Global Disposable Syringes Market By Type (Conventional Syringes , and Safety Syringes), By Application (Medical Uses , and Non-medical Uses), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022–2032

- Published date: Nov 2021

- Report ID: 20258

- Number of Pages: 249

- Format:

- keyboard_arrow_up

Disposable Syringes Market Overview

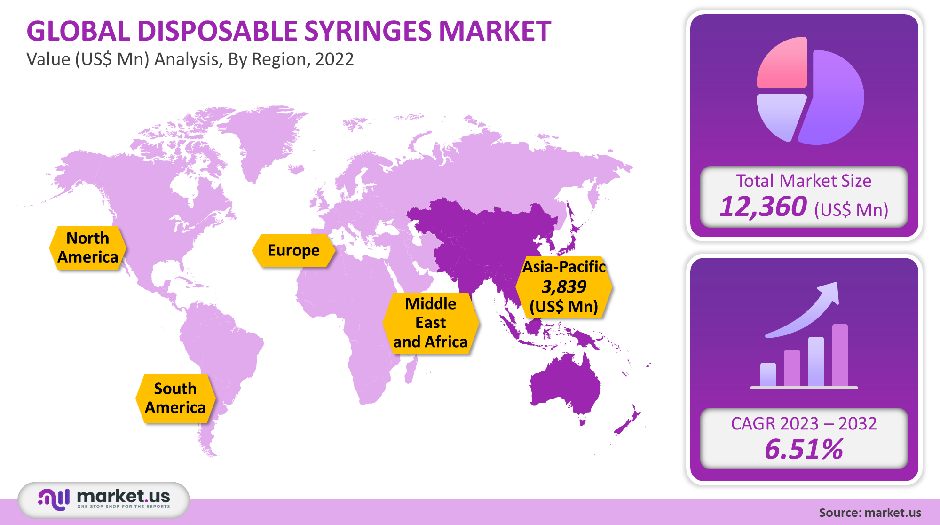

The global disposable syringes market was valued at USD 12,360 million in 2021. It is anticipated that it will grow at a CAGR of 6.51% from 2022 to 2032.

The growing prevalence of chronic conditions, the increased adoption of safety syringes, and the increase in surgeries worldwide are some of the reasons for this growth. Molnlycke Health Care AB predicts that 70 million procedures will be performed in Europe every year by 2021.

Global Disposable Syringes Market Scope:

Product Analysis:

Safety syringes lead the market and account for 64.03% of 2021’s revenue. Safety syringes, while still being used for a long, are now more in demand due to their advantages. Safety syringes prevent patient-to-patient transmission of infections.

They are therefore likely to stay in their position throughout the forecast period. Safety syringes primarily serve to administer medication by using standard and specialized methods.

Around the globe, hazardous injecting techniques are responsible annually for 33,800 HIV cases, 315,000 hepatitis C infections, and 1.7 million hepatitis B infections.

Neglecting to take precautionary measures, such as not using the needles and syringes as directed by healthcare professionals, can lead a person to sustain needle stick injuries.

Additionally, while disposable syringes offer protection for the recipient they do not provide safety for patients. The segment growth is expected to be boosted by such factors.

Traditional syringes were the second-leading segment, accounting for 35.97% market share in 2021. These syringes, which are mostly made of plastic and have visible graduations, are intended for single-use.

Disposable conventional syringes provide many benefits, including eliminating the possibility of infection by blood-borne pathogens (e.g. HIV, Ebola virus, Hepatitis C). With the goal of reducing disease transmission in patients, governments in emerging nations are making efforts to increase disposable syringes.

Application Analysis

The market leader in therapeutic injections was 85.69%, with a market share of 85.69% for 2021. One of the main factors driving this market is the growing awareness of blood donation worldwide.

According to the American National Red Cross for 2021, 13.6 million units of red blood cells and whole blood cells are collected from the U.S. each year.

The fastest-growing segment in immunization injections during the forecast period is expected to be the vaccines segment, at a CAGR rate of 7.43%.

The vaccine process is very much a mass activity. This can increase the risk of blood-borne diseases. To prevent needle, and stick injuries, avoid multiple uses of a needle and a syringe. Also, the injections used will depend on how safe, effective, and cost-effective the vaccine is to be administered.

Prefilled, prefilled auto-disable Syringes are the best option, provided all vaccines are in prefilled forms. This avoids vaccine contamination, increases the accuracy of the dose, and reduces the amount of waste that can be generated by multiple vials.

Key Market Segments:

By Product

- Conventional Syringes

- Safety Syringes

- Retractable Safety Syringes

- Non-retractable Safety Syringes

By Technology

- Immunization Injections

- Therapeutic Injections

Disposable Syringes Market Dynamics:

The syringes had been expensive at the time and could have been made in large quantities. Therefore, healthcare professionals had the responsibility of reusing syringes with different patients. Therefore, all doctors/physicians needed to sterilize and sharpen the scissors after each use.

In this way, chronic diseases became more common in recent years. Disposable syringes have seen an increase in demand due to their many advantages over reusable. Safety and sterilization are just two of the many advantages that disposable syringes provide.

Because disposable syringes are disposable, patients don’t have to rely only on their doctors’ sterilization protocols. Instead, they can be discarded after each use. Cross-contamination is therefore eliminated. Another advantage of disposable syringes is their low cost and environmental friendliness. These factors are positive for sales growth. Future growth is expected in this market.

In light of the rapidly spreading COVID-19 epidemic, manufacturers have focused their efforts on sterilizing products in a way that minimizes infection to patients and healthcare practitioners.

To increase their international credibility, market players are focusing their efforts on improving operational performance. BD, a multinational technology company that specializes in medical technology, announced, for example, in June 2021, that it had received pandemic requests for 2 billion injectable devices, including syringes, and syringes.

Furthermore, organizations are learning more about their supply chain to help reduce product prices as well as improve the quality and service associated with disposable syringes. This operational approach helps organizations save money by eliminating unnecessary third-party expenses. These attributes will lead to lucrative market growth.

The rising prevalence of chronic conditions like Crohn’s disease, diabetes, and other disorders can be managed through self-injecting medication. According to the International Diabetes Federation 2021, approximately a 537million adults will have diabetes by 2021 (20-79), and close to 783million by 2045.

Because they play an essential role in medication administration, tests and treatment of chronic diseases, syringes have a growing demand.

Regional Analysis

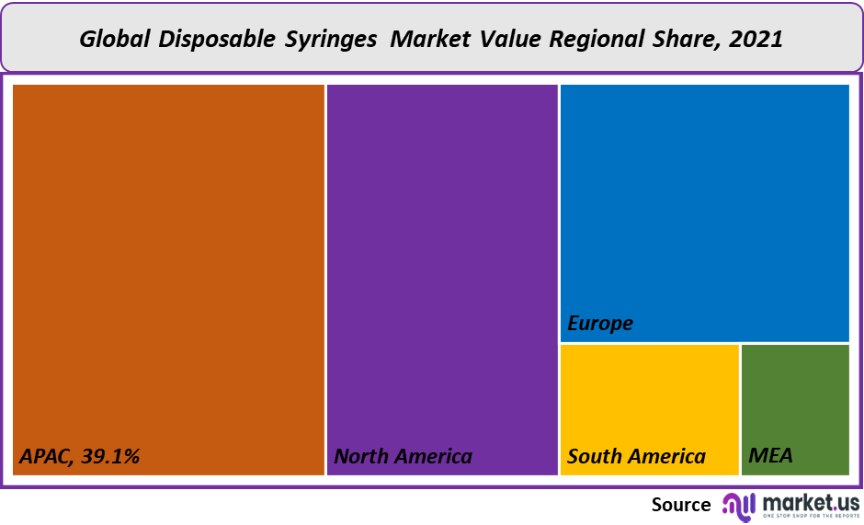

The Asia Pacific dominated the market in 2021 and was responsible for a 39.1% revenue share. The region’s growth will be supported by a number of government initiatives to ensure the safe use of single-use medication supplies.

The region’s growing aging population, the prevalence of chronic disease and high awareness about the safety of disposable products will all likely drive up demand for disposable needles.Hindustan Syringes & Medical Devices Ltd. (HMD) received a new government order in March 2021 for 265,000,000 disposable AD syringes. September 2021. HMD had already fulfilled all its orders for 177.5 Million AD syringes 0.5 ml.

Syringes are used for administering immunizations to a range of diseases, such as yellow fever and measles. The market is expected to grow by boosting the production capacity for 0.5ml AD Syringes, which has already increased from 500 to 800 million annually to 500,000.

MEA’s market will grow at 6.83%. U.N. Children’s Agency estimates that by 2021 the market could be affected by a shortage of up to 2.2 million auto-disposable syringes.

They lock to prevent re-use and spontaneously lock. After months of delay, the COVID-19 vaccine is finally being delivered to Africa. Because of such a shortage, disposable syringe sales will continue to rise.

Market forces include increased healthcare spending and the adoption of modern healthcare facilities. According to UNICEF South Africa 2017/2018, the South African government has allocated 13.5% of its total government spending to healthcare programs. These events are expected to attract new and important players to the MEA market.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

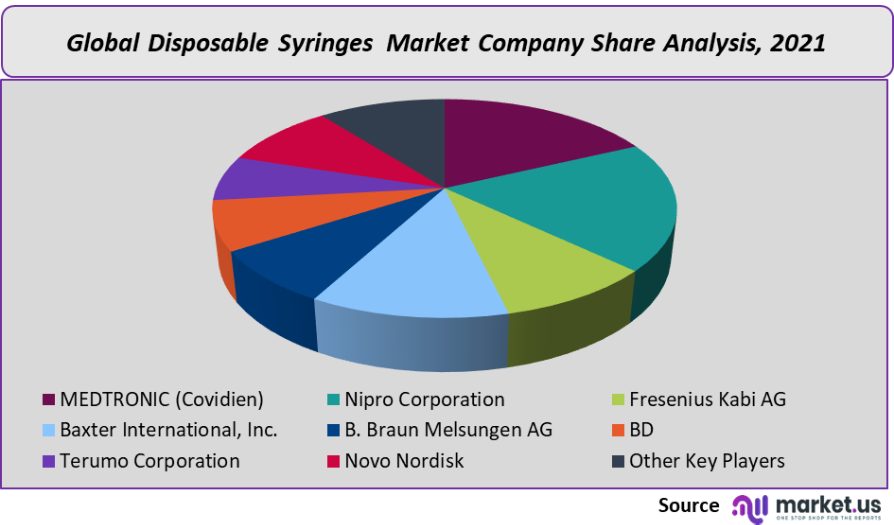

Market Share & Key Players Analysis:

Companies in the market are increasing their efforts for approval of their products so that they can be mass-produced. Avoiding needle stick injuries in healthcare is a key concern for manufacturers.

The market players are also pursuing various strategies to increase their market presence, including mergers & acquisitions, partnerships, and product launches. Morimoto Pharmaceuticals (Japan) launched a new prefilled kit in August 2019 called Morimoto S.A.F.E. Syringe Kit, Smart Accident Prevention. Fast & Easy.

Prefilled syringes are safe for nurses and pharmacists because the preparation of injections is done in an enclosed area. In order to provide safe and simple healthcare practices, market leaders are expanding their R&D capabilities.

This will help to boost the market growth. Some of the most prominent players in disposable syringes include:

Market Key Players:

- MEDTRONIC (Covidien)

- Nipro Corporation

- Fresenius Kabi AG

- Baxter International, Inc.

- B. Braun Melsungen AG

- BD

- Terumo Corporation

- Novo Nordisk

- UltiMed, Inc.

- Henke-Sass, Wolf

- Retractable Technologies

- Flextronics International Vita Needle Company

- Other Key Players

For the Disposable Syringes Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![Disposable Syringes Market Disposable Syringes Market]()

- MEDTRONIC (Covidien)

- Nipro Corporation

- Fresenius Kabi AG

- Baxter International, Inc.

- B. Braun Melsungen AG

- BD

- Terumo Corporation

- Novo Nordisk

- UltiMed, Inc.

- Henke-Sass, Wolf

- Retractable Technologies

- Flextronics International Vita Needle Company

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |