Global Digital Remittance Market By Type, By Channel, By End-use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2022

- Report ID: 12200

- Number of Pages: 259

- Format:

- keyboard_arrow_up

Digital Remittance Market Overview

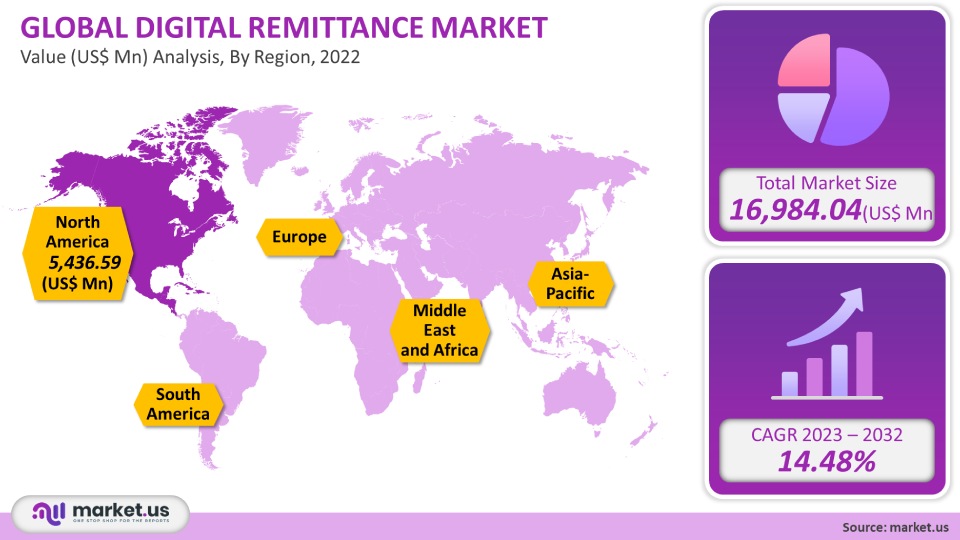

The Digital Remittance Market size is expected to be worth around USD 74.8 billion by 2032 from USD 16.9 billion in 2021, growing at a CAGR of 14.48% during the forecast period from 2022 to 2032.

Market growth can be attributed largely to increased fund transfers by migrant workers to families. Growth is expected to be driven by the rising number of cross-border transactions and the increased adoption of mobile-based payment solutions.

Global Digital Remittance Market Scope:

Type Analysis

In 2021, the outward digital remittance market growth dominated and accounted for more than 56% of global revenue. People who live in foreign countries send money home to help their families. These people can send money home safely and quickly through banks and financial institutions. Financial institutions and international banks are increasing their customer base and charging low fees. International outward remittances occur on a secure banking network that minimizes the risk of fraud and financial harm to the sender and receiver.

Inward digital remittance is expected to grow the fastest during the forecast period. The segment is expected to grow due to the increased adoption of mobile payment technology among migrants for money transfers. Many banks and financial institutions worldwide are focusing on adopting real-time banking technology to maximize Immediate Payment Service (IMPS). This technology allows banks to offer services to non-resident and resident customers. Because wire transfer services are the most trusted, fast, and popular fund transfer method, migrants increasingly turn to them for their inward remittances.

Channel analysis

In 2021, the money transfer operator segment was the dominant market. It accounted for over 41.01% of global revenue. Compared to banks, money transfer businesses can frequently provide reduced transfer fees. Additionally, these money transfer businesses provide the same level of security and dependability as banks. Money transfer companies offer several significant advantages, including the speed of money transactions. Money transfers can be initiated instantly and processed in a matter of days or less. This segment will be driven by the introduction of digital-first money transfer companies and the rapid introduction and digitization of funds, and the digital initiation capabilities of established money transfer providers over the forecast period.

Online platforms are expected to experience the fastest growth over the forecast period. Online money transfer platforms make managing funds transfers between companies and customers easy. These platforms make it easy for users to access money transactions and execute the fund transfer process. Many online money transfer platforms provide user-friendly services for their client base. These platforms make it easy for clients to navigate their websites. The segment’s growth is expected to be accelerated by the growing adoption of digital wallets. Customers can track their funds using digital wallets.

End-use Analysis

The market’s largest segment, the individual digital remittance segment, accounted for over 39.7% of the global revenue forecast in 2021. New products and services are constantly being developed to make it easier to use financial customer accounts. The adoption of digital remittance operator services to send money back to their home countries is expected to increase due to increasing global migration. The individual segment is expected to grow due to increased smartphones and worldwide internet penetration. Innovative solutions are already changing the landscape in remittance services, increasing convenience and decreasing costs for senders and recipients.

Over the forecast period, significant growth is expected in the migrant labor workforce segment. Digital remittance Market size By services allows migrant labor workers to compare transfer costs and locate support organizations easily. This service makes it easy and affordable for migrants to send money home. Innovations in cross-border payments and fintech will also support segment growth. Segment growth was also helped by the hard work of migrant workers, who continued to work hard during the COVID-19 epidemic to support their families.

Кеу Маrkеt Ѕеgmеntѕ

By Type

- Outward Digital Remittance

- Inward Digital Remittance

By Channel

- Money Transfer Operators

- Banks

- Online Platforms

- Other Channels

By End-use

- Personal

- Migrant Labor Workforce

- Small Businesses

- Other End-uses

Market Dynamics:

Customers will be more inclined to use online transactions due to the proliferation of a digital platform for remittance. The increasing penetration of mobile devices worldwide has encouraged the adoption of digital technology for cross-border payments and remittance services. The digital remittance Market is becoming more popular by reducing money transfer times and lowering remittance fees. Digital remittance services also offer privacy and protection for customers’ money.

It was difficult and costly because of the many intermediaries, hidden fees, and paperwork involved with the money transfer. The digital remittance Market has made money transfer easier, more remittance cost-effective, faster, and more valuable for customers and business plans. Because of the healthier competition between market players, the costs of transferring money have fallen dramatically.

Many governing bodies are now being forced to regulate and pay more attention to the digital remittance market due to its rising popularity among low-wage migrants who use them to send money home. Foreign remittances are crucial for economic development in emerging markets. To encourage customers to use digital remittance Market services and contribute to the economic growth of their home countries, authorized regulators monitor and control money transfer fees. These key factors will contribute to market growth during the forecast period.

Over the forecast period, the market will see growth opportunities due to the increasing acceptance and ease of electronic payments. Market growth will be impeded by a lack of awareness and high remittance prices. Market growth could be hampered by security issues such as money laundering and terrorist financing. Market growth is expected to be detailed covid-19 impact analysis. The rise in digital money transfer methods has been attributed to movement and other restrictions. Regulatory changes have been announced to encourage digital payments. An increase in digital payments has resulted in a substantial rise in using e-wallet payments instead of cash. In low- and mid-income countries, mobile money services are steadily increasing. These major factors will create market growth opportunities during the forecast period.

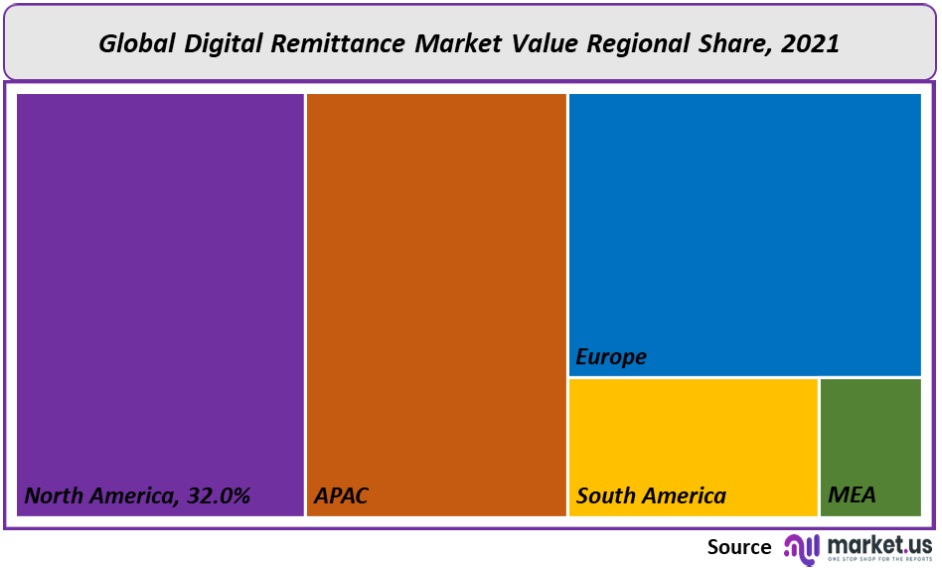

Regional Analysis

Latin America dominated the market, accounting for over 32% of global revenue in 2032. Many prominent region-wise communication and financial services companies, including Western Union Holdings, Inc., Continental Exchange Solutions, Inc., and MoneyGram. Many people move to North America for better education, job opportunities, and business reasons. There are many growth factor opportunities for digital remittance services providers in the region wise due to the increasing number of immigrants. The introduction of many payment apps has helped Latin America adopt the current trend of faster money transfers.

Growth in the adoption of banking and financial services in the region is expected to propel the regional market growth over the forecast period; the Asia Pacific market will be the fastest growing. Many people from the Asia Pacific region send billions of dollars yearly in remittances to their family members, business partners, and colleagues abroad. The region’s financial services and banking adoption are expected to increase over the impeccable forecast period. The region’s growth is being supported by India and China, which are heavily focusing their efforts on mobile banking, cashless payments, and mobile-based payment channel. The growth of the customer base and increased competition will create opportunities for growth for the regional market.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

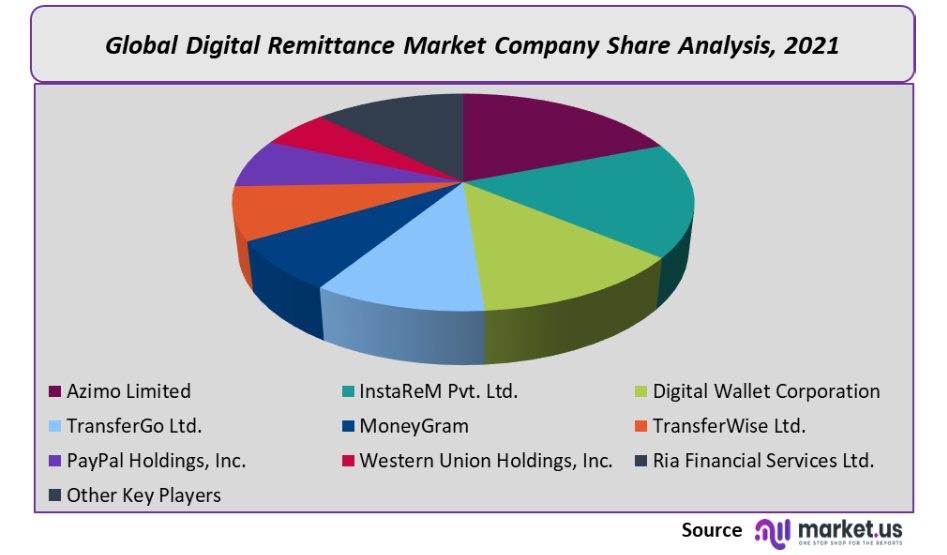

Market Share & Key Players Analysis:

Moderate fragmentation is evident in the market. To strengthen their market position, prominent players have adopted various strategies, including product innovation, partnerships, and research & development initiatives. Money transfer software facilitates money transfers between businesses as well as between customers and businesses. B2B customers, finance professionals, and others use money transfer software to send money online.

Маrkеt Кеу Рlауеrѕ:

- Azimo Limited

- InstaReM Pvt. Ltd.

- Digital Wallet Corporation

- TransferGo Ltd.

- MoneyGram

- TransferWise Ltd.

- PayPal Holdings, Inc.

- Western Union Holdings, Inc.

- Ria Financial Services Ltd.

- Other Key Players

For the Digital Remittance Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

USD 16.09 Bn

Growth Rate

14.48%

Forecast Value in 2032

USD 74.8 Bn

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Digital Remittance market in 2021?The Digital Remittance market size is US$ 16,984.04 million in 2021.

What is the projected CAGR at which the Digital Remittance market is expected to grow at?The Digital Remittance market is expected to grow at a CAGR of 14.48% (2023-2032).

List the segments encompassed in this report on the Digital Remittance market?Market.US has segmented the Digital Remittance market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Outward Digital Remittance and Inward Digital Remittance. By Channel, market has been segmented into Money Transfer Operators, Banks, and Online Platforms. By End User, the market has been further divided into Personal, Migrant Labor Workforce, and Small Businesses.

List the key industry players of the Digital Remittance market?Azimo Limited, InstaReM Pvt. Ltd., Digital Wallet Corporation, TransferGo Ltd., MoneyGram, TransferWise Ltd., PayPal Holdings, Inc., Western Union Holdings, Inc., Ria Financial Services Ltd., and Other Key Players engaged in the Digital Remittance market.

Which region is more appealing for vendors employed in the Digital Remittance market?North America accounted for the highest revenue share of 32%. Therefore, the Digital Remittance industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Digital Remittance?The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc., are key areas of operation for Digital Remittance Market.

Which segment accounts for the greatest market share in the Digital Remittance industry?With respect to the Digital Remittance industry, vendors can expect to leverage greater prospective business opportunities through the outward digital remittance segment, as this area of interest accounts for the largest market share.

![Digital Remittance Market Digital Remittance Market]()

- Azimo Limited

- InstaReM Pvt. Ltd.

- Digital Wallet Corporation

- TransferGo Ltd.

- MoneyGram

- TransferWise Ltd.

- PayPal Holdings, Inc.

- Western Union Holdings, Inc.

- Ria Financial Services Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |