Global Docking Station Market By Product, By Distribution Channel, By Connectivity, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Jul 2022

- Report ID: 52861

- Number of Pages: 289

- Format:

- keyboard_arrow_up

Docking Station Market Overview:

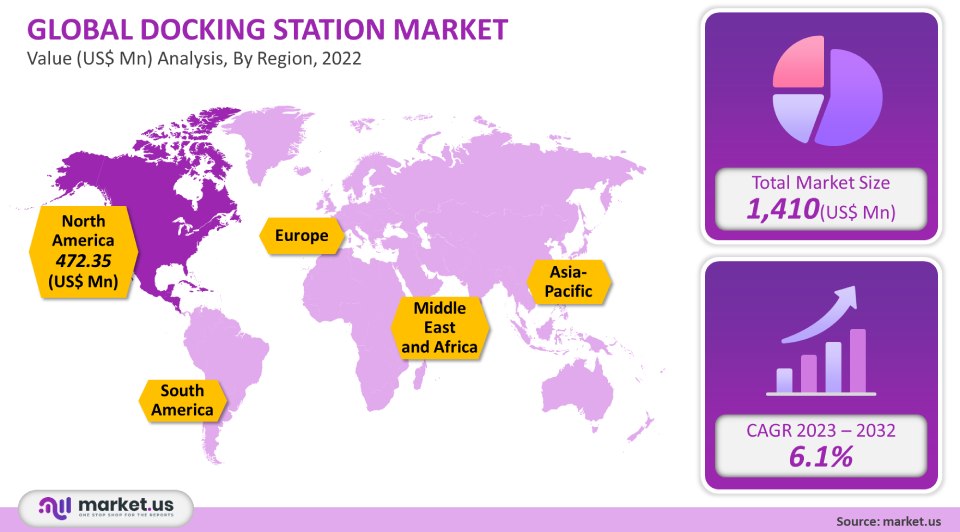

The docking station market size is expected to be worth around USD 2,704.51 million by 2032 from USD 1,410 million in 2021, growing at a CAGR of 6.1% during the forecast period 2022 to 2032.”

The global docking station market size accounted for USD 1,410 million in 2021. It is expected to expand at a 6.1% (CAGR) compound annual growth rate.

The increasing popularity of bringing own device work culture to decrease expenditures and raise flexibility and efficiency is supporting the industry growth. The rising popularity and increased use of portable devices by consumers have resulted in a higher demand for docking station platforms. A docking station’s multifunctionality will make it a market that is expected to grow in the future. It can be used to input and output audio and also provide Ethernet connectivity.

The docking stations market is expected to grow due to an increase in the docking system adoption in the IT industry, as well as the gaming industry and most gaming equipment is linked to docking stations.

This market analysis report gives an overview of the Docking Station market growth, value, and other key factors.

Global Docking Station Market Scope:

Product Analysis

The laptop category accounted for the highest revenue share at over 68.5% in 2021. The rapid growth of the market demand will be driven by the expansion of the docking station application in many industries including e-commerce, supply chain, and warehouse management. Because of the increased use of smartphones/tablets in the IT sector for testing new apps and device compatibility, the segment scope of smartphones and tablets is expected to grow at a 7.5% CAGR from 2023 to 2032. Flexibility is becoming increasingly important due to the increasing trend towards a more flexible work culture in corporate offices and the increased number of startups as well as remote workers. These docking stations can be used to improve meeting rooms and lounges as well as convert workstations from standing desks into standing ones. The market opportunity is expected to be driven by the above-mentioned factors during the forecast period. Increasing flexibility in workplaces and the growing use of electronic devices are opening paths for the market.

Distribution Channel Analysis

In 2021, the offline distribution channel accounted for over 73.2% of revenue, and this trend is expected to continue during the forecast period. Statistics indicate that approximately 63% of Americans prefer shopping in stores to purchase their products. The growth of retail stores, especially those in emerging markets like India and China, is expected to increase product sales through offline channels. Exclusive, company-operated shops only sell authentic products. This will fuel the growth and expansion of the offline distribution channel segment in the forecast period. The forecast period will see the fastest CAGR at 7.2% for the online segment. E-commerce will experience significant growth due to the availability of a wide range of docking stations featuring various features at reasonable prices.

Online channels are also hosted by businesses who are into eCommerce, as well as manufacturers that realize the potential of this channel and have thus hosted their websites to better address customer needs. Alibaba, Amazon.com, Walmart, Home Depot Product Authority, LLC, Flipkart, and eBay are just a few of the big sellers in markets for a docking station, both for industrial and retail customers. Additionally, online portals offer 24-hour support, various models of products to choose from, and deep discounts on branded products. Websites are a common feature for most well-known companies. All of these major factors contribute to the segment’s growth.

Connectivity Analysis

In 2021, wired accounted for over 73% of the total revenue. Due to their high level of convenience, wired docking stations are very popular in the IT sector. These devices facilitate high-speed data transfer which is essential in the IT sector.

A DisplayPort or HDMI cable can be used to connect a wired docking station with a monitor or desktop computer. This wireless system is susceptible to internet congestion, slow data transfer speeds, and other issues. Therefore, wired products are more popular than wireless devices. Wireless connectivity will see the most growth between 2023-2032, thanks to the introduction of more efficient wireless technologies like WI Gig, WiFi, and Bluetooth.

The increasing scope for the application of docking stations in many industries, supply chains, e-commerce, warehouse management, and others is the primary factor driving the market demand.

Кеу Маrkеt Ѕеgmеntѕ:

Proper segmentation is given below on the basis of product, Distribution channel, and connectivity.

By Product

- Smartphone & Tablet

- Laptop

- Others

By Distribution Channel

- Online

- Offline

By Connectivity

- Wireless

- Wired

Market Dynamics:

Due to the increasing demand for wireless technology, many manufacturers have started to include it in their products. Samsung Group has recently introduced Samsung DeX, a wireless charging station, and a Samsung Galaxy S8. The docking station allows smartphones and tablets to connect to power supplies as well as monitors, wireless mice, keyboards, network ports, and monitors. It allows smartphones to turn into touchpads.

The market growth is also being driven by the rapid development of new technologies like Thunderbolt, USB-C, and USB 3.0. Manufacturers in this market are working to improve their product designs so that they offer easier-to-use mobile devices with enhanced functionality. Because of the increasing demand for wireless technology, these companies are now incorporating Wi-Fi and Bluetooth into their products. Additionally, due to the ease of accessing high-speed internet efficiency and compatible hardware, multiplayer video games are expected to increase the demand for docking stations. Additionally, vendors in the gaming industry offer customized products in a range of portable options like the Nintendo Switch with Neon Blue or Neon Red Joy-Console.

As more companies expanded their staff to meet social distancing and asked employees to come in one week, the demand for docking stations grew. Many offices are opened only on a “need-to-know” basis. Most employees were required to work almost entirely remotely. The use of docking stations increased as more employees started working remotely. To be efficient at homework, you need docking equipment that can handle the most common tools.

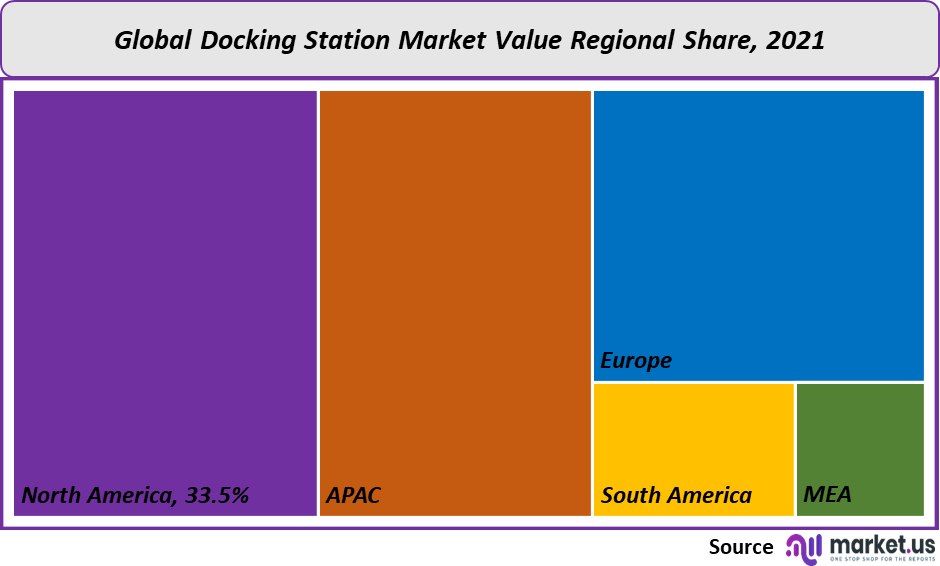

Regional Analysis:

North America had a 33.5% largest revenue share in 2021. The demand for docking stations in this region is increasing due to millennials’ and younger gamers’ increased interest in e-sports. The booming esports industry is attracting investors, as the U.S. government declared esports athletes professional athletes. These consumer trends are expected to increase the demand for smartphones, tablets, and laptops and will also drive up the demand for docking stations during the forecast period. According to data from the U.S. Department of Commerce’s ‘SelectUSA.gov.’ program, over 525,000 software and IT companies are currently in the U.S. Of these, approximately 40,000. These are all tech startups that were founded in 2018. These industry trends are expected to increase demand for laptops, smartphones, and PCs. This will then lead to an increase in docking station demand over the forecast period.

Asia Pacific is projected to experience the fastest CAGR,7.4%, over the forecast period. Due to the presence of a number of technology giants such as China, India, Japan, South Korea, and Singapore, are the Asia Pacific a technology hub? In the last few decades, Asian countries have seen an increase in their IT industry, increasing automation in manufacturing, and a rise in the penetration of online gaming. These factors have provided new growth opportunities for docking station manufacturers. The regional market for docking stations will be driven by the anticipated rise in demand for smartphones, laptops, and PCs over the forecast period. North America has the largest share of the market contribution.

Detailed insight into major regions is given below including North America, Europe, Asia- Pacific, South America, and Middle East Africa.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

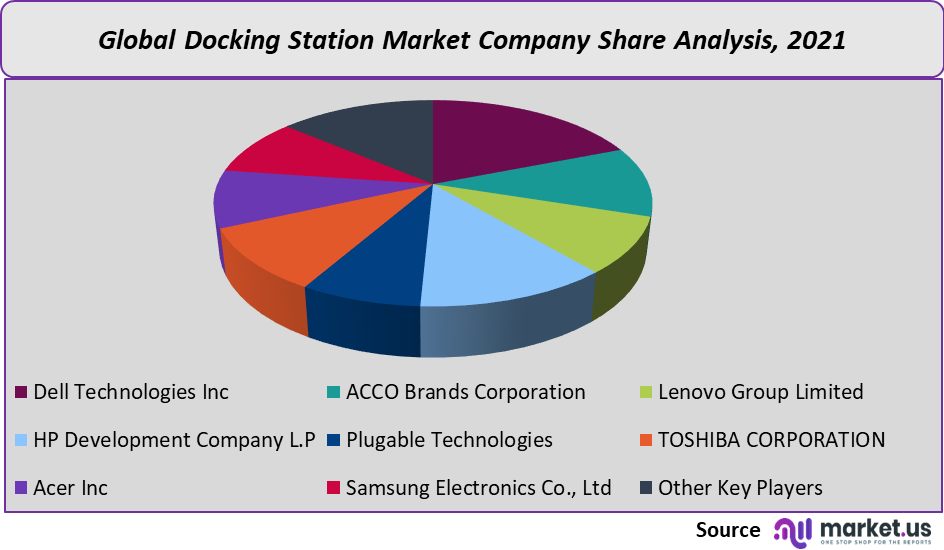

Competitive Landscape:

The global Docking Station market is fragmented. Online retailers are helping companies increase product visibility and maximize their consumer base. Plugable Technologies is an American company that sells products through Amazon (FBA Platform). The company stores its products at Amazon’s fulfillment centers, after production. Amazon then arranges for their pickup, packaging, and shipment. Some of the most prominent players in this global docking station market share are:

Following are the major key players in this industry including Dell Technologies Inc, ACCO Brands Corporation, Lenovo Group Ltd., Toshiba Corp, IMARC Group, Apple, Inc., Hp Inc., Samsung Electronics Co. Ltd., StarTech.com Ltd., Targus International LLC, Wellink Industrial Tech (Shenzhen) Co., Ltd., Targus Corporation, and other key companies.

Маrkеt Кеу Рlауеrѕ:

Below are the major players included in the Docking Station market report,

- Dell Technologies Inc.

- ACCO Brands Corporation

- Lenovo Group Ltd

- Hp Inc.

- Targus International LLC

- HP Development Company L.P

- Plugable Technologies

- TOSHIBA CORPORATION

- Acer Inc

- Samsung Electronics Co. Ltd

- Apple Inc.

- IMARC Group

- Other Major Players

For the Docking Station Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

USD 1,410 million

Growth Rate

6.1%

Forecast Value in 2032

USD 2,704.51 million

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the actual market size of the Docking Station market in 2021?The Docking Station market size is US$ 1,410 million in 2021.

What is the projected CAGR at which the Docking Station market is expected to grow at?The Docking Station market is expected to grow at a CAGR of 6.1% (2023-2032).

List the segments encompassed in this report on the Docking Station market?Market.US has segmented the Docking Station market analysis by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Product, the market has been segmented into laptops, smartphones & tablets, and Others. By Distribution Channel, the market has been further divided into Offline, Online. By Connectivity, the market has been further divided into Wired, and Wireless.

List the key industry players in the Docking Station market?Dell Technologies Inc., ACCO Brands Corporation, Lenovo Group Limited, HP Development Company L.P, Plugable Technologies, TOSHIBA CORPORATION, Acer Inc., Samsung Electronics Co., Ltd, and Other Key Trends engaged in the Docking Station key market analysis.

Which region is more appealing for vendors employed in the Docking Station market?North America accounted for the highest revenue share of 33.5%. Therefore, the Docking Station industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the growth of Docking Station?The US, Canada, Mexico, China, Japan, and India are key areas of operation for the Docking Station Market.

Which segment accounts for the greatest market share in the Docking Station industry?With respect to the Docking Station industry, vendors can expect to leverage greater prospective business opportunities through the Laptop segment, as this area of interest accounts for the largest market share.

![Docking Station Market Docking Station Market]()

- Dell Technologies Inc.

- ACCO Brands Corporation

- Lenovo Group Ltd Company Profile

- Hp Inc.

- Targus International LLC

- HP Development Company L.P

- Plugable Technologies

- Toshiba Corporation Company Profile

- Acer Inc

- Samsung Electronics Co. Ltd Company Profile

- Apple Inc. Company Profile

- IMARC Group

- Other Major Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |