibility necessary for developing software solutions quickly, securely, reliably, and efficiently. These initiatives are key to the development of the DevOps industry in the region.

Due to digitization in banking, Asia Pacific will be the fastest-developing regional market at a CAGR of 24.2%. To meet the changing business needs of clients, banks have adopted agile project management and execution to manage their projects. One major bank in Southeast Asia wanted to market its digital banking services to meet growing customer demand. The internal IT team used Atlassian Jira software to integrate the services.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

competitive landscape:

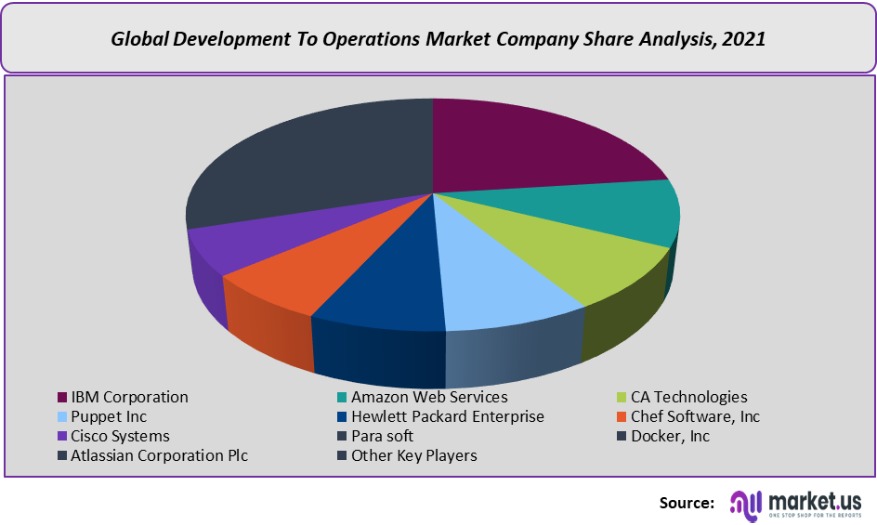

In order to increase their market share and improve their products, companies can engage in mergers & acquisitions. In order to increase market share and gain new customers, they are constantly working on new product development.

Industry incumbents are also investing in innovation labs, and centers of excellence, and collaborating with research institutes to increase their market share. Perforce Software is buying DevOps pioneer Puppet. A software company that provides IT automation software, which will take the company’s developer-oriented and DevOps portfolio to a higher level.

Маrkеt Kеу Рlауеrѕ:

- IBM Corporation

- Amazon Web Services

- CA Technologies

- Puppet Inc

- Hewlett Packard Enterprise

- Chef Software, Inc

- Cisco Systems

- Para soft

- Docker, Inc

- Atlassian Corporation Plc

- Other Key Players

Frequently Asked Questions (FAQ)

What is the Development To Operations market size in 2021?The Development To Operations market size is $ 7,450.4 million in 2021.

What is the CAGR for the Development To Operations market?The Development To Operations market is expected to grow at a CAGR of 20.1% during 2023-2032.

What are the segments covered in the Development To Operations market report?Market.US has segmented the Development To Operations market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Deployment, the market has been segmented into Cloud, On-premise. By End-Use, the market has been further divided into IT, BFSI, Retail, Telecom, and Other End-Use.

Who are the key players in the Development To Operations market?IBM Corporation, Amazon Web Services, CA Technologies, Puppet Inc, Hewlett Packard Enterprise, Chef Software Inc, Cisco Systems, Para soft, Docker, Inc, Atlassian Corporation Plc, and Other Key Players

Which region is more attractive for vendors in the Development To Operations market?North America will account for the highest revenue share of 38.9% among the other regions. Therefore, the Development To Operations market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

What are the key markets for Development To Operations?Key markets for Development To Operations are South Korea, Germany, and the US.

Which segment has the largest share in the Development To Operations market?In the Development To Operations market, vendors should focus on grabbing business opportunities from the cloud segment as it accounted for the largest market share in the base year.

![Development to Operations (DevOps) Market Development to Operations (DevOps) Market]() Development to Operations (DevOps) MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Development to Operations (DevOps) MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - IBM Corporation

- Amazon Web Services

- CA Technologies

- Puppet Inc

- Hewlett Packard Enterprise Development LP Company Profile

- Chef Software, Inc

- Cisco Systems

- Para soft

- Docker, Inc

- Atlassian Corporation Plc

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |