Global Digital Transaction Management Market By Component (Hardware, Software, Services), By Solution (Electronic Signatures, Workflow Automation, Others), By End-User (Large enterprises and SMEs), By Vertical (Retail, BFSI, Healthcare, IT & Telecom, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 64605

- Number of Pages: 366

- Format:

- keyboard_arrow_up

Digital Transaction Management Market Overview:

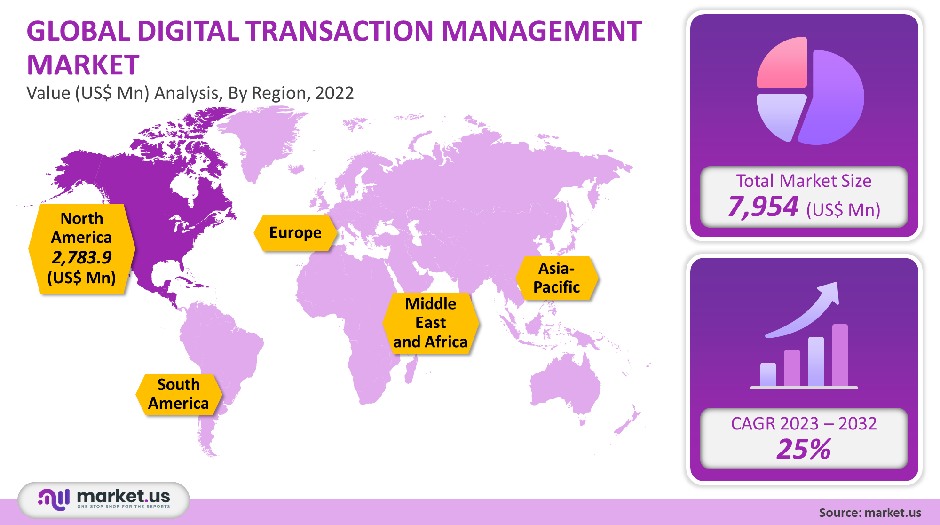

The global market for digital transaction management was valued at USD 7,954 million in 2021. It is projected to grow at a CAGR of 25.0% between 2023 and 2032.

The shift to workflow and automation in many industries and verticals is responsible for the growth of this market. Global enterprises are eager to adopt efficient, seamless business processes that can be applied regardless of where they are located. Digital Transaction Management (DTM), solutions can be used to improve customer experience and reduce transaction times. This will allow organizations to increase market growth over the forecast period.

Global Digital Transaction Management Market Scope:

Component Analysis

In 2021, the hardware industry dominated and generated 42.0% of the total market revenue. Vendors in a range of sectors, including healthcare, retail, and hospitality, are the main drivers of hardware expansion.

Sales orders, inventory information, customer profiles, POS transactions, and any other activity that occurs in a retail store can all be tracked using POS devices. The demand for DTM hardware has also increased as a result of electronic signature pads and contactless technologies like Near Field Communication (NFC).

The software segment is predicted to have the fastest CAGR during the projection period. The rise in popularity of different types of software, such as Contract Lifecycle Management (CLM) software and other programs that help with conducting digital transactions, may be a factor in the expansion of this market.

Digital transaction management software can help businesses by capturing legally valid electronic signatures, monitoring and controlling the flow of documents between contractual parties, and protecting document-based transactions and information storage. Particularly useful for consumers is the cloud-based functionality of digital transaction management solutions.

Solution Analysis

In 2021, the electronic signatures market was dominant due to the wide range of electronic signature software and services that are being aggressively rolled out by many vendors, the segment will continue to dominate the market. Electronic signatures technology can improve efficiency, speed up transactions, and reduce overall business costs. There are many areas where there have been significant reductions, including recording costs and archiving costs.

Over the forecast period, workflow automation is expected to experience the fastest CAGR. Automation helps businesses save time and money, while also avoiding mistakes in their processes. Document and transaction errors can lead to serious financial losses. Businesses can avoid such errors by defining conditions and rules as part of workflow automation solutions. Organizations are opting to automate their workflows more frequently, which will drive segment growth in the future.

End-User Analysis

The large enterprise market sector dominated in 2021. Large businesses still need to set up transaction workflows and make sure that business processes are effective and economical. For the effective management of transactions and transaction documentation, large enterprises are more likely to employ digital transaction management solutions than smaller ones.

Large businesses are increasingly implementing digital transaction management solutions to support timestamped updates, offer sufficient authentication, and cooperate with reviewers, thereby accelerating the lifespan of the business.

Over the forecast period, the fastest CAGR is expected to be in the SMEs segment. For efficient transaction management and automation, SMEs are slowly adopting digital transaction management solutions. The technological shift that SMEs are making from traditional transaction management to digital transactions management is responsible for the segment’s growth. SMEs are also choosing state-of-the-art solutions based on the most recent technologies such as Artificial Intelligence (AI) to lower risks and manage administration costs.

Vertical Analysis

In 2021, the BFSI segment was dominant in the market. Banks and financial institutions are known for their agile transaction workflows. In order to make their transactions more efficient and flexible, the BFSI industry’s incumbents are adopting cloud-based digital transfer management solutions.

Banks and financial institutions are increasingly being challenged by increasing competition and demanding customers and a changing regulatory environment. This is driving the BFSI segment’s growth over the forecast period.

Over the forecast period, the fastest CAGR is expected to be in the government segment. As part of various digital governance initiatives around the globe, government agencies will likely adopt digital transaction management software. These solutions can be used by governments to provide sophisticated algorithms and high levels of security that allow them to store records of transactions safely and enable efficient governance.

Many governments around the globe are now aggressively approaching vendors to create digital transaction management solutions.Key Market Segments:

By Component

- Hardware

- Software

- Services

By Solution

- Electronic Signatures

- Workflow Automation

- Authentication

- Document Archival

- Others

By End-Use

- Large enterprises

- SMEs

By Vertical

- Retail

- BFSI

- Healthcare

- IT & Telecom

- Government

- Real Estate

- Utilities

- Others

Market Dynamics:

Over the forecast period, the market is expected to grow due to the continued adoption by businesses around the world of electronic tools and practices to streamline routine document-based tasks. Market growth will also be driven by the increasing demand for secure record filing.

Digital transaction management solutions are becoming increasingly popular with businesses. These solutions can be used to manage all aspects of the document lifecycle, from creation to storage. Digital transaction management solutions can also make business operations more efficient, safer, and faster.

Over the forecast period, the market will experience growth opportunities due to the increasing use of cloud-based services. Cloud-based filing management and storage is a consistent approach that could lay the foundations of paperless documentation. Indexing, document capture and safe sharing, access control, searching, retrieval, encryption, security, integration, and backup are all essential components of digital document management systems. These capabilities can be combined with content analytics to help businesses eliminate redundant data entries.

Online services and solutions that are based on digital technology can be vulnerable to fraud and cyberattacks. Online transactions are often subject to fraud, including identity thefts and merchant and triangulation frauds. The market’s growth is expected to be hampered by growing concerns about fraud and cyberattacks. Cyberattacks and security breaches that result in default digital transactions are expected to have a significant impact on the market for digital transaction management solutions.

Regional Analysis

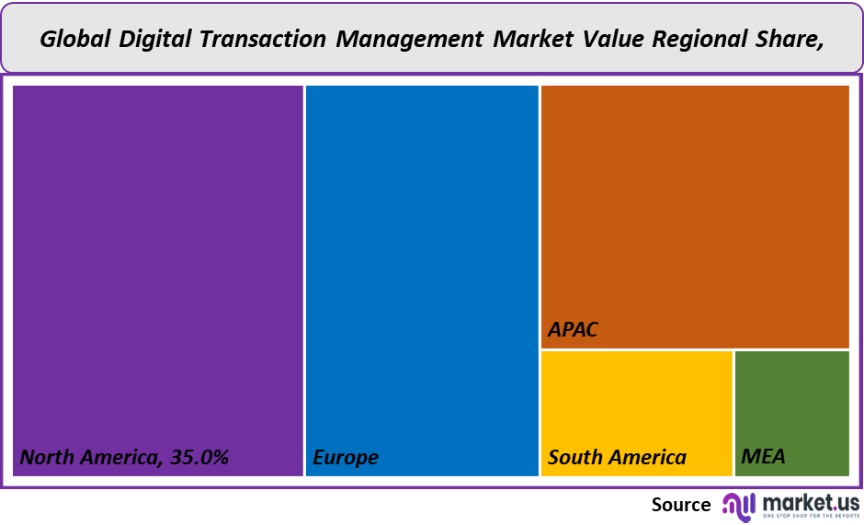

North America was the dominant marketplace in 2021, accounting for 35.0% of global revenue. There are many key players in North America, as well as new companies offering digital transaction management solutions. The region is well-known for its early adoption of digital transaction management solutions. These factors have allowed the North American regional market to hold a significant share of the global market. Over the forecast period, Asia Pacific will be the fastest-growing regional market.

The growth of the region’s market will be driven by the increasing adoption of digital solutions to transaction management in developing countries like India and China. Market growth is expected to be driven by continued digitization in India and government initiatives such as Digital India. Over the forecast period, the region will see growth opportunities due to the increasing number of SMEs.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

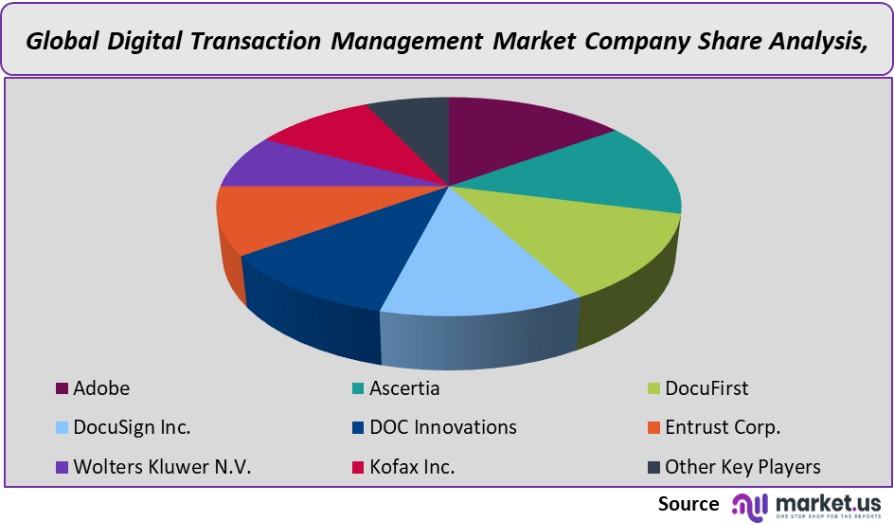

Market players are expanding their digital transaction management solutions’ capabilities by adding innovative features. These include seamless document generation and automatic reminders. They also allow for configurable workflows and automated tracking.

Many vendors are developing solutions that meet international security standards and audit agreements. As part of their efforts to consolidate their market position, market players are focusing on product development, mergers and acquisitions, and business expansions.

OneSpan, for instance, announced in September 2021 that BankID, an electronic personal ID used by all Norwegian banks to sign online and secure identification, had implemented cloud authentication and anti-fraud solutions from OneSpan. These solutions help improve customer experience and secure banking applications in Norway.

BankID is a tool that allows citizens to make online payments and secure their identities. However, cloud authentication and anti-fraud solutions will help protect BankID against increasing fraud and mobile threats.

Market Key Players:

- Adobe

- Ascertia

- DocuFirst

- DocuSign Inc.

- DOC Innovations

- Entrust Corp.

- Wolters Kluwer N.V.

- Kofax Inc.

- Other Key Players

For the Digital Transaction Management Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Digital Transaction Management market in 2021?A: The Digital Transaction Management market size is US$ 7,954 million in 2021.

Q: What is the projected CAGR at which the Digital Transaction Management market is expected to grow at?A: The Digital Transaction Management market is expected to grow at a CAGR of 25% (2023-2032).

Q: List the segments encompassed in this report on the Digital Transaction Management market?A: Market.US has segmented the Digital Transaction Management Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Component, the market has been segmented into Hardware, Software, Services; by Solution, the market has been segmented into Electronic Signatures, Workflow Automation, Authentication, Document Archival, Others, ; by End-user, the market has been segmented into Large enterprises and SMEs, and the Vertical market has been segmented into Retail, BFSI, Healthcare, IT & Telecom, Government, Real Estate, Utilities, Others.

Q: List the key industry players of the Digital Transaction Management market?A: Adobe, Ascertia, DocuFirst, DocuSign Inc., DOC Innovations, Entrust Corp., Wolters Kluwer N.V. , Kofax Inc., Other Key Players, are the key vendors in the Digital Transaction Management market.

Q: Which region is more appealing for vendors employed in the Digital Transaction Management market?A: North America accounted for the highest revenue share of 35%. Therefore, the Digital Transaction Management industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for the Digital Transaction Management Market.A: The U.S., Canada, Mexico, Germany, U.K., Spain, France, Italy etc., are leading key areas of operation for Digital Transaction Management Market.

Q: Which segment accounts for the greatest market share in the Digital Transaction Management industry?A: With respect to the Digital Transaction Management industry, vendors can expect to leverage greater prospective business opportunities through the hardware industry segment, as this area of interest accounts for the largest market share.

![Digital Transaction Management Market Digital Transaction Management Market]() Digital Transaction Management MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Digital Transaction Management MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - Adobe

- Ascertia

- DocuFirst

- DocuSign Inc.

- DOC Innovations

- Entrust Corp.

- Wolters Kluwer N.V.

- Kofax Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |