Global Diabetic Food Market By Product (Confectionery, Snacks, Bakery Products, Dairy Products, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 55960

- Number of Pages: 245

- Format:

- keyboard_arrow_up

Diabetic Food Market Overview

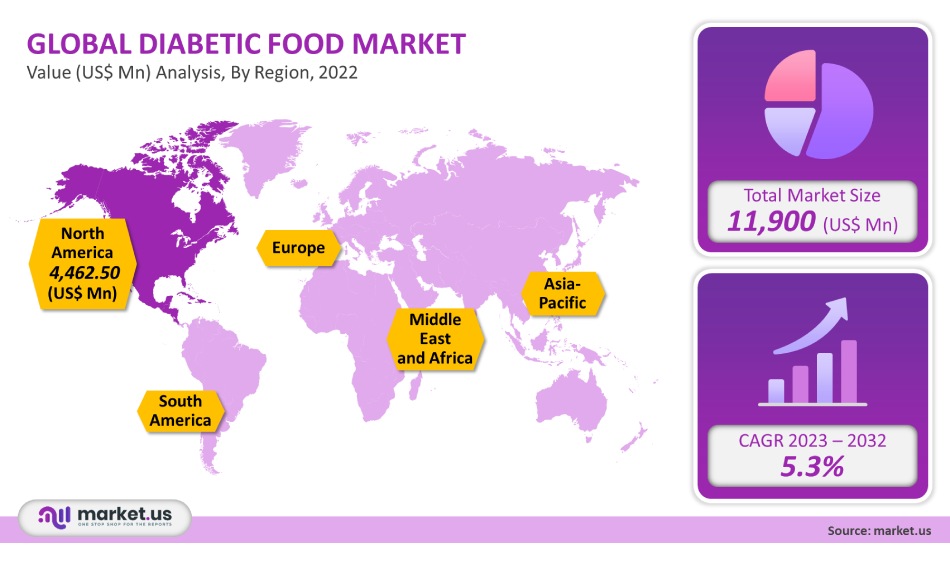

The global Diabetic Food Market is estimated to be worth USD 11,900 million by 2021. This number will increase at a compound annual growth rate of 5.3% between 2023-2032.

Diabetes has been on the rise, resulting in a greater demand for diabetic food. The Centers for Disease Control and Prevention’s “The National Diabetes Statistics Report”, published January 20,22, estimates that 37.3 million Americans have been diagnosed as having diabetes in 2021. This is approximately 1 in 10 people. These factors are likely to support the overall market growth. The COVID-19 epidemic has had an adverse effect on the entire food and beverage industry. According to the World Health Organization, healthy people are encouraged to stay home, along with those suffering from acute chronic diseases and symptoms.

Global Diabetic Food Market

Product Analysis

The largest market share for diabetic foods was held by dairy products, with a more than 25.0% revenue share in 2021. In January 2019 Everyday Health article claims that yogurt and other fermented dairy products have natural sources of probiotics. This is believed to be linked to increased glucose and insulin levels. People with diabetes choose Greek yogurt, string cheese, and grass-fed dairy options. Future growth is expected to be assured by the increasing number of product launches within this market. Chobani’s Greek Yogurt Mango & Cream was launched in June 2021. It contains 60 calories and is made with natural ingredients. The price at US retail stores is US$ 4.29.

However, the segment of confectionery is expected to experience the fastest growth over the forecast period. The overall growth has been supported by product launches in the confectionery sector by major brands and startups from around the world. BeyondBrands, for example, launched GoodSam Foods in January 2021. This brand is dedicated to sugar-free products. The product line comprises three chocolate bars, including dark chocolate, dark chocolate & sea salt nibs, dark chocolate, and mint.

Distribution Channel Analysis

In 2021, the market for diabetic foods was led by hypermarkets and supermarkets. They accounted for more than 65.0% of the total revenue. Its high-value generation is due to its huge number of supermarkets and hypermarkets across the globe. Customers visit local supermarkets and hypermarkets for the convenience of finding a variety of food items, including diabetic food, at one place. Future segment growth will be supported by new product launches at supermarkets in segments like bakery, dairy, confectionery, and other food items. Fitbakes introduced sugar-free caramel cake in around 1000 Tesco stores in the U.K.

Online delivery channels are expected to grow the fastest during the forecast. This segment will likely see a significant shift to online ordering from major retailers like Amazon, Walmart.com, and Target.com. A majority of brands and companies in the diabetic market prefer to launch their products through third-party e-commerce sellers. Amazon U.S. has a distinct range of diabetic snacks and foods under brands like Happy Belly, PLANTERS, and Simple Mills.

Key Market Segments

Product

- Confectionery

- Snacks

- Bakery Products

- Dairy Products

- Others

Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

Market Dynamics

The pandemic caused people to become more conscious of their health and cut down on sugar consumption. Sugar is associated with many infections, including diabetes, obesity, pain syndrome, and diabetes. Thus, there was a demand for low- or no-sugar products. Different regulations govern the diabetes food industry. They cover all aspects of the product’s lifecycle from production through to use. All diabetic products used in the healthcare sector must adhere to strict U.S. FDA regulations. These health conditions are caused by unhealthy lifestyles like sedentary lifestyles and smoking, and long working hours. They are expected to have a significant impact on the industry’s growth during the forecast period. Rising demand for junk food and a chronic lifestyle are also contributing to diabetes. These factors will likely fuel the demand in the coming years for diabetic foods.

The growing awareness of diabetes among consumers and its long-term impact has led people to focus more on their diets, sugar intake, and weight gain. Numerous companies have launched awareness campaigns to raise awareness about the increasing number of diabetics and the new products and labels in this market. In March 2021, The American Diabetes Association (ADA), launched the Better Choices for Life Program. This program focuses on educating the public. The program is intended for consumers to be aware of ADA claims on products and labeling. Currently, the association covers three product categories: Food and Nutrition, Health and Wellness, and Diabetes Management.

Diabetic food producers are expanding their market share by offering a range of products such as low-fat dairy, dietary beverages & snacks, low-calorie sugar jellies, ice creams, diabetic baked goods, and confectionery. These products will drive demand in the future. Lo! A Foods-India-based startup has increased its product line. The new product range includes low-carb, sugarless, and half-off in the glycemic index. The products can be used by diabetics.

The industry is likely to benefit from the growth of mergers & acquisitions to provide a wide variety of products. To help control diabetes, BeatO, an Indian Healthtech Startup, bought Novique Health. The company would help diabetics by diagnosing the root cause and offering preventative and educational measures.

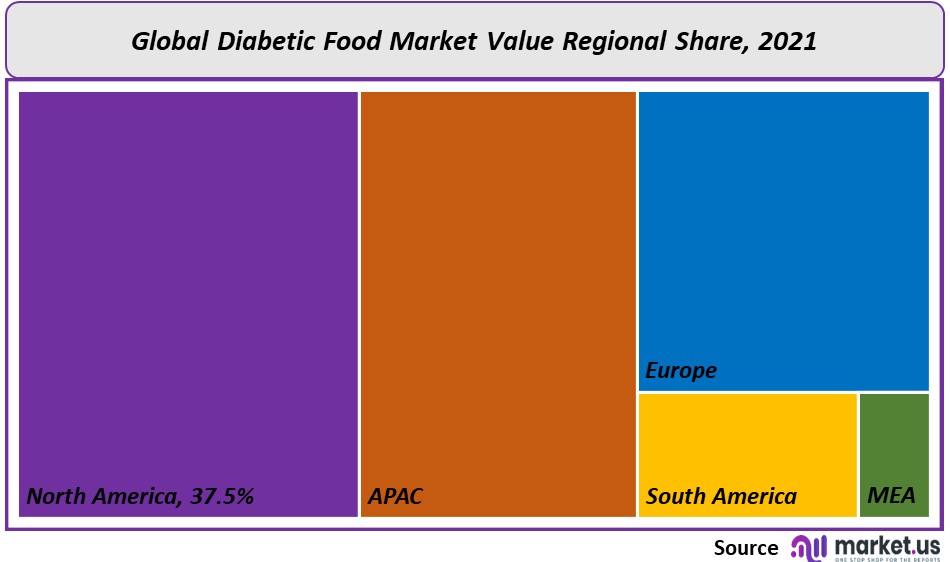

Regional Analysis

North America held the top spot in the market for diabetic products and was responsible for the largest share of revenue in 2021. With a market share of 37.5% for all diabetes foods, North America dominated the industry. This was due to rising health complications caused by high blood sugar levels and an aging population. High blood pressure and high cholesterol are other factors that have led to a rise in demand for diabetic food products in the U.S. This market will continue to grow. According to the Centers of Disease Control and Prevention report, approximately 1.4 million new cases of diabetes were reported in 2019. Of those, 69.0% of them had high blood pressure and 44% had elevated cholesterol. These facts are likely favorable to regional market growth.

The Asia Pacific is expected to experience the fastest growth in the market for diabetic meals during the forecast period. Expect a positive impact on regional demand from the growing number of diabetics with high cholesterol, chronic renal disease, and obesity in China and India. A strong preference for these products will lead to high demand in the Asia Pacific. This will aid the regional growth of the diabetic food market.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

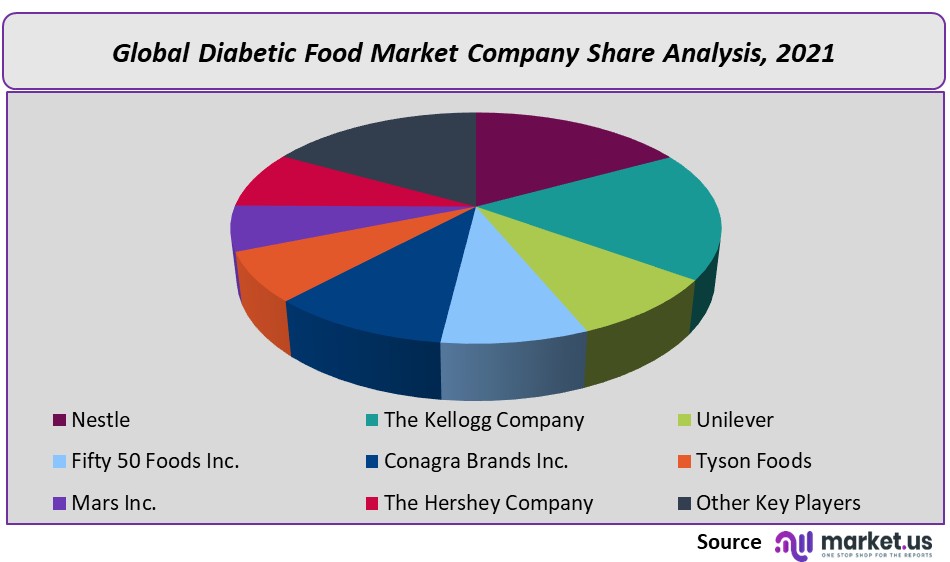

Market Share Analysis

There are many players in the diabetic food market, both regionally and globally. These players are involved in major acquisitions and merges, awareness campaigns, product launches, and product launches to increase brand loyalty and customer base. They are also developing new products, including barley porridge, white oats (oat bran), and 100.0% of natural ingredients that have no harmful or chemical content in diabetes foods.

Kate Farms launched glucose support for diabetics in the U.S. in February 2022 with a sugar-support 1.2 plant-based, natural Nutrition Shake.

Glucose Health, Inc. introduced new GLUCODOWN water-enhancement drink mixes in December 2021. These are now available on Amazon North America.

Splenda, a Splenda sweetener brand, launched Splenda diabetes care shakes in June 2020. These are designed to manage blood sugar and prediabetes.

Key Market Players

These are some of the most prominent players in the diabetes food market:

- Nestle

- The Kellogg Company

- Unilever

- Fifty 50 Foods Inc.

- Conagra Brands Inc.

- Tyson Foods

- Mars Inc.

- The Hershey Company

- Other Key Players

For the Diabetic Food Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Diabetic Food market in 2021?The Diabetic Food market size was US$ 11,900 million in 2021.

Q: What is the projected CAGR at which the Diabetic Food market is expected to grow at?The Diabetic Food market is expected to grow at a CAGR of 5.3% (2023-2032).

Q: List the segments encompassed in this report on the Diabetic Food market?Market.US has segmented the Diabetic Food market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Confectionery, Snacks, Bakery Products, Dairy Products, and Others. By Distribution Channel, the market has been further divided into Supermarkets & Hypermarkets, Specialty Stores, Online, and Others.

Q: List the key industry players of the Diabetic Food market?Nestle, The Kellogg Company, Unilever, Fifty 50 Foods Inc., Conagra Brands Inc., Tyson Foods, Mars Inc., The Hershey Company, and Other Key Players engaged in the Diabetic Food market.

Q: Which region is more appealing for vendors employed in the Diabetic Food market?North America is accounted for the highest revenue share of 37.5%. Therefore, the Diabetic Food industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Diabetic Food?The U.S., Canada, Mexico, U.K., Germany, France, India, Japan, China, Brazil, UAE, South Africa are key areas of operation for Diabetic Food Market.

Q: Which segment accounts for the greatest market share in the Diabetic Food industry?With respect to the Diabetic Food industry, vendors can expect to leverage greater prospective business opportunities through the dairy products segment, as this area of interest accounts for the largest market share.

![Diabetic Food Market Diabetic Food Market]()

- Nestlé S.A Company Profile

- The Kellogg Company

- Unilever Plc Company Profile

- Fifty 50 Foods Inc.

- Conagra Brands Inc.

- Tyson Foods, Inc. Company Profile

- Mars Inc.

- The Hershey Company

- Other Key Players

- Nestlé S.A Company Profile

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |