Global Dolomite Market By Product (Calcined, Sintered and Agglomerated), By End-Use (Construction, Agriculture, Glass & Ceramics, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Mar 2022

- Report ID: 31467

- Number of Pages: 328

- Format:

- keyboard_arrow_up

Dolomite Market Overview:

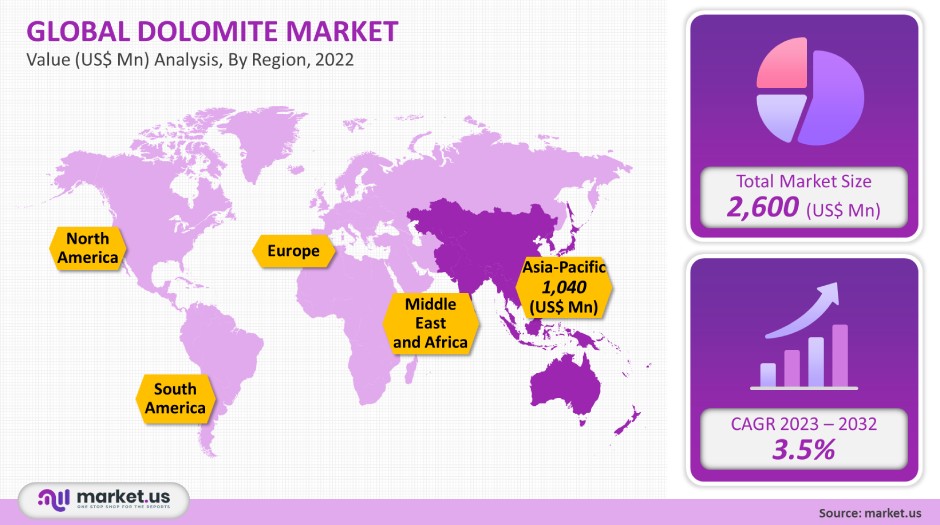

The global dolomite industry was valued at USD 2,600 million in 2021 and is expected to grow at an annual compound growth rate (CAGR), of 3.5% between 2023-2032.

This market growth is due to the widespread use of dolomite in large-scale global steel production. The COVID-19 Pandemic is likely to cause a slowdown in product demand for at least two years. The COVID-19 virus pandemic has had an enormous impact on global economic operations, and this includes mining.

The virus outbreak forced mining companies to temporarily suspend operations. This has had an adverse effect on the production and demand for minerals. The situation is so critical that the end-use industry, including iron & metal, construction, and glass, is operating at a very low capacity. This could have a negative impact on the 2020-2021 dolomite supply.

Global Dolomite Market Scope:

Product analysis

Calcined, which accounted for more than 39% of all product segments in 2021, was the largest. Calcined Dolomite is made from minerals such as Calcium carbonate and magnesia by the process of calcination. It is used in the iron and steel industries as refractory insulation protectors and scorifiers. It is also used to treat water and soil in agriculture.

Another significant segment in the market is sintered limestone. The product is valued for its high refractoriness, and it is used in the manufacture of bricks for LD converter lining. This product is also known to be dead-burned dolomite because it is heated above 1,650°C to attain maximum bulk density and high resistance to hydration.

In the long term, increased investment in the steel industry is expected to have a positive impact on product demand. The Indian Union Ministry of Steel has planned to make USD 70 billion cumulative investments in the country’s eastern region to establish an integrated steel hub. This region is rich in iron ore and coking coal as well as significant amounts of bauxite.

End-Use analysis

Iron & metal was the biggest end-use segment and held 62% of the global market share in 2019. This is due to the increasing demand for different steel applications. It is expected that it will maintain its lead in the forecast period. Dolomite serves as a refractory component in steelmaking converters lining, opening hearts furnaces, and electric heater walls.

The market was driven to expand its production capacity by the increasing demand for refractory raw materials. RHI Magnesita made a June 2018 announcement about a Euro 20 million investment (USD 23.5million) in its China dolomite operation to meet global demand for raw materials.

Covid-19 caused a decline in the high demand for refractories. The outbreak of the virus forced the companies to close down all manufacturing facilities. This greatly affected the supply chain for dolomite and had a detrimental impact on sales of those market players who were part of the value chain.

The glass & ceramics market is another important segment and will experience a 4.4% increase in revenue. Dolomite plays a crucial role in glass production. It is resistant to chemical erosion caused by water and the atmosphere, increases plasticity, and has high strength. The segment is expected to grow as more glass is needed to make vials of medicines and vaccines.

Covid-19 vaccines are nearing the end of testing and drug makers and governments have been chasing packaging to protect the vaccine shots. SiO2 Materials Science, a specialist in drug packaging, announced that it was spending USD 163 million to expand its Auburn packaging plant. The U.S. is expected the increase in glass container production will prove beneficial for the global marketplace.

Кеу Маrkеt Ѕеgmеntѕ

By Product

- Calcined

- Sintered

- Agglomerated

By End-Use

- Construction

- Agriculture

- Glass & Ceramics

- Iron & Steel

- Water Treatment

- Other End-Uses

Market Dynamics:

Dolomite can be used extensively in refractory, which is designed for the steel industry. Manufacturers are expanding their production because of the increasing refractory market.

RHI Magnesita made a July 2020 announcement about a Euro 40 million investment (USD 47.02million) at Hochfilzen Tyrol, Austria. It will include the construction of a tunnel that will eliminate approximately 7,500 truck trips annually in the future. Furthermore, the site will be a center for European dolomite processing as the annual production is projected to rise to 200 kilotons. This is good news for market growth.

The construction industry is another important end-use for dolomite. Dolomite has many uses, including as a road base, aggregate, railroad ballast, cement production, and railroad ballast. The ease of lockdown restrictions means that construction activities are being resumed slowly, which is good for market growth. By following stringent sanitation measures and locking down advisories, construction activities were resumed in several states of India, including Telangana.

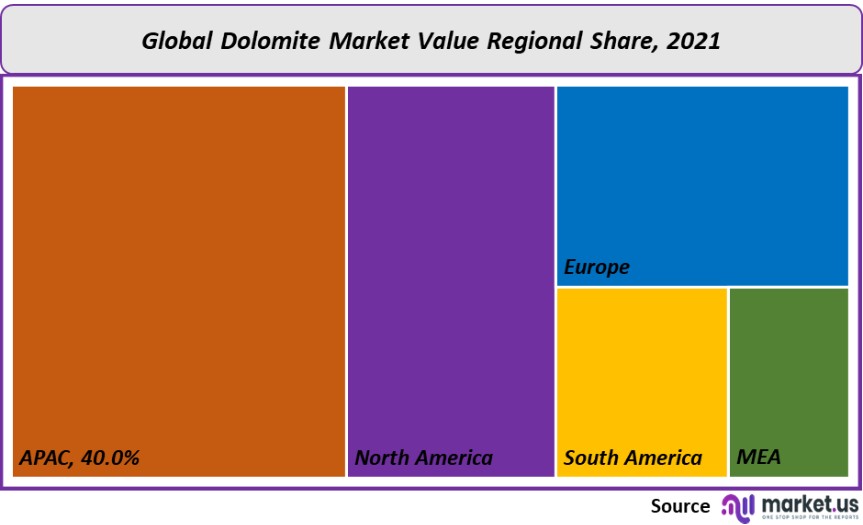

Regional Analysis

The Asia Pacific was the region with the highest share of more than 40% in 2021. The iron & metal industry is seeing a rise in demand due to increased production of refractories. The imposition of lockdown was necessary because of the impact that the covid-19 virus outbreak had on the production activities. Industries are currently refocusing their operations after the restrictions were lifted.

China is a significant consumer of dolomite. It is also resuming activities at a quicker pace than other countries. According to the Henan Association of Refractories, Henan’s refractories production rose to 2.62 Kilotons from April-May 2020. This figure is 66% greater than the first quarter of 2019. This is a positive sign that the country’s market can continue to flourish despite the COVID-19 outbreak.

The rising demand for the covid-19 vaccine will be fueled by a focus on increasing glass production to support the pharmaceutical industry. Gerresheimer India has announced that it will triple its production of tubular glass by 2020 and double its production of molded vials in 2021.

North America was second in revenue share for 2021, due to the region’s high production of glass, cement, and refractories. The importance of the region is being recognized by key players who are now making strategic moves to increase their market share in the region. RHI Magnesita bought Missouri Refractories by RHI Magnesita in February 2020 in order to improve its position in North America.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

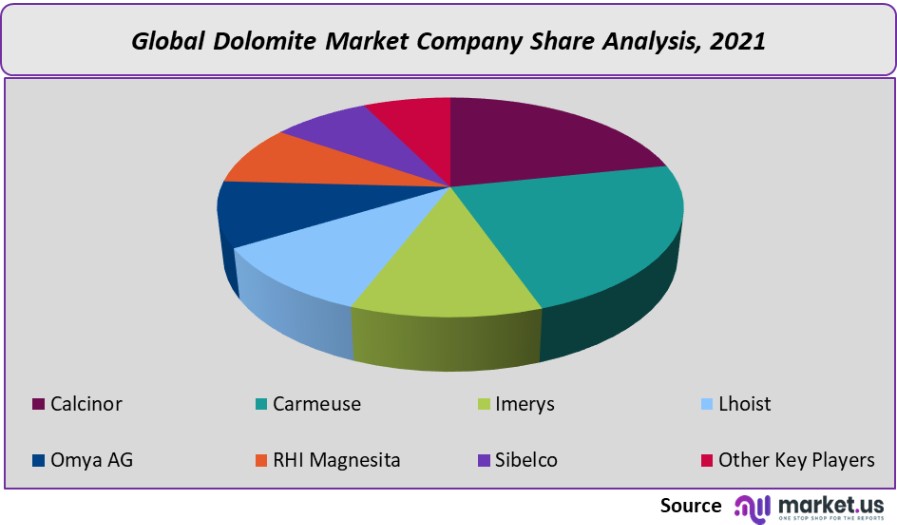

Market Share & Key Players Analysis:

It is highly competitive because there are many players already in the industry. Many of the leading companies use strategic strategies to improve their market shares, such as acquisitions and mergers. Mineracao Be local was a joint venture formed by Votorantim Cito and Lhoist in May 2018 and acquired L-Imerys Brazilian dolomite and lime business. The prominent players in the dolomite industry include:

Маrkеt Kеу Рlауеrѕ:

- Calcinor

- Carmeuse

- Imerys

- Lhoist

- Omya AG

- RHI Magnesita

- Sibelco

- Vardar Dolomite

- Other Key Players

For the Dolomite Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Dolomite market in 2021?A: The Dolomite market size is estimated to be US$ 2,600 million in 2021.

Q: What is the projected CAGR at which the Dolomite market is expected to grow at?A: The Dolomite market is expected to grow at a CAGR of 3.5% (2023-2032).

Q: List the segments encompassed in this report on the Dolomite market?A: Market.US has segmented the Dolomite market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Calcined, Sintered and Agglomerated. By End Use, the market has been further divided into Construction, Agriculture, Glass & Ceramics, Iron & Steel, Water Treatment and Other End-Uses

Q: List the key industry players of the Dolomite market?A: Calcinor, Carmeuse, Imerys, Lhoist, Omya AG, RHI Magnesita, Sibelco and Other Key Players engaged in the Dolomite market.

Q: Which region is more appealing for vendors employed in the Dolomite market?A: APAC is expected to account for the highest revenue share of 40%. Therefore, the Dolomite Technology industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Dolomite?A: The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc. are key areas of operation for Dolomite Market.

Q: Which segment accounts for the greatest market share in the Dolomite industry?A: With respect to the Dolomite industry, vendors can expect to leverage greater prospective business opportunities through the End-Use segment, as this area of interest accounts for the largest market share.

![Dolomite Market Dolomite Market]()

- Calcinor

- Carmeuse

- Imerys

- Lhoist

- Omya AG

- RHI Magnesita

- Sibelco

- Vardar Dolomite

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |