Global Digital Workplace Market By Type , By Application , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019-2028

- Published date: Jun 2022

- Report ID: 42682

- Number of Pages: 293

- Format:

- keyboard_arrow_up

Digital Workplace Market Overview

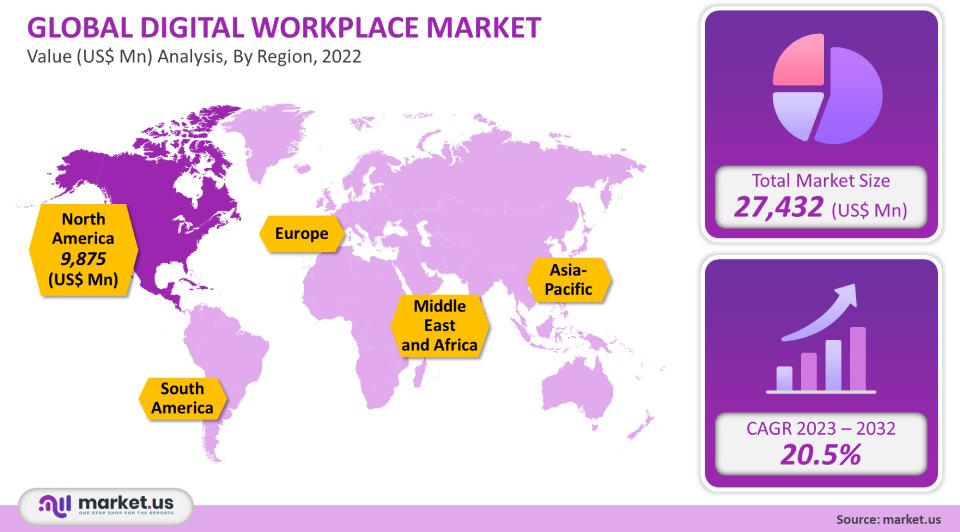

The global digital workplace market was worth 27.432 Billion in 2021. This number will increase at a CAGR of 20.5% between 2023-2032. The current growth is due to the increasing demand for desktop-as-a-service, increased digitalization, and growing demand for employee engagement for greater flexibility in terms of work-life balance. To ensure continuity of business, many businesses switched to remote working after the COVID-19 epidemic.

Global Digital Workplace Market Analysis

Component Analysis

In 2021, the segment of solutions held a market share of 65%. The adoption rate of workplace solutions like enterprise social and collaborative tools and cloud storage tools and content management systems by end-users, to improve resource usage and productivity, is responsible for the segment’s growth. Trianz PULSE, a next-generation digital workplace solution, allows clients, partners, and vendors to collaborate and communicate in a single centralized environment. This makes remote workforce management easier. It creates a social network at work, encourages collaborations and team building, and allows users to access social media for corporate messages. The self-service capabilities of the IT department in the organization further enhance productivity and operational efficiency. These benefits will help to boost the segment’s growth during the forecast period.

The forecast period sees the services segment growing at a 21.5% CAGR. It includes services such as consulting services, maintenance, training support, and integration or implementation services. These services assist organizations in aligning their digital workplaces effectively and efficiently. They can also offer cost-effective support for technical questions and prevent downtime due to the implementation of digital workplace solutions. They also help organizations keep a competitive edge in their market through several benefits like stable operating environments and reduced governance and compliance risk. These factors will continue to boost the adoption of digital workplace services in the forecast period.

Enterprise Size Analysis

The large enterprise segment held a significant revenue share in 2021. Large enterprises are increasingly adopting cloud technology, as well as innovative technologies, which are easy to consume and powered with AI and other automation technologies. TCS Limited Cognex is an example of a digital workspace that has been designed, configured, and developed to meet large-scale organizational needs and provide complete automation. The solution provides real-time dashboards that provide intelligent reporting. Users can also access future technologies like Augmented Reality, Virtual Reality (VR), or cognitive automation. This will help large companies adopt digital workplace solutions.

The Small & Medium Enterprises (SMEs), the segment is forecast to grow at a rate of 20.7% during the forecast period. SMEs are rapidly deploying digital workplace solutions despite having limited organizational infrastructure. It has many advantages for SMEs. They can increase workforce productivity and business efficiency.

SMEs are also increasingly adopting cloud-based enterprise sizes due to their lower costs, no requirement for human labor for hardware maintenance, and scalability. This leads to lower operating and capital expenses. These factors are driving the growth in the digital workplace industry trends among SMEs over the forecast.

End Use Analysis

2021 saw a high revenue share for the IT and telecom segment. A rise in digital workplace solutions has resulted from the rising trend of remote work, increased adoption of Software as a Service (SaaS), and BYOD in countries such as Australia, Canada, India, and China. Many IT and telecom companies. Globalization has led to increased workforce flexibility and resilience as economies worldwide become more digital. Digital solutions are being aggressively invested by organizations to manage their businesses and provide resilience to unprecedented lockdowns.

Infosys, a company that offers business consulting and outsourcing services, launched four digital platforms within their workplace. They include Launchpad for employee onboarding, InfyMe for employee services platform, LEX for digital learning, Meridian, and Launchpad. Infosys was able to adapt quickly to hybrid and remote working models during the pandemic. These developments will boost the adoption rate of digital workplace solutions by the IT & Telecom industry over the forecast period.

The forecast period sees the healthcare and pharmaceuticals market in terms of growing at a rate of 21.3%. Numerous healthcare organizations are adopting the digital workplace solution and its benefits. They include centralized information access and paper reduction as well as substantial savings. Healthcare organizations can increase communication, collaboration, as well as information flow throughout the organization by adopting digital workplace tools.

Atos, an IT consulting and service company, has signed a contract with Bayer, a German pharmaceutical-life science company, to develop digital workplace solutions and services. Bayer employees can benefit from Atos digital workplace solutions. This includes simplified Omni channel service through modern device management and high levels of automation. Interactive technology is also used. These changes in healthcare will drive demand for digital workplace solutions over the forecast period.

Key Market Segments

By Component

Services

Solutions

By Enterprise Size

Small and Medium Enterprises

Large Enterprises

By End-Use

BFSI

IT & Telecommunication

Healthcare & Pharmaceuticals

Manufacturing

Other End-Uses

Market Dynamics

The widespread use of web and video conferencing has been a necessity due to the pandemic. It has enabled new ways of communication, team bonding, and collaboration. Because pandemics are so easily spread, many companies have made long-term investments in workplace transformation to create a hybrid work model. Cloud-based solutions were necessary to allow remote access and secure working. The increasing use of digital transformation technology to aid employees in their work and not compromise the company’s ongoing operations has many benefits. HCL Technologies, a provider of IT services and consulting, entered into a contract with Munich Re in August 2021 to offer a next-generation digital workplace environment to its 16,000 employees. It is available in 40 countries.

Munich Re’s global workforce through a combination of a global and local strategy is supported by HCL. HCL will implement a personalized service desk solution and leverage the power and automation of self-service and automation to enhance employee productivity and user experience. These technological advances offer key companies new opportunities to expand their portfolio of workforce management.

Market growth can be attributed to the increased adoption of advanced technologies like Bring Your Own Device (BYOD), enterprise mobility, and other innovative technologies. It improves flexibility and mobility and reduces time spent on software licensing and device management. It helps to change the nature and process of workplaces, as well as reduce the operational costs of businesses.

AI and automation technology proliferation are playing an important role in automating manual tasks and opening up new avenues for companies to increase productivity and streamline their processes. Wipro Limited, an Information Technology (IT), consultancy, and business service company, announced a partnership in May 2022 with Scania, a transport services provider, to provide support, greater automation, and a better customer experience for Scania employees using Wipro’s Live Workspace.

The industry’s driving factors are the rapid advancement of mobile technology, the changing workforce demographics, as well as the growing trend toward connected workplaces. Cloud-based services are being adopted by many future workplaces, including Infrastructure as a Service (“IaaS”), Backend as a Service (“BaaS”) Platform as a Service [PaaS], and Software as a Service (“SaaS”) to help their business and get the job done.

Additionally, cloud services can be used by organizations to give instant access to business-critical data as well as enterprise applications on a wide range of devices like tablets, smartphones, laptops, and desktops. However, security restrictions are kept in check. These major factors will offer growth opportunities to the major players operating in the global digital workplace market growth over the forecast period.

Regional Analysis

North America held a 36% largest revenue share in the 2021 market and was the market leader. The growing adoption of new technologies, such as AI, BYOD, enterprise mobility management solutions, and BYOD, has contributed to the growth of the region’s digital workplace industry. Many regional workplace transformation service providers incorporate cloud technologies and Artificial Intelligence in their service offerings.

IBM Talent & Transformation is an AI-based business solution that helps human resources increase their skills. The solution is designed to enable business professionals in many areas to embrace digital technology. Due to the region’s high level of manufacturing, automotive, and retail activity, there is a strong demand for software- and robotics-related solutions. This drives the development and expansion of the regional marketplace.

Asia Pacific is expected to grow at a significant CAGR of 21.9% over the forecast period. This growth can be attributed to digitization adoption by different industry sectors and the growing use of cloud platforms. Market players in the region are also adopting a number of strategies to maintain their market leadership, including product development, collaborations, and strategic partnerships.

Tata Consultancy Services Limited, with the support of the Singapore Economic Development Board, launched the (DAC) Digital Acceleration Center to help Singapore businesses in the COVID-19 Recovery. TCS will offer university graduates of Singapore opportunities through Workforce Singapore’s Traineeships Program. These include AR, digital workplace, IoT, and AR. Regional market players can now expand their digital workplace portfolios through these new technologies initiatives.

Key Regions and Countries covered in thе rероrt:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

Market Share & Key Players Analysis:

Accenture, Capgemini, and IBM are the major players in the market. These key players tend to invest heavily in R&D to help grow their businesses and increase their profitability. In order to improve their products, and gain a competitive advantage, companies are seen engaging in mergers and acquisitions. They are actively working on new product launches, development, and enhancements of existing products to gain new customers and expand their market share.

Маrkеt Кеу Рlауеrѕ:

TCS Limited

Atos SE

Accenture plc

Capgemini

Trianz

Infosys Limited

HCL Technologies Limited

Other Key Players

For the Digital Workplace Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

27.43 Billion

Growth Rate

20.5%

Forecast Value in 2032

47.997 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Digital Workplace Market in 2021?The Digital Workplace Market size is 27.432 Billion in 2021.

What is the projected CAGR at which the Digital Workplace Market is expected to grow at?The Digital Workplace Market is expected to grow at a CAGR of 20.5% (2023-2032).

List the segments encompassed in this report on the Digital Workplace Market?Market.US has segmented the Digital Workplace Market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Component, the market has been further divided into Services and Solutions. By Enterprise Size, the market has been further divided into Small and Medium Enterprises and Large Enterprises. By End-Use, the market has been further divided into BFSI, IT & Telecommunication, Healthcare & Pharmaceuticals, Manufacturing, and Other End-Uses.

List the key industry players of the Digital Workplace Market?IBM, TCS Limited, Atos SE, Accenture plc, Capgemini, Trianz, Infosys Limited, HCL Technologies Limited, and Other Key Players are engaged in the Digital Workplace market

Which region is more appealing for vendors employed in the Digital Workplace Market?North America is expected to account for the highest revenue share of 36%. Therefore, the Digital Workplace industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the Digital Workplace?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Digital Workplace Market.

Which segment accounts for the greatest market share in the Digital Workplace industry?With respect to the Digital Workplace industry, vendors can expect to leverage greater prospective business opportunities through the solution segment, as this area of interest accounts for the largest market share.

![Digital Workplace Market Digital Workplace Market]()

- International Business Machines Corporation Company Profile

- TCS Limited

- Atos SE

- Accenture plc Company Profile

- Capgemini SE Company Profile

- Trianz

- Infosys Limited

- HCL Technologies Limited

- Other Key Players

- Nestlé S.A Company Profile

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |